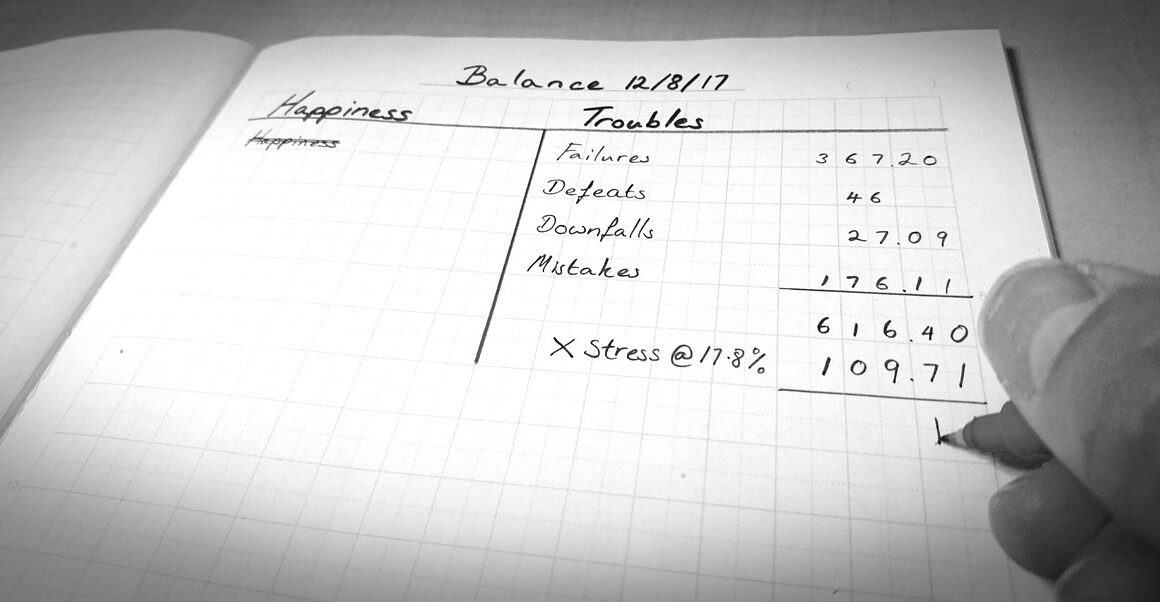

Common Mistakes to Avoid When Preparing Balance Sheets

Understanding balance sheets is critical for effective financial reporting. A balance sheet offers a snapshot of a company’s financial position at a specified time. One common mistake occurs when organizations fail to accurately classify their assets and liabilities. Misclassifying current assets as long-term or vice versa can lead to misinterpretations of liquidity ratios. Another frequent error is omitting necessary disclosures regarding off-balance-sheet items. These items, like operating leases, can significantly impact how stakeholders view a company’s financial health. Additionally, using outdated data is problematic, as financial positions change frequently. Relying on old figures undermines the credibility of the balance sheet and often results in poor decision-making. It is equally important to ensure that the balance sheet adheres to generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS). Ignoring these guidelines can lead to inconsistencies and, ultimately, legal implications. Regular training for financial staff on compliance and best practices can mitigate these issues. Consistent reviews of prepared balance sheets by external auditors also help ensure accuracy and compliance. This diligence is essential for maintaining transparency with investors and stakeholders.

Another mistake to recognize is the failure to reconcile accounts properly. Reconciliation ensures that the balance sheet matches the financial statements and the cash flow reports. Such mismatches can lead to serious discrepancies, creating a perception of mismanagement. Organizations should regularly perform reconciliations of all accounts to maintain accuracy. Furthermore, not accounting for depreciation can drastically alter the reported value of assets over time. Failing to properly reflect these values in balance sheets can inflate asset values and mislead stakeholders regarding the true worth of the company. Employees may overlook intangible assets, such as intellectual property, when preparing reports. While these assets aren’t always straightforward to value, they are significant contributors to overall company value. In addition, misestimating liabilities or failing to recognize contingent liabilities can undermine a company’s risk assessment. Therefore, meticulous attention to detail cannot be overstated in this process. Avoiding common errors takes commitment, education, and the right processes. Regular training of staff is vital for understanding methodologies and recognizing potential pitfalls. Collaborating with financial advisors can also provide additional insights into best practices.

Importance of Clear Documentation

Clear documentation is crucial when preparing balance sheets. Poorly documented sources or calculations can result in significant financial discrepancies. Essentially, every number on a balance sheet should have a reliable source. Failing to keep thorough records can lead to miscommunication and errors during audits. Companies may also overlook the significance of updating their balance sheet to reflect recent changes in business operations. Changes such as mergers, acquisitions, or divestitures can result in assets and liabilities being improperly recorded or nonexistent on financial statements. Regularly updating and reviewing balance sheets ensures that stakeholders and management have accurate insights into financial standing. Furthermore, balance sheets can provide a historical perspective on financial performance. Failure to track changes over time denies companies the opportunity to learn from past trends and decisions. Inaccuracies can mislead investors and cause companies to miss out on funding opportunities. It is equally important to ensure that the balance sheet is structured logically. Following a consistent format allows stakeholders to navigate the report easily. An organized balance sheet not only improves comprehension but also demonstrates professionalism, positively impacting stakeholder perceptions.

