Insurance Scams Targeting Seniors: How to Protect Yourself

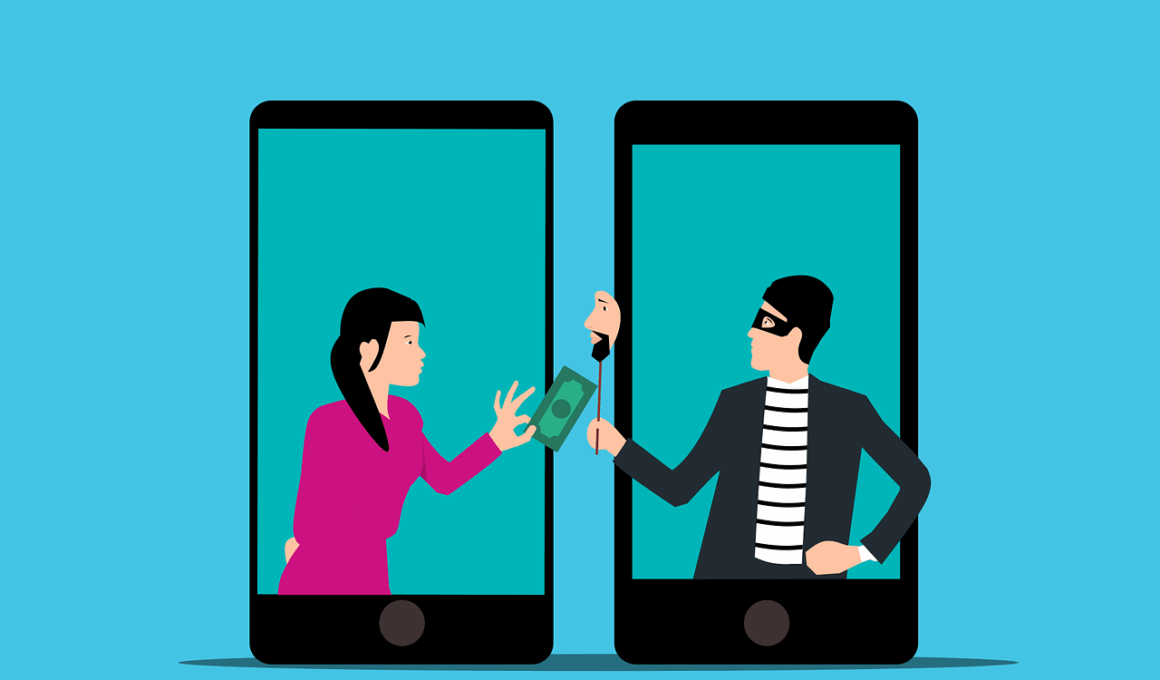

As we age, the importance of having reliable insurance becomes paramount. Unfortunately, seniors are often seen as easy targets by fraudsters looking to exploit their vulnerabilities. These insurance scams can take various forms, making it essential for older adults to stay informed and vigilant. Common tactics used by scammers include unsolicited emails, phone calls, and even door-to-door visits, all of which aim to deceive seniors into providing sensitive personal information. To protect yourself or your loved ones from these deceptive practices, it’s crucial to remain aware of potential scams and their signs. Implementing strategies such as verifying the legitimacy of anyone requesting personal information or money can significantly reduce the risk of falling victim to these scams. Additionally, staying connected with trusted family members or friends can provide a strong support system for recognition and reporting of suspicious activities. Taking these proactive steps will ensure that you can enjoy the peace of mind that your insurance is secure, without the fear of falling prey to scams targeting seniors. Knowledge truly is power when it comes to safeguarding your health and financial well-being.

One of the most common scams targeting seniors involves fake insurance policies. Scammers may present themselves as representatives of legitimate insurance companies, offering policies that sound amazing but don’t truly exist. They often create high-pressure scenarios where seniors feel compelled to make quick decisions without fully understanding the terms. It’s essential to thoroughly research any company or policy before committing. Checking for a company’s accreditation and reading reviews online can unveil potential red flags. If it sounds too good to be true, it probably is. Moreover, consider seeking advice from a trusted family member or a financial advisor before making any major insurance purchase. Educating yourself on the types of insurance policies available for seniors can significantly contribute to informed decision-making. Being proactive about understanding the specifics of health, life, or long-term care insurance can also help seniors identify scams. Another useful strategy is to utilize resources such as the National Association of Insurance Commissioners or the Better Business Bureau, which offers information and guidance on recognized firms. Engaging with these resources can empower seniors and protect against deceitful tactics.

Understanding Technical Scams

In addition to traditional scams, technological advancements have introduced more complexity to the types of fraud targeting seniors. Tech-savvy criminals exploit online platforms, leading to a surge in phishing scams aimed at obtaining sensitive information. These scams often involve deceptive emails or messages that mimic real financial institutions, asking recipients to click links or provide personal details. Seniors should be cautious with emails that request personal information or urge immediate action. Always inspect the sender’s email address and never click on suspicious links. Utilize official websites or phone numbers to verify if a request is truly legitimate. If you receive unsolicited communication, consider reporting it to local authorities to help combat these practices. It is also beneficial to inform your family and friends about any suspicious communications to prevent further victimization. Building awareness within the community can inhibit scammers’ success. Online classes and seminars specifically aimed at educating seniors on technology use can serve as a valuable resource for enhancing their digital literacy and empowerment against scams. Seniors have the right to feel secure and educated in an increasingly technological world.

