The Role of Inflation in Tax Planning and Strategies

Inflation significantly influences personal finance, particularly tax planning strategies. Understanding inflation can help individuals develop effective tax planning approaches to minimize their liabilities. Various inflation rates may affect tax brackets and assets’ growth rates, impacting how much taxpayers owe. As inflation rises, the purchasing power of money declines, leading to adjustments in tax brackets. Consequently, individuals might find themselves paying higher taxes simply due to nominal income increases, despite their real income remaining constant or even declining. One strategy to mitigate this effect is to utilize tax-advantaged accounts such as IRAs or 401(k)s, which help maintain value despite inflation. It’s essential to forecast inflation trends when planning financial goals as it helps determine the actual growth rates needed for investments. Awareness of specific strategies can enhance your overall tax planning efficiency, making certain deductions and credits more valuable during high inflation periods. Staying informed about economic indicators, such as the Consumer Price Index (CPI), can equip taxpayers to adapt to inflation impacts better. Consequently, sound financial strategies in the context of inflation can lead to long-term growth and stability for individuals and families alike.

Effective management of taxes requires consideration of inflation’s impact on various financial aspects, including capital gains. Capital gains tax liability can increase significantly in times of inflation, making it essential for investors to reevaluate their financial portfolios regularly. When inflation rises, asset values often increase, which contributes to higher realized capital gains upon asset liquidation. This rise can push investors into higher tax brackets, intensifying the financial burden. A strategic approach includes focusing on investments that outperform inflation adjustments, such as stocks or real estate that traditionally appreciate over time. Additionally, tax-loss harvesting may offset gains by realizing losses from underperforming assets, mitigating overall tax exposure. Long-term holders of stocks may also strategize by reinvesting dividends, which helps defer taxes. Another strategy is to hold onto investments longer to benefit from favorable tax rates. Considering inflation while planning capital gains can help ensure better long-term financial independence. Remembering the relationship between inflation, asset value, and tax can serve as a foundation for smart investing decisions that will protect one’s wealth even during economic fluctuations.

Inflation and Deductions

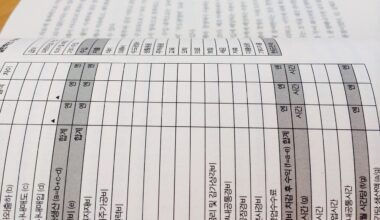

Understanding how inflation affects various tax deductions is crucial for efficient financial planning. Deductions can substantially reduce taxable income, but their effectiveness may fluctuate with inflation. For instance, standard deductions are set by law, but their value diminishes as inflation rises. Similarly, itemized deductions such as mortgage interest or charitable contributions may not rise in line with inflation, sharpening their real effect. Taxpayers could focus on maximizing deductions that counter inflation impacts. By donating appreciated assets rather than cash, taxpayers may avoid gaining taxes while still benefiting from deductions. Analyzing past tax returns can reveal opportunities to maximize deductions impacted by inflation trends. Furthermore, certain expenditures related to education or medical expenses might yield above-inflation benefits, helping to cushion their effect. Crafting a tax strategy that prioritizes these deductions can aid individuals in preserving capital during inflationary periods. Keeping meticulous records of expenses can help ensure all potential deductions are claimed appropriately. Thus, understanding how to navigate inflation’s influence over deductions can lead to better financial outcomes and more effective tax liability management for individuals seeking to optimize their tax performance.

The timing of income recognition is another critical factor in tax planning amid inflation. With increasing inflation, individuals might consider strategies to defer income or accelerate deductions to reduce tax liability in the present climate. For instance, one may choose to delay bonuses or other income sources until a time when tax brackets or rates shift favorably. Proactive timing can significantly decrease tax exposure, especially in periods where higher incomes lead to larger tax obligations. Furthermore, accelerating deductible expenditures within the current tax year can shore up benefits against rising inflation costs. Taxpayers may also capitalize on taxpayer-friendly provisions, such as retirement contributions leading to future taxation at potentially lower rates. Preparing for income fluctuations and prospects allows individuals to be strategically smart in meeting financial goals. Planning for employment changes, retirement, or entrepreneurial ventures during inflation influences tax planning practices. Ultimately, judicious timing of income recognition and deductions proves valuable for achieving long-term wealth goals and ensuring that individuals remain ahead of inflation’s challenging pressures on personal finance.

