How to Protect Yourself from Income Tax Scams

Income tax scams can take various forms, preying on innocent taxpayers. Recent years have seen a rise in these fraudulent schemes, which often lead to financial loss and stress. It’s crucial to remain vigilant and educated about these scams. One common tactic involves people impersonating tax officials or IRS agents. They might call or send emails demanding payment of fictitious debts. Another method could include phishing attacks, where scammers use deceptive links to steal personal information. Understanding potential warning signs is essential to protecting your financial privacy. Legitimate tax authorities rarely request sensitive information via email or threaten immediate actions. Always verify any unsolicited communication by contacting the agency directly using verified contact details. Additionally, safeguarding your personal information should be a priority. Use strong, unique passwords for online tax accounts and enable two-factor authentication whenever possible. Regularly monitor your financial accounts for suspicious activities. Educating yourself and discussing these risks with family members can further reduce the likelihood of falling victim. Remember, staying informed is your best defense against income tax scams.

Recognizing Common Tax Scams

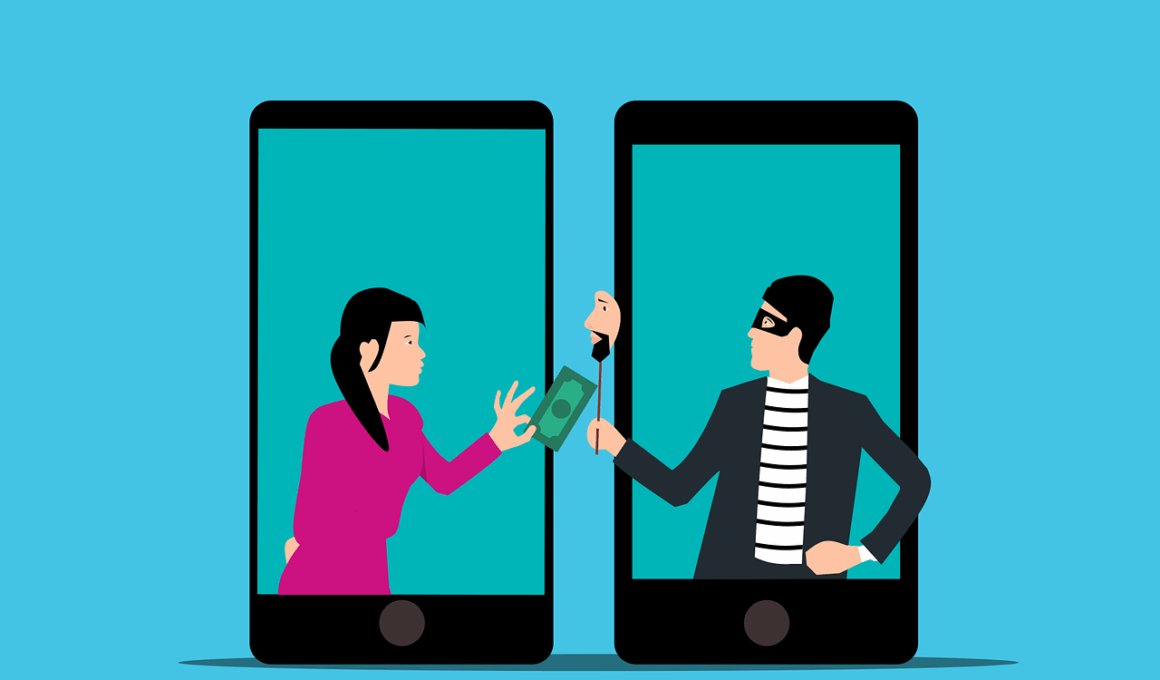

Recognizing the different types of income tax scams is vital in effectively protecting yourself. There are two major scam categories: impersonation schemes and phishing attacks. Impersonation scams involve callers claiming to be IRS officials, demanding quick payment of a supposed tax debt. They use high-pressure tactics to create urgency. You might receive threatening messages about legal actions if you fail to comply. Legitimate government entities do not operate this way; they typically send formal notices through the mail. Phishing scams, on the other hand, are designed to steal personal information. These emails or messages often look authentic, leading recipients to fake websites that appear genuine. Once on these sites, they can be coaxed into entering personal data. To combat these scams, always scrutinize any communication requesting personal details. Anyone who receives suspicious emails should refrain from clicking on links and seek confirmation through official channels. Furthermore, spreading awareness about these scams within your community can make a significant difference. Share information on protecting oneself and recognizing the signs that something isn’t right. Vigilance is key in keeping your finances secure.

Be cautious when sharing your personal information online, especially on social media platforms. Scammers often gather data from social media profiles to tailor their scams. By piecing together information from public profiles, they can create a believable facade, increasing their chances of scamming victims. Thus, it’s crucial to limit the amount of personal information shared on these platforms. Always adjust privacy settings to restrict who can view your details. If you get an unsolicited communication requesting personal info, refrain from responding until you verify its authenticity. A good practice is to directly contact the organization through official channels. Also, consider using identity theft protection services, which can monitor your financial accounts and alert you to any suspicious activities. Many people assume that identity theft won’t happen to them, but the reality is that anyone can be at risk. Take precautions today, like shredding documents that contain sensitive information before disposal, to prevent data theft. Additionally, encourage friends and family to be equally vigilant to foster a more secure community. An environment where everyone is informed protects you and those around you equally.

