Introduction to Cybersecurity Threats

In the realm of finance, cybersecurity threats pose significant risks, especially concerning digital identity management. Such threats evolve continually, driven by technological advances and changing criminal tactics. A variety of paramount challenges occur when securing digital identities. Phishing, for instance, is a prevalent tactic, tricking individuals into revealing sensitive data. Additionally, data breaches have become increasingly common, highlighting the vulnerability of financial institutions. Organizations must prioritize protecting digital identities as breaches can lead to severe financial losses, reputational damage, and legal repercussions. As reliance on digital platforms grows, the demand for robust cybersecurity measures intensifies. Financial institutions face pressures not only from cybercriminals but also regulatory requirements aimed at safeguarding data. Unprepared entities may suffer devastating consequences that could have been mitigated with adequate strategies in place. Effective management of digital identities requires not only advanced technology but also employee training and public awareness initiatives. Cybersecurity threats demand a proactive stance, emphasizing the necessity for continual updates to security protocols and frameworks. By fostering a culture of security awareness, organizations can better equip their workforce to identify and address potential threats, thus bolstering their defenses against persistent risks to digital identity.

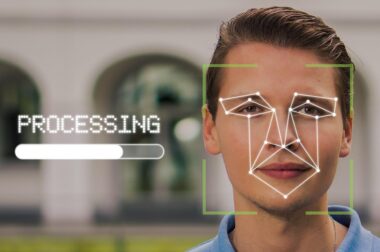

Digital identity management becomes an unavoidable focus, forcing financial institutions to reassess current practices. One fundamental strategy involves implementing Multi-Factor Authentication (MFA). MFA adds layers of security beyond simple passwords, utilizing something users know, something they have, or biometric identifiers. As cybercriminals innovate their approaches, MFA stands out as an effective deterrent against unauthorized access. Furthermore, organizations must consider the integration of behavioral biometrics, which analyze user behavior patterns. These patterns assist in verifying identities based on how individuals interact with systems. Regular security audits also play a crucial role in identifying vulnerabilities, ensuring that organizations remain compliant with industry standards. Conducting vulnerability assessments can unveil weaknesses that hackers exploit. Moreover, staff training and development initiatives can significantly raise awareness of best practices and potential threats. Employees often serve as the first line of defense against cyber threats. By educating them on phishing schemes and social engineering tactics, institutions can help reduce overall risk. Adopting a comprehensive approach protects both the organization and customers. These efforts contribute to building a sustainable cybersecurity framework that evolves with emerging threats, ensuring robust protection for digital identities throughout the financial sector.

Data Encryption and Secure Transactions

Data encryption is another critical aspect of digital identity management. In finance, sensitive data must be encrypted both at rest and in transit. This practice ensures that even if hackers intercept data, they cannot access meaningful information. Strong encryption algorithms, such as AES-256, provide robust security against unauthorized access. Furthermore, secure transactions, facilitated by encryption, are essential for maintaining customer trust. Customers expect their data to be protected, which significantly impacts their loyalty and willingness to engage with financial services. Utilizing SSL certificates for web transactions ensures that data exchanged between users and financial institutions remains secure. The importance of compliance with regulations, such as GDPR and PCI-DSS, also cannot be overstated. These frameworks outline necessary measures for handling personal and payment information. Failure to adhere to these regulations could result in hefty fines and reputational damage. Organizations should continuously monitor their compliance status and implement necessary updates. Additionally, adopting tokenization techniques can further enhance security by replacing sensitive data with unique identifiers. Such safeguards allow institutions to minimize the risk of data breaches while securely managing digital identities and conducting transactions within the financial ecosystem, thus prioritizing customer security.

Recognizing the growing importance of cybersecurity as a managerial focus is fundamental for financial organizations. Decisions driven by risk assessments can shape strategic planning with respect to cybersecurity investments. It is vital to evaluate which assets and data types are most sensitive and therefore require heightened protection. Risk management frameworks like NIST and ISO 27001 offer robust systems for managing these assessments effectively. Strategic investments in cutting-edge technologies such as AI and machine learning can also help identify and mitigate potential threats proactively. The analysis of large data sets allows organizations to detect unusual patterns and flag them for review. This predictive capability can ultimately prevent data breaches before they occur. Establishing incident response teams is equally important; they should be equipped to react swiftly to breaches or attempted attacks. These teams must follow established protocols to ensure a rapid containment and mitigation process takes place. Furthermore, a post-incident analysis can provide insights into vulnerabilities and improve future strategies. Building partnerships with technology vendors specializing in cybersecurity is valuable. Engaging with experts ensures access to the latest tools and resources for stronger defense mechanisms in the dynamic landscape of finance.

Regulatory Compliance and Best Practices

Navigating the landscape of regulatory compliance is a crucial element in the management of digital identities within finance. Regulatory frameworks regarding data protection and privacy, such as the GDPR, mandate stringent measures to safeguard personal data. Non-compliance can inadvertently lead to financial penalties and resource allocation for remedial measures. This underscores the importance of integrating compliance as a core focus within organizational strategy. Financial institutions must develop and continuously update privacy