Environmental Impact Assessments in Supply Chain Finance

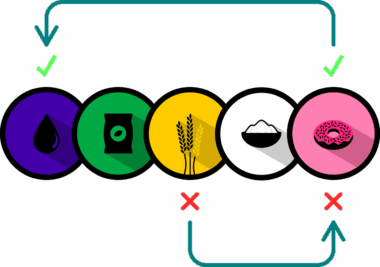

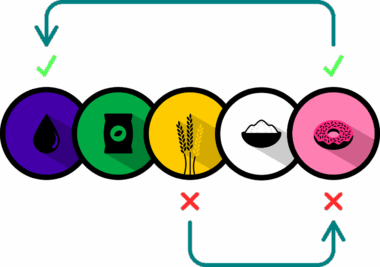

Environmental Impact Assessments (EIAs) play a critical role in sustainable supply chain finance, ensuring that companies systematically evaluate their environmental performance. These assessments analyze potential environmental consequences of projects or activities prior to their initiation, providing essential insights into ecological risks. By integrating EIAs into financing decisions, organizations can identify areas requiring improvement. This proactive approach applies to resource utilization, waste management, and emissions reduction. For instance, businesses can assess how their sourcing decisions impact local ecosystems. Moreover, EIAs promote transparency and accountability, allowing stakeholders to make informed choices. Investors increasingly favor companies committed to sustainability, driving organizations to adopt eco-friendly practices. Participation in community engagement enhances corporate social responsibility, fostering goodwill and long-term relationships. Entities utilizing sustainable supply chain finance look beyond immediate profits, recognizing the importance of conserving resources for future generations. Therefore, implementing EIAs can enhance corporate reputation and potentially reduce regulatory risks. Understanding these processes enables companies to align their financing with broader sustainability goals and addresses stakeholder expectations. Ultimately, EIAs contribute to creating resilient supply chains while minimizing detrimental environmental impacts, paving the way for sustainable business practices in a rapidly evolving market.

Incorporating EIAs into financial systems requires robust methodologies that account for various environmental factors. Effective assessments must evaluate several key components, including ecological footprints, biodiversity impacts, and greenhouse gas emissions. This comprehensive evaluation helps organizations quantify potential risks associated with projects. Stakeholders increasingly utilize data-driven approaches, underlining the importance of accurate and transparent reporting. Financial institutions, such as banks and investors, are beginning to demand detailed EIA reports as prerequisites for funding. Consequently, this trend encourages suppliers and manufacturers to adopt improved environmental practices. Financing entities that integrate sustainability criteria into their operations can significantly enhance their risk management strategies. By understanding the potential financial implications of environmental liabilities, businesses can make better-informed decisions. Sustainable supply chain finance links a firm’s financial performance to its ecological impact, illustrating that proactive environmental stewardship can yield significant competitive advantages. Investors searching for environmentally friendly portfolios are increasingly directing capital toward organizations that prioritize sustainability. As these practices gain momentum, regulatory compliance becomes more critical, further incentivizing organizations to adopt rigorous EIAs. The interplay between effective financial management and environmental assessments fosters a culture of responsible resource use, ultimately benefiting both the planet and the economy.

Challenges in Implementing EIAs

While the benefits of EIAs in supply chain finance are evident, numerous challenges hinder their implementation across various industries. A primary difficulty stems from a lack of uniformity in assessment methodologies, leading to discrepancies in data collection and reporting. Different regions and sectors may employ varied standards and practices, complicating cross-border financing efforts. Additionally, companies may encounter resistance to change from established practices, making the transition to sustainable methods challenging. Furthermore, training personnel to effectively conduct EIAs requires time and resources, which some firms may be unwilling to allocate. Perception also plays a crucial role; companies often regard EIAs as additional costs rather than essential investments. This perspective can hinder the necessary cultural shift towards sustainability. Information asymmetry presents another challenge, as smaller firms may lack access to resources and expertise required for comprehensive assessments. As a result, disparities between large and small enterprises could widen, limiting the adoption of sustainable practices across the supply chain. Financial institutions must develop support mechanisms to assist smaller suppliers in enhancing their assessment capabilities. Addressing these challenges is crucial to fostering a more equitable and sustainable financial environment.

An essential step towards achieving effective EIAs is enhancing collaboration among various stakeholders. Comprehensive stakeholder engagement fosters a deeper understanding of environmental issues and promotes shared accountability. Collaboration can occur at multiple levels, including partnerships between companies, governments, and non-governmental organizations (NGOs). Developing innovative financing solutions, such as public-private partnerships, can strengthen the implementation of EIAs in supply chains. For example, collaborative initiatives may pool resources for research, enabling entities to share costs and data. This shared approach enhances the overall quality of the assessments. Furthermore, integrating local community perspectives during the evaluation process can uncover critical insights often overlooked. Emphasizing the voices of stakeholders directly affected by environmental consequences encourages greater transparency and responsiveness. As businesses begin prioritizing community engagement, they enhance their reputational value and reduce the risk of public backlash. Effectively addressing community concerns helps solidify long-term relationships, fostering loyalty among customers and stakeholders alike. As the global demand for sustainable products rises, integrating EIA into supply chain finance not only becomes a necessity but also presents unique opportunities for organizations committed to distinguishing themselves in the marketplace.

