How Market Psychology Can Create Trading Opportunities

Market psychology is a significant aspect of the financial markets, influencing trader behavior and decision-making. Understanding the emotional drivers behind trading decisions can be crucial for developing effective strategies. Traders often rely on various psychological factors, including fear and greed, to make decisions. Fear can cause traders to sell prematurely, while greed may lead to holding positions too long. These emotions can create opportunities for informed traders who recognize the patterns in market behavior. By identifying moments of irrational exuberance or panic, investors can act strategically. It is essential to analyze market sentiment through both technical indicators and fundamental analysis to comprehend the overall mood. Tools such as sentiment analysis can help gauge investor sentiment. This knowledge allows traders to position themselves advantageously ahead of market shifts. The cyclical nature of market psychology offers unique chances for profit if traders can anticipate breakouts and reversals. Recognizing these psychological patterns can provide a significant edge in trading. Adopting a disciplined approach helps mitigate emotional trading, leading to better long-term outcomes in investor performance.

As traders delve deeper into market psychology, they discover the importance of cognitive biases. Biases like confirmation bias and anchoring can hinder decision-making, affecting trading outcomes. Confirmation bias leads traders to seek information that supports their preexisting beliefs, neglecting contrary evidence. This can result in poor investment choices based on limited perceptions. Anchoring occurs when traders rely heavily on initial information, setting a biased reference point that influences future decisions. Recognizing and mitigating these biases is essential for traders aspiring to achieve consistent performance. By employing methods such as journaling their trades, they can identify patterns in their decision-making processes. Furthermore, enhancing self-awareness allows traders to counteract cognitive errors effectively. Incorporating statistical and probabilistic thinking can also prove beneficial. By embracing an evidence-based approach, traders can remain dispassionate when evaluating market conditions. Additionally, engaging in continuous education and self-assessment aids traders in mastering their psychological landscape. Developing resilience against emotional turmoil can foster a sense of control in uncertain markets. By investing in mental fortitude, traders position themselves for success in navigating the complex world of financial markets.

The Role of Social Media

Social media has transformed the way traders access information and interact with each other, shaping market psychology in profound ways. Platforms such as Twitter, Facebook, and Reddit serve as hubs for discussion and dissemination of market insights. Traders often turn to these platforms for real-time updates, influencer opinions, and the latest trends. The viral nature of social media can amplify sentiments, causing rapid emotions to lead to drastic price movements. For example, a single tweet from a high-profile individual can spark a buying frenzy or ignite a sell-off. This unpredictability offers opportunities for nimble traders who can capitalize on these events. However, it also presents challenges, as misinformation and hype can create false signals. A discerning trader must develop the skills to filter through noise and identify genuine opportunities. Active participation in online trading communities can foster collaboration and shared learning. Traders learn from peers while offering their insights, creating a collective intelligence environment. The ability to monitor social sentiment around particular stocks or assets can yield valuable insights necessary for successful trading strategies.

Recognizing the importance of sentiment analysis can greatly enhance a trader’s performance. Sentiment analysis involves evaluating the prevailing attitudes of market participants towards specific assets. This may include surveying social media conversations, news articles, and forums where traders express their sentiments. By monitoring changes in sentiment, traders can predict market trends and adjust their strategies accordingly. High levels of optimism or pessimism can signal upcoming volatility, creating trading opportunities. Engaging sentiment analysis tools can simplify this complex process, allowing traders to quantify feelings and gauge market mood. Analyzing sentiment in conjunction with technical indicators provides a comprehensive view of market conditions. For example, a bullish sentiment combined with upward price momentum may affirm the validity of a buying signal. On the other hand, bearish sentiment amidst declining prices could indicate a potential shorting opportunity. Effective traders intertwine sentiment analysis with their stock selection criteria to enhance their performance. Ultimately, successfully navigating modern financial markets entails continually adapting to the evolving landscape and effectively interpreting market psychology.

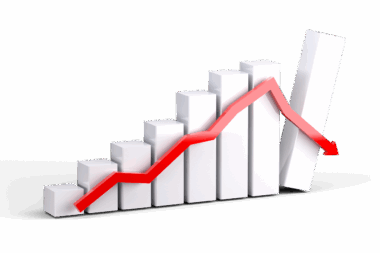

The Impact of Market Cycles

Market cycles present fluctuations that evoke various psychological reactions among traders. Each market cycle typically embodies distinct phases, including accumulation, markup, distribution, and markdown. Understanding these cycles allows traders to align their strategies accordingly. During accumulation, conservative traders accumulate positions as prices begin to stabilize. Conversely, during markup, market enthusiasm drives prices higher, often fueled by fear of missing out (FOMO) among traders. The distribution phase may signal a peak, instilling fear among traders of an impending downturn. Finally, the markdown phase typically elicits panic as prices fall, leading to increased activity among traders looking to exit. Identifying which phase a particular asset is in can yield valuable insights for new positions. Traders must stay attuned to market sentiments that influence these cycles. Moreover, cultivating patience during periods of consolidation is vital for high-probability setups. Implementing strategies such as scaling in and out of positions can further enhance profits. Recognizing and adapting to market cycles plays a pivotal role in a trader’s long-term success in fluctuating financial landscapes.

Furthermore, maintaining a strong psychological framework is crucial for navigating the inherent stress of trading. Developing the mental resilience needed to withstand market volatility reduces emotional decision-making. Techniques such as mindfulness and visualization can empower traders by enhancing their focus and emotional control. A positive mindset acts as a buffer against losses while promoting rational analysis in uncertain market conditions. Trading requires a unique blend of skill, discipline, and psychology, requiring continuous improvement. Establishing a structured trading plan can provide direction and accountability throughout the trading process. Traders who adhere to their plans can reduce regrettable emotional responses that often derail their progress. Additionally, building a supportive network of fellow traders can enhance accountability and motivation. Sharing experiences and strategies can shed light on market behavior and foster a deeper understanding of personal trading psychology. The journey of mastering market psychology is ongoing. By embracing a commitment to ongoing education and skill development, traders can unlock opportunities that arise amidst the collective emotions driving financial markets.

Conclusion

In summary, market psychology plays an indispensable role in shaping trading opportunities within the financial markets. Emotions and cognitive biases significantly influence trading decisions, highlighting the need for self-awareness. By understanding psychological drivers, traders can better anticipate market shifts and adjust their strategies accordingly. Tools such as sentiment analysis and social media monitoring provide valuable insights into market behavior. Moreover, recognizing cycles and maintaining mental resilience are essential components of a successful trading approach. Emphasizing the development of psychological fortitude empowers traders to navigate unpredictable markets more effectively. Continuous learning and collaboration within trading communities foster growth and adaptability. Ultimately, the ability to interpret and leverage market psychology can create lasting competitive advantages for traders. As financial markets evolve, the psychology of traders will continue to shape the landscape. Adapting to these dynamics will remain critical for achieving sustained success in trading throughout ever-changing market environments. Traders who embrace the psychological aspects of investing find themselves in an advantageous position, able to exploit irrational market behavior and capitalize on emerging opportunities.