The Relationship Between Interest Rates and Business Cash Flow Management

Understanding the impact of interest rates on business cash flow management is crucial for managers. Interest rates influence borrowing costs and investment decisions, which directly affect cash flow. When interest rates rise, the cost of loans increases as well. Businesses often seek external financing to support their growth objectives or mitigate cash shortfalls. If interest rates are elevated, the additional cost of servicing loans can strain budgets, ultimately impacting cash reserves. Additionally, businesses have to react to the external economic environment and adjust their cash flow forecasts accordingly. When borrowing is expensive, companies may opt to delay investments or project initiation, leading to a potential slowdown in growth. This cautious approach can affect operational efficiency, as opportunities to innovate or expand may be sacrificed. Conversely, lower interest rates can facilitate easier access to credit, spurring investment. It decreases financial burdens, allowing businesses to allocate funds toward growth strategies. Companies equipped with a solid understanding of interest rates can adapt their cash management strategies swiftly, ensuring sufficient liquidity throughout economic fluctuations. Overall, efficient cash flow management intertwined with interest rate awareness ultimately fosters stability.

Effects of Rising Interest Rates

The rise in interest rates can have a profound and multifaceted impact on businesses. Increased borrowing costs often lead to tighter cash flow situations, as companies are forced to allocate larger portions of their budgets to service debt. Small businesses may feel this pressure acutely, as they typically lack the financial buffers larger corporations possess. This tightening can lead to a reassessment of expansion plans or operational spending. Moreover, firms may curtail hiring plans and reinvestment strategies in anticipation of prolonged periods of high rates. The effect can ripple through the economy, causing a slowdown as consumer spending decreases due to higher borrowing costs. Additionally, businesses often reconsider their pricing strategies in light of inflationary pressures that accompany rising rates. If consumers are feeling the financial strain, firms may need to absorb increased costs rather than passing them on. This decision could hinder profitability and limit growth prospects. Therefore, effective cash flow management becomes imperative in such environments, as firms must navigate these challenges strategically. Analytics support firms in evaluating their financial positioning and making informed decisions during these turbulent economic times.

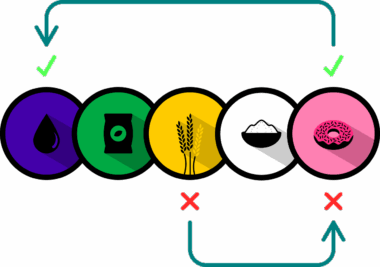

Understanding the relationship between interest rates and cash flow also involves exploring the benefits of low interest rates. When interest rates are low, businesses experience decreased borrowing costs that can greatly enhance their cash flow. This situation allows companies to invest in essential areas such as technology upgrades or employee training. Additionally, lower rates facilitate greater flexibility in cash management strategies, enabling firms to access credit lines without burdening their financials. As a result, firms can bolster their capabilities and positioning, fostering growth and scalability. However, it’s essential for business leaders to remain vigilant and proactive. They must assess how changes in interest rates influence their operational costs and long-term viability. Furthermore, understanding market signals can provide clarity on when to act. Companies that effectively navigate these macroeconomic factors benefit, as they capture opportunities that arise during favorable conditions. Staying ahead allows businesses to maintain positive cash flow even amid unpredictable conditions. Ultimately, recognizing the duality of both high and low interest rates is paramount for strategic planning. Businesses that manage their cash flow dynamics effectively will have a competitive advantage.

Cash Flow Forecasting Techniques

Accurate cash flow forecasting is essential for businesses to manage interest-related impacts effectively. Reliable forecasting involves analyzing past financial performance and incorporating market and economic indicators. Businesses should continuously track their cash inflow and outflow to adjust strategies promptly. Using prognostic tools, such as detailed cash flow statements, enables firms to identify patterns and predict future performance. Additionally, scenario planning can help businesses prepare for varying interest rates and their consequent effects on cash flow. By incorporating different interest rate projections into their forecasts, businesses can devise contingency strategies to avoid financial strain. Regular updates to forecasts are crucial as they allow companies to maintain flexibility in financial planning. Moreover, stakeholder engagement is vital; communicating with investors and lenders about potential changes in cash flow facilitates easier negotiations and fosters trust. Lastly, using budgeting tools can encourage disciplined spending habits and improve cash management routines. Business leaders should consistently engage with financial advisors to align their strategies with dynamic market conditions. Proper cash flow forecasting and management not only safeguard businesses against volatility but also empower them to take calculated risks when opportunities arise.

The influence of interest rates extends beyond money management; it significantly affects investor confidence as well. When interest rates are low, borrowing becomes cheaper; this incentivizes businesses to undertake expansion projects. Investors often respond positively to rates, as they signify a favorable environment for corporate earnings growth. Increased investments can, in return, elevate market confidence and lead to stock price appreciation. The interconnectedness of interest rates and cash flow management means that businesses must understand investor sentiment as they navigate financial strategies. We’re witnessing a shift where consumer preferences impact the interest rate landscape. Companies focusing on sustainability can attract investments. Therefore, aligning financial strategies with investor priorities can create significant advantages. As businesses adapt to changing interest rates, assessing the impact on investor relationships is paramount. They should leverage transparent communication about their cash flow management tactics; fostering partnership growth between investors and firms becomes essential. Furthermore, focusing on financial resilience allows businesses to withstand economic fluctuations while maintaining investor trust. Cash flow strategies aligned with investor expectations can enhance long-term sustainability and viability.

Long-Term Strategy Adaptation

The relationship between interest rates and business cash flow management necessitates long-term strategy adaptation. Firms need to be proactive rather than reactive to financial fluctuations influenced by interest rates. Crafting robust financial plans ensures that companies have sufficient liquidity to withstand unexpected changes. Managers should develop risk assessment frameworks, outlining potential scenarios influenced by interest rates. A comprehensive plan addresses both the favorable and unfavorable impacts of shifting rates on cash flow. This approach cultivates an Agile mindset—allowing businesses to pivot quickly. Enhancing savings and optimizing operational efficiency are critical components. Startups, in particular, must prioritize financial prudence to protect themselves from volatile economic phases. Doing so ensures adequate cash reserves are available when rates rise unexpectedly. Moreover, incorporating technology can enhance forecasting accuracy, which can facilitate data-driven decisions. Businesses should invest in financial analytics, helping them track key performance indicators aligned with changing market conditions. Continuous improvement in cash flow management practices can provide a competitive edge, helping businesses remain viable during fluctuations while positioning them for growth post-economic stabilization.

In conclusion, the intricate relationship between interest rates and business cash flow management underscores the importance of strategic foresight and adaptability. Fluctuations in interest rates can produce significant effects on costs, purchasing behavior, and ultimately, business success. Companies must keep a close eye on economic indicators, as these can provide valuable insights into market trends. Understanding how to respond to shifts is key for survival in competitive settings. Engaging with financial professionals can support building sound cash flow strategies that accommodate potential fluctuations in interest rates over time. Continuous education, data analysis, and risk management can foster financial resilience, contributing to sustainable operations. Business leaders must prioritize agility, ensuring that cash flow management evolves alongside external changes. Being well-prepared can lead to maintaining stability amidst economic uncertainties while also embracing growth prospects. As today’s financial landscape continues to adapt, companies that harness effective cash flow management techniques in alignment with interest rates will thrive. Strategic decision-making, targeted investments, and robust planning will drive future success.