Important Supply Chain Finance Terms for Small Businesses

Supply Chain Finance (SCF) refers to various financial instruments and practices enabling businesses to optimize their working capital through manageable transactional relationships. By understanding SCF, small businesses can effectively enhance cash flow and reduce costs linked to their supply chain operations. One of the key components in SCF is reverse factoring, which entails a financial process where suppliers are paid earlier without burdening their cash flow or credit standing. This option allows businesses to maintain better relationships with suppliers while securing cost savings. It’s also essential to understand discounts, particularly when suppliers offer early payment options that can result in considerable savings over time. Implementing good practices within SCF can also help businesses negotiate superior terms with financial institutions, resulting in better financing terms. On a broader scale, understanding SCF will empower small businesses to leverage supplier relationships for mutual benefit. Financial technology is making these processes more streamlined, but getting acquainted with the terminology is crucial to navigating these options successfully. Access to these tools could very well define a business’s operational efficiency and profitability in the fast-paced market. Ultimately, knowledge is the first step towards a smarter supply chain.

Understanding Supply Chain Finance

SCF also encompasses the notion of liquidity optimization, which involves managing the financial aspects of supply chain flows effectively. This management practice allows businesses to increase their available capital while minimizing the time that money is tied up in inventory. A critical tool often discussed in SCF is the concept of dynamic discounting, wherein buyers can negotiate varying payment terms with their suppliers based on specific strategic considerations. This enables buyers to benefit from discounts on early payments, positively impacting cash flow and supplier relationships while maintaining a balance with financial liquidity. Small businesses engaging in SCF strategies should focus on their unique cash flow needs and how these tools can be adapted accordingly. Moreover, there’s a need to familiarize yourself with key metrics and performance indicators relevant to SCF, such as days payable outstanding (DPO) and days sales outstanding (DSO), which measure how long it takes to settle bills and collect customer payments, respectively. Building a comprehensive financial structure also frequently involves external advisors or consultants who specialize in SCF to assist with optimizing financial operations effectively and sustainably.

Another essential aspect of SCF is the role of technology and its influence on modern supply chain practices. Financial tools such as blockchain, for instance, provide transparency and security, which can significantly enhance trust among supply chain participants. Smart contracts created through blockchain technology can automate payment processes, making transactions quicker and reducing administrative burdens. Additionally, the emergence of Artificial Intelligence (AI) and data analytics has transformed how businesses optimize their supply chains and forecast financial needs. AI-driven insights allow businesses to make informed decisions on when to pay suppliers and how to maintain optimal inventory levels. Furthermore, integrated platforms enable seamless communication among stakeholders, improving the speed at which financial transactions occur, thus enhancing liquidity. Embracing such technologies not only fosters competitiveness but also prepares businesses for the rapid changes occurring in finance. Small businesses should continuously assess how these technological innovations can be leveraged within their supply chain finance strategies to ensure ongoing relevancy and sustainability. Ultimately, marrying finance with technology creates a proactive approach to managing supply chains, essential for any growing enterprise.