How to Report Income Tax Scams

Taking swift action if you encounter a tax scam can help protect others as well. Reporting such incidents not only aids in tracking down fraudsters; it also assists authorities in curbing these illegal activities. The IRS has a dedicated portal for reporting scams, making it straightforward for citizens to submit fraudulent communication details. You can file a report online, providing as much information as possible. This includes the scammer’s name, the method of communication, and any other relevant details. Additionally, you can report identity theft by filling out Form 14039, the Identity Theft Affidavit. Sharing your experience with family and friends bolsters awareness in your community. In many cases, consumers feel isolated when they fall victim. However, by discussing these experiences, they will empower others to recognize similar attempts. Networking with local community groups can also be an effective strategy—these groups can provide resources and support to educate members on recognizing scams. Awareness campaigns at local events can further contribute to spreading information. Collective action increases resilience against income tax fraud, aiding in reducing the overall prevalence of scams.

Utilizing tax filing software can minimize your risk of encountering scams. Many reputable platforms come with advanced security measures to protect your data. These programs simplify the filing process through built-in validation checks that can help catch errors before submission. They often include alerts on potential scams relevant to taxpayers. Furthermore, utilizing a certified tax professional is another way to safeguard against scams. Professionals are often up-to-date on the latest scams and can spot red flags that the average taxpayer might miss. They provide additional insights into tax regulations and help ensure compliance, which ultimately reduces risk. When selecting a tax expert, verify their credentials, read reviews, and choose someone with a solid reputation. Also, aim to have all tax-related correspondence documented and safely stored. This documentation not only serves as proof in case of a discrepancy but may also aid in identifying patterns in fraudulent attempts. Building a network of reliable resources, including knowledgeable professionals and secure software, is essential. These efforts can significantly bolster your defense against the threat of income tax scams, ultimately contributing to your financial security.

Staying Informed About Tax Changes

The tax landscape is constantly evolving, which can open new avenues for scams. Keeping yourself updated with changes in tax laws and regulations can inoculate you against related fraud. Numerous resources are available to help taxpayers stay informed; check the IRS website frequently for updates. Many communities also hold tax preparation workshops or seminars led by professionals who share vital information. Engaging in these opportunities cultivates knowledge that can be invaluable in spotting potential scams. Additionally, subscribing to newsletters from financial institutions or tax agencies can provide timely updates directly to your inbox. Awareness of tax deadlines, regulations, and potential scams ensures you remain proactive instead of reactive. Following trusted financial blogs or forums can also help you keep abreast of the latest discussions and scams in real-time. Actively participating in discussions on these platforms allows you to seek advice and share experiences with fellow taxpayers. Knowledge not only strengthens your defenses but fosters a sense of community empowerment, offering resources to stay vigilant against threats as they arise.

Lastly, maintaining an organized document management system can prove beneficial in protecting yourself against income tax scams. It allows for quick and easy access to your financial records. By keeping track of your income, expenses, and tax filings, you reduce the chance of becoming a victim. Consider categorizing documents into secure folders, either digitally or physically, ensuring sensitive information remains safe. In case of any suspicious activities, having organized records can expedite the resolution process. Set a regular schedule for reviewing your financial documents, minimizing clutter while maintaining essential records. It’s also important to store your documents securely, utilizing encryption for digital files and locked cabinets for physical copies. Furthermore, regularly back up your files to protect against losses due to theft or damage. Logging any correspondence you receive from the tax department will further assist in identifying potential fraudulent narratives. When spending time regularly managing your documents prioritizes security, it gives you peace of mind in knowing that you are actively working to protect yourself. This diligent approach contributes significantly to strengthening your defenses against income tax scams.

Ultimately, protecting yourself from income tax scams requires a proactive approach. By staying informed, recognizing potential scams, and maintaining robust financial practices, you create an environment less susceptible to fraud. Educate yourself continually about the tactics employed by scammers, as they often evolve, adapting their methods to exploit new vulnerabilities. Build a network of trusted resources to assist you. Whether using reputable filing software, working alongside tax professionals, or actively engaging with the community, every action counts. Remember that scammers often rely on urgency and fear to manipulate their victims. Taking the time to verify information can save you from unnecessary grief. Furthermore, empower those around you to be vigilant and proactive. Debunk myths about tax payments and legitimate practices through community discussions, ensuring that misinformation doesn’t spread. Group efforts in sharing knowledge not only keep individuals safe but fortify the community as a whole. Lastly, remain resilient. Even if one encounters a scam, it should not deter your willingness to engage with tax matters responsibly. Instead, treat any experience as a learning opportunity that strengthens your future defenses against income tax scams.