Innovative Approaches to Supply Chain Finance Optimization

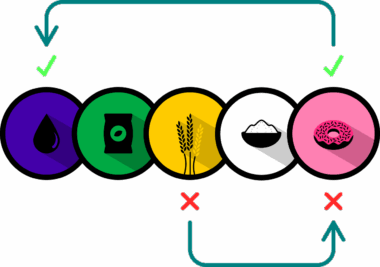

Supply Chain Finance (SCF) plays an essential role in optimizing working capital and improving liquidity throughout the supply chain ecosystem. Various innovative approaches have emerged, making SCF more efficient and beneficial for companies seeking to enhance their financial performance. One effective strategy involves leveraging technology, such as blockchain, to facilitate transparency and traceability in transactions, which builds trust among supply chain partners. Additionally, integrating advanced analytics can provide companies with real-time insights into cash flow patterns, helping them align their financing solutions more effectively. Factoring, reverse factoring, and dynamic discounting are prominent financial instruments used to optimize cash flow. By using these techniques, suppliers can receive timely payments while buyers can extend their payment terms without adversely affecting relationships. Furthermore, technology-driven solutions can automate invoicing and payments, reducing errors and operational costs. Collaboration is vital, as engaging multiple stakeholders within the supply chain enhances communication and leads to better financial outcomes. Collectively, these innovative approaches can lead to improved financial stability, reduced costs, and enhanced overall performance, establishing a more resilient supply chain capable of adapting to market changes.

Implementing progressive risk management practices is another crucial aspect of Supply Chain Finance optimization. Companies increasingly recognize the importance of identifying, assessing, and addressing risks associated with their supply chain operations. Risk management techniques, such as scenario analysis and risk mapping, can help firms pinpoint vulnerabilities within their supply chain network. By proactively managing risks, organizations can enhance their resilience against unexpected disruptions caused by geopolitical events, natural disasters, or economic fluctuations. Diversifying supplier bases and fostering strong relationships within the supply chain are additional proven strategies that mitigate risk exposure. Moreover, companies should consider implementing robust contingency plans to ensure business continuity during crises. The incorporation of supply chain finance with risk management initiatives helps create a more comprehensive approach that benefits all parties involved. Additionally, employing credit risk scoring models allows firms to evaluate supplier creditworthiness, enabling informed decisions regarding financing options. As organizations continue to evolve and leverage technology, they can create adaptive supply chain frameworks capable of minimizing risks while maximizing financial efficiency, ultimately leading to a competitive advantage in today’s dynamic market. This approach not only strengthens SCF programs but also enhances the overall resilience of the entire supply chain.

Collaboration and Partnerships in SCF

Another innovative approach to optimizing Supply Chain Finance is fostering collaboration among stakeholders. Collaboration creates a virtuous cycle of efficiency where all parties benefit from improved processes and shared information. By working closely with suppliers and buyers, companies can ensure that financing solutions meet the diverse needs of the supply chain participants. Collaborative relationships encourage transparency, which leads to better understanding and alignment of goals and expectations. Establishing partnerships with financial institutions is equally essential, as these entities bring expertise and resources to the table. By leveraging credit risk assessments and banking solutions, firms can develop tailored financing options that suit the unique requirements of their supply chain. Furthermore, enabling open communication channels among stakeholders enhances trust and encourages innovation. Implementing a shared platform for data exchange, such as an online portal, can streamline processes ranging from procurement to payment. This interconnectedness allows all parties to make informed decisions based on real-time data, ultimately facilitating timely transactions and reducing inefficiencies. Overall, collaboration and partnerships are pivotal in driving Supply Chain Finance optimization, enabling companies to respond to challenges effectively while achieving mutual gains.

Incorporating sustainable practices into Supply Chain Finance is gaining traction as firms strive to demonstrate their commitment to corporate responsibility. By aligning financing solutions with sustainability initiatives, companies can mitigate risks while enhancing their brand image and attracting socially conscious investors. Sustainable SCF practices involve considering environmental, social, and governance (ESG) factors when making financing decisions. These considerations can lead to investments in green technologies, sustainable sourcing, and ethical production processes. Additionally, adopting circular economy principles can help organizations reduce waste and optimize resource use throughout the supply chain. Companies can explore tying financing options to sustainability targets, rewarding suppliers who meet or exceed environmental benchmarks with better financing terms. Enhanced visibility into the supply chain allows companies to identify opportunities for improvement and promote responsible supplier selection. Moreover, by promoting green finance options, businesses can demonstrate their commitment to combating climate change and encouraging eco-friendly practices. By integrating sustainability principles into SCF strategies, organizations not only enhance their competitiveness but also contribute positively to global sustainability efforts, ensuring the long-term viability of their operations.