Many companies make the mistake of focusing solely on net income when evaluating performance. Net income is indeed important but should not be the only metric considered. Balance sheets present a broader picture of financial health than income statements alone. Stakeholders should evaluate various metrics derived from balance sheets, including liquidity ratios and debt-to-equity ratios. Not leveraging these metrics can result in strategic misalignment and financial risk. Businesses often fail to consider the effects of seasonal fluctuations on their balance sheets. Seasonal businesses may not present a true reflection of financial health during certain times of the year. The necessity to analyze seasonal trends and their impact on financial outcomes should not be understated. It is also crucial to ensure that all contracts and agreements to which the company is a party are reviewed. Omitting relevant contracts can lead to massive financial misrepresentations. Lastly, relying too heavily on automated processes for data entry can yield inaccuracies. Though convenient, human oversight remains indispensable. Regularly performing checks and adjustments can significantly improve the accuracy of balance sheets, ensuring they serve their true purpose effectively.

Collaboration and Best Practices

Collaboration among departments is vital for creating accurate balance sheets. Finance, operations, and sales teams should communicate effectively to ensure that all financial data is accurately represented. Miscommunication among departments can lead to discrepancies that tarnish financial integrity. Companies should implement a collective approach to financial reporting, ensuring everyone comprehensively understands their role. Best practices in balance sheet preparation also underscore the need for training staff thoroughly in record-keeping. Employees vary in their understanding of accounting principles, so regular training sessions can help unify knowledge across teams. Additionally, defining clear timelines for when balance sheets need to be completed promotes accountability and organization. All stakeholders should be aware of these deadlines to ensure timely submission. The information technology department can also play a vital role in ensuring accurate data collection. Utilizing financial software that integrates seamlessly with existing systems can minimize errors commonly found in manual entry. Employing these technologies allows employees to focus on analysis rather than mundane data entry, ultimately enhancing overall productivity. Lastly, regularly auditing financial processes helps identify areas for improvement, fostering an environment that values accuracy and compliance.

In conclusion, avoiding common mistakes in balance sheet preparation is essential for effective financial reporting. A company’s financial health often depends on clear and reliable balance sheets. Accurate classifications of assets and liabilities are necessary to produce a realistic financial picture, as misclassifications can mislead stakeholders. Regular reconciliations ensure that balance sheets harmonize with financial statements while helping built a reliable audit trail. Moreover, companies should never underestimate the importance of transparency, clear documentation, and regular reviews in promoting accuracy. Moreover, businesses need to remember the relevance of timely updates to consider changes in their operations. This attention to detail will ultimately ensure that balance sheets present the most accurate representation of a company’s financial position. In this competitive market, companies must leverage accurate financial data to guide strategic decisions and performance evaluations. Remember, balance sheets not only present static data but also encapsulate the company’s history, health, and potential growth trajectory. Organizations that embrace these practices can mitigate risk, improve stakeholder trust, and position themselves better for future opportunities. Committing to best practices in financial reporting will undeniably pay dividends in the long term.

Companies must treat balance sheets not just as regulatory obligations but essential tools for strategic decision-making. Understanding how to avoid common pitfalls when preparing these financial documents can significantly enhance their value. A well-prepared balance sheet reflects diligence, sound financial management, and a commitment to transparency. Emphasis should be placed on the accuracy of financial reporting, as their consequences can extend beyond compliance issues. Stakeholders, including investors, creditors, and regulatory bodies, depend on precise data to make informed decisions. The aim is to build trust in financial reporting, as inaccurate documents can lead to a variety of challenges for organizations. Additionally, industry standards must be adhered to in order to promote consistent reporting practices. Awareness and understanding of these standards within the organization facilitate smoother financial reporting processes. Each department should familiarize themselves with their specific role in the preparation of the balance sheet. This departmental ownership ensures that all stakeholders are accountable for presenting an honest representation of the company’s financial status. Lastly, cultivating a culture of financial clarity within an organization will encourage adherence to best practices while facilitating collective responsibility and continuous improvement.

By avoiding these common mistakes, organizations can demonstrate their commitment to financial integrity and transparency. Clear organizational policies around balance sheet preparation foster a culture of accountability and professionalism. These policies should be reviewed and updated regularly to adapt to changing regulations and market conditions. Investing in financial training programs benefits not only individual employees but the organization as a whole. When staff members are well-trained, they can confidently prepare accurate financial reports. This not only improves the quality of the balance sheets but also gives management valuable insights into the company’s financial health. Furthermore, regular feedback from auditors or external professionals can highlight additional areas of improvement in financial processes. Organizations should strive for continuous improvement, evaluating their reporting practices regularly. Ultimately, an accurate balance sheet serves as a powerful tool for stakeholders analyzing a company’s position. This essential financial document can facilitate better strategic decisions. In a fast-paced business environment, companies that commit to best practices in balance sheet preparation can enhance their stability and boost stakeholder confidence.