Comparing Developed vs. Emerging Market Investments

Investment strategies focused on international markets can yield distinct outcomes depending on the geographical and economic conditions of the target regions. Developed markets are characterized by established financial systems, regulatory frameworks, and a history of stable economic growth. In contrast, emerging markets often come with higher volatility but potentially greater returns, driven by rapid growth rates, increased consumer spending, and youthful populations. Investors must consider the implications of political stability, economic policies, and market infrastructure before diving into either market. Hence, understanding these contrasts is crucial. Diversification remains vital; allocating assets across both markets allows investors to balance risks and rewards effectively. By leveraging the strengths of developed and emerging markets, investment portfolios can achieve resilience while capitalizing on growth opportunities. Advanced markets often provide lower risk and more predictable returns, appealing to conservative investors. In contrast, emerging markets require a risk appetite. The potential for higher returns can attract those willing to bear the associated risks. Engaging with trusted financial advisors can assist in navigating the nuances between these two categories of markets.

Investor sentiment plays a crucial role when assessing the viability of developed versus emerging market investments. In developed markets like the United States, the United Kingdom, and Japan, economic indicators often reflect mature industries and steady growth. However, macroeconomic variables such as interest rates, employment figures, and consumer confidence in these regions can significantly influence market performance. Conversely, emerging markets, like those in Asia or Africa, can show rapid economic shifts influenced by demographic changes and governmental reforms. Investors may experience erratic market behavior due to local political situations, making it essential to conduct thorough research. Investigating regional trends, sector performances, and currency fluctuations can assist investors in making informed decisions. Additionally, foreign direct investment often fluctuates based on these variables, compounding the opportunities and risks presented by emerging markets. Investors must have a holistic understanding of global dynamics. Scenario analysis and risk assessment become pivotal tools when comparing market potentials and deciding where to allocate resources. Behavioral finance principles also suggest how investor biases can affect perceptions of developed versus emerging markets. Understanding these psychological influences enhances investment decision-making.

Economic Indicators and Their Impact

Analyzing economic indicators is critical in the comparison between developed and emerging markets. In developed economies, GDP growth rates, inflation, and unemployment rates typically provide insights into market stability and growth trajectories. For instance, steady GDP growth usually signals a well-functioning economy. In contrast, emerging markets may exhibit high GDP growth but also higher inflation and instability. Investors seeking opportunities must weigh these factors carefully. Comparative evaluations of economic performance, trade balances, and fiscal policies can guide investment choices effectively. Emerging economies often have a more significant scope for unexpected economic adjustments and can present high returns. However, the associated risks are considerable. Long-term economic viability in these markets frequently reflects their capacity to manage external shocks. Investors should comprehensively analyze the social and political conditions impacting economic indicators. Regional partnerships and alliances can directly influence growth perceptions and provide additional context. Learning about key players within these emerging markets and their projected economic trajectories can reveal promising opportunities. It is essential not to overlook the strategic importance of understanding how these elements interact and influence potential investment outcomes.

Investment opportunities in emerging markets can be enhanced through sector-specific analyses. Unlike development economies, which may display growth across traditionally stable sectors, emerging markets might exhibit rapid advancements in technology, green energy, and consumer goods. Identifying sectors with strong growth potential is crucial for investors aiming to maximize returns. Countries with strong demographic trends can indicate burgeoning consumer markets, particularly in sectors like e-commerce, fintech, and renewable energy. Exploring the varying regulatory environments is also vital; understanding how local governments support or hinder specific industries can guide investment strategies. Engaging in sector analysis entails thoroughly understanding competitive landscapes, market players, and potential barriers to entry. Conducting thorough due diligence and risk assessments can help ensure maximized potential returns in these sectors. Active engagement with local experts and industry leaders often reveals beneficial insights. Additionally, appreciating the differences in corporate governance and practices between markets helps investors align their strategies with local contexts. Investors are advised to adopt innovative investment strategies that blend traditional approaches and modern techniques to succeed in emerging markets. This adaptable mindset fosters opportunities amidst rapid changes.

Risks Involved in International Investing

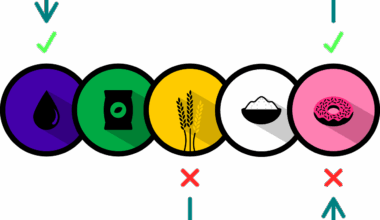

Understanding the challenges associated with international investing is crucial. Emerging markets typically possess higher volatility and risks, including currency fluctuations, liquidity issues, and geopolitical tensions. These markets can experience abrupt market movements driven by domestic and international events. As a result, investors must adopt a comprehensive approach to risk management. This entails using protective strategies, including diversification and asset allocation. Analyzing interest rates and inflation rates locally provides insight into potential risks. Currency exposure becomes a critical factor, as fluctuations can significantly impact investment value. In contrast, developed markets, though generally more stable, are also not immune to risks, particularly in times of economic downturns or geopolitical tensions. Additionally, regulatory changes and market dynamics can shift. Investors must stay updated on global events influencing both developed and emerging markets. A proactive approach to monitoring economic conditions fosters better investment strategies. Educational resources and workshops can further equip investors with knowledge on navigating these complexities. Establishing robust exit strategies can also safeguard investments against adverse market movements, allowing for swift decisions. A nuanced understanding of associated risks enhances investment resilience.

The role of technology in global investing has transformed the landscape significantly. The rise of fintech and digital platforms has made accessing both developed and emerging markets easier than ever before. Investors are no longer limited by geographical barriers. This has facilitated real-time market analysis, data-driven decision-making, and streamlined trading processes. However, alongside this opportunity comes the need for cybersecurity awareness. Investors must protect their assets from potential cyber threats prevalent in today’s digital age. Innovations like blockchain technology and artificial intelligence can offer additional layers of efficiency and transparency. These emerging technologies are critical in evaluating investment opportunities, analyzing market movements, and managing risks effectively. The adoption of advanced analytics enables investors to gauge unseen trends and align strategies accordingly. Understanding the impact of technology on different sectors is essential when investing internationally. As technology reshapes market dynamics, investors should remain agile and always adapt to these changes. Staying informed about new technological advancements also provides competitive advantages. Networking with peers and attending industry events fosters knowledge sharing and collaboration, driving investment success through innovative approaches.

Conclusion: Crafting a Balanced Portfolio

In conclusion, crafting a well-balanced investment portfolio requires an informed approach to both developed and emerging markets. Each market presents unique opportunities and challenges that must be considered strategically. As discussed, understanding economic indicators, sector potentials, technological advancements, and associated risks is paramount to effective international investing. Analyzing the global economic landscape and remaining adaptable to changes enhances decision-making capabilities. Diversification between developed and emerging markets mitigates risks while maximizing potential returns. Engaging with financial advisors can provide additional insights and bolster investment strategies tailored to individual risk tolerance. Building a resilient portfolio focuses on long-term growth while considering market fluctuations. Investors eager to delve into international markets must prioritize due diligence and continuous learning. Education helps navigate complexities and promotes informed investment choices. By fostering a balanced approach and leveraging insights from both markets, investors can thrive in an ever-evolving investment landscape. Ultimately, the careful consideration of all factors paves the way for successful international investing and wealth accumulation. Embracing the intricacies of these diverse markets opens doors to myriad opportunities that await diligent investors in today’s global economy.