Global Supply Chain Finance Market Size and Competitive Landscape

The global supply chain finance market is experiencing significant growth due to the increasing complexity of supply chains and the need for efficient cash flow management. Companies are now more focused on enhancing operational efficiency and mitigating risks associated with extended payment terms. This shift has resulted in a rising demand for innovative financing solutions. Key players in the supply chain finance landscape are leveraging technology to streamline processes, reduce costs, and improve transparency. Major trends contributing to the market expansion include the adoption of digital platforms that facilitate transactions and enhance visibility across supply chains. As businesses seek to optimize liquidity, supply chain finance is increasingly viewed as an essential element in maintaining competitiveness. Additionally, the integration of artificial intelligence and blockchain technology into financial processes is transforming traditional approaches in this sector. The increased emphasis on sustainability is also shaping strategies, as companies strive for responsible financing options that align with global sustainability goals. In conclusion, the global supply chain finance market is well-positioned for growth, driven by technological advancements, evolving business needs, and a focus on sustainable practices.

Several factors are driving strategic decisions in the global supply chain finance market, including globalization and economic volatility. Companies today navigate a complex environment characterized by fluctuating demand patterns and cross-border trade challenges. In response, businesses are seeking comprehensive solutions that not only enhance cash flow but also provide flexibility and support in risk management. This includes the use of dynamic discounting and supply chain financing tools that can adapt to varying market conditions. The increasing number of supply chain disruptions due to political and social factors is pushing organizations to reassess their financing strategies. Additionally, the need for enhanced supplier relationships and collaboration has also elevated the relevance of supply chain finance. Strong relationships with suppliers can yield significant benefits, including improved cash flow and reduced costs. To capitalize on these opportunities, companies are investing in technology-driven solutions that improve decision-making processes and overall efficiency. A robust supply chain finance framework can help organizations proactively manage their working capital and enhance financial resilience. Ultimately, businesses are more equipped to thrive in an unpredictable global market environment.

The competitive landscape of the global supply chain finance market is rapidly evolving as more players enter the field. Traditional financial institutions are now competing with fintech startups, creating a dynamic environment that fosters innovation and competitive pricing. These new entrants are using digital solutions to offer faster and more flexible financing options that appeal to a broader range of customers. As a result, the focus has shifted towards user experience, technology integration, and value-added services to differentiate offerings. Moreover, established players are investing heavily in technological advancements to maintain their market share and meet changing customer demands. These developments underline the importance of agility in the supply chain finance space. Key players are also forming strategic partnerships to leverage complementary strengths and enhance service delivery. As companies continue to seek integrated solutions, providers that can offer seamless experiences through digital channels stand to gain a competitive advantage. Additionally, there is a growing emphasis on customer education to help organizations understand the full potential of supply chain finance and tailor solutions to their specific needs.

Key Trends Influencing the Market

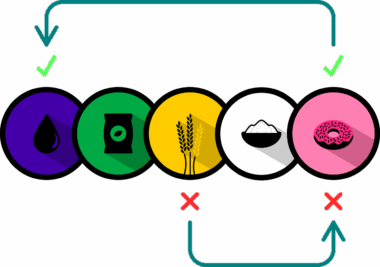

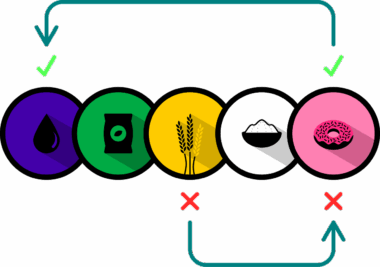

Several key trends are shaping the global supply chain finance market, driving growth and change. Firstly, the digital transformation of financial processes is a substantial factor, with organizations increasingly adopting cloud-based solutions. This shift enables better data analytics and enhances the overall visibility of the supply chain, allowing businesses to make informed decisions regarding financing. Secondly, the rise of e-commerce has created new demands for agile supply chain solutions, leading to greater emphasis on fast and flexible financing options. As online purchasing continues to surge, companies are looking for ways to optimize their financial operations to keep up with consumer expectations. Additionally, sustainability has become a critical component, as firms aim to align financial practices with environmental goals. The integration of green financing options in supply chain finance is garnering attention from stakeholders who prioritize corporate responsibility. Furthermore, regulatory changes and compliance requirements are pushing companies to adopt more transparent financing practices. These trends illustrate the evolving nature of the market, highlighting the intersection of technology, consumer behavior, and sustainability as driving forces in the future.

Technological advancements play a crucial role in the evolution of the global supply chain finance market. The proliferation of digital technologies has made it possible to automate numerous processes traditionally handled manually. This includes the implementation of electronic invoicing, blockchain, and machine learning, which enhance accuracy and streamline transactions. Moreover, these technologies are improving risk assessment capabilities, allowing firms to make better-informed financing decisions. For example, blockchain’s inherent transparency can mitigate fraud risk and improve trust between parties. Furthermore, artificial intelligence-driven analytics are enabling companies to predict trends and manage portfolios effectively. Businesses can harness data insights to tailor financing products more closely aligned with their operational requirements. Additionally, mobile applications have made supply chain finance solutions more accessible, empowering suppliers and buyers alike to utilize these tools efficiently. This democratization of financial solutions is transforming traditional dynamics, empowering small and medium-sized enterprises. As these technologies mature, they will further influence the competitive landscape of supply chain finance by fostering collaboration and enhancing risk management. In summary, technological innovation will continue to be a driving force reshaping the future of the industry.

The impact of the COVID-19 pandemic on the global supply chain finance market has been profound, highlighting vulnerabilities and prompting a reassessment of strategies. Organizations faced disruptions in supply chains due to lockdowns, leading many to realize the importance of financial agility and flexibility. As a result, companies are now prioritizing measures that ensure resilience in their financial frameworks. There has been an acceleration in the adoption of supply chain finance as firms seek to stabilize cash flow and strengthen relationships with suppliers. This trend has encouraged innovation in financing solutions, including improvements in payment terms and the introduction of alternative financing mechanisms. Furthermore, lessons learned from the pandemic, such as the need for rapid adaptability, are influencing long-term strategies. Companies are integrating contingency planning into their finance models to accommodate unforeseen obstacles. Furthermore, ongoing economic recovery processes will require businesses to rethink their financing approaches. Investments in digital transformation have also been catalyzed by the pandemic, as companies focus on enhancing digital capabilities to navigate future disruptions. Ultimately, the pandemic has underscored the necessity for organizations to adopt proactive financial strategies to thrive in an unpredictable world.

Future Outlook of Supply Chain Finance

Looking ahead, the future of the global supply chain finance market appears promising, marked by continuous evolution and expansion. The increasing need for sustainable practices is driving the integration of environmentally friendly financing options into supply chain strategies. Companies are prioritizing stakeholders’ demands for responsible business practices, thus enhancing pressure on financial solutions providers to adapt. Additionally, as global trade continues to grow, demand for supply chain finance solutions is expected to rise. This creates opportunities for service providers to develop tailored products to meet specific market needs. Furthermore, advancements in technology will drive the development of more sophisticated platforms that support seamless financing solutions. The emergence of real-time data will enable companies to make timely decisions, enhancing operational efficiency. Companies are also projected to diversify their financing options to mitigate risks and accommodate a broader supplier base. It will be essential for organizations to embrace ongoing change and innovation to remain competitive in this ever-evolving environment. Overall, the future of supply chain finance is likely to be characterized by sustainability, technological advancement, and a focus on holistic financial strategies.

In summary, the global supply chain finance market is set for remarkable growth propelled by technological advancements and changing business dynamics. Companies are increasingly recognizing the importance of streamlining their financing processes and enhancing liquidity. As they face new challenges in an evolving economic landscape, organizations aim to implement robust financing frameworks that can withstand external shocks. The adoption of innovative solutions will play a critical role in enabling organizations to navigate complexities effectively. Furthermore, the growing emphasis on sustainability within supply chain finance will encourage businesses to prioritize responsible practices in their operations. Stakeholders are increasingly expecting financial solutions to align with their corporate sustainability goals. This desire for alignment will push financial providers to develop sustainable financing models while improving overall customer satisfaction. The interplay of technology, sustainability, and evolving consumer preferences will shape the trajectory of the supply chain finance sector in the years to come. Companies that are agile in their approaches and willing to invest in digital transformation will be better positioned to succeed, ensuring a competitive edge in the market. Ultimately, the future holds a landscape rich in opportunities for businesses that actively engage in supply chain finance.