Nonprofit Financial Policies and IRS Compliance

Nonprofit organizations play a vital role in society, providing various services that enhance community welfare. To maintain this crucial status, adhering to financial policies and IRS compliance is indispensable. Nonprofits must navigate complex regulations that dictate how finances are managed and reported. Establishing clear financial policies is essential for promoting transparency and accountability. These documents serve not only as guidelines for internal practices but also as essential tools in compliance with IRS standards. Without comprehensive financial policies, nonprofits could face severe consequences, including loss of tax-exempt status. IRS compliance entails regular reporting, accurate financial record-keeping, and adherence to restrictions on activities and compensation. Therefore, providing training for staff and volunteers is key to ensuring everyone understands these policies. Clear procedures help nonprofits declare revenue correctly, manage grants, and uphold their commitment to stakeholders. Implementing robust financial policies can lead to improved trust from donors and supporters. It is vital to continuously review and update these policies to address changing regulations or operational needs. This practice ensures that the organization remains in good standing with the IRS and maximizes its effectiveness in serving its mission.

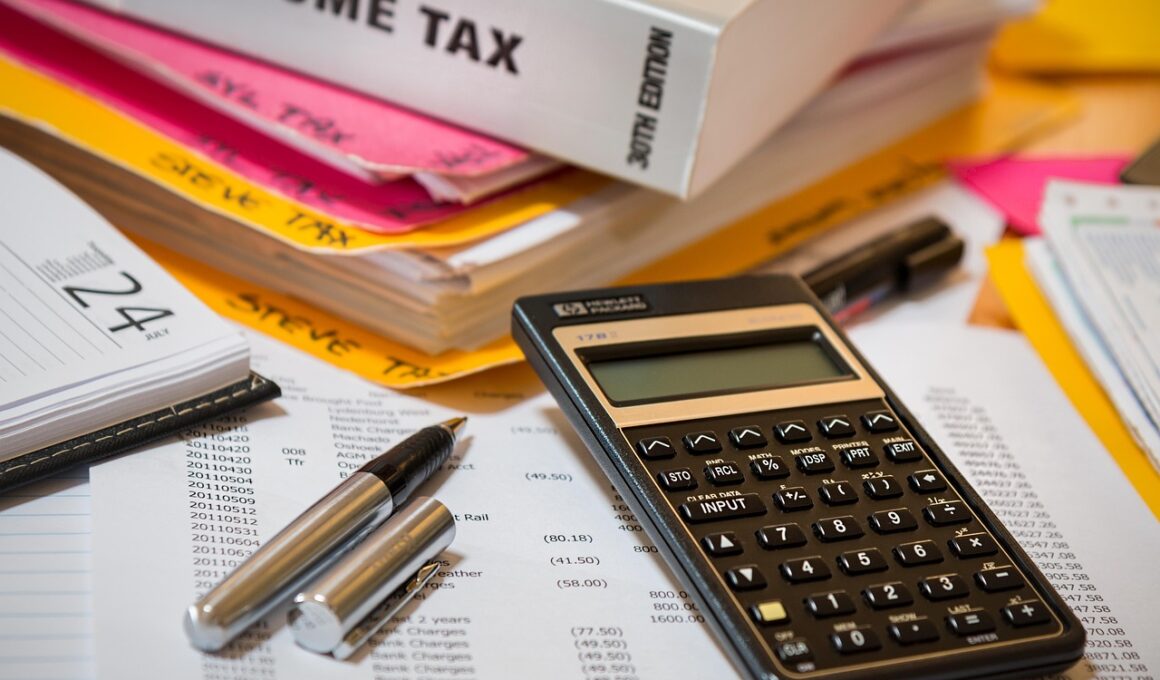

Understanding IRS compliance requirements is imperative for nonprofits to fulfill their obligations as tax-exempt entities. Nonprofits must regularly file specific forms, including the IRS Form 990, which provides a comprehensive overview of their financial activities, governance, and programs. These forms are critical for public transparency and accountability. Additionally, exact record-keeping is essential for supporting the information reported on Form 990. This process involves documenting all financial transactions, including revenues, expenditures, and contributions. Moreover, nonprofits must maintain their tax-exempt status by complying with IRS regulations related to lobbying and political activities. Engaging in excessive lobbying can jeopardize tax-exempt status, so limitations exist. Nonprofits should ensure that they properly allocate funds and resources to charitable purposes. Another vital aspect is the proper handling of donor contributions. Nonprofits need to provide receipts for donations received, which help to maintain trust and transparency with their supporters. Furthermore, it is essential to communicate these policies to board members, staff, and volunteers. By doing so, nonprofits foster a culture of compliance, ensuring financial integrity and protecting their mission. A continuous evaluation of compliance processes ensures that organizations remain proactive in adhering to all necessary regulations.

Key Elements of Financial Policies

Developing comprehensive financial policies involves encompassing various essential elements that contribute to effective management. First, nonprofit organizations must establish clear definitions and roles regarding financial responsibilities. This clarity ensures that everyone involved understands their duties. Second, creating a budgeting process must be a priority for organizations. A well-thought-out budget outlines expected revenue and expenses, provides a roadmap for financial operations, and helps mitigate potential risks. Furthermore, nonprofits should emphasize the importance of cash flow management. Adequate cash flow is crucial for sustaining operations and funding programs. The establishment of strong internal controls is another critical component of financial policies. These controls prevent fraud and ensure that funds are managed properly. An example of this is segregation of duties, which mandates that no single individual handles all facets of a financial transaction. Regular financial reporting is also necessary for maintaining oversight and transparency. Finally, ongoing staff training and education about financial policies can significantly enhance understanding and compliance among team members. A solid financial policy framework can strengthen operations and build confidence with stakeholders and donors, making it easier to achieve the organization’s goals.

