The Future of Annuities in a Changing Financial Landscape

The world of annuities is increasingly under scrutiny as market dynamics shift unprecedentedly. Annuities, traditionally seen as safe havens, now face challenges from emerging financial products and tech-driven investment solutions. Consumers are questioning whether these products still offer the security and growth potential needed in today’s economy. Some financial advisors advocate for a reassessment of annuities, suggesting they may not fit every client in our current economy. For instance, younger investors are favoring investments with higher growth potential instead of safe but low-interest annuities. However, the unique features of annuities, such as guaranteed income and tax-deferred growth, still attract a demographic seeking security during retirement. While some younger people lean towards high-risk options, many older individuals appreciate annuities’ predictable returns amidst market volatility. As such, financial advisors must balance offering innovation while preserving traditional options to meet diverse client needs. Understanding these perspectives and consumer preferences is essential to navigating the future landscape surrounding annuities. With this understanding, financial professionals can best guide their clients to solutions customized to their financial objectives and risk tolerance levels.

Understanding the Evolving Annuity Market

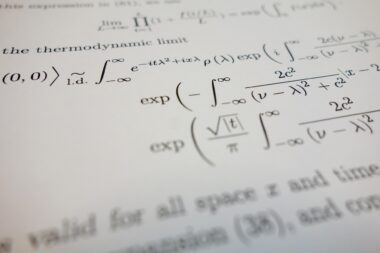

The evolution of the annuity market reflects significant shifts in investor behavior and economic conditions. Over the years, annuities have evolved, catering to a variety of needs and preferences. With growing options such as fixed, variable, and indexed annuities available to potential investors, today’s landscape appears complex yet beneficial. Many individuals feel confused because of the sheer number of available choices which can lead to missed opportunities for optimal growth or security. To address this confusion, education becomes paramount. Potential investors need detailed insights into features, advantages and downsides of each annuity type. Moreover, scenarios demonstrating real-world impacts of annuities can create informed investing choices. By fostering an understanding of these products, consumers can avoid pitfalls that stem from the lack of knowledge. One key to building wealth through annuities lies in recognizing their role in a comprehensive financial plan. Taking the time to align personal financial goals with the right annuity offers individuals the potential for a stable, secure retirement income that fits into their larger investment strategy. Education and awareness are vital to ensuring success within the evolving annuity market.

As the financial landscape transforms, the perception of annuities is changing too. Historically regarded merely as a conservative investment choice, today’s investor profile exhibits greater demand for flexible solutions. Progressive annuity products now incorporate innovative features that respond to market demands. With added provisions like long-term care and inflation protection, annuities cater to diverse retirement challenges. These modifications lay opportunities for securing a financial future while maintaining somewhat of an investment strategy. Consequently, financial institutions strive to promote these enhanced offerings to attract consumers looking for customized solutions. Additionally, the hybrid products merging life insurance and annuity features are gaining traction among retirees. Such products conceptually provide death benefits along with guaranteed income, presenting significant pull for consumers. Therefore, both traditional and modern annuities can coexist in the marketplace. This synergy ensures no segment of consumers feels neglected as they navigate their retirement options. Financial marketing campaigns focused on evolving annuity solutions can engage modern clients, highlighting the benefits of protecting their wealth while allowing for growth within their portfolios. Innovation remains central to ensuring annuities stay relevant within the modern financial ecosystem, especially among younger investors.

Impact of Technology on Annuities

Advancements in technology infinitely influence the annuity landscape by improving accessibility and transparency. Fintech firms are introducing digital solutions streamlining the purchase process, providing real-time data and personalized services. The use of algorithms and AI serves to match consumers with annuity products tailored to their specific needs more efficiently than ever before. Such technology fosters an environment where investors can conduct thorough research and gain insights quickly, promoting informed decision-making. Investors can easily compare multiple options without traditional inconveniences associated with brokers. Digital tools not only enhance user experiences but also provide financial professionals with data-driven insights to tailor their offerings effectively. Enhanced analytics allow for better understanding of consumer behavior, creating opportunities for customizing marketing strategies. Moreover, customer support has evolved, enabling consultations and management through online platforms or mobile applications. Such innovations build efficiency into the communication process between financial advisors and clients, enhancing relationships. Consumers now benefit from an array of choices, empowering them to make educated decisions. As digital interaction continues to impact financial services, annuities must leverage these technologies to remain competitive and relevant.

Despite amid evolving attitudes towards annuities, consumer skepticism endures, molded by past experiences and widespread education gaps. Common myths surrounding such products persist, causing misunderstandings regarding their benefits and roles within a financial strategy. Many potential buyers erroneously perceive annuities as inflexible, tying their money without potential returns. However, with evolving products offering more options, a shift towards positivity seems plausible. Another prevalent misconception revolves around fees, often perceived as hidden costs by clients. Transparency from providers is vital in overcoming such skepticism and conveying the value inherent in such products. Yet disinformation amplifies doubt, leading individuals to overlook annuities entirely due to mistrust in the industry. Financial professionals must address these fears through education, explaining how annuities can provide protection and peace of mind. Engaging clients using data and testimonials can be useful strategies for rehabilitating annuities’ reputation. Overcoming the skepticism surrounding these products will determine how consumers react within this landscape. Providing evidence of annuities’ benefits while dispelling myths ensures advisors can build strong investor relationships that foster long-term growth.

Future Trends in Annuities

The future trajectory of annuities appears focused on customization and integration with holistic financial planning strategies. As consumers continue to demand personalized solutions, providers must adapt accordingly, ensuring that flexibility is at the core of their offerings. This shift necessitates collaboration amongst financial professionals as they work together to incorporate annuities into comprehensive plans addressing clients’ multifaceted needs. Additionally, insurers and providers increasingly recognize the importance of aligning investments with longevity and lifespan realities. With rising life expectancy, the demand for income that lasts through retirement affirms the importance of annuities. Furthermore, incorporating ESG (Environmental, Social, and Governance) factors into product offerings starts to resonate with ethically oriented investors. As the younger generation becomes more involved in financial decisions, providers must ensure that their products align with these values. This movement towards responsible investing will likely shape product development and marketing strategies in the coming years. Overall, the blend of customized solutions, ethical considerations, and continued emphasis on client education will drive innovation. This realignment will attract consumers to an evolving landscape where annuities provide lasting value within financial networks.

In conclusion, the future of annuities encompasses a wide spectrum of trends and challenges demanding attention. While skepticism lingers, novel offerings and technological innovations position the industry for reinvigoration. Financial professionals must continue to embrace education, transparency, and flexibility within their client interactions. By addressing misconceptions and articulating the benefits of annuities, they can reshape market perceptions that linger within potential investors. As more tailored solutions emerge, annuities will serve a crucial role within diverse investment strategies, appealing to a broader demographic. Balancing traditional elements with modern advancements creates avenues for surreal growth and increased adoption among younger investors. Innovative product development incorporating consumer insights will enhance annuities’ image in the face of existing barriers. Ultimately, the success of annuities hinges upon adaptability and responsiveness to ever-changing market conditions. It is time for annuities to redefine their path within the financial ecosystem, presenting themselves as optimal solutions rather than outdated relics. By embracing a holistic approach, the industry can foster consumer confidence, ensuring annuities remain vital players in securing financial futures.