Behavioral Tools for Improving Decisions Under Uncertainty

Decision-making under uncertainty represents a critical area in behavioral finance. It emphasizes how individuals confront ambiguous situations and the strategies they employ to navigate these complexities. Numerous cognitive biases impact these decisions, potentially leading to suboptimal outcomes. Understanding these biases requires a multi-faceted approach, integrating psychological insights with financial reasoning. For instance, overconfidence can lead investors to underestimate risks. Alternatively, loss aversion makes them overly cautious, missing out on valuable opportunities. By recognizing the inherent biases, individuals can leverage behavioral tools to enhance decision-making processes. Tools like checklists, systematic evaluations, and mental simulations can aid in addressing uncertainties effectively. One such strategy includes scenario analysis, helping individuals consider various potential outcomes based on different variables. By expanding the decision framework, people’s choices can transition from reactive to proactive, fostering a more robust financial strategy. However, the success of these tools hinges on the individual’s willingness to confront their biases consciously. Thus, increasing self-awareness plays a pivotal role in overcoming irrational behaviors, which ultimately leads to better outcomes in uncertain situations. The marriage of behavioral insights with practical application remains essential for all investors.

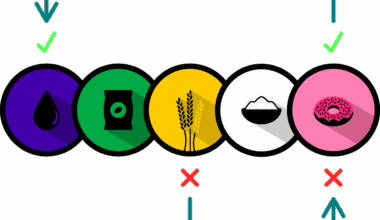

Recognizing and understanding cognitive biases are essential steps in improving decision-making under uncertainty. Biases such as confirmation bias, anchoring, and hindsight bias can severely distort one’s judgment. Confirmation bias leads individuals to seek information that supports their pre-existing beliefs while ignoring contradictory evidence. This can be particularly detrimental during times of uncertainty when the need for objective analysis is paramount. Anchoring can cause individuals to overly rely on initial information received, skewing subsequent evaluations of risks and opportunities. Hindsight bias can create an illusion of predictability, leading to overconfidence in one’s decision-making abilities after an outcome is known. To mitigate these biases, practitioners can adopt strategies such as seeking diverse perspectives, utilizing decision-making frameworks, and relying on quantitative data. By developing a more structured and analytical approach to decision-making, individuals can minimize the effects of cognitive distortions. Engaging in practices like peer reviews and focus groups allows individuals to challenge their viewpoints. Furthermore, incorporating objective metrics for performance evaluation can cultivate a culture of accountability and improve long-term outcomes.

Emotional Factors in Decision-Making

Emotions play an undeniable role in how individuals manage uncertainty. Decisions often arise from emotional responses rather than logical reasoning, leading to potential pitfalls. Fear of loss can paralyze action, whereas excessive optimism can spur rash decisions. This emotional aspect of decision-making is crucial, especially when investors confront fluctuating markets. Being aware of emotional triggers enables individuals to approach decisions with a more balanced mindset. Thus, it is essential to develop emotional intelligence, a skill that allows better management of emotional responses in uncertain situations. Behavioral finance research emphasizes the significance of mindfulness practices and reflective techniques to maintain emotional equilibrium. By embracing these strategies, decision-makers can enhance their ability to evaluate choices without being overwhelmed by emotional turbulence. Techniques such as meditation, journaling, and even practicing gratitude can serve to ground individuals during periods of volatility. This emotional awareness not only aids in personal decision-making but also impacts collaborative environments where group dynamics come into play. Fostering a culture of emotional understanding in team settings can lead to improved group decisions and outcomes, reducing the risks associated with emotional biases.

Another effective approach is the implementation of decision-making frameworks. These frameworks serve as structured guidelines that facilitate better choices amid uncertainty. One popular model is the OODA loop, which stands for Observe, Orient, Decide, and Act. This cyclical model encourages individuals to continuously assess their environment, adapt their strategies, and make informed choices based on real-time feedback. Practicing the OODA loop requires and reinforces an agile mindset, crucial for navigating unpredictable financial landscapes. By adopting decision-making frameworks, individuals and organizations can create consistency in their approaches. Moreover, utilizing these frameworks cultivates an environment where teams can deliberate openly, thus minimizing the influence of biases and emotional interruptions. This structured approach is particularly beneficial for businesses facing dynamic market changes. As teams engage with these frameworks, members can provide diverse input while grounding discussions in a shared methodology. Ultimately, applying decision-making models not only enhances the individual decision-making process but structures the way groups work together, embodying a more resilient strategy against uncertainty in various scenarios.

