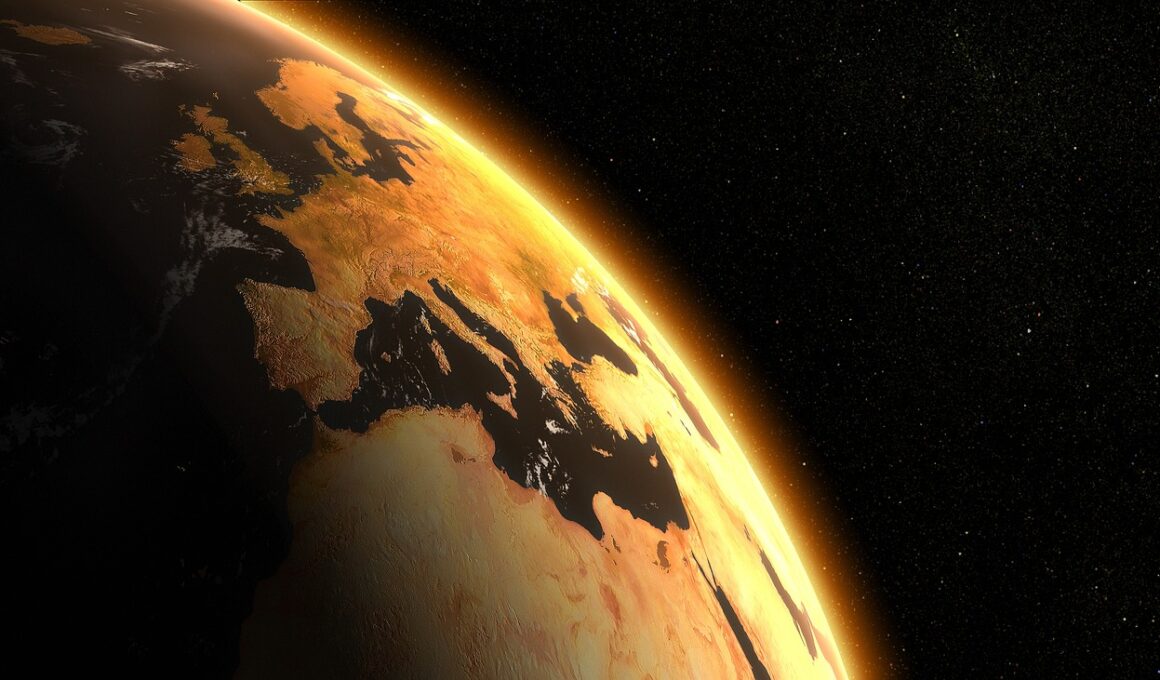

Key Climate Finance Policies Influencing Investment Decisions

Climate finance policies play a crucial role in shaping investment strategies and facilitating sustainable economic growth. These policies aim to encourage the transition to a low-carbon economy while addressing the risks posed by climate change. One of the most influential frameworks is the Paris Agreement, which establishes international targets for emission reductions. Countries involved must create national commitments, often referred to as Nationally Determined Contributions (NDCs), influencing investor confidence. By setting clear climate targets, this framework helps mobilize public and private investments towards renewable energy and green technologies. Additionally, carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems, provide financial incentives for businesses to reduce greenhouse gas emissions. They create a market for carbon credits, which can generate significant revenue streams for governments. Furthermore, financial institutions are increasingly incorporating Environmental, Social, and Governance (ESG) criteria in investment decisions, incentivizing businesses to adopt sustainable practices. By driving capital toward environmentally friendly projects, these policies ensure a more resilient and adaptive global economy. Ultimately, effective climate finance policies not only mitigate climate risks but also create a competitive advantage for investors focused on sustainability.

Strategies for Implementing Climate Finance Policies

Implementing effective climate finance strategies requires collaboration between governments, private sectors, and civil society. First, providing financial assistance for developing countries is essential in fostering climate resilience and adaptation. Organizations such as the Green Climate Fund support projects aimed at transitioning to low-carbon development paths in vulnerable nations. Second, creating regulatory frameworks that enhance transparency is vital. Disclosure mandates require companies to report their climate-related risks and opportunities, thus empowering investors to make informed decisions. Third, implementing blended finance models allows the coupling of public funds with private investments, attracting greater capital towards sustainable ventures. By sharing risks, these models increase investor interest and facilitate access to essential technologies for climatologic advancements. Fourth, promoting public-private partnerships enhances resource mobilization for climate finance initiatives. Governments can provide guarantees for private investments, creating a secure environment for risk-averse investors to engage in sustainable projects. Moreover, leveraging technological advancements in data analytics improves climate finance decision-making processes. These interactive methods help investors evaluate climate risks and monitor project performance, ensuring a dual focus on profitability and environmental sustainability.

An essential aspect of climate finance policies is integrating sustainability into governmental budgetary processes. By aligning public spending with climate goals, governments can prioritize investments that promote green development and create green jobs. This means redirecting funds from fossil fuel subsidies towards renewable energy projects, energy efficiency measures, and sustainable infrastructure. Such reallocation not only supports climate objectives but also stimulates economic growth in emerging green sectors. Additionally, enhancing access to climate finance for small and medium-sized enterprises (SMEs) is critical. SMEs often face challenges in securing funding for sustainable innovations due to perceived risks or lack of collateral. Creating targeted financial instruments, like green loans or credit guarantees, can bridge the gap. Furthermore, building capacity among financial institutions to assess climate risks and recognize sustainable opportunities is crucial. Training programs and workshops can equip professionals with the necessary skills to evaluate the financial viability of green projects. Lastly, public awareness campaigns can stimulate demand for sustainable investment products, engaging citizens and consumers in the climate finance landscape. This engagement paves the way for greater accountability and pushes for responsible investment practices across sectors.

