Cloud Computing in Government Finance Systems

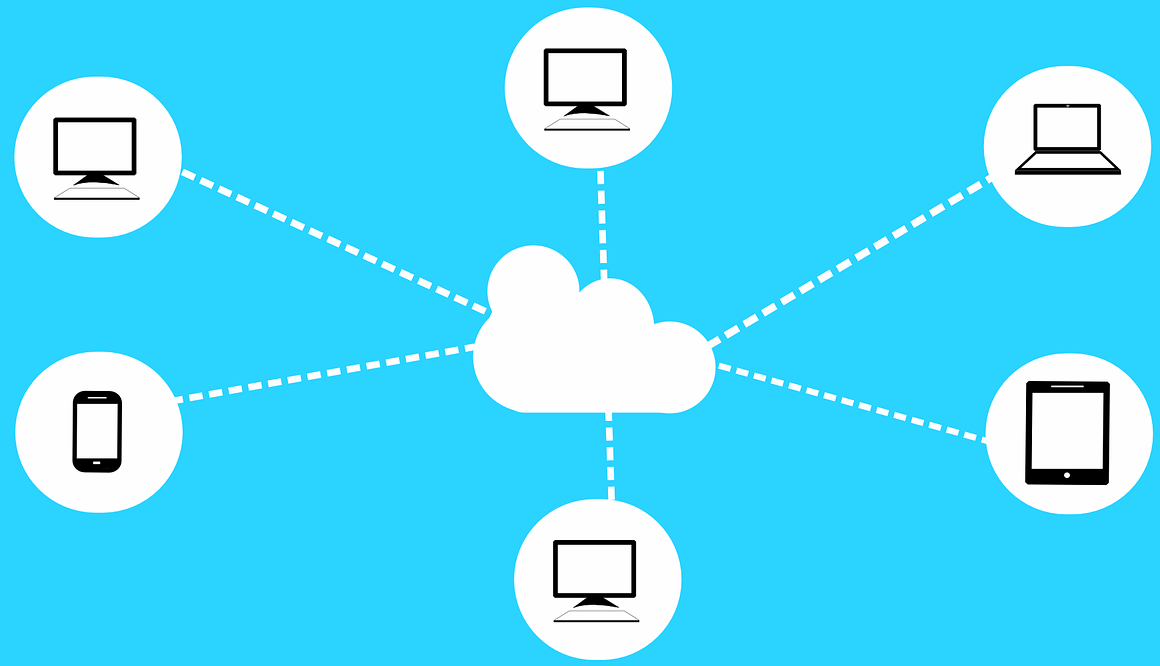

The integration of cloud computing into government finance systems represents a transformative approach that reshapes public finance management. Traditionally, governments relied on outdated legacy systems, struggling with inefficiencies, high maintenance costs, and limited scalability. Cloud computing significantly enhances these capabilities, allowing for real-time data access and collaboration across various departments. Governments can opt for Software as a Service (SaaS) solutions, which offer comprehensive financial management tools without substantial upfront costs. The ease of updates and maintenance in cloud environments compares favorably to traditional systems, ensuring governments always utilize the latest technology. Furthermore, accessibility from different locations empowers governmental staff, promoting productivity and facilitating better decision-making. By harnessing analytical tools built into these platforms, authorities can better understand fiscal patterns and make data-driven policy decisions. However, the adoption of cloud solutions also raises concerns about data security and compliance with regulations. Addressing these concerns necessitates robust security measures and compliance programs to safeguard sensitive financial information. Therefore, cloud computing represents both opportunity and challenge in enhancing public finance systems, steering governments towards digital transformation.

Benefits of Cloud Solutions

Adopting cloud solutions in government finance systems brings numerous benefits that can revolutionize the way financial data is managed and processed. First, cloud computing ensures improved operational efficiency, as agencies leverage automatic updates and seamless integration with existing tools. This leads to quicker transactions and lowers the chances of errors arising from manual updates. Additionally, the scalability offered by cloud platforms means that financial systems can easily adjust to fluctuating needs, accommodating growth in data without resource-heavy investments. Enhanced collaboration among different departments is another key benefit, providing unified access to real-time financial information regardless of geographic constraints. Data centralization reduces silos, enabling a more holistic view of financial health across governmental bodies. Further, cost savings are significant, as cloud solutions generally operate on a pay-as-you-go model, reducing the need for large capital expenditures. Enhanced compliance capabilities also arise from the structured nature of cloud solutions, simplifying adherence to financial regulations. Consequently, these benefits combine to create a more agile and responsive government finance system that can better serve the needs of the public while ensuring strict financial stewardship.