The Role of Technology in Decision-Making

With advancements in technology, decision-making under uncertainty has also evolved significantly. Tools such as artificial intelligence and big data analytics offer novel opportunities for individuals and organizations. These technologies provide real-time insights and predictive analytics, enabling more informed choices amidst complex uncertainties. By leveraging data, individuals can enhance their understanding of market trends and consumer behavior, which traditionally relied on intuition or limited experience. Machine learning algorithms can identify patterns that may not be obvious, guiding users toward potential risks and opportunities effectively. The integration of such technologies necessitates a shift in mindset; individuals must be willing to trust algorithms while retaining critical thinking skills. Data literacy becomes increasingly important, ensuring decision-makers interpret data accurately and effectively. Furthermore, technology can facilitate collaborative decision-making by connecting diverse stakeholders and aggregating opinions efficiently. By utilizing cloud-based platforms and communication tools, organizations can make collective decisions under uncertainty swiftly. This enhanced collaboration not only streamlines decision processes but also enriches the quality of outcomes through a blend of diverse perspectives and shared information.

Accountability and reflection are also crucial elements in improving decision-making under uncertainty. Having a clear accountability structure ensures that individuals take ownership of their choices, promoting better decision quality. Utilizing mechanisms such as post-decision reviews and accountability partners can foster a culture where decisions are analyzed thoroughly. Through such reviews, individuals can evaluate what worked and what didn’t, cultivating a mindset of continual learning. This practice is essential during uncertain times, as it allows individuals to refine their decision-making processes and rectify recurring errors. Reflection encourages critical thinking, empowering individuals to question their assumptions and biases. By engaging in this reflective practice, decision-makers can develop resilience and adaptability. Adaptability is particularly important in dynamic environments where uncertainties proliferate. Organizations and individuals that embrace reflection as part of their process can better respond to contingencies while optimizing future outcomes. This iterative learning process ultimately enhances decision quality and reduces the detrimental impact of emotional and cognitive biases. Furthermore, fostering accountability and reflection encourages collective growth within teams, thereby strengthening the decision-making framework.

Conclusion and Future Directions

In summary, behavioral tools play a vital role in improving decisions under uncertainty. By understanding cognitive biases, harnessing emotional intelligence, and utilizing decision-making frameworks, individuals can navigate complexities more effectively. The integration of technology further enhances this process by providing insightful data and analytics. As behavior finance continues to evolve, new tools and methodologies will emerge, offering fresh insights. Continuous learning remains paramount, ensuring that individuals adapt to new challenges and information. As markets grow increasingly unpredictable, honing decision-making skills will become essential to success. Educational initiatives focused on behavioral finance can equip individuals with tools to improve their judgment. Moreover, enhancing emotional resilience through workshops and training can foster a workforce capable of managing uncertainty with confidence. The collective embrace of accountability and reflection not only benefits individuals but also entire teams and organizations. As we look toward the future, the synergy between behavioral insights and practical applications will be paramount. By fostering a culture that prioritizes effective decision-making, we can all enhance our capacities to thrive in an uncertain world.

Behavioral finance underpins the comprehension of decision-making. In uncertain environments, biases and emotional responses significantly skew judgments. By applying various behavioral tools systematically, not only can individual decisions improve, but organizations can also cultivate smarter, more informed strategies. Focusing on emotional intelligence, embracing technology, utilizing structured frameworks, and committing to continual reflection underscores the evolving nature of this field. It is critical to establish an environment that values educated risks and learning from mistakes. As we harness the full potential of behavioral finance tools in decision-making, collectively advancing the understanding of uncertainty mitigation will pave the way for a more resilient future.