Implementing Financial Ethics Training for Nonprofit Staff and Leadership

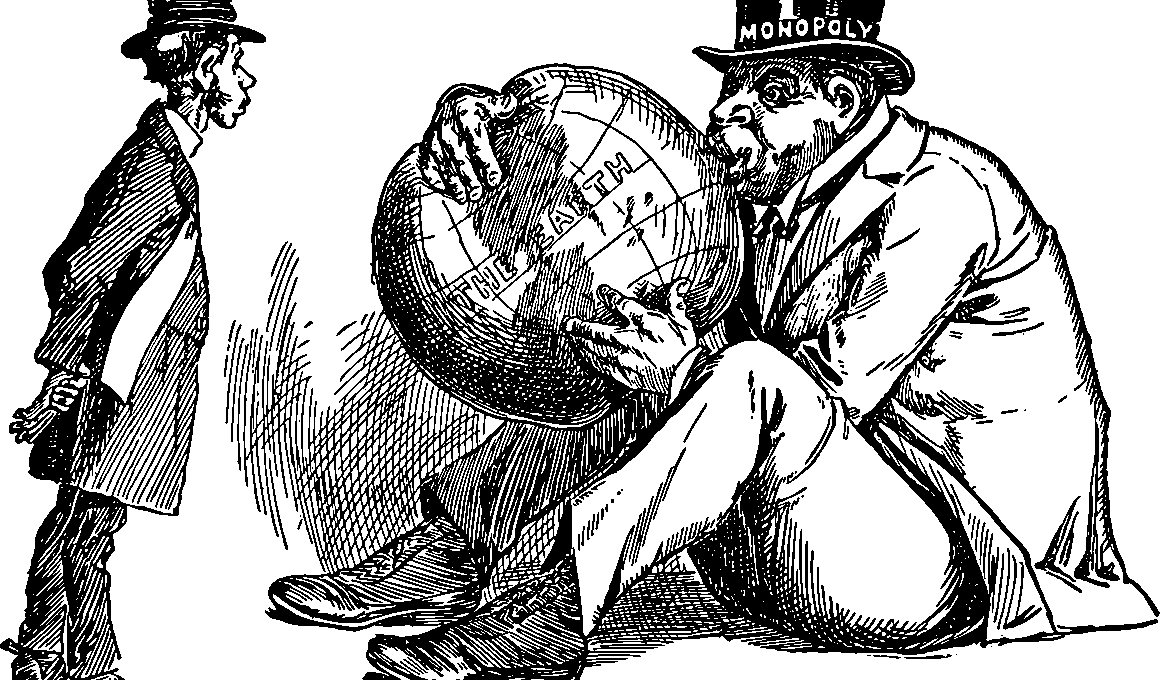

In today’s nonprofit sector, fostering a culture of financial ethics is not only essential but also a strategic imperative. Nonprofits often operate with limited resources, making it crucial for staff and leadership to adhere to ethical financial practices. Financial ethics training can help create a transparent environment that encourages accountability and trust. By implementing structured programs, nonprofits can equip their teams with the necessary knowledge and tools to navigate the complexities of financial decision-making. Training should cover a range of topics, including managing donor funds, adhering to regulations, and understanding financial reporting. Incorporating real-life scenarios can make training more relatable and effective. Among various strategies, it is important to facilitate open discussions about ethical dilemmas. Furthermore, organizations should regularly revisit their financial protocols and refine them based on feedback from staff. This creates an ongoing dialogue about ethics in finance, elevating the organization’s integrity. Leaders must lead by example, demonstrating high ethical standards in their financial dealings and decisions. Such efforts contribute significantly to building trust with stakeholders, laying a strong foundation for long-term organizational success.

To build an effective financial ethics training program for nonprofit staff, it is crucial to assess the organization’s specific needs and risks effectively. This entails conducting a thorough review of existing financial policies, procedures, and practices. Engaging staff in this assessment process creates a sense of ownership and accountability. Moreover, examining case studies where financial ethics were compromised can provide valuable insights, highlighting the consequences of unethical behavior. It’s vital to tailor training sessions to address identified gaps and reinforce positive behaviors. Incorporating diverse learning methods—such as workshops, interactive e-learning modules, and peer discussions—can cater to various learning preferences and enhance retention. Additionally, organizations might consider inviting guest speakers or ethics experts to share their insights and experiences. Participants can gain immense value from hearing real-world applications of ethical principles. Other components, like developing easy to understand reference materials, can simplify complex concepts and provide ongoing support for staff. Regularly updating training content ensures it remains relevant in a rapidly changing regulatory and financial environment. Ultimately, continuous education fosters an ethical culture that plays a crucial role in the nonprofit’s overall mission and effectiveness.

The Role of Leadership in Promoting Financial Ethics

Leadership commitment is paramount in promoting financial ethics within nonprofit organizations. Leaders should embody ethical behavior and serve as role models for their teams. They must communicate the importance of financial ethics consistently and show that adherence to these principles is non-negotiable. This can be achieved through providing platforms for discussing ethical challenges openly and fostering an environment where staff feel safe to voice concerns. One effective strategy involves establishing an ethics committee or task force responsible for monitoring compliance and providing guidance regarding ethical dilemmas. Additionally, organizations can implement a whistleblower policy to protect individuals who report unethical practices. Such measures encourage transparency and accountability while helping to deter misconduct. By holding leadership accountable for financial ethics, nonprofits can foster a culture of integrity and responsibility. This not only enhances the organization’s reputation but also cultivates trust among stakeholders. Furthermore, celebrating successes in ethical financial practices can motivate staff to adhere to these principles. Recognizing individuals who demonstrate exemplary ethical behavior reinforces the expected standards and encourages a collective commitment to financial integrity. Ultimately, leadership plays a pivotal role in shaping a culture of ethics within the nonprofit sector.