Health insurance scams are another critical area where seniors find themselves vulnerable. With the complexity of health insurance policies, scammers capitalize on confusion, offering ‘free’ services or policy reviews that can lead to significant financial loss. It’s vital to approach unsolicited health insurance offers with skepticism, especially when an agent claims to be state-approved or affiliated with well-known organizations. Always confirm affiliations through credible sources before considering any insurance changes. Enrollment periods and changes to policies often bring about an influx of scams, making it essential for seniors to maintain up-to-date knowledge regarding their coverage and available options. Understanding the specifics of Medicare and current health plans can be a lifeline against scams, giving seniors the confidence to ask questions and demand legitimate answers. Additionally, utilizing organizations like SHIP (State Health Insurance Assistance Program) can provide guidance and support specifically tailored to older adults. They offer unbiased assistance to help seniors navigate their health insurance options. This can significantly diminish the likelihood of being deceived by fraudulent offers that take advantage of their circumstances, ensuring better security and well-being.

Recognizing Social Engineering Techniques

Understanding the psychological tactics used in scams can greatly enhance protective measures. Scammers often use social engineering techniques, leveraging emotional responses such as fear, urgency, or compassion to manipulate seniors into making impulsive decisions. For example, they may claim that immediate payment is required to prevent a loss of services or access to important benefits. This tactic can push the unsuspecting victim into making hasty or uninformed choices. Being aware of these strategies can help seniors take a step back and evaluate the legitimacy of the request. Encourage the practice of waiting and discussing any important financial decisions with family members or friends before acting. Calmly examining the situation can unveil questionable practices and unnecessary urgency. Additionally, participating in community awareness programs can further educate seniors about prevalent scams and their indicators. This knowledge enables them to stay one step ahead of fraudsters and fortifies community resilience. Empowerment through education and open communication with loved ones fosters a safer environment for seniors, ensuring they feel supported while navigating potential threats to their financial and personal safety.

Seniors should also be vigilant about their personal information, as it remains a prime target for scammers. Many fraudulent schemes require the sharing of sensitive data such as Social Security numbers, bank account details, or personal identification information. These details can lead to much larger scams, including identity theft. It is essential to keep personal documents secure and shred any unnecessary materials that contain sensitive information. Regularly monitoring bank statements and credit reports can help detect any unusual activity early on. Taking preventative action such as placing freezes on credit reports can provide an additional layer of security, making it more challenging for fraudsters to open accounts in their name. Educating seniors about the importance of maintaining their privacy on social media and other platforms can also help diminish the likelihood of being targeted by scams. Awareness campaigns emphasizing protecting personal information have proven beneficial in combating fraud. Building a holistic protective strategy ensures that seniors can engage with their everyday lives while safeguarding themselves against evolving threats.

Final Thoughts

Combating insurance scams targeting seniors requires a multi-faceted approach involving vigilance, knowledge, and support. As fraudsters continuously innovate their tactics, older adults must remain informed about the latest scams and how to recognize them. Fostering strong communication with family members and trusted advisors can enhance protective measures and help create a support network for seniors. Community programs that educate older citizens on recognizing and reporting scams can establish a united front against fraudulent practices. Encourage conversations and sharing personal stories about encounters with scams among seniors to highlight the importance of awareness and vigilance. Practical tips, such as keeping personal information secure, verifying the legitimacy of offers, and being cautious online, can significantly reduce the chances of falling victim to insurance scams. Finally, empowering seniors through education and community support not only protects them individually but strengthens overall community resilience against scams. Working together creates a safer environment for everyone, where seniors can feel more assured in their insurance choices and secure in their financial well-being.

To promote ongoing protection against insurance scams, it’s also essential to know when and how to report any suspicious activities immediately. When experiencing potential fraud, the immediate response involves informing trusted family members or friends, who can provide assistance in addressing the problem. Reporting scams to local law enforcement or fraud prevention agencies increases awareness and potentially prevents others from falling victim to the same schemes. Organizations like the Federal Trade Commission (FTC) offer valuable resources for reporting issues and accessing information regarding various scams circulating in the community. Additionally, documenting any communications or evidence related to the scam can greatly support investigations and assist authorities in understanding the broader network of fraudulent activities. Building a proactive approach toward tackling insurance fraud not only empowers seniors but helps them regain control over their financial safety. Awareness and reporting systems can lead to meaningful change in the community, compelling officials to take action against scammers targeting seniors. Ultimately, fostering an environment of vigilance and support will contribute to an overarching culture where seniors can navigate their insurance needs without the fear of scams threatening their peace of mind.