The Impact of Supply Chain Finance Training on Operational Efficiency

Supply chain finance (SCF) training plays a paramount role in enhancing the operational efficiency of businesses in today’s dynamic marketplace. By providing organizations with the necessary insights into financial management, risk mitigation, and strategic procurement, these training programs enable teams to optimize their workflows. As a result, firms can significantly reduce their working capital costs and improve cash flow. Participants in SCF workshops are equipped with practical tools and knowledge that help streamline processes. This operational focus is essential considering the increasing complexity faced by supply chains. Moreover, training enhances communication and collaboration among different stakeholders in the supply chain, fostering a more cohesive approach to financing. A well-rounded understanding of these concepts allows businesses to anticipate challenges and respond effectively, ensuring the sustainability of operations. By actively engaging employees in SCF initiatives, organizations unlock potential savings and profitability. Therefore, investing in supply chain finance training is no longer optional but a strategic necessity for maintaining competitive advantage. Organizations must prioritize effective training frameworks to reap these benefits, thereby aligning their financial strategies with operational goals efficiently.

The structure of supply chain finance training includes various modules focusing on key aspects such as cash flow optimization, risk management, and supplier collaboration. Effective workshops are designed to cover fundamental concepts and advanced techniques alike. These multifaceted curricula ensure that participants, regardless of their prior knowledge, can grasp the intricacies of SCF. The enhanced understanding gained from these courses empowers employees to make informed decisions that directly affect the organization’s bottom line. Furthermore, participants often engage in real-world case studies that illustrate practical applications of learned theories. This hands-on experience results in lasting retention of the knowledge acquired during the sessions. Facilitators of SCF workshops typically bring invaluable industry expertise, enriching the learning process with relevant insights and examples. By creating an interactive atmosphere, attendees can discuss challenges and solutions pertinent to their roles, fostering an environment of collaborative learning. Peer-to-peer dialogue significantly enhances the training experience, allowing insights from diverse perspectives. Overall, the structure and content of SCF training are instrumental in transforming concepts into practical strategies that have positive long-term impacts on operational performance.

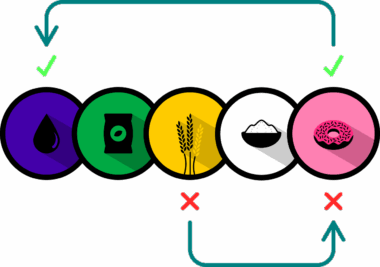

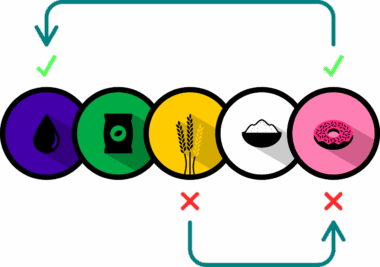

The significance of adopting a standardized approach within supply chain finance training cannot be understated. Establishing a cohesive framework ensures that every participant receives consistent and comprehensive information. This standardization contributes to a unified understanding of SCF across various departments and levels in an organization. Such consistency enables better alignment between financial and operational strategies, facilitating smoother processes and decision-making. Furthermore, a standardized curriculum promotes best practices and trending methodologies, thereby enhancing the overall quality of training. Ensuring that all employees adhere to the same principles reduces discrepancies in execution and operational inefficiencies. Besides, it creates a culture of accountability where team members understand their roles and responsibilities within the supply chain. Having a shared language and framework minimizes misunderstandings and fosters collaboration, essential for optimizing operational performance. As stakeholders become more adept at navigating the complexities of SCF, the potential for achieving significant improvements in cash flow and supplier relationships increases. Ultimately, establishing this standardized approach supports organizations in cultivating a more resilient supply chain capable of adapting to evolving market conditions effectively.

The Role of Technology in Supply Chain Finance Training

Technology has revolutionized the delivery and effectiveness of supply chain finance training programs. The incorporation of digital tools, such as learning management systems and interactive platforms, enhances accessibility and engagement. Participants can access training materials remotely, allowing for flexibility in learning schedules. Online modules can include interactive elements such as quizzes and simulations that test knowledge and application skills. Additionally, technology enables real-time updates of training content, ensuring that learners are exposed to the latest trends and regulations in SCF. Virtual workshops and webinars also allow for broader participation, breaking geographical barriers that often limit access to quality training. Furthermore, providing access to analytics tools during training helps participants understand the metrics crucial for performance evaluation in the supply chain context. By leveraging data analytics, participants can analyze supply chain performance and identify areas for improvement. In essence, technology not only modernizes the training experience but also enriches it, leading to more informed decision-making and improved operational efficiency. The interplay of technology and training drives the advancement of supply chain finance practices significantly.