The Role of Technology in EIAs

Technological advancements play a pivotal role in optimizing EIAs and enhancing their effectiveness within sustainable supply chain finance. Innovations such as data analytics, remote sensing, and artificial intelligence (AI) empower organizations to conduct thorough assessments. Data analytics enable businesses to better understand their environmental impact by identifying trends and evaluating performance metrics more accurately. When employed strategically, remote sensing technology can assist in tracking changes in land use, monitoring pollution levels, and assessing habitat disruptions. Adoption of such technologies can streamline reporting processes, ensuring compliance with regulatory requirements while reducing the burden on organizations. Meanwhile, AI applications can enhance predictive modeling of environmental risks, helping businesses anticipate potential impacts before they materialize. As a result, financing decisions can be based on more reliable data, promoting transparent communication of risks to stakeholders. Additionally, integrating technology often reduces the time needed for assessments, allowing organizations to respond faster to changing environmental conditions. Consequently, businesses can make timely adjustments in their supply chain operations. Organizations should be prepared to invest in these technological solutions to reap the long-term benefits of improved EIAs, which will ultimately enhance their sustainability efforts.

As global regulations surrounding environmental protection continue to evolve, the need for robust EIAs in supply chain finance is becoming increasingly critical. Governments worldwide are adopting stricter guidelines aimed at minimizing ecological footprints and promoting sustainable practices. As a result, companies that integrate EIAs into their operations are more likely to remain compliant with regulations, avoiding potential penalties. Furthermore, proactive environmental management can enhance access to capital, as investors increasingly prefer financing ventures with clear sustainability commitments. Understanding compliance allows organizations to align their strategies with broader regulatory frameworks, ensuring accountability while simultaneously addressing stakeholder expectations. Companies recognizing the interconnectedness of environmental protection and financial performance create opportunities for innovation and differentiation. Sustainable supply chain finance is not only about risk mitigation but also about value generation. Firms embracing these principles can enjoy improved reputations, relationships with stakeholders, and increased operational efficiency. Consequently, organizations must continuously adapt their practices to keep pace with changing regulations and investor demands. The integration of EIAs into supply chain finance represents a significant step toward building a resilient and sustainable business environment that benefits the economy, society, and the planet.

Future Directions in Sustainable Supply Chain Finance

As sustainability becomes a vital consideration in finance, the future of sustainable supply chain finance appears promising. Organizations are progressively recognizing the importance of integrating environmental assessments into their core operations. This growing commitment is likely to prompt increased investments in sustainable supply chain practices, fostering a culture of accountability and transparency within companies. Furthermore, collaboration between public and private sectors will play an essential role in developing innovative financial models that support inclusive growth. Innovations in green finance, such as sustainability-linked loans, will drive organizations to achieve performance targets tied to environmental outcomes. These financing mechanisms will encourage firms to pursue ambitious EIA initiatives, mitigating their ecological footprints. Additionally, as consumer preferences shift towards sustainable products, companies that prioritize environmental responsibility will likely gain a competitive advantage. Creating value through sustainable practices extends beyond compliance, resulting in enhanced stakeholder relationships and market positioning. To overcome challenges associated with implementing EIAs, organizations must foster a mindset focused on sustainability, innovation, and collaboration. Embracing these principles can position businesses as leaders in the evolving landscape of supply chain finance while contributing to a greener future for all.

In conclusion, the integration of Environmental Impact Assessments in sustainable supply chain finance is essential for fostering responsible business practices. Corporations increasingly understand the significance of assessing their environmental impact, leading to improved sustainability and accountability. However, challenges persist, including methodological inconsistencies and stakeholder engagement. Collaboration and technological advancements can address these hurdles, paving the way for more effective EIAs. The role of policymakers and regulators is paramount in facilitating a supportive environment for sustainable practices in finance. As nations implement stricter regulations, organizations that proactively adopt EIAs stand to benefit financially and reputationally, enhancing investor confidence and attracting capital. The future of sustainable supply chain finance hinges on companies committing to environmentally responsible practices while driving a positive change. Embracing innovative financing models and fostering partnerships will not only enhance the effectiveness of EIAs but also contribute to a thriving global economy. Ultimately, integrating sustainability into finance requires a shared vision for collaborative action. By prioritizing sustainability, businesses can create resilient, responsible supply chains that serve as models for future generations, ensuring that economic growth aligns with environmental preservation and social equity.