Nonprofit Fund Accounting Basics and GAAP Compliance

Nonprofit fund accounting is a specialized system designed specifically for nonprofit organizations. Its primary purpose is to ensure accurate tracking of financial resources and compliance with applicable accounting standards. Nonprofits often operate under specific funding constraints, which require them to demonstrate accountability to donors, government agencies, and other stakeholders. Understanding standard accounting principles such as GAAP (Generally Accepted Accounting Principles) is vital for nonprofits. GAAP provides a framework of accounting standards, principles, and procedures ensuring transparency in financial reporting. Nonprofits typically engage with numerous funding sources, each with unique requirements and restrictions. This makes stringent adherence to GAAP even more essential. Effective fund accounting keeps track of restricted and unrestricted contributions separately. It ensures that funds earmarked for specific purposes are used according to donor intentions. Nonprofits that follow GAAP also strengthen their financial management and decision-making processes. Moreover, compliance with FASB regulations, particularly Statement 117, is crucial. This facilitates accurate accounting for all types of donations and grants, ensuring proper classification on financial statements. Therefore, understanding nonprofit fund accounting advances fiscal responsibility, which is indispensable to maintaining stakeholder trust.

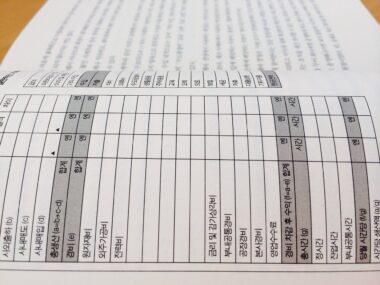

Another vital aspect of nonprofit accounting is the classification of funds. Nonprofits categorize funds into distinct classes for better tracking. Typically, there are three main categories: unrestricted, temporarily restricted, and permanently restricted funds. Unrestricted funds can be used for any purpose that aligns with the organization’s mission. Temporarily restricted funds have donor-imposed restrictions on their usage but will eventually become unrestricted. Permanently restricted funds, however, require adherence to long-term stipulations set by the donors, often involving the principal amount remaining intact. Properly managing these classifications is fundamental to reporting transparency and accountability to stakeholders. Each type of fund has specific recording and reporting requirements under GAAP, emphasizing the necessity for detailed record-keeping. Accurate tracking not only assists in fulfilling donor expectations but also provides a clear financial snapshot for the organization. Nonprofits must maintain detailed records of all financial activities concerning their various funds to ensure compliance and avoid significant legal issues. Implementing robust financial policies that address these aspects can prove beneficial. By understanding these classifications, organizations can establish stronger financial foundations and enhance their credibility.

Understanding Financial Statements in Nonprofits

Financial statements are critical tools for effective nonprofit management. The three primary types of statements include the statement of financial position, statement of activities, and statement of cash flows. The statement of financial position provides a snapshot of the organization’s assets, liabilities, and net assets at a particular point in time. It is essential for understanding the financial health of the organization. The statement of activities showcases the organization’s revenues and expenses over a specific period, detailing how funds are utilized. Meanwhile, the statement of cash flows highlights inflows and outflows of cash, essential for assessing liquidity and operational efficiency. Each of these statements serves unique purposes, offering a comprehensive view of the nonprofit’s fiscal status. Furthermore, they must align with GAAP standards to ensure comparability and transparency. By producing these financial reports, organizations can foster trust among stakeholders while ensuring compliance with regulatory requirements. Regularly updated and audited financial statements enhance the nonprofit’s reputation and can aid in attracting new funding sources. In the end, understanding these financial documents allows nonprofits to make informed decisions and improve overall operational effectiveness.

Proper budgeting and forecasting are essential for nonprofits operating within limited resources. A budget outlines expected revenues and expenses, serving as a financial plan to guide the organization’s activities throughout the fiscal year. Incorporating realistic projections based on historical performance can enhance budgeting accuracy. Effective forecasting, which predicts future revenues and expenditures, provides critical insights into potential financial challenges. Nonprofits must prepare for scenarios that could impact funding availability. Regularly revisiting and adjusting budgets is crucial to adapting to changing circumstances, especially in uncertain economic climates. It allows organizations to stay aligned with their missions while ensuring financial stability. Moreover, employing budgeting software can streamline the process, facilitating better planning and tracking of actual vs. budgeted expenses. Transparency in the budgeting process, particularly in how funds will be spent, enhances accountability and fosters stakeholder confidence. Nonprofits should engage stakeholders when creating budgets to ensure alignment with organizational goals. By developing thorough budgeting and forecasting practices, nonprofits position themselves to successfully navigate financial uncertainties while fulfilling their missions. These practices support sustainability and help attract additional funding by showcasing financial responsibility.