Key Terminology in Supply Chain Finance

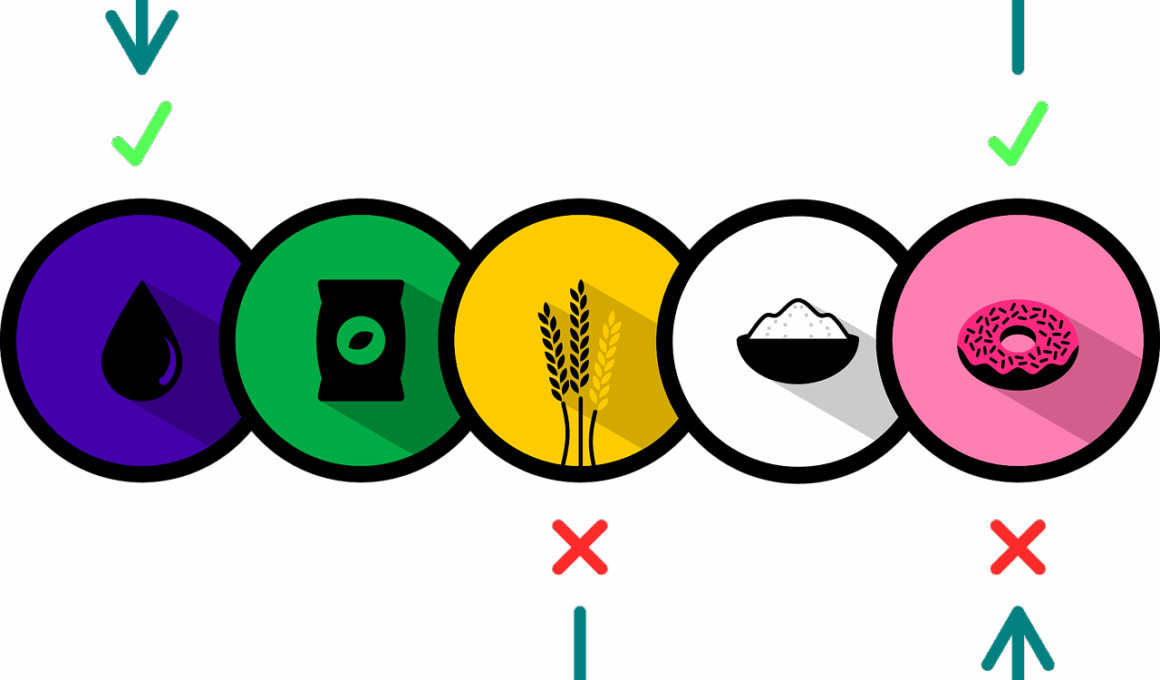

Understanding some critical terminology related to SCF can go a long way in empowering small business owners. For instance, “working capital” refers to the funds used to operate daily and is crucial for maintaining liquidity. It’s essential to monitor these metrics closely, particularly because supply chain operations can considerably influence a company’s working capital situation. Another critical term is “financing cost”; this indicates the total cost incurred for borrowing funds, which can often dictate a company’s financial decisions in dealings with suppliers or customers. Additionally, the term “supply chain visibility” refers to the ability to track and manage the supply chain from end to end. Increased visibility contributes to better decision-making, enabling businesses to align supply with demand effectively. Moreover, “collateral” may also become a key term in SCF, as businesses sometimes need to pledge assets against loans. Having a clear understanding of these terms enriches communication with financial partners and contributes to better financial strategies and outcomes. Small businesses that educate themselves on these terminologies will gain the confidence to negotiate more effectively.

Another important concept to grasp when delving into SCF is “risk management.” Effective risk management practices within supply chain finance can mitigate potential disruptions, such as delays or defaults from suppliers, ensuring that businesses maintain workflow continuity. Additionally, educating oneself about supplier credit ratings and assessments can greatly influence decision-making. The risk of working with lower-rated suppliers can lead to unexpected financial complications, necessitating thorough evaluations to ensure stability and reliability. Companies should regularly review their contracts and terms with suppliers to adapt to changing financial circumstances, ensuring that they maintain advantageous payment arrangements. Furthermore, it’s worth noting that cash flow forecasting is an invaluable tool in SCF, as it allows businesses to predict their financial flow and challenges efficiently. This practice aids in preparing for unforeseen expenses or market fluctuations. Finally, establishing strong relationships with financial institutions is fundamental in securing the needed liquidity and flexibility during times of financial uncertainties. Small businesses that actively participate in continuous education surrounding these functions will be newly empowered and prepared to manage their supply chain finances effectively.

The Importance of Supplier Relationships

Building and maintaining good supplier relationships is a cornerstone of effective supply chain finance. When suppliers feel valued, they are more likely to be flexible with payment terms and may offer discounts for early payments. Therefore, fostering strong partnerships with suppliers is crucial for any small business looking to thrive in a competitive landscape. Negotiating favorable prices and terms can generate significant cost savings and enhance a company’s overall financial health. Furthermore, aligning goals and communication with suppliers ensures a smooth supply of goods and reduces risks associated with delays or miscommunication. Regularly communicating with suppliers about their capabilities, constraints, and financial health is advisable; this method enhances trust and reliability. In turn, reliable suppliers contribute to smoother operations and better cash management. Networking with suppliers at industry events or workshops can further solidify these relationships, creating a community where all parties benefit. Engaging in open discussions and fostering collaborative solutions adds to the overall resiliency of the supply chain. Small businesses that prioritize these relationships are better positioned to adapt to market changes while maintaining robust supply chains that support financial success.

In conclusion, the importance of being acquainted with essential supply chain finance terminology cannot be overestimated for small businesses. As they embark on their operational journey, having a firm grasp of terms such as working capital, financing costs, and supplier relationships will enable better financial management. Moreover, understanding the risks involved and practicing continuous risk management can safeguard companies from unanticipated liabilities and disruptions. Additionally, leveraging innovative technologies like artificial intelligence and blockchain within finance and supply chain operations will propel these businesses towards greater efficiency. Collaborative efforts with suppliers, as well as transparent communication, create a foundation that encourages smooth transactions and potentially improves capital availability. SCF strategies must evolve and enable small businesses to make data-driven decisions while keeping a keen eye on liquidity. Ultimately, the education and application of these concepts within supply chain finance will play a pivotal role in a small business’s overall success. Staying informed and adaptable will ensure that they are inclined to seize opportunities as they arise in an ever-changing economic climate. Therefore, businesses should continually assess their SCF strategies for ongoing improvement.