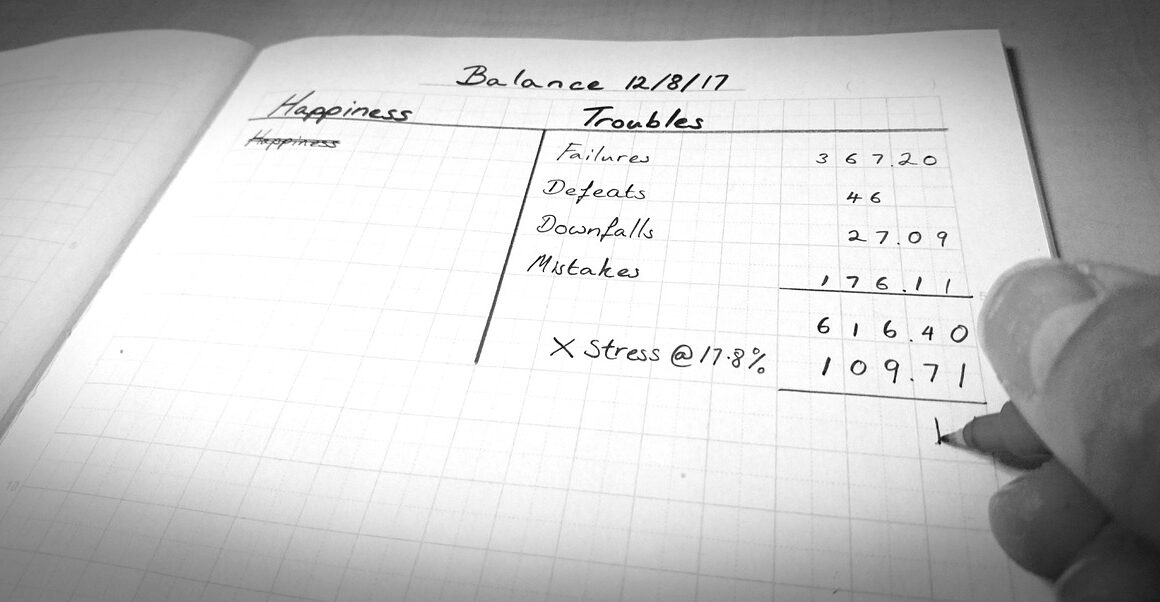

The Use of Balance Sheet in Budgeting and Forecasting

The balance sheet is a fundamental financial statement that provides a snapshot of a company’s financial condition at a specific point in time. It lists the assets, liabilities, and shareholders’ equity, providing critical information for stakeholders. When integrated into budgeting and forecasting processes, the balance sheet assists in projecting future financial positions based on historical data. By analyzing trends in assets and liabilities, businesses can make informed decisions about resource allocation, funding, and operational strategies. The balance sheet’s data influences cash flow projections and profit forecasts, helping organizations assess their financial health comprehensively. Moreover, financial ratios derived from the balance sheet, like the current ratio and debt-to-equity ratio, aid in evaluating liquidity and solvency, guiding executives in strategic planning. This integration helps businesses remain agile, responding swiftly to market changes. By leveraging the balance sheet in planning, companies can also align their budgeting with long-term financial goals, ensuring sustainable growth and stability. It’s crucial for management to revisit the balance sheet regularly to refine forecasts and budgets continually, adapting to new business realities.

Budgeting and forecasting are essential components of effective financial management.

Importance of Accurate Balancing

Accurate balancing in the context of the balance sheet is paramount for successful budgeting and forecasting. Any discrepancies in asset or liability reporting can lead to misguided forecasts, resulting in strategic errors that can have significant repercussions on a company’s performance. When crafting budgets, managers rely on the accuracy of balance sheet information to set realistic financial targets and allocate resources effectively. This reliance underscores the importance of diligent financial record-keeping and regular account reconciliations. Financial personnel must maintain current data, cross-check entries, and ensure compliance with accounting principles to achieve this accuracy. Furthermore, technology solutions like accounting software can aid in maintaining a precise balance sheet. Automated systems decrease human error while enhancing efficiency in financial reporting. Regular reviews and audits of financial statements will also contribute greatly to maintaining the integrity of the balance sheet, ensuring that any misleading data can be corrected before impacting the organization. By prioritizing accuracy, companies can foster confidence among stakeholders, creating a solid foundation for sound financial planning and strategic decision-making.

Integration of financial statements provides holistic insights into performance.

Evaluating Financial Health through Ratios

The assessment of a business’s financial health is integral to effective budgeting and forecasting, and this is where financial ratios play a vital role. These ratios, derived from the balance sheet, assist in evaluating liquidity, profitability, and leverage. Key ratios, such as the current ratio, measures a firm’s capability to cover short-term obligations, thus impacting its budgeting decisions. On the other hand, the debt-to-equity ratio provides insights into the company’s financial structure, guiding management in making informed strategic choices regarding funding. Investors and creditors also heavily rely on these ratios when making decisions. They use this quantitative analysis to gauge the risk associated with their investments. Consequently, companies should proactively monitor these ratios over time, as fluctuating metrics can signal potential issues or opportunities for improvement. By employing ratio analysis, businesses can forecast future financial scenarios based on realistic assessments of financial strength. As a result, a nimble reaction to market trends becomes possible, as informed adjustments to budgets or forecasts can be made, enhancing overall organizational resilience and adaptability.

Forecasting requires an understanding of historical financial performance.

Using Historical Trends for Future Planning

A critical aspect of effectively utilizing the balance sheet in budgeting and forecasting involves analyzing historical financial trends. By looking back at previous performances, businesses can identify patterns in revenue, expenses, and asset utilization. This historical perspective not only informs the forecasting process but also establishes realistic business goals. For instance, if a company notices a consistent increase in accounts receivable, it may forecast higher revenue for the upcoming period, prompting adjustments in inventory budgets. Conversely, persistent rises in liabilities may necessitate stricter budgeting measures. Additionally, historical trends can highlight seasonal fluctuations in sales or operational costs, enabling organizations to predict and plan for these variances. Therefore, thorough examination, correlation, and understanding of past data become crucial in creating an effective forecast. Continuous learning from historical financial performance empowers businesses to adopt a more strategic approach for future opportunities and challenges. Leveraging historical insights can lead to proactive measures, fostering an environment of increased adaptability and foresight within organizational financial planning.

Continual assessment of budget effectiveness drives improvement.