The History and Evolution of Double-Entry Bookkeeping

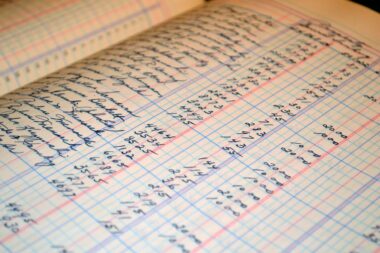

Double-entry bookkeeping is a crucial accounting system that has evolved significantly over centuries. Traditionally accredited to Luca Pacioli, the system offers a framework for accurately recording financial transactions. Pacioli’s work in the late 15th century emphasized recording both debits and credits, providing a clearer financial picture. This revolutionized accounting by ensuring that every financial entry has a corresponding opposite entry. Pacioli’s foundational principles centered around systematic record-keeping, promoting accountability and reducing fraud. Over time, this method gained acceptance and became the standard accounting practice across Europe. The method’s roots in merchant record-keeping fostered better business management. Consequently, double-entry bookkeeping played a pivotal role in expanding trade during the Renaissance. The advantages of double-entry lie in its inherent checks and balances, aiding in error detection and financial clarity. As commerce evolved, so did the accounting practices, leading to standardized methodologies still utilized today, catering to businesses worldwide. In the modern era, with advancements in technology, bookkeeping has transitioned to digital means, simplifying processes. Despite changes, the core principles of double-entry remain relevant, demonstrating its lasting impact on the field of accounting.

Before the adoption of double-entry bookkeeping, single-entry systems dominated financial record-keeping. These systems provided minimal accountability and often led to confusion and inaccuracies. Merchants realized a need for a more reliable method as business transactions grew complex. The introduction of double-entry bookkeeping fundamentally altered the landscape of financial reporting. Early proponents of this method recognized the importance of ensuring that all transactions were thoroughly documented. This system provided a clearer view of financial positions, allowing businesses to make more informed decisions. As the need for transparency increased, so did the necessity for robust accounting systems. The spread of the double-entry method throughout Europe coincided with the rise of trade and commerce, facilitating economic growth. It became a backbone for financial institutions and helped safeguard against fraudulent practices. The simplicity of recording each transaction in a balanced manner significantly enhanced fiscal responsibility, instilling confidence in businesses and stakeholders alike. Additionally, the systematic nature of double-entry helped in the evolution of financial statements, which are indispensable today. Moreover, the traditions established by these early practices continue to inform modern accounting practices, ensuring accuracy and integrity within financial records.

The Essential Principles of Double-Entry Bookkeeping

At the heart of double-entry bookkeeping lies its fundamental principles that ensure accurate and reliable financial reporting. Primarily, each transaction impacts at least two accounts, illustrating the equation: Assets = Liabilities + Equity. This essential accounting equation credits and debits transactions, maintaining the balance in financial statements. Every business transaction must be recorded in at least two accounts: one account is debited while another is credited. For example, if a company purchases equipment, the equipment account increases (debit) while the cash account decreases (credit), keeping the balance intact. This methodology provides a comprehensive view of a company’s financial status, ensuring every aspect of a transaction is accounted for. Furthermore, double-entry bookkeeping fosters transparency and accountability, enhancing trust among stakeholders. Improved error detection is another significant advantage; discrepancies in accounts can be identified and addressed promptly. The systematic nature streamlines the reconciliation process, promoting efficient financial management. As businesses evolve, these core principles remain relevant, supporting decision-making and strategic planning. The integral role of double-entry bookkeeping has made it indispensable in today’s ever-changing economic landscape, underpinning sound financial practices.

The rise of technology has significantly transformed how double-entry bookkeeping is implemented within businesses globally. The traditional methods of ledger books have largely been replaced by sophisticated accounting software. These digital tools streamline data entry, reduce human errors, and enhance efficiency, enabling businesses to adapt quickly to market changes. Additionally, cloud-based platforms allow for real-time data access, facilitating collaboration among team members from various locations. Furthermore, automated reporting features simplify financial analysis, helping organizations identify trends and make informed decisions swiftly. As businesses become more globalized, managing finances across different currencies and regulations presents a challenge. However, innovative accounting software incorporates features that address these complexities, automating processes for consistency and compliance. The integration of artificial intelligence in bookkeeping is also emerging, allowing predictive analytic functions that can foresee potential financial challenges. For business owners, this technological shift means a greater focus on strategic initiatives rather than administrative tasks. Despite these modern advancements, the principles of double-entry bookkeeping remain unchanged, ensuring rigorous financial accountability and transparency. As we progress, understanding the interplay between technology and traditional accounting practices will be vital for future developments in the industry.