Technology and Automation in SCF

The rapid advancement of technology has fundamentally transformed Supply Chain Finance, driving automation and efficiency in operations. Robotic process automation (RPA) and artificial intelligence (AI) have introduced innovative solutions to streamline SCF processes, reducing manual intervention and error rates. By automating tasks such as invoicing, transaction processing, and payment reminders, organizations can significantly improve their operational efficiency. Additionally, machine learning algorithms can analyze vast amounts of data to identify payment patterns, optimizing cash flow forecasting and ensuring the timely availability of funds. Implementing cloud-based platforms offers real-time access to financial data, enabling collaborative decision-making among stakeholders. Such systems enhance the visibility of cash flow across the supply chain, allowing businesses to make timely, informed decisions. Integrating data from multiple sources and effectively managing it through advanced analytical tools can further improve supply chain financial management. Furthermore, utilizing blockchain technology introduces unprecedented levels of trust and security by providing a decentralized ledger of transactions. As companies embrace these technological innovations, they are not only optimizing supply chain finance but also setting new standards for efficiency and competitiveness in an ever-evolving marketplace.

Continuous improvement methodologies are instrumental in optimizing Supply Chain Finance as well. Concepts such as Lean and Six Sigma can be adopted to streamline processes, reduce waste, and minimize inefficiencies across the supply chain. By focusing on process optimization, organizations can uncover hidden opportunities for savings or cash flow improvements. Lean methodologies prioritize eliminating non-value-added activities, which translates to shorter lead times and faster payment cycles. Simultaneously, Six Sigma focuses on minimizing variances and defects, enhancing overall quality. Implementing these continuous improvement frameworks involves engaging employees at all levels of the organization, promoting a culture of collaboration, accountability, and innovation. Organizations should also prioritize regular performance reviews to gauge the effectiveness of SCF strategies and ensure alignment with business objectives. Establishing key performance indicators (KPIs) can provide measurable insights into the performance and efficiency of supply chain finance activities. Additionally, incorporating audits and feedback loops enables firms to learn from challenges and adapt. Through ongoing improvement efforts, companies can create resilient SCF programs that consistently contribute to their long-term financial growth and sustainability goals.

Conclusion

In conclusion, the optimization of Supply Chain Finance through innovative approaches is crucial for organizations seeking to enhance financial performance and resilience. By leveraging technology, fostering collaboration, embracing sustainability, and adopting continuous improvement methodologies, companies can create a robust financial framework that effectively addresses the complexities of modern supply chains. Each strategy plays a vital role in building a more adaptive and efficient supply chain capable of responding to market fluctuations and uncertainties. Organizations that commit to integrating these best practices will not only optimize their cash flow and working capital but also reinforce their competitive advantage in the global marketplace. Ultimately, a well-optimized supply chain finance program can lead to improved supplier relationships, increased customer satisfaction, and greater overall profitability. As the landscape of supply chain finance continues to evolve, staying informed and proactive in implementing these innovative approaches will be key to securing success in an increasingly complex environment. Companies willing to innovate and adapt their SCF strategies will be better equipped to thrive in the future, positioning themselves as leaders in the industry.

As companies navigate the evolving landscape of Supply Chain Finance, building a foundation based on innovation, trust, and collaboration ensures lasting success. By embracing change and focusing on best practices, organizations can equip themselves with the tools needed to drive efficiency, mitigate risks, and unlock value throughout their supply chains. Companies that prioritize continuous improvement, consistently innovate, and leverage technology will find themselves better prepared to overcome challenges. Moreover, fostering long-term relationships with financial institutions and key supply chain partners unlocks new financing avenues that contribute to the overall success of supply chain finance initiatives. In this rapidly changing environment, organizations must remain agile and adapt to fluctuations in market dynamics and customer expectations. The benefits of a well-optimized Supply Chain Finance program extend beyond mere cost savings; they foster a culture of resilience and adaptability within organizations. Engaging stakeholders effectively and leveraging shared insights will enhance operational performance while promoting sustainability. By unlocking the potential of innovative strategies, firms can position themselves for success and elevate their supply chain finance practices to new levels, ultimately resulting in sustainable growth and improved overall performance.