Financial Transparency and Its Impact on Mergers and Acquisitions

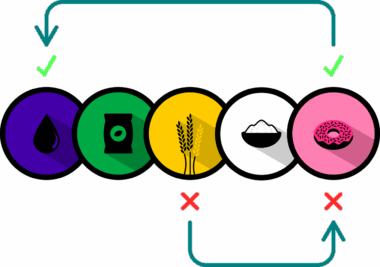

Financial transparency has become a critical element in the arena of business mergers and acquisitions. It serves as the foundation for trust between negotiating parties, fostering a conducive environment for collaboration. Transparent financial disclosure increases investor confidence, thereby influencing market perceptions and stock valuations significantly. Companies looking to merge or acquire typically present their financial statements to demonstrate their financial health. Undeniably, accurate disclosures are essential to prevent potential legal issues arising from misrepresentations. Moreover, when firms openly share their financial data, they invite scrutiny that can lead to a more thorough due diligence process. This facilitates informed decision-making for both buyers and sellers. Consequently, the presence of transparent practices mitigates the risks associated with financial ambiguities. Transparency also helps analysts and stakeholders assess the true value of the target company, thereby reducing the chances of overpaying. It aids in identifying synergies that can be leveraged post-acquisition, enhancing overall strategic fit. Thus, fostering financial transparency within corporate governance frameworks is paramount to the success of mergers and acquisitions, and it undeniably influences the overall marketplace dynamics.

One of the main benefits of financial transparency in mergers and acquisitions is the mitigation of risks associated with incomplete or misleading information. Potential acquirers often have concerns regarding hidden liabilities or off-balance-sheet items. These worries can prevent a deal from occurring or lead to unfavorable deal terms. When companies share detailed financial statements, they reduce uncertainty for prospective buyers, thus paving the way for smoother negotiations. Greater openness in financial dealings not only enhances the credibility of the merging entities but also positively influences stakeholder perceptions. This embrace of financial clarity can ultimately improve investor relations. Additionally, organizations known for transparency are likely to receive more favorable financial terms during acquisitions. This favorable environment provides opportunities for companies hoping to excel in the long term. Furthermore, favorable perceptions associated with transparency can lead to increased competitive advantages. Companies that prioritize transparent practices may find their stock prices receiving better valuation and market attention. The integration of stringent financial disclosure standards into corporate cultures is therefore essential, presenting multiple benefits for successful mergers and acquisitions, enabling more strategic alliances in the ever-evolving business landscape.

The Role of Regulatory Frameworks

Regulatory frameworks play a significant role in promoting financial transparency within the context of mergers and acquisitions. Regulations establish necessary guidelines which companies must adhere to, ensuring that disclosures are made in a systematic and uniform manner. In jurisdictions where regulations are strictly enforced, firms tend to maintain higher levels of transparency and accountability in their financial practices. This compliance fosters confidence in the merger and acquisition process, enhancing collaborative decision-making among parties involved. Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, enforce rules that mandate timely and accurate reporting of financial information. Such regulations deter companies from engaging in fraudulent activities, thereby protecting investors and stakeholders adequately. Moreover, stringent regulatory environments lead to a more competitive marketplace where transparent financial information is readily available. This heightens the level of scrutiny involved in transactions, benefiting both parties and leading to better overall deal structures. Ultimately, effective regulation cultivates a culture of transparency that not only benefits individual mergers and acquisitions but also strengthens the overall financial landscape.

The impact of financial transparency on pricing mechanisms during mergers and acquisitions cannot be underestimated. When potential buyers have access to reliable and comprehensive financial information, they can make better estimates regarding the fair value of a target company. Consequently, this data-driven approach often leads to more equitable pricing for both parties. Transparency can also influence negotiation dynamics, as disclosing financial performance metrics allows for conversations based on facts rather than assumptions. Availability of audited financial statements and detailed disclosures empowers acquirers to formulate competitive offers that reflect genuine interest while minimizing risks. Additionally, financial insights enable buyers to identify potential synergies, ensuring that anticipated post-merger enhancements are attainable. Therefore, transparency not only eases price negotiations but also enhances the overall efficiency of the acquisition process. As a result, financial transactions can be completed more rapidly and with a clearly defined rationale. Ultimately, the enhancements brought forth by transparent financial practices contribute to the long-term success of merged entities, enhancing stakeholder value and operational efficiency. Thus, adopting transparency within corporate governance is a significant factor in achieving favorable outcomes during mergers and acquisitions.