Impact on Financial Reporting

The evolution of double-entry bookkeeping has profoundly impacted financial reporting standards and practices. By ensuring that every financial transaction is accurately recorded in two accounts, the method offers a comprehensive view of a company’s financial health. This clarity aids stakeholders in assessing a business’s performance and financial stability, allowing for informed investment decisions. As regulatory frameworks governing financial reporting have evolved, many jurisdictions mandate adherence to standards that rely on the principles established by double-entry bookkeeping. This consistency enhances comparability across different businesses and sectors, creating a standard language in accounting. Furthermore, the introduction of Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) reflects the necessity for transparency and integrity in financial statements. Double-entry bookkeeping serves as a foundational pillar supporting these frameworks, ensuring that all aspects of financial transactions are considered and reported. As organizations strive for compliance, the robustness of double-entry accounting ensures that financial statements provide a true and fair view of their activities. The enduring relevance of these principles underscores their critical role in the ongoing evolution and sophistication of financial reporting in the modern business environment.

As the business landscape continues to evolve, the importance of double-entry bookkeeping cannot be overstated. With increasing complexities in regulatory requirements and financial markets, the method provides a reliable basis for maintaining accurate financial records. Companies that implement robust bookkeeping practices benefit from improved risk management and financial decision-making. Moreover, double-entry bookkeeping facilitates better cash flow management, enabling businesses to navigate fluctuations more effectively. The efficiency gained from technology further complements the advantages of this accounting method. Businesses that embrace double-entry principles stand to gain a competitive edge by ensuring that their financial practices are solid, transparent, and compliant. Furthermore, as we move into an increasingly digital economy, the principles of double-entry bookkeeping will continue to evolve, adapting to new financial technologies such as blockchain. By leveraging innovations while retaining core accounting practices, businesses can enhance operational efficiency and strategic foresight. Ultimately, the legacy of double-entry bookkeeping reflects a commitment to accountability that will remain essential for businesses of all sizes, ensuring they not only survive but thrive in the complex world of modern finance.

The Future of Double-Entry Bookkeeping

Looking ahead, the future of double-entry bookkeeping appears promising as technology continues to integrate into accounting practices. As businesses push for efficiency and real-time financial insights, the evolution of bookkeeping solutions will play a critical role. Advanced algorithms and machine learning capabilities can enhance the precision of financial data collection and processing, mitigating the potential for human error. Moreover, automation will drive productivity by reducing time spent on repetitive tasks, allowing accountants to focus on higher-level strategic activities. The rise of mobile applications will also facilitate on-the-go bookkeeping, making financial management accessible to small business owners. Additionally, as globalization shapes the economy, double-entry bookkeeping will remain relevant, accommodating diverse regulatory requirements and currencies. The applications of blockchain technology could further revolutionize bookkeeping by providing unprecedented transparency and security, paving the way for decentralized finance. Even though double-entry principles remain constant, their implementations will adapt to leverage these emerging technologies. The ability to embrace change while maintaining fundamental accounting principles will be key for businesses as they navigate an increasingly complex economic environment, ensuring that double-entry bookkeeping’s legacy continues.

In conclusion, the history and evolution of double-entry bookkeeping highlight its significant contributions to the field of accounting. From its early beginnings in the 15th century to its widespread adoption today, this method has transformed financial management. It has helped establish essential principles that define modern accounting standards, ensuring accuracy and transparency in financial reporting. As we move forward, embracing technology will be crucial in maintaining its relevance, allowing businesses to adapt to the fast-paced economic climate. The foundational concepts of double-entry bookkeeping not only instill confidence but also serve as a guide for future innovations in the accounting world. By preserving the integrity of financial practices, organizations can leverage double-entry systems for long-term success. Thus, as the landscape of commerce continues to evolve, so must our commitment to uphold the principles of double-entry bookkeeping, ensuring sound financial practices that benefit businesses and stakeholders alike. Ultimately, this approach remains integral to understanding historical accounting practices and moving forward with innovative techniques.