The Role of Institutions in Climate Finance

Institutions play a pivotal role in developing and implementing climate finance policies that can steer investment towards sustainable practices. Central banking authorities, for instance, can influence lending practices and incorporate climate risks into their financial stability assessments. By doing so, they encourage financial institutions to factor in environmental considerations when making lending decisions. Moreover, multilateral development banks (MDBs) are increasingly vital in funding climate initiatives, particularly in developing countries. They provide substantial capital and leverage additional private sector funding, driving impactful climate projects forward. Additionally, international financial institutions play a crucial role in establishing climate finance standards and guidelines. They foster collaboration among countries, ensuring the availability of best practices and lessons learned from successful initiatives globally. Furthermore, insurance companies are beginning to introduce products that cover climate-related risks, which can encourage investment by mitigating perceived financial challenges. Implementing such innovative financial products can protect investors while promoting resilience against climate impacts. Through these collective efforts, institutions can facilitate an environment where climate finance thrives, ultimately driving the global transition towards a sustainable and resilient economy.

Another significant element of climate finance policies involves fostering innovation and entrepreneurship in green technologies. Policymakers can create enabling environments that stimulate research and development of sustainable solutions by providing grants, tax incentives, and subsidies for innovative projects. Such support ensures that entrepreneurs can effectively develop new technologies to combat climate change. Moreover, public sector investments in renewable energy infrastructure create markets for private investments, effectively reducing overall costs and risks for investors. Partnerships between research institutions, businesses, and government entities can drive technological advancements, enhancing access to clean energy sources. Furthermore, integrating climate considerations into educational curricula and skill development programs can nurture a workforce capable of addressing climate-related challenges. Developing expertise in sustainable practices enables individuals to contribute meaningfully to green economic growth. As a result, fostering a culture of innovation empowers communities and encourages investment in science and technology aimed at climate solutions. This broad approach underscores the need for a multi-faceted response to climate challenges, ensuring that financial resources are strategically allocated to areas yielding the most significant impact on sustainability efforts.

The Future of Climate Finance Policies

The future of climate finance policies is likely to evolve in response to emerging trends and global challenges. As climate impacts become more pronounced, adapting existing financial frameworks to address these changes will be paramount. One anticipated shift involves the rise of nature-based solutions in climate finance policies, attracting investments into projects that restore ecosystems and promote biodiversity. Such approaches can offer valuable co-benefits, including carbon sequestration, improved air quality, and enhanced resilience to climate impacts. Additionally, the accelerated adoption of digital technologies, such as blockchain, can enhance transparency and efficiency in climate finance. By improving tracking mechanisms, blockchain can ensure the integrity of funds allocated to climate projects, thereby increasing investor confidence. Furthermore, as climate risks become more integrated into financial decision-making processes, transparency regarding climate risk assessments will become essential. Investors will demand standardized reporting metrics for climate-related financial risks, emphasizing a shift towards accountability and sustainability in investment approaches. As climate finance policies continue to adapt, their success will ultimately rely on collaborative efforts from stakeholders across all sectors, creating a unified front against the climate crisis.

In conclusion, climate finance policies are instrumental in influencing investment decisions towards sustainable development. By developing and implementing frameworks that encourage the transition to low-carbon economies, governments will foster investor confidence and mobilize significant capital into green projects. Emphasizing transparency, inclusivity, and collaboration across sectors will be key, creating opportunities for public-private partnerships and innovative financial solutions. Furthermore, the future of climate finance relies on innovative funding mechanisms, digital technologies, and fostering entrepreneurship in green technology. Policymakers and investors must remain proactive in adapting to climate challenges, continually creating strategies that meet evolving environmental conditions. By aligning financial systems with climate goals, stakeholders can ensure a sustainable economy that addresses current and future generations’ needs. This alignment will ultimately create a more resilient financial system, equipped to navigate the uncertainties of climate change, while driving economic growth and job creation in sustainable industries. As we move towards a future defined by sustainability, climate finance policies will play a central role in shaping investment landscapes, paving the way for a more environmentally conscious and economically viable world.

The overall impact of climate finance policies on investment decisions cannot be overstated. As global efforts to combat climate change gain momentum, the financial sector is increasingly embracing sustainability as a core operational principle. Investors are now recognizing the financial risks associated with climate change, driving demand for environmentally responsible investment options. Reports increasingly demonstrate that companies with strong ESG performance often experience lower costs of capital, higher valuations, and improved financial stability. These findings encourage investors to integrate climate risk assessments into their portfolios, making informed choices aligned with sustainability goals. Moreover, government support for climate finance initiatives reinforces private sector commitment to sustainable investments. The alignment of public and private interests ensures a more robust funding ecosystem for climate initiatives. In this context, shareholder advocacy has emerged as a powerful tool for driving corporate engagement on climate issues, pressing companies to prioritize sustainability in their business strategies. As climate finance policies evolve, they will need to address the growing expectations of investors and stakeholders, ensuring that funds are directed towards initiatives that genuinely contribute to climate resilience and sustainable economic growth.