The Importance of Investments

Investments play a vital role in countering inflationary pressures within personal finance. Proper investment strategies can help individuals maintain and grow their wealth as inflation rises. Investing in commodities, real estate, and equities can serve as a hedge against inflation, preserving the value of personal finances in turbulent economic times. Investors may consider diversifying their portfolios to include inflation-protected securities such as TIPS, which offer returns adjusted to inflation rates. Recognizing the importance of asset allocation is crucial; spreading investments across various asset classes can reduce risk while capitalizing on inflation-adjusted returns. Additionally, developing a systematic approach to rebalancing can enhance long-term success during inflationary periods. Investing in quality companies that consistently raise dividends can provide a reliable income stream that outpaces inflation. Staying informed about market trends will enable better portfolio adjustments in tough economic conditions. With prudent investment practices, individuals can not only protect their financial standing during inflationary times but also set themselves up for future success. Therefore, prioritizing investment strategies in financial planning ensures stability and growth even amid inflation’s inevitable fluctuations.

Another essential component of addressing inflation’s impact on personal finance is understanding the importance of continuous financial education. The evolving landscape of tax laws and inflation requires individuals to adapt to changes proactively. Developing financial literacy can help taxpayers navigate complex situations and optimize tax strategies accordingly. Participating in workshops, reading relevant literature, and seeking professional advice are all valuable avenues for gaining knowledge of personal finance and tax implications of inflation. Additionally, utilizing online resources can empower people to stay informed about new legislation and financial products that offer benefits during inflation. Implementing sound financial practices based on current knowledge can lead to informed decision-making. Furthermore, those who invest time in learning about inflation’s economic forces will appreciate how it affects personal finance management and planning. Consider engaging with a financial advisor to develop tailored strategies for minimizing tax impacts in inflationary periods. Cultivating a solid foundation in finance will be a lifelong asset, ensuring that individuals can weather inflation challenges and seize advantageous opportunities as they arise in their financial journeys.

Conclusion: Planning for the Future

The interplay between inflation and personal finance necessitates careful tax planning and strategy formulation. Individuals must remain vigilant about the potential effects of inflation on their finances. Being proactive in tax planning, investment allocation, and understanding the role of inflation in various financial aspects can lead to better financial security. Taxpayers should focus on leveraging available strategies, such as deductions, inflation-protected securities, and sound investment choices, to mitigate inflation’s adverse effects. Building a strong foundation of financial literacy equips individuals with the knowledge necessary to approach financial decisions confidently. Monitoring inflation indicators and tax legislation can enhance one’s ability to adapt, leading to successful financial outcomes. Ultimately, comprehensive planning and acknowledgment of inflation’s impact on finances can help individuals achieve their long-term financial goals. Investing time and effort into tax strategies rooted in an understanding of inflation will pay dividends well into the future. Therefore, making informed choices today while accounting for inflation is crucial for ensuring lasting financial health and resilience.

In summary, engaging in effective personal finance management during inflationary times is essential for achieving financial well-being. Awareness of the differences inflation brings to tax implications can lead to better strategies for minimizing liabilities and maximizing deductions. By strategically planning investments and staying informed, individuals can successfully navigate the complexities of inflation impacting personal finance. Financial education and preparedness to adapt to changes will prove valuable for long-term success in achieving desired financial outcomes. As inflation continues to be a significant factor in the financial landscape, individuals are encouraged to embrace proactive management strategies that prioritize their economic health while maintaining a robust portfolio. Staying engaged, continuously learning, and strategically planning will empower individuals to make decisions that safeguard their financial future, even amidst volatility. In conclusion, understanding the implications of inflation on taxes is vital for formulating informed strategies that align with personal finance goals. This protects against inflation’s potential erosion of wealth and positions individuals for regulatory changes in tax laws. A balanced approach that considers both immediate and long-term financial objectives will enable thriving personal finance management. Consequently, making thoughtful choices in the face of inflation will yield successful financial outcomes over time.