The Importance of Invoice Discounting Metrics in Supply Chain Finance

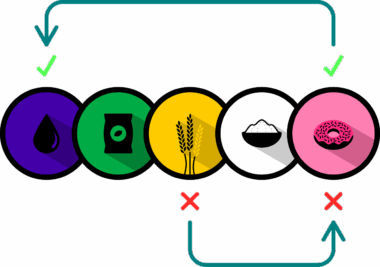

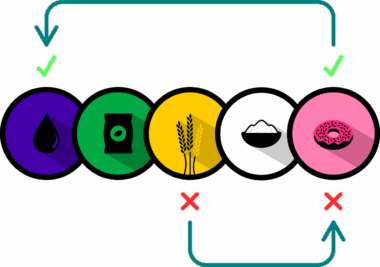

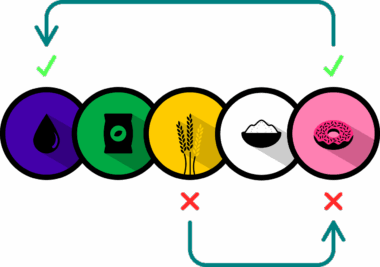

Invoice discounting is a critical component of supply chain finance that optimizes liquidity by enabling businesses to access cash tied up in unpaid invoices. Understanding the related metrics and KPIs allows organizations to manage their cash flow more effectively. By tracking metrics such as the average days sales outstanding (DSO), companies can get insights into their collection processes. Monitoring DSO ensures businesses maintain healthy cash flow levels, necessary for operational efficiency. Another important metric is the invoice discounting ratio, which indicates the proportion of sales being financed through this method. A higher ratio signifies reliance on invoice financing, reflecting on the company’s ability to convert receivables into cash. Furthermore, measuring the cost of discounting is essential, allowing businesses to calculate the financial impact of using this service. It’s crucial for organizations to maintain a balance between using invoice discounting and the associated costs. With detailed financial analysis, companies can ensure they are maximizing their working capital while minimizing unnecessary expenses. Monitoring these metrics not only drives better decision-making but also supports strategic supply chain financing initiatives enhancing overall financial health.

Identifying key performance indicators (KPIs) relevant to invoice discounting is essential for boosting financial performance. Key metrics like the funding cost comparison can often highlight how much it costs to use invoice discounting versus traditional financing options. Organizations must review these figures to determine the most cost-effective path for financing needs. Additionally, evaluating the customer default rate is crucial; it quantifies the risk associated with invoice discounting. A high default rate would suggest a need for change in customer relationships or credit policies. Another critical KPI is the time to funding, which assesses how quickly a business can receive cash once an invoice is submitted. Reducing this time can lead to immediate improvements in cash flow. Also, examining the average invoice value can help entities gauge the scale of financing required. By segmenting metrics, companies can better tailor their financing strategies and focus on high-value customers. Effective tracking and management of these KPIs will empower organizations to react promptly to market changes and maintain operational flexibility. Subsequently, these enhancements will contribute toward fostering a financially robust supply chain and improved business resilience.

Strategic Use of Metrics for Financial Health

Fostering a culture that emphasizes the relevance of invoice discounting metrics is fundamental for organizations focused on financial health. Aligning these metrics with operational goals enables businesses to monitor progress toward achieving financial stability and improved liquidity. By educating all stakeholders about these metrics, companies can establish a unified approach toward managing receivables and overall financial strategy. Furthermore, regular reporting on these metrics promotes transparency, allowing departments to make informed decisions quickly. Involving cross-functional teams in setting up KPI benchmarks and performance objectives will enhance accountability and ensure diverse perspectives are taken into account. This collaborative approach will motivate teams to strive for continual improvement, as they clearly understand the impact their roles have on financial outcomes. Investment in technology for automating these metrics can ease the burden of manual calculations, providing real-time data analysis to facilitate better decision-making. Adopting advanced analytics allows organizations to predict future trends based on historical data, ultimately influencing strategic direction. Hence, fostering a metrics-driven culture supported by technology will lead to elevated financial performance and sustained growth for organizations within the framework of supply chain finance.

In addition to evaluating internal KPIs, it is vital for companies to assess external market conditions periodically. Understanding competitors’ strategies can provide valuable insights and inform organizational approaches. Metrics derived from industry benchmarks allow businesses to position themselves effectively within the marketplace while enhancing their invoice discounting strategies. Engaging in market analysis can assist organizations in spotting industry trends, emerging risks, and potential opportunities. The insights garnered from these analyses provide companies with an enhanced perception of their invoice discounting performance compared to competitors. Furthermore, it is essential to analyze the impact of macroeconomic factors on invoice discounting metrics. Economic fluctuations can influence customers’ payment behaviors, making it vital to adapt financial strategies accordingly. For example, during economic downturns, organizations may experience slower invoice payments prompting a revision of funding strategies. Having a comprehensive understanding of both internal and external environments will better equip companies to navigate challenges. This structured approach to performance analysis encourages sustained growth while minimizing risks, ensuring optimal use of invoice discounting within supply chain finance frameworks.