Integrating financial ethics training into existing programs is another effective way to reinforce the importance of ethical decision-making within nonprofits. Organizations should consider incorporating relevant financial ethics topics into onboarding processes and other training sessions. This ensures that new employees understand the organization’s commitment to ethical practices from the start. Incorporating role-playing activities in training can also enhance learning experiences by allowing participants to engage in realistic scenarios. Another strategy is to develop case studies based on previous financial ethics breaches within the sector. Participants can dissect these cases to understand the factors that led to unethical decisions and discuss alternative outcomes. Additionally, organizations can leverage technology for delivering training. Online platforms allow for flexible access to training materials, making it easier for staff to engage with the content at their convenience. Regular communication about financial ethical standards through newsletters, reminders, or team meetings reinforces their importance. Furthermore, organizations should evaluate the effectiveness of their training through surveys or feedback sessions to ensure continuous improvement. Integrating ethical considerations into the organizational culture leads to a more sustainable ethical practice model, ultimately improving the nonprofit’s overall effectiveness and impact.

Challenges in Financial Ethics Training Implementation

While implementing financial ethics training programs, nonprofits may face several challenges that require careful consideration and management. One primary concern is resource allocation; many nonprofits operate with limited budgets and may struggle to dedicate funds towards comprehensive training initiatives. In such cases, organizations can explore partnerships with educational institutions or online platforms that offer free or low-cost training resources. Another challenge is ensuring staff engagement; without buy-in from employees, training programs may fail to achieve their desired effects. Creating an engaging curriculum that appeals to different learning styles can significantly increase participation and retention rates. Additionally, balancing training with everyday responsibilities can be difficult, leading to scheduling conflicts. To counter this, organizations can offer training in shorter, more manageable segments. There can also be varying levels of understanding of financial ethics among staff, which necessitates tailoring sessions accordingly. Some employees may need more foundational knowledge while others might require advanced discussions. Addressing these challenges proactively ensures a smoother implementation process. By navigating obstacles effectively, nonprofits can successfully foster an environment steeped in financial ethics, benefiting the organization, its stakeholders, and the communities they serve.

Measurement and evaluation of financial ethics training’s effectiveness is crucial for ensuring continuous improvement. Establishing clear objectives and performance indicators at the outset allows organizations to measure outcomes against set goals. After each training session, soliciting feedback from participants can provide invaluable insights. Surveys or focus groups can help gauge understanding and application of ethical principles learned in training sessions. Additionally, organizations should track incidents related to financial ethics both before and after training implementation. This data can help assess whether training has successfully impacted behavior. One innovative approach involves using scenario-based assessments or simulations to evaluate staff’s ability to apply financial ethics concepts. A practical test can demonstrate whether training translates into real-world application. Furthermore, organizations can conduct regular audits of financial processes to ensure compliance with established ethical standards. Reviewing and refining training programs based on feedback and performance evaluations is essential to maintain relevance and effectiveness. Ultimately, measuring success fosters accountability and demonstrates the organization’s commitment to financial ethics, thereby enhancing overall stakeholder confidence. By prioritizing evaluation, nonprofits strengthen their ethical foundations and contribute positively to their mission.

The Future of Financial Ethics in Nonprofits

Looking ahead, the future of financial ethics in nonprofits will likely be shaped by evolving regulations, increased public scrutiny, and a growing focus on accountability. As the landscape becomes more complex, nonprofits must remain proactive in their approach to financial ethics training. This entails staying informed about legal changes and industry standards to ensure compliance. Additionally, embracing technology can enhance training delivery and content management. Virtual training platforms can provide insightful resources and foster collaborative learning among team members. Social media and online forums present opportunities for nonprofits to engage with external stakeholders, demonstrating their commitment to ethical practices transparently. Future training programs might also necessitate the inclusion of diverse perspectives to reflect societal changes and cultural nuances. As stakeholders demand more transparency, nonprofits must be prepared to adapt their financial practices and training methodologies correspondingly. Building partnerships with like-minded organizations can amplify their resource pool while promoting shared values in financial ethics. Moreover, an unwavering commitment to financial ethics can differentiate nonprofits in a competitive landscape, attracting donors and volunteers. Ultimately, a robust ethical framework will serve as a cornerstone for future success and sustainability in the nonprofit sector.

The commitment to ethical financial practices in nonprofits goes far beyond training; it nurtures an ethos of integrity that can endure dynamic changes. Therefore, it’s vital for nonprofits to invest in creating a supportive framework that promotes ethical behavior consistently. Celebrating ethical successes and creating recognition programs encourages staff to embody these principles in their daily work. Peer accountability can foster heightened ethical awareness, where staff support one another to make sound decisions. Additionally, sharing success stories within the organization can inspire others to uphold similar values. Networking with other organizations can facilitate the exchange of best practices and innovative ideas around financial ethics. Nonprofits can keep abreast of trends and lessons learned from various sectors, enriching their training programs further. Collaborating with external experts can bolster internal capabilities while providing fresh perspectives. Continual emphasis on financial ethics prepares nonprofits for unforeseen challenges ahead. A culture of ethical vigilance can ensure that the organization remains resilient and equipped to address any dilemmas effectively. In essence, fostering a strong ethical culture not only helps nonprofits fulfill their missions but also builds trust and credibility with donors, stakeholders, and the communities they serve.