Investor Confidence and Market Response

Financial transparency significantly influences investor confidence and market response in the context of mergers and acquisitions. Investors are more likely to back companies that prioritize transparency, as they perceive these firms to be more trustworthy and reliable. This heightened confidence can have a considerable effect on a company’s stock price before and after a merger announcement. Transparency instills a sense of assurance among investors, leading them to engage positively with the firm’s stock. In contrast, companies shrouded in financial ambiguity often face skepticism, resulting in potential drops in share prices and increased volatility. Moreover, the market’s perception of a merger can be heavily swayed by the quality of disclosures provided by both companies. Investors seek out information pertaining to profitability, debts, and overall financial health, and clarity in such matters can elicit enthusiastic responses. Conversely, a lack of transparency may lead investors to speculate on negative outcomes, hindering potential growth trajectories. Companies must therefore establish robust internal controls and disclosure policies to ensure high levels of transparency during the merger and acquisition process, allowing for greater investor trust and increased market stability.

Aside from positively influencing investor sentiment, financial transparency serves as a powerful tool for improving post-merger integration outcomes. Effective integration involves aligning two distinct corporate cultures, systems, and processes to achieve a more cohesive entity. Transparent financial practices can assist in identifying key performance indicators and monitoring integration success. When both companies operate with a shared understanding of financial goals and objectives, they are likely to experience smoother transitions. Additionally, transparent practices can enhance employee morale and engagement during this critical period. Employees are more likely to be committed to the success of the merged organization when they are informed of its financial health and future potential. Open communication channels regarding financial performance can also facilitate greater alignment in operational strategies post-merger. Ultimately, transparency plays a vital role in guiding the merged entity toward achieving its ambitions while minimizing disruptions. Companies focused on transparency can improve stakeholder relationships and establish a collaborative workplace culture, which is necessary for organizations operating after mergers and acquisitions. For lasting success, transparency in financial reporting should extend beyond the initial merger phase, supporting continued growth.

Challenges in Achieving Financial Transparency

Despite the benefits of financial transparency in mergers and acquisitions, there are challenges companies face in achieving it. Organizations must navigate complex financial landscapes and regulatory requirements, which can hinder the timely dissemination of information. Moreover, companies may encounter resistance internally when necessary changes to disclosure practices are proposed. Employees may be concerned about exposing sensitive financial data, leading to reluctance to embrace transparency fully. Additionally, the evolving nature of regulations can create uncertainty regarding compliance, complicating financial reporting efforts. Companies must also invest in technological solutions to facilitate seamless data collection and disclosure processes. Implementing effective management systems can address issues surrounding accuracy and timeliness of financial information, but adequate training and resource allocation are required to do so. Moreover, there may be costs associated with enhancing transparency, particularly for organizations with historically opaque practices. Yet, the long-term advantages of improved transparency often outweigh these initial hurdles. By understanding the challenges and actively working to overcome them, companies can establish a more transparent culture that ultimately enhances their prospects during mergers and acquisitions. This proactive approach may lead to larger benefits for both the organization and stakeholders alike.

To conclude, financial transparency significantly affects mergers and acquisitions, influencing investor confidence, pricing structures, and post-merger integration success. As companies increasingly recognize the value of open financial communication, they can build trust with their stakeholders and pave the way for successful transactions. Regulatory frameworks provide essential guidance in promoting these practices. However, organizations must remain vigilant in addressing challenges associated with transparency. By fostering an organizational culture that embraces openness, companies can position themselves as trustworthy partners in the merger process. Moreover, the competitive landscape rewards firms that prioritize financial transparency by enhancing their market value. Thus, the emphasis on transparent practices is essential for organizations seeking to optimize mergers and acquisitions. As a result, organizations should continue to refine their financial disclosure processes, ensuring compliance with applicable regulations and fostering investor relations. The ultimate goal is to establish a sustainable framework that supports effective oversight of financial practices and creates long-lasting benefits. Firms committed to transparency will likely find themselves ahead in an increasingly complex business environment, making the case for integrating strong governance frameworks. Doing so can lead to enduring success in future transactions, increasing stakeholder trust while facilitating optimal growth.