Success stories from organizations that have invested in supply chain finance training reveal the tangible benefits of these initiatives. Companies that commit resources to SCF workshops often witness marked improvements in operational metrics and financial performance. Enhanced visibility into supply chain dynamics allows businesses to anticipate disruptions and manage risks proficiently. For example, after implementing SCF training, one manufacturing firm reduced its inventory costs by 20% within a year. This achievement was largely due to improved communication and collaboration among departments following standardized training that aligned operations. Similarly, another company reported a 15% decrease in lead times, a direct result of refining processes based on insights gained from training sessions. Employees who participated in SCF workshops exhibited increased confidence in decision-making, translating to more innovative solutions to operational challenges. Improved relationships with suppliers, rooted in better financial practices established through training, invite collaboration and enhanced performance across the supply chain. These success stories exemplify the profound impact of effective training on both operational efficiency and competitive positioning in the broader market landscape.

Challenges and Barriers in Supply Chain Finance Training

Despite the evident advantages, several challenges hinder effective supply chain finance training initiatives. One significant barrier is the lack of awareness regarding the importance of SCF among operational executives. Many organizations view financial aspects as separate from supply chain management, resulting in missed opportunities to integrate these domains. Furthermore, budget constraints often limit the resources allocated for comprehensive training programs, affecting their quality and reach. Additionally, resistance to change among employees can impede the acceptance of new financial methodologies introduced during training. As established practices become ingrained, adapting to innovative SCF strategies can be met with skepticism. Furthermore, scheduling conflicts among employees can cause disruptions in participation, leading to inconsistent learning experiences. Organizations must recognize these challenges as opportunities for improvement and develop strategies to overcome them. This may involve fostering a culture that values continuous learning and investing in the necessary resources for effective training. Ultimately, awareness and commitment are vital for maximizing the benefits of SCF training and ensuring long-term operational success.

Reflecting on the future of supply chain finance training, organizations must strategically adapt to emerging trends and technologies shaping the marketplace. The ongoing evolution in financial practices necessitates dynamic training programs that evolve regularly. Instead of being static, these programs should continually assess industry needs to remain relevant and effective. Incorporating elements such as artificial intelligence and machine learning into SCF training will enhance participants’ analytical capabilities. Providing insights garnered from data-driven decision-making will allow businesses to respond more effectively to market changes. Future training curricula should also include a strong emphasis on sustainability practices, as global standards shift in favor of environmentally responsible approaches. Moreover, fostering collaborations with technology providers can enhance learning experiences by offering tailored solutions that address specific organizational challenges. Organizations should continuously re-evaluate their training protocols and embrace innovative learning methodologies to achieve enduring operational efficiency. By investing in the ongoing development of SCF training, businesses will empower their workforce, ensuring they remain prepared and competitive in an ever-changing landscape, thereby promoting sustained operational success.

The conclusion of this discussion on the impact of supply chain finance training on operational efficiency encapsulates the significance of investing in employee education. Organizations that prioritize SCF workshops can leverage the skills and insights gained by their teams to drive financial and operational improvements. As the complexity of supply chains continues to grow, the demand for knowledgeable banking professionals capable of navigating these intricacies is more pressing than ever. Training empowers employees to understand the relationships between finance, procurement, and logistics intricately, leading to enhanced collaboration among departments. Beyond financial literacy, SCF training encourages innovative thinking, enabling participants to identify and seize opportunities for cost reduction and optimized performance. Furthermore, the resulting culture of continuous learning contributes to organizational resilience, allowing companies to adapt to market fluctuations with agility. The advantages of effective training are broad, impacting not just individual employees but the entire supply chain ecosystem. Therefore, it is essential for organizations to view supply chain finance training as a strategic investment that pays dividends in terms of operational efficiency, supplier relationships, and overall business success.