Insurtech Collaborations with Traditional Insurers: Market Effects

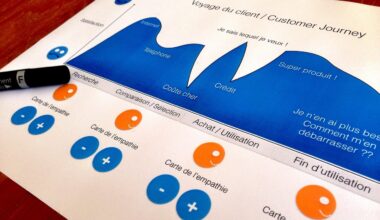

Insurtech collaborations with traditional insurers represent a significant evolution in the insurance landscape. This partnership brings new technologies and operational efficiencies and allows traditional companies to remain competitive. Traditional insurers often struggle with outdated business models, while insurtech firms harness innovative technologies to attract modern consumers. Through collaborations, these companies can leverage each other’s strengths. Insurtechs provide seasoned insurers access to digital platforms and advanced data analytics, improving customer engagement and streamlining processes. As a result, consumers gain better services tailored to their specific needs. Additionally, these collaborations foster quicker adaptation to changing market dynamics, ensuring that both parties stay relevant in an evolving landscape. Insurers can utilize cutting-edge technologies like artificial intelligence and big data to comprehend market trends, predict risks, and optimize pricing strategies. This drive for innovation facilitates the development of personalized insurance products, ultimately enhancing customer experience. Furthermore, the growing trend of partnerships enhances overall industry competition, motivating all players to innovate continuously. Insurtechs, with their agility, and traditional insurers, with their breadth of experience, can create compelling value for consumers and other stakeholders in the insurance space.

By combining resource strengths, innovation, and market knowledge, insurtech collaborations create a framework for a more robust insurance market. The shift towards digital transformation has prompted these traditional firms to rethink their strategies. Whereas in the past, many insurers relied on long-standing practices, the current environment requires agility and adaptation. Insurtech firms excel in experimenting with new ideas, often finding unconventional solutions to longstanding issues. For example, they might offer on-demand insurance policies that cater to the gig economy, something traditional insurers have struggled to address. This flexibility allows for rapid market entries for products tailored to specific customer segments. Furthermore, the collaboration enables better risk assessment, with improved data analysis capabilities. By utilizing AI-driven underwriting processes, insurers can make swift and informed decisions, which not only reduces operational costs but also boosts customer satisfaction rates. As the market landscape becomes increasingly dynamic, businesses that embrace such partnerships find themselves better equipped to navigate the challenges. Notably, these collaborations are not merely transactional; they can inspire continuous learning and innovation across the insurance industry. The blending of experiences and technologies cultivates a culture of agility and resilience among participants, setting a precedent in the market.

The implications of insurtech collaborations reach beyond immediate financial advantages and operational efficiencies. They catalyze changes in consumer behaviors and expectations within the insurance market. Today’s consumers seek experiences that are seamless, personalized, and quick. Traditional insurers, known for their slower adaptation to change, find their market positions challenged by nimble insurtechs. In response, partnerships with these tech-savvy firms enable insurers to enhance their customer engagement efforts. As collaboration becomes a norm, traditional insurers can offer more user-friendly interfaces and improve claim processes through technological integration. Furthermore, this evolution influences the overall market outlook, fostering a culture of innovation across the board. Consumers begin to expect high levels of digital interaction, and insurers who fail to adapt risk losing market share. Moreover, collaborative efforts enhance the industry’s capabilities, ensuring protection measures evolve alongside existing and emerging risks. Additionally, integrating technology allows for improved fraud detection methods, benefiting both the insurer and the consumer. The industry-wide shift in focus towards innovation ultimately propels the entire insurance sector towards a more modernized paradigm, establishing increasingly higher standards for service delivery.

Regulatory Considerations in Insurtech Collaborations

As insurtech collaborations reshape the insurance landscape, regulatory considerations become increasingly critical. Regulators must keep pace with innovations to create guidelines that safeguard the interests of consumers while fostering a fertile environment for growth. The collaboration raises questions about compliance, data privacy, and security, compelling insurers and tech companies to align their practices with regulatory demands. Moreover, traditional insurers often have established procedures to adhere to regulatory frameworks. However, insurtechs might introduce unconventional business models that raise compliance concerns. The challenge necessitates a strong partnership approach to ensure that all parties operate within established parameters. An environment of mutual understanding between insurtechs and regulators is essential for future success. Such cooperation could lead to the creation of a regulatory sandbox, enabling experimentation under a controlled setting. Additionally, transparency in how data is managed is vital to maintaining consumer trust. As more organizations join forces, a shared commitment to compliance and ethical standards emerges, enhancing credibility. Ultimately, navigating these regulatory considerations harmoniously facilitates the growth of collaboration and innovation, establishing a more resilient insurance market landscape.

