Tech-Driven Approaches to Fraud Prevention in Supply Chain Finance

Supply chain finance is a crucial aspect of modern commerce, significantly impacted by technological innovations. Fraud prevention within this field has become increasingly essential as businesses partner globally, leading to complex transactions that can be targets for fraudulent activity. With the integration of advanced technology, companies can develop robust systems to monitor, detect, and prevent potential fraud, ensuring the integrity of their supply chains. Implementing machine learning algorithms enables organizations to analyze vast information quickly, identifying suspicious patterns that would often be overlooked. Furthermore, blockchain technology enhances transparency and traceability within the supply chain, making it more difficult for malicious actors to manipulate data or documents. By utilizing smart contracts within this ecosystem, payments and terms can be automated, ensuring compliance without human intervention. Overall, the combination of machine learning and blockchain offers a multidimensional approach to combat fraud effectively. Data-driven insights become vital in forecasting risks and enhancing operational efficiencies. Adopting a proactive stance in fraud prevention can yield significant financial savings and build trust among stakeholders in such an interconnected environment.

The landscape of supply chain finance continues to evolve as technology influences operational processes and addresses challenges. Fraud detection and prevention require not only technology but also the collaboration among various stakeholders, including suppliers, financial institutions, and logistics providers. This synergy fosters a robust network where information sharing is common, allowing for rapid response to potential fraud risks. Technology acts as a facilitator in this collaborative environment. Advanced analytics platforms can analyze transaction data across the network, flagging anomalies and prompting quick investigations. Furthermore, implementing artificial intelligence systems can help organizations to assess credit risks better and streamline due diligence processes. These systems can provide predictive analytics, enabling businesses to foresee potential issues before they escalate. The integration of real-time data streams enhances decision-making capabilities, allowing for agile responses to fraud attempts. This proactive approach is essential in maintaining operational integrity and reducing financial losses. Leveraging technology not only strengthens security but also optimizes resources, contributing to the overall efficiency of supply chain finance. In this digital age, businesses must be equipped with the tools necessary to navigate complexities and safeguard against fraud.

The Role of Data Analytics in Fraud Prevention

Data analytics plays a pivotal role in the modern supply chain finance framework, revolutionizing the way businesses approach fraud prevention strategies. By employing big data, organizations can process and analyze historical transaction data to discern genuine behavior patterns and identify anomalies, which may indicate fraudulent activity. This ability to distinguish between legitimate and suspicious transactions is invaluable in preventing financial losses. Real-time data analysis allows for immediate alerts when a transaction deviates from established norms, enabling organizations to respond quickly and mitigate risks. Moreover, predictive models built on historical data can forecast potential fraud risks, allowing businesses to implement preventive measures proactively. Retrofitting legacy systems with advanced analytics capabilities ensures all dimensions of the supply chain are covered, enhancing overall security. Additionally, integrating analytical tools with automated systems helps streamline operations, reducing human error and further enhancing fraud prevention. Comprehensive training on data-driven tools ensures staff are equipped to leverage these technologies effectively. As companies continue to adapt to evolving threats, fostering a culture of data utilization will remain paramount to maintain a competitive edge in the supply chain finance sector.

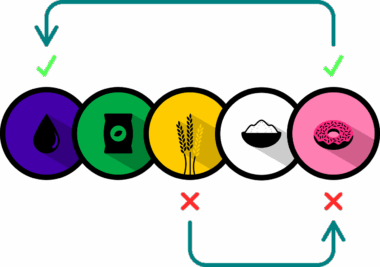

Blockchain technology stands out as a groundbreaking solution in the fight against fraud in supply chain finance. By creating a decentralized and immutable ledger, blockchain enhances transparency and accountability within the supply chain. Every transaction recorded on the blockchain is time-stamped and can be traced back to its origin, making it exceedingly difficult for fraudsters to alter or replicate records without detection. Smart contracts, empowered by blockchain, automate and enforce contractual agreements, thus reducing the risk of disputes and facilitating smoother transactions. This technological approach not only minimizes human intervention, but also limits the potential for fraud-related discrepancies. Furthermore, blockchain fosters trust among stakeholders by ensuring that all parties have access to the same factual information, enhancing collaboration and efficiency. Given the increasing prevalence of cyber threats, blockchain’s security features protect sensitive data from breaches. In essence, adopting blockchain technology equips businesses with a formidable tool against fraud while driving operational efficiencies. However, the successful implementation of blockchain requires a shift in traditional mindsets and practices within the supply chain finance ecosystem.

Emerging Technologies and Fraud Detection

Emerging technologies are continuously enhancing the capabilities of fraud detection systems in supply chain finance. Artificial Intelligence (AI) and machine learning algorithms are being harnessed to improve data processing speeds and accuracy, driving innovation in fraud prevention methodologies. These technologies analyze large datasets for behavioral anomalies linked to fraud, alerting risk managers in real time. By employing neural networks, machine learning models learn from previously identified fraud instances and continually refine their criteria for detecting irregularities. As fraud techniques become more sophisticated, AI-driven analysis can adapt and evolve, staying one step ahead of potential fraudsters. Natural Language Processing (NLP) also contributes by enabling systems to scrutinize documentation and communications, identifying inconsistencies that might indicate fraudulent intent. Additionally, integrating Internet of Things (IoT) devices into the supply chain provides real-time data streams enriching analytics, allowing further insight into transaction authenticity. Coordinating these technologies can substantially bolster the fraud prevention framework, enhancing overall supply chain security and optimizing operational performance. For organizations, investing in these technological advancements not only minimizes risks but also positions them as leaders in the competitive supply chain landscape.

Collaboration across the industry is a crucial aspect of developing effective fraud prevention strategies. Stakeholders, including businesses, subcontractors, and financial institutions, must work together to create shared standards and protocols to address fraud concerns. By establishing collaborative networks and consortia, organizations can pool resources and knowledge, enhancing their collective ability to combat fraud. Sharing best practices and threat intelligence across the industry strengthens the overall security posture. Additionally, conducting joint training sessions and simulations helps prepare all stakeholders for potential fraud scenarios. Collaborative platforms can also facilitate the development of shared databases, allowing organizations to track known fraud attempts and bad actors in real time. This shared intelligence fosters a culture of transparency and cooperation, empowering all parties to detect and combat fraud more effectively. Moreover, joint investment in anti-fraud technology can be more financially feasible and help achieve a greater return on investment. Ultimately, a united front against fraud not only protects individual businesses but also fortifies the integrity of the entire supply chain finance ecosystem.

Conclusion: The Future of Supply Chain Fraud Prevention

Looking ahead, the future of fraud prevention in supply chain finance is marked by continuous innovation and adaptation to new challenges. As technology advances, businesses must remain vigilant and proactive in mitigating risks associated with fraud. Implementing advanced data analytics, AI, and blockchain technology are key strategies that will define the path forward. In addition, fostering industry collaboration will enhance the collective ability to address emerging threats. Continuous education and training for stakeholders across the supply chain are crucial to ensure that everyone is equipped with the skills and knowledge to identify and respond to fraudulent activities effectively. As companies increasingly rely on digital platforms for transactions, developing robust, secure systems will be paramount. It’s important for organizations to regularly assess and update their fraud prevention strategies, staying ahead of potential threats. By embracing technology and fostering collaboration, businesses can create resilient supply chains capable of withstanding fraud attempts. In this evolving landscape, innovative tech-driven strategies will be the foundation of secure operations, ultimately enhancing trust and stability within the supply chain finance sector.

Supply chain finance is a crucial aspect of modern commerce, significantly impacted by technological innovations. Fraud prevention within this field has become increasingly essential as businesses partner globally, leading to complex transactions that can be targets for fraudulent activity. With the integration of advanced technology, companies can develop robust systems to monitor, detect, and prevent potential fraud, ensuring the integrity of their supply chains. Implementing machine learning algorithms enables organizations to analyze vast information quickly, identifying suspicious patterns that would often be overlooked. Furthermore, blockchain technology enhances transparency and traceability within the supply chain, making it more difficult for malicious actors to manipulate data or documents. By utilizing smart contracts within this ecosystem, payments and terms can be automated, ensuring compliance without human intervention. Overall, the combination of machine learning and blockchain offers a multidimensional approach to combat fraud effectively. Data-driven insights become vital in forecasting risks and enhancing operational efficiencies. Adopting a proactive stance in fraud prevention can yield significant financial savings and build trust among stakeholders in such an interconnected environment.