Future Considerations for Invoice Discounting Metrics

As the financial landscape continues to evolve, organizations must remain adaptable to changing dynamics surrounding invoice discounting metrics. Future trends such as the emergence of technology-driven financing solutions will likely reshape traditional supply chain finance practices. Companies should keep an eye on innovations in fintech, which can enhance liquidity management and impact the metrics they track. Automated invoicing processes are gaining traction, enabling quicker turnaround times for invoice processing while capturing valuable data. Additionally, the incorporation of artificial intelligence (AI) could revolutionize how businesses evaluate risks associated with customers in terms of invoice discounting. Using AI-driven analytics allows for more effective credit assessments and dynamic risk modeling. This agile approach can inform financing decisions, creating opportunities for operational efficiency. Continuous learning through workshops or seminars focused on invoice discounting will keep teams informed about advancements in the field. Organizations must foster an ecosystem that encourages adaptation, ensuring metrics evolve as business and economic landscapes change. Hence, incorporating agility into financial management practices will serve as a vital strategy in achieving long-term success through effective invoice discounting in supply chain finance.

Implementing a robust framework for monitoring invoice discounting metrics is vital for sound decision-making processes in finance. Establishing a standardized reporting procedure will help to streamline performance evaluations, enabling quicker adjustments when necessary. This framework should include routine assessment intervals and clearly defined roles for team members. Moreover, it is essential for companies to leverage visualization tools for better interpretation of metric data. Presenting information in an easily digestible format facilitates enhanced communication among stakeholders while driving insights into performance trends. Utilizing dashboards can further support efficient tracking of invoice discounting metrics, promoting transparency across the organization. Stakeholders can benefit from real-time reporting, allowing them to challenge assumptions and make informed decisions quickly. It’s also prudent to include contingency plans within this framework to address potential disruptions in funding. Recognizing that invoice payments can vary depending on external factors surpasses financial management adaptability. Addressing these uncertainties proactively will enable organizations to maintain operational stability despite market fluctuations. In conclusion, a well-structured monitoring framework and effective communication about invoice discounting metrics are essential for articulating financial performance and driving growth in supply chains.

The Role of Continuous Improvement

Continuous improvement in processes related to invoice discounting can enhance an organization’s operational efficiency. A commitment to regularly assessing performance metrics fosters an environment of accountability and transparency. By implementing a structured approach to process review, organizations can identify inefficiencies that may exist within invoice processing, collection or financing strategies. Encouraging feedback from employees involved in these processes can uncover practical insights from frontline interactions with customers, enhancing decision-making perspectives. This insight-driven approach can empower teams to innovate solutions that not only address current challenges but also future-proof the organization against potential issues. Moreover, fostering a culture that celebrates metric improvement will reinforce the significance of these KPIs within the organization. Recognition of achievements can motivate teams to sustain high performance levels. Providing resources for training and development on invoice discounting will further prepare teams to adapt to changes in the market. Over time, these continuous improvement practices integrate seamlessly into an organization’s operational strategy, leading to more efficient cash flow management. Consequently, establishing a culture that prioritizes incremental improvement ensures that organizations remain competitive and resilient in a dynamic supply chain finance landscape.

In conclusion, understanding the importance of invoice discounting metrics is paramount for optimizing financial health within supply chain finance. By carefully monitoring key performance indicators, organizations can make informed decisions that significantly impact their liquidity and overall operational efficiency. These metrics provide insights necessary to refine strategies, ultimately steering companies toward enhanced competitiveness in the market. As trends in fintech and economic conditions evolve, organizations must remain vigilant, adapting their approaches to further cultivate financial resilience. Establishing a framework for continuous improvement will pave the way for sustainable practices while empowering teams to excel in their financial strategies. Organizations should prioritize education on these metrics across departments, fostering a collaborative environment that emphasizes collective responsibility for financial performance. Additionally, addressing risks associated with external market influences ensures businesses can navigate uncertainties adeptly. By incorporating a proactive approach, companies can leverage invoice discounting effectively as part of their financing structure. Ultimately, embracing metrics related to invoice discounting as a core strategy will enable organizations to achieve enduring success in the competitive landscape of supply chain finance. With these practices in place, businesses will be empowered to thrive financially and operationally.