Another important aspect of the insurtech-traditional insurer partnership is the role of consumer education. Many consumers may not fully grasp the benefits and workings of these new digital solutions, potentially stifling their adoption. To ensure success, both insurtechs and traditional insurers must prioritize consumer education as a key pillar of their strategy. Educational initiatives can serve to demystify the technologies being implemented and explain advantages like lower premiums, faster claims, and improved customer service. There should be targeted marketing that highlights real-life applications and testimonials showcasing these superior offerings. Additionally, providing information on the security measures taken to protect their data reassures consumers about privacy concerns. A well-informed customer base is conducive to greater acceptance and satisfaction with new products. Stakeholders should also focus on addressing the differing levels of tech-savvy among consumers. In particular, older demographics might hesitate to embrace technological advancements. Therefore, simplifying experiences and offering diverse communication channels ensures inclusivity for all customers. Enhancing understanding can significantly improve engagement rates and promote wider adoption across various consumer segments, illustrating the necessity of collaboration between insurers and tech companies.

Moreover, as insurtechs and traditional insurers partner, technology integration becomes a focal point for success. With the influx of new tools and methodologies, aligning systems and practices is essential. Insurers need to ensure that their existing infrastructure can accommodate new technologies seamlessly. Successful integration entails understanding not only technological aspects but also the cultural shift required within organizations. It’s imperative for both parties to foster a culture of collaboration, openness, and willingness to adapt. Training employees on new systems promotes smoother transitions and encourages synergy between traditional practices and innovative approaches. Furthermore, fostering an atmosphere where both organizations share insights and expertise enhances the learning curve and builds trust. Insurers must acknowledge that adopting insurtech solutions requires ongoing commitment. It’s not just about implementing a new system; they must actively participate in continuous improvement processes. In addition to the initial setup efforts, ongoing collaboration offers room for refinement, increasing long-term sustainability. Aligning their objectives with shared visions can enhance the impact of technological adoption and ensures they’re addressing evolving market needs effectively. Thus, collaboration becomes a continuous journey of shared success in a transformative landscape.

Future Outlook for Insurtech Collaborations

Looking ahead, the future of insurtech collaborations with traditional insurers presents substantial opportunities for growth and innovation. As technology continues to evolve, businesses will likely explore new ways to integrate artificial intelligence, blockchain, and data analytics into their operations. These advancements promise to reshape product offerings significantly, enabling insurers to create more personalized and relevant solutions for their customers. Moreover, the increase in consumer demand for digital-first experiences will likely drive insurers to pursue partnerships more aggressively than before. Traditional insurers, realizing the benefits of agility and technological prowess, will seek innovative partnerships to remain competitive. As regulatory landscapes evolve, opportunities for collaboration aimed at compliance will also emerge, cultivating practices that safeguard consumers. Additionally, the focus on sustainability and social responsibility may result in initiatives and products aimed at combating climate change, benefiting from technology and innovation. Ultimately, these collaborations will likely enhance the industry’s overall resilience and adaptability in the face of future challenges. Insurtech partnerships will continue to thrive, resulting in a fully integrated insurance ecosystem that places consumers at the forefront of development efforts while addressing their diverse needs effectively.

Lastly, the collaboration between insurtechs and traditional insurers is set to redefine not only competition but also the collaborative nature of insurance itself. As these partnerships evolve, they will lay the groundwork for a more versatile industry that can address various consumer needs and emerging challenges. Innovations resulting from these relationships could lead to disruptive models, transforming how insurance is delivered and managed on a broad scale. This evolution might encompass the introduction of pay-per-use policies or micro-insurance products generated through data analytics. By capitalizing on real-time insights, insurers can offer new products that better align with today’s consumer lifestyles. Furthermore, continuing this trend may lead to increased transparency in pricing structures and more straightforward claims processes, enhancing public perception of the industry. Consumers will benefit from enhanced choices, thanks to the competitive landscape these collaborations create. Such direction ensures that insurers remain agile, customer-centric, and responsive to market demands. In conclusion, as insurtech collaborations yield new opportunities, the insurance market should look forward to a future characterized by improved service delivery and greater user satisfaction through technological integration.