Leveraging Technology to Promote Sustainable Supply Chain Finance

Sustainable Supply Chain Finance (SSCF) integrates economic, environmental, and social considerations. This approach facilitates financial transactions that prioritize sustainability at every stage of the supply chain. Technology is pivotal, enabling real-time tracking, efficient communication, and precise data analysis. Utilizing advanced technological solutions supports transparent and sustainable practices. Innovations such as blockchain ensure data integrity, enhance security, and improve traceability, which are critical for sustainable financing. Additionally, cloud technology enables businesses to store vast amounts of data, making it accessible from anywhere. By improving information flow, companies can evaluate risks and opportunities more effectively. Furthermore, automation in financial processes minimizes human error and accelerates transactions. Enhanced data analytics provide insights into supplier performance, assisting decision-making regarding sustainable sources. Ultimately, leveraging technology promotes a competitive advantage, enabling companies to meet customers’ growing demand for sustainability. This includes assessing and improving the ecological impact of their operations. As the global market dynamics shift, embracing SSCF allows businesses to protect their reputation, secure long-term partnerships, and meet regulatory expectations. Companies must invest in technological innovations to achieve these goals and ensure a sustainable future.

One key aspect of SSCF is its potential to influence supplier behavior significantly. By providing financial incentives for sustainable practices, companies can motivate suppliers to adopt environmentally friendly techniques. For instance, if a supplier implements green initiatives, the buying company can offer preferential financing terms as a reward. This encourages additional suppliers to engage in sustainable practices. Technology also enhances transparency through tools like mobile applications, allowing all participants in the supply chain to monitor progress and compliance with sustainability standards promptly. Companies can utilize these platforms to showcase their sustainability efforts to stakeholders, enhancing corporate reputation. Supply chain visibility is crucial in understanding the impacts of products throughout their lifecycle. Technology such as Internet of Things (IoT) devices can track product conditions in real-time, ensuring adherence to sustainability criteria. Stakeholders can access valuable information, from energy consumption to waste management practices, allowing informed investment decisions. The result is a resilient supply chain with minimized environmental impact and optimized resources, which ultimately leads to reputation enhancement and market competitiveness.

The Role of Data Analytics in SSCF

Data analytics drives improvements in sustainable supply chain finance by allowing businesses to make informed, data-backed decisions. Companies can harness vast amounts of information to identify inefficiencies or risks in their supply chains. Predictive analytics can model potential environmental and social impacts, giving firms a competitive edge as they navigate sustainability challenges. This leads to better supplier selection and further strengthens the integrity of SSCF. Additionally, machine learning algorithms can optimize inventory management, reducing waste and ensuring resources are utilized efficiently. Insights derived from data analytics enable firms to distribute funds effectively, prioritizing transactions that align with sustainability goals, which positively contributes to their environmental, social, and governance (ESG) performance. Furthermore, comprehensive data sets allow for continuous monitoring and evaluation of suppliers’ sustainability practices, enabling companies to hold them accountable. When suppliers are aware that their performance is actively monitored, they often strive for improvement. As a result, a culture of sustainability permeates throughout the supply chain, driving collective efforts towards achieving overarching environmental objectives.

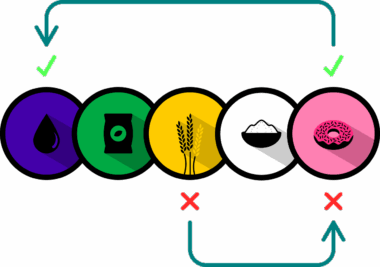

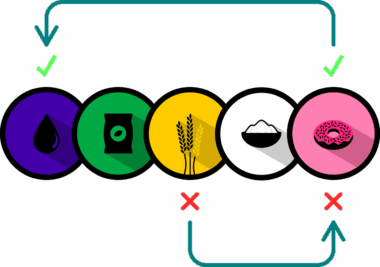

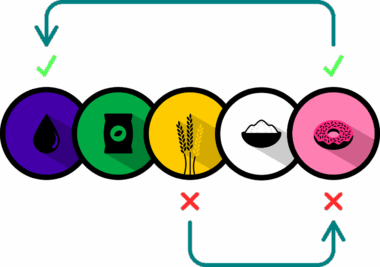

Partnerships across industries are vital for the advancement of SSCF initiatives. Collaborative efforts enable knowledge sharing and resource pooling, ensuring that sustainable practices are effectively adopted and implemented. Financial institutions play a key role in these partnerships, providing funding options tailored to sustainable projects. By working together, stakeholders can identify viable financing solutions that foster innovation in supply chains. These partnerships can also consist of technology providers who supply the necessary tools and platforms. As businesses increasingly prioritize sustainable supply chain practices, technology providers are innovating their offerings to include tools that facilitate SSCF. This collaboration promotes a circular economy, where materials and resources are reused and recycled efficiently. Additionally, industry associations and NGOs contribute valuable frameworks and certifications, guiding firms in their sustainability efforts. Participating in these initiatives raises awareness about the importance of sustainable supply chains among various stakeholders and consumers. Ultimately, the collective approach enhances the overall effectiveness of SSCF solutions and accelerates progress towards sustainability goals across sectors.

