The Role of Trade Credit in Business Growth

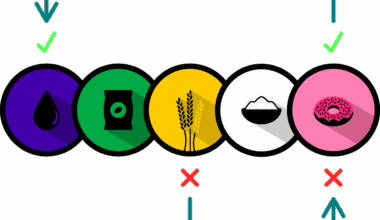

Trade credit plays an essential role in fostering business growth by allowing companies to acquire goods and services on credit. This practice enables businesses to manage cash flow effectively, ensuring that they have enough liquidity to invest in growth opportunities. One of the key advantages of trade credit is that it provides immediate access to products without an upfront payment, which can be crucial for startups and small businesses. Additionally, trade credit helps strengthen supplier relationships, leading to better negotiation terms in the future. Businesses can use trade credit as a financial tool by extending their accounts payable while improving inventory turnover rates. This mechanism ultimately supports a company�27s operational efficiency, allowing it to compete more vigorously in the market. Moreover, trade credit can indicate a company�27s financial health and reputation, offering a competitive edge in negotiations. Managing trade credit effectively involves maintaining a balance between maximizing purchasing power and ensuring timely repayments. Proper management can also mitigate risks associated with late payments and defaults, safeguarding both suppliers and buyers.

Another major advantage of trade credit is that it often comes with favorable terms, making it an attractive option for businesses wary of interest payments that typically come with loans. Suppliers may provide extended repayment terms, which can range from 30 to 90 days or longer. This flexibility allows businesses to use their revenue to reinvest into product development or marketing strategies before facing payment deadlines. Trade credit also promotes intent, as businesses often prioritize maintaining good relationships with suppliers, thus ensuring future credit access. When a company can secure trade credit, it demonstrates trustworthiness to its vendors, which may translate into further financial opportunities. However, businesses should carefully assess their ability to meet repayment terms to avoid tarnishing their credit ratings. An essential component to balance is evaluating the cash cycle and understanding inventory levels. Customer flexibility can correlate with trade credits, impacting customer demand and sales forecasts. As a result, effective trade credit management can lead to sustained business growth, allowing companies to remain agile while making substantial investments.

Trade Credit and Supplier Relationships

Maintaining robust supplier relationships is critical for leveraging trade credit effectively. Establishing trust and open lines of communication with suppliers can facilitate better terms and conditions for credit agreements. When suppliers perceive a business to be reliable, they are more inclined to extend favorable credit terms, which are essential for maintaining liquidity. The negotiation of these terms could include discounts for early payments, extended payment periods, or even increased credit limits over time. Moreover, having a solid reputation influences a business’s overall standing in the marketplace. By fulfilling payment obligations on time, companies not only preserve their creditworthiness but also enhance their bargaining power. Trade credit can, thus, be a reciprocal arrangement, where trust and reliability lead to better terms for businesses seeking growth. In addition, suppliers may provide unique insights and feedback about a company’s practices and products through these relationships. This knowledge can be instrumental for making informed business decisions and tailoring offerings to meet customer needs more effectively.

Moreover, trade credit offers significant strategic advantages, enhancing operational efficiency through streamlined inventory management practices. Businesses can leverage credit arrangements to adjust inventory levels based on seasonal demand fluctuations without significant cash outflows. This flexibility minimizes the risk of overstocking or understocking, ensuring products remain available and reducing costs associated with storage and inventory management. Additionally, using trade credit to finance inventory can free up cash flows for other business activities, such as marketing or expansion efforts, further enhancing growth potential. However, it is crucial for businesses to analyze their historical sales data and market trends to make informed decisions regarding inventory purchases. Implementing inventory management software can also facilitate tracking and managing inventory levels effectively. Companies can assess how much trade credit they require to cover anticipated increases in demand and strategically plan purchases. Ultimately, aligning trade credit with inventory management practices can lead to improved cash flow and operational performance, ultimately supporting long-term growth and sustainability.

Risks of Trade Credit

Despite its many benefits, trade credit is not without risks. Companies must be vigilant about their credit management practices to avoid negative repercussions. Late payments could result in supplier penalties, which might strain relationships and lead to stronger scrutiny from vendors. Further, businesses heavily relying on trade credit may inadvertently harm their cash flow if they experience delays in receiving payments from their customers. A fundamental risk associated with trade credit is potential customer defaults, resulting in losses for suppliers and extended payment periods for buyers. Companies need to implement strong credit policies, including regular assessments of customers’ creditworthiness to mitigate these risks effectively. Employing these strategies can help businesses anticipate potential payment issues, protecting their liquidity and fostering better relationships with suppliers. Another crucial aspect of managing trade credit risk is adherence to regular financial reviews. Monitoring outstanding balances and payment histories aids in recognizing patterns that may indicate trouble ahead, allowing businesses to take preemptive action before issues escalate into more significant challenges.

In conclusion, trade credit serves as a powerful tool for driving business growth by enhancing cash flow, improving supplier relationships, and fostering strategic operational practices. Companies operating in various industries can harness its benefits while managing inherent risks through careful credit analysis and management strategies. By leveraging trade credit effectively, organizations can align purchasing decisions with growth objectives, ensuring that they utilize available resources efficiently. Maintaining healthy cash flow alongside good supplier relationships allows companies to remain competitive. As businesses analyze their end-of-month finances, preparing for future needs by understanding trade credit can enhance planning and operational success. Having an adaptable financing strategy positions businesses to capitalize on emerging market trends and customer demands. Ultimately, trade credit not only helps address immediate financial constraints but also propels long-term growth strategies. Properly managed trade credit acts as a lifeline, allowing businesses to navigate uncertainties while reinforcing their position in their respective markets. Therefore, understanding and implementing effective trade credit strategies is essential for any organization aiming for success.

The Future of Trade Credit

Looking ahead, the landscape of trade credit is likely to evolve with advances in technology and changing market dynamics. Digital transformation is poised to enhance how companies assess and manage trade credit solutions. The rise of fintech companies and online marketplaces is beginning to reshape traditional credit practices, making it easier for small businesses to access trade credit quickly. Furthermore, the integration of artificial intelligence can assist companies in evaluating customer credit risk more effectively and in real-time, leading to more informed decisions. Companies adopting these digital tools may have a competitive advantage in streamlining credit assessments and improving cash flow management. Innovations in blockchain technology may also facilitate secure and transparent transactions, enhancing trust between parties involved. Additionally, sustainability considerations are becoming a central focus, influencing credit policies and practices. Companies demonstrating commitment to ethical and sustainable practices may see favorable credit terms as suppliers prioritize working with responsible partners. Thus, the future of trade credit looks promising as technological advancements change how businesses approach credit management, driving performance and fostering growth.

As the exchange of goods and services continues to expand in a globalized economy, understanding the dynamics of trade credit becomes increasingly vital for businesses. Different regions may have unique cultural practices regarding credit and payment, which companies will need to adapt to. Learning to navigate these variations can open up new markets and opportunities for growth. Additionally, as businesses embrace e-commerce, the demand for swift and flexible credit solutions will likely increase. Trade credit mechanisms will need to adapt to cater to the needs of these industries, allowing businesses to thrive without compromising their financial stability. Collaboration among businesses, suppliers, and financial institutions will be crucial in achieving a sustainable credit ecosystem. By fostering an inclusive environment where businesses can access essential trade credit resources, stakeholders create opportunities for mutual growth. Creating awareness about the importance of trade credit and providing education on best practices will be vital in equipping businesses with the tools necessary for success. Overall, as the commercial landscape continues to evolve, effectively embracing trade credit will remain instrumental for businesses looking to achieve sustained growth.