Top Trends in Digital Identity Management for the Finance Sector

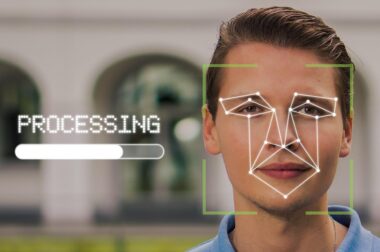

In today’s rapidly evolving financial landscape, digital identity management plays a pivotal role in safeguarding sensitive information and maintaining trust. Financial institutions now face unprecedented challenges, including increasing cyber threats and regulatory compliance, requiring them to adopt more sophisticated digital identity solutions. The convergence of technology and finance has ushered in a new era where managing digital identities effectively not only protects consumer data but also enhances user experience. The importance of robust authentication mechanisms cannot be overstated, as they serve as the first line of defense against identity theft and fraud. Embracing multi-factor authentication (MFA) is becoming a standard practice among financial organizations. This approach requires users to provide multiple verification forms, significantly reducing the risk of unauthorized access. Implementing biometric technology, such as fingerprints and facial recognition, is also gaining traction, providing an additional layer of security. Institutions that proactively adapt to these innovations will not only mitigate risks but also foster greater customer confidence in their digital services. By prioritizing digital identity management, finance companies can remain competitive while ensuring the safety of their stakeholders.’

The advent of artificial intelligence (AI) and machine learning (ML) is transforming digital identity management within the finance sector. AI algorithms can analyze vast amounts of data to identify patterns and anomalies, enabling real-time risk assessment and fraud detection. This capability is instrumental in enhancing security measures by recognizing suspicious activities that traditional systems may overlook. Additionally, machine learning models continuously adapt and improve, which means they can better anticipate and prevent potential cyber threats. Financial institutions leverage AI-driven identity management solutions to streamline their processes, enabling faster onboarding of customers while maintaining stringent security standards. The integration of biometric data also benefits from AI, as these technologies become more adept at distinguishing between legitimate user behaviors and potential fraudulent actions. Consequently, utilizing AI in digital identity systems not only strengthens security but also boosts operational efficiency. As finance companies increasingly depend on data-driven strategies, adopting AI and ML for identity management becomes essential to stay ahead. This trend marks a significant shift towards a future where financial transactions become safer, quicker, and more user-friendly, paving the way for new financial services and innovations.

Regulatory Compliance and Digital Identity Management

With regulatory changes and increased scrutiny, the finance sector must ensure compliance with various data protection and privacy laws. Regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) mandate strict guidelines on how organizations manage and protect consumer data. Digital identity management must, therefore, integrate these legal requirements into their frameworks to avoid penalties and protect customer trust. Financial institutions are adopting identity governance frameworks to effectively manage compliance risk by assuring proper access controls, data classification, and audit trails. Implementing these frameworks allows organizations to demonstrate that they adhere to legal obligations while effectively managing user identities. Additionally, continuous training and awareness programs for employees enhance understanding and adherence to compliance requirements. As regulatory landscapes evolve, financial companies must invest in technology solutions that are nimble enough to adapt to these changes. Focusing on privacy-by-design principles can further streamline compliance efforts, resulting in sustainable practices. Ensuring robust digital identity management aligned with regulatory expectations is critical not only for compliance but also for fostering a strong reputation within the financial sector.

Cloud-based digital identity management solutions are becoming increasingly popular among financial institutions seeking scalability and flexibility. These solutions allow organizations to manage user identities across multiple platforms without compromising security. Cloud services offer cost-effective options, enabling finance companies to streamline their operations while enhancing their security posture. Moreover, with the growing trend of remote work, employees require secure access to sensitive financial data from various locations. Cloud-based identity management systems address this need while ensuring that sensitive data remains protected. Features such as single sign-on (SSO) facilitate seamless access without having to remember multiple passwords, enhancing user experience and security. As businesses expand, cloud solutions allow for easy integration of emerging technologies, fostering innovation. However, organizations must choose cloud providers that prioritize data security and comply with regulations. Along with emerging trends in identity federation and decentralized identity, financial institutions can leverage cloud solutions to create a more resilient infrastructure. Investing in cloud-based digital identity management will ultimately position finance organizations for future growth and success. It provides a foundation that supports ongoing technological advancements in the financial sector.

The Role of User Education in Digital Identity Management

Incorporating user education into digital identity management strategies is fundamental to reducing risks associated with identity theft and fraud. Users often play a critical role in maintaining the security of their own identities. Financial organizations should invest in comprehensive training programs that educate customers on best practices for digital security, covering topics such as password management and recognizing phishing attempts. Moreover, educating employees on the importance of protecting customer identities enhances security within the organization. A well-informed user is less likely to fall victim to cyber threats, which ultimately improves overall security for the financial institution. Interactive workshops and regular communications can reinforce this knowledge, fostering a security-conscious culture. Additionally, financial institutions can use personalized reminders and alerts to inform users about security threats and updates. Creating an engaging learning environment encourages users to take an active role in safeguarding their identities. By prioritizing user education, financial organizations not only enhance their security measures but also build trust and loyalty among their customer base. A partnership between organizations and users is essential for successful digital identity management.

As cybersecurity threats continue to evolve, financial institutions are increasingly adopting a zero-trust approach toward digital identity management. This model operates on the principle of ‘never trust, always verify,’ ensuring that every request for access is authenticated and authorized, regardless of the location. By minimizing implicit trust, organizations can significantly reduce the potential attack surface. Implementing a zero-trust architecture involves continuous monitoring and validation of user identities, which bolsters the security of financial transactions. Integrating various technologies, such as identity analytics and behavioral biometrics, enhances this approach, providing insights into potentially unauthorized activities. Additionally, organizations may leverage blockchain technology to establish decentralized identities, further ensuring that user data remains secure and inaccessible to any single entity. Embracing a zero-trust framework allows financial institutions to respond proactively to threats and reinforces customer confidence. Moreover, a zero-trust approach aligns with compliance requirements by ensuring that only verified users can access sensitive information. As financial institutions embrace this innovative security paradigm, they will be better equipped to navigate the continuously shifting cybersecurity landscape.

Future of Digital Identity Management in the Finance Sector

The future of digital identity management in finance is poised for transformation, driven by emerging technologies and shifting consumer expectations. The rise of decentralized finance (DeFi) necessitates innovative identity solutions that ensure user privacy while facilitating seamless transactions. This trend reflects a broader move towards user-centric identity frameworks, allowing individuals greater control over their digital identities. As consumers become more aware of data privacy, financial institutions must adapt by implementing transparent identity management practices. Tokenization is another trend gaining traction, as it allows users to access financial services without exposing sensitive personal information. This technology not only enhances user safety but can also streamline the verification process, making onboarding more efficient. Additionally, advancements in privacy-preserving technologies like zero-knowledge proofs have the potential to redefine identity verification standards within finance. These developments underscore the need for financial institutions to remain agile and responsive to the evolving landscape. By focusing on innovation and consumer-centric approaches, the finance sector will be well-positioned to meet future demands while ensuring secure and trustworthy digital identity management.