Regulatory Frameworks Supporting SSCF

Government regulations and industry standards are crucial in facilitating the adoption of sustainable supply chain finance. Policies aimed at reducing carbon emissions and promoting socially responsible investing support firms committed to sustainability. Companies find it beneficial to align their practices with these regulations to maintain compliance and avoid potential penalties. Furthermore, adopting best practices in sustainability is essential for enhancing the company’s competitive advantage globally. Businesses seeking to operate in international markets must adhere to both local and international regulations concerning sustainability. Governments may offer financial incentives for companies that implement eco-friendly practices, making sustainable finance more attractive. For instance, grants, tax reductions, or preferential loan terms can serve as motivations for companies striving for sustainability. Moreover, the evolving regulatory landscape encourages firms to innovate their supply chain processes continuously. As part of adapting to these changes, many businesses are investing in technologies that enhance their compliance measures, such as software solutions that track sustainability metrics. By integrating these technologies to adhere to regulatory frameworks, businesses can improve their transparency while building trust with stakeholders.

Corporate social responsibility (CSR) initiatives further reinforce the importance of sustainable supply chain finance. Companies that prioritize sustainability not only enhance their brand reputation but also strengthen customer loyalty. Today, consumers are increasingly drawn to businesses that demonstrate a commitment to ethical and environmentally friendly practices. By focusing on SSCF, organizations communicate their dedication to sustainability to their stakeholders. This open approach often leads to enhanced relationships between suppliers, partners, and customers, fostering collaboration driven by shared values. Technology plays a pivotal role here by facilitating the dissemination of the company’s CSR goals and achievements through various platforms. Social media, for instance, amplifies messages regarding a company’s sustainability achievements, which can position a brand as a market leader. Regularly sharing updates on sustainable practices can also encourage customer engagement and foster stronger connections with consumers. Additionally, companies gain valuable feedback through direct interactions with stakeholders. By actively participating in sustainability conversations, businesses can gather insights that improve their supply chain practices and shape future sustainability strategies.

Looking Ahead: The Future of SSCF

The future of sustainable supply chain finance looks promising, driven by technological advancements, evolving consumer preferences, and regulatory pressures. As more businesses embrace sustainable practices, the entire industry is expected to shift towards more environmentally-friendly models. Innovative technologies such as artificial intelligence and blockchain will continue to revolutionize supply chain management and finance. This will enhance operational efficiency and foster collaboration among multiple stakeholders. As consumers increasingly prioritize sustainability, businesses will need to adapt their supply chain strategies accordingly to remain competitive. Transparency and traceability will become the norm, as companies must provide evidence of their sustainable practices. Furthermore, financing mechanisms will continue evolving to support green projects, ensuring businesses can access the capital necessary for sustainable initiatives. Financial institutions will likely develop more sophisticated products tailored to the specific needs of sustainable supply chains. Collaborative ecosystems that bring together stakeholders spanning industries and regions will further accelerate progress towards sustainable financing. Overall, as sustainable development gains traction globally, companies integrating this philosophy into their supply chains will emerge as leaders in their sectors.

As the world becomes increasingly aware of environmental issues, the role of technology in promoting sustainable supply chain finance will only become more critical. The marriage of sustainability with advanced technology offers unparalleled opportunities for creating efficient, transparent, and responsible supply chains. In this endeavor, businesses that are proactive in leveraging technological advancements will be in a position to shape best practices for their respective industries. Moreover, continuous improvements in data security and privacy measures will enhance trust among participants throughout the supply chain. Adopting cutting-edge technologies will also enable companies to predict future trends, manage risks effectively, and adapt swiftly to changes in the market. Being agile and innovative will equip organizations to navigate the complexities inherent in global supply chains today. It is crucial for companies to remain forward-thinking, incorporating dynamic solutions into their operations that address evolving sustainability challenges. By investing in technological advancements and forging strategic partnerships, businesses can unlock the potential of SSCF. In conclusion, the commitment to leveraging technology for sustainable supply chain finance will not only benefit organizations but also the planet as a whole, contributing to a more sustainable future for generations to come.