Best Practices for Compliance and Reporting

Compliance with accounting standards is pertinent for nonprofits aspiring to build trust with donors and stakeholders. To achieve this, nonprofits should adopt best practices for financial reporting and compliance. One such practice is employing a qualified accountant or financial manager familiar with nonprofit standards. Their expertise in GAAP and FASB regulations will help ensure accurate reporting and adherence to financial rules. Nonprofits must maintain detailed records of all transactions, facilitating transparent reporting. Regular audits are also beneficial, providing an external perspective on financial accuracy and good practices. They foster trust and can shine a light on improvement areas. Additionally, utilizing accounting software designed for nonprofits can simplify tracking and reporting processes, making it easier to generate statements compliant with GAAP. Staff training on fund accounting principles and financial best practices is another essential practice; enhancing team understanding fosters a culture of compliance. Lastly, establishing strong internal controls to minimize financial risks is vital. These best practices collectively empower nonprofits to uphold accountability and ensure their financial reporting aligns with ethical standards.

One important consideration for nonprofits is ensuring they maintain their nonprofit status while adhering to GAAP. This involves regularly reviewing compliance requirements and staying current on accounting principles and regulations. Nonprofits must understand the different types of financial reporting they are required to produce based on state and federal regulations. It may involve additional disclosures not typically required by for-profit entities. Additionally, nonprofits should recognize that their financial statements serve as a form of communication with donors and the public. As a result, clarity and transparency are vital to maintaining credibility. Organizations might consider adopting generally accepted auditing standards (GAAS) to enhance the reliability of financial reporting. Collaborating with skilled accountants familiar with the nonprofit sector can streamline this process, ensuring the organization understands its obligations. Nonprofits should also stay proactive by engaging in continual professional development and networking with industry peers to keep updated on best practices. This vigilant approach to compliance will not only help avert legal issues but also bolster the organization’s reputation. It demonstrates a commitment to ethical practices, promoting long-term sustainability.

Conclusion: The Importance of GAAP Compliance

GAAP compliance is indispensable for nonprofits not only for regulatory adherence but also for establishing credibility. By utilizing the principles of GAAP in their financial reporting, nonprofits can provide accurate and reliable financial information to stakeholders. This transparency is crucial in building trust with donors, which, in turn, can lead to increased funding opportunities. Furthermore, rigorous financial practices involving GAAP ensure that resources are used efficiently, fostering organizational growth and sustainability. Organizations can leverage compliant financial reporting to secure grants and funding as part of their broader engagement strategies. Moreover, adherence to these standards sets clear expectations within the organization regarding financial management practices. This allows for consistent and informed decision-making across all levels, ultimately enhancing overall operational effectiveness. A nonprofit that commits to GAAP compliance positions itself as a responsible steward of its resources, essential for attracting future support. As such, it becomes vital for nonprofit leaders to not only understand but also implement GAAP principles effectively. In conclusion, strict adherence to nonprofit fund accounting standards leads to greater organizational success, fulfilling their mission while ensuring accountability.

Nonprofit fund accounting is a specialized system designed specifically for nonprofit organizations. Its primary purpose is to ensure accurate tracking of financial resources and compliance with applicable accounting standards. Nonprofits often operate under specific funding constraints, which require them to demonstrate accountability to donors, government agencies, and other stakeholders. Understanding standard accounting principles such as GAAP (Generally Accepted Accounting Principles) is vital for nonprofits. GAAP provides a framework of accounting standards, principles, and procedures ensuring transparency in financial reporting. Nonprofits typically engage with numerous funding sources, each with unique requirements and restrictions. This makes stringent adherence to GAAP even more essential. Effective fund accounting keeps track of restricted and unrestricted contributions separately. It ensures that funds earmarked for specific purposes are used according to donor intentions. Nonprofits that follow GAAP also strengthen their financial management and decision-making processes. Moreover, compliance with FASB regulations, particularly Statement 117, is crucial. This facilitates accurate accounting for all types of donations and grants, ensuring proper classification on financial statements. Therefore, understanding nonprofit fund accounting advances fiscal responsibility, which is indispensable to maintaining stakeholder trust.