Nonprofits benefit from establishing clear guidelines for the management of their grants and funding. Proper grant management policies ensure accountability and demonstrate effective use of funds to donors and grant-making agencies. Every nonprofit organization must understand the terms of grants and maintain compliance with funders’ requirements. This involves routine reporting on how funds are spent and achieving the desired outcomes. Furthermore, developing policies around grant applications is crucial for ensuring consistency in pursuit of funding. These policies may include guidelines about who can apply, how applications should be prepared, and the criteria for awarding grants. Evaluating grant proposals systematically promotes fairness and objectivity in decision-making. In addition, maintaining documentation related to grant funds is vital. This documentation includes receipts, invoices, and reports on project outcomes. Strong financial policies will guide the organization in maintaining proper records and accounting for how grant resources are utilized. Transparency is equally essential in these processes, fostering trust between nonprofits and their funders. Nonprofits can secure funds effectively, optimize resources, and fulfill their missions by adhering to best practices in grant management through clear policy development.

Monitoring and Evaluation of Financial Policies

Regular monitoring and evaluation of financial policies are essential for nonprofits to ensure compliance with IRS regulations and overall financial health. Nonprofits should conduct internal audits to assess the effectiveness and appropriateness of existing financial controls. These audits help identify areas for improvement and potential vulnerabilities that could jeopardize financial integrity. Furthermore, engaging external auditors to conduct annual financial audits can provide an unbiased look into the organization’s financial practices. These audits not only enhance public trust but also comply with IRS expectations. In addition to external reviews, nonprofits can create key performance indicators (KPIs) to track financial operations effectively. Setting specific KPIs related to cash flow, budgeting accuracy, and grant management can greatly enhance financial oversight. Nonprofits should foster a culture of accountability with regular report-sharing among staff, board members, and stakeholders. Additionally, creating a feedback loop where employees can express concerns or suggestions regarding financial policies contributes to continuous improvement. By investing time and resources into evaluating financial policies, organizations can ensure both compliance and improved financial performance, ultimately strengthening their mission and impact within the community.

Adapting financial policies in response to changing regulations is critical for nonprofit sustainability. Nonprofits operate in a dynamic regulatory environment, requiring organizations to stay informed about potential changes in IRS rules or local laws that may affect their operations. Staying proactive means regularly reviewing relevant regulatory updates and adjusting practices accordingly. Some areas may require deeper scrutiny, such as tax laws affecting charitable donations, which can have direct effects on donor behavior. Effective communication with legal advisors or financial consultants can help nonprofits navigate such changes confidently. Furthermore, nonprofits should institutionalize a process for revising financial policies. This process should involve stakeholder engagement and input from team members who directly interact with financial policies. Additionally, training personnel in updated policies is essential to ensure understanding and compliance throughout the organization. Regular training sessions provide organizations an avenue to reinforce the significance of financial policies and IRS compliance. By being proactive in adapting to changes, nonprofits can maintain operational effectiveness and trust among their stakeholders, ultimately enhancing their ability to achieve their mission and serve their communities effectively.

Conclusion: Building a Strong Financial Future

In conclusion, robust financial policies and IRS compliance are paramount for nonprofits aiming to fulfill their missions effectively. Establishing clear financial guidelines, embracing transparency, and implementing accountability measures lead to sustainable financial management. Nonprofits are tasked with adhering to various regulations, which highlights the importance of ongoing staff training and evaluation of policies. Moreover, organizations must routinely assess their financial practices and make necessary adjustments to stay compliant with ever-evolving regulations. By fostering an environment of strong financial governance, nonprofits can significantly impact their communities. Strong financial policies cultivate trust with stakeholders, including donors and grantors, improving fundraising efforts. This foundation of trust ensures that donors feel confident in supporting their initiatives, knowing funds will be managed ethically and efficiently. Furthermore, a commitment to adapting and continuous improvement in financial policies ensures long-term sustainability and resilience in the face of challenges. As nonprofits build on these principles, they empower themselves to better serve their communities and achieve their established goals. Ultimately, prioritizing sound financial practices and compliance with IRS regulations is an investment in the organization’s future success.

Fundamentally, enhancing nonprofit financial practices requires a commitment to education, transparency, and ongoing evaluation. By approaching financial policies strategically, nonprofits can ensure their operational integrity and alignment with their mission. Engaging board members and staff in the development and implementation of these policies creates a sense of ownership and accountability among all members. Nonprofit leaders should prioritize communication concerning financial matters, ensuring that everyone understands the importance of these practices. Promoting a culture where compliance is seen as a shared responsibility strengthens the organization’s foundation. Building an environment of trust and support among stakeholders amplifies the potential for impactful community initiatives. Additionally, consistent training helps maintain an informed workforce prepared to manage compliance risks effectively. Nonprofits can create an effective feedback system where staff can voice concerns, share best practices, and suggest potential improvements. By fostering a collaborative atmosphere, organizations are likely to realize more innovative solutions to challenges and enhance their overall efficiency. Overall, nonprofits must recognize that adhering to financial policies not only meets regulatory requirements but also enhances their capacity to achieve their missions.