Despite significant advantages, transitioning to cloud computing in public finance poses several challenges that agencies must address thoughtfully. Key among these challenges is the concern surrounding data security, as government entities manage sensitive financial information that could be attractive to cybercriminals. Ensuring robust access controls and encryption is critical to maintaining data integrity. Additionally, there exists a level of apprehension regarding compliance with applicable regulations and standards, especially in sectors with strict data handling requirements. As such, governments must engage in thorough risk assessment processes to identify potential vulnerabilities. Moreover, the cultural shift associated with adopting cloud technologies can create resistance among staff accustomed to traditional systems. Training programs and change management strategies are essential for fostering staff buy-in and ensuring smooth adaptation. The initial learning curve may be steep, necessitating investment in skill development and support resources. Furthermore, selecting the right cloud service provider can be daunting, as agencies must evaluate numerous offerings to find one aligned with their financial goals. Consequently, addressing these challenges is vital for the successful implementation of cloud computing within government finance systems.

Impact on Financial Reporting

The influence of cloud computing extends to financial reporting practices in government finance systems, significantly enhancing transparency and accountability. With cloud-based financial systems, real-time reporting becomes a reality, allowing stakeholders to access up-to-date financial information promptly. This immediacy supports informed decision-making processes at all levels, from day-to-day operations to strategic planning initiatives. Enhanced visualization tools within cloud platforms also allow for clearer presentation of financial data, promoting more effective communication among government officials, policymakers, and the public. Stakeholders can easily identify trends, discrepancies, and performance metrics through intuitive dashboards and reports. Furthermore, data integrity is bolstered through automated processes that reduce the risks of human error and discrepancies. Governments can also easily track expenditures against budgets, providing a comprehensive view of spending practices. Compliance with financial regulations is further facilitated by detailed audit trails, ensuring accountability in financial reporting. The ability to share reports securely with external stakeholders, including citizens and oversight bodies, fosters a culture of transparency. All these aspects significantly improve public trust in government financial practices, underpinning the efficacy of cloud computing in enhancing financial reporting in the public sector.

Another significant impact of cloud computing on government finance systems is the facilitation of better budgeting and forecasting processes. Cloud solutions empower agencies to integrate advanced analytical tools that leverage historical data alongside real-time financial insights. This capability enables more accurate forecasting, allowing governments to make strategic budgetary adjustments based on shifting economic conditions and priorities. Moreover, budget development takes on a collaborative nature, as various departments can contribute seamlessly to create a unified budget proposal. The cloud allows for simultaneous access to financial data, fostering discussions that can lead to innovative budget solutions. Agencies can utilize scenario modeling to simulate different fiscal scenarios, assessing potential implications before decisions are finalized. Such practices result in more agile and responsive budgeting processes, adapting quickly to changing demands and public needs. Furthermore, the ability to monitor actual spending against budgeted figures in real-time promotes fiscal discipline and accountability. Regular reviews can reveal variances, prompting timely corrective actions. As a result, cloud computing not only transforms existing budgeting practices in government finance but encourages a proactive and responsive approach to public financial management.

Challenges of Implementation

The implementation of cloud solutions within government finance systems does not come without challenges that require careful consideration. First, these implementations often entail significant changes to existing workflows and processes, which can result in temporary disruptions. The resistance to change among staff may present hurdles, necessitating comprehensive training programs to facilitate smooth transitions. Ensuring the alignment of cloud functionalities with specific government requirements may require customizing cloud solutions, which can introduce additional complexities at a higher investment cost. Moreover, procuring cloud services entails selecting from a wide array of vendors, each offering different security features, costs, and levels of support. The evaluation process for selecting the right provider is critical and involves extensive research to ensure data security and reliability. Additionally, laws and regulations governing public financial management (PFM) may impose restrictions on data residency, potentially siloing government entities based on geographical limitations. Overcoming these challenges calls for a strategic approach involving comprehensive planning, collaboration among stakeholders, and strong leadership to guide the implementation process. Ultimately, while challenges exist, thoughtful planning can lead to successful outcomes for government finance systems.

Finally, the role of stakeholder engagement in transitioning to cloud solutions within government finance cannot be overstated. It is essential for decision-makers to actively involve all relevant stakeholders throughout the adoption process. This includes government officials, financial staff, information technology units, and end-users who will interact with the new systems. Engaging these individuals early in the process ensures that their concerns and needs are understood and addressed, fostering an inclusive atmosphere that promotes collaboration. Furthermore, open communication regarding the benefits and challenges of cloud technology will facilitate greater acceptance and mitigate resistance to change. Regular updates regarding project status and opportunities for feedback also contribute to a sense of ownership among stakeholders. Ongoing training and support resources must be tailored to varying skill levels, ensuring that everyone is equipped to embrace the transition smoothly. By making stakeholder engagement a priority, governments can enhance their chances of successfully implementing cloud computing in finance systems. The active participation of all parties fosters a culture of innovation and adaptation within public finance, supporting the overarching objectives of transparency, efficiency, and accountability in service delivery.

This concluding remark underscores the journey that cloud computing sparks in the evolution of government finance systems, ultimately leading towards enhanced efficiency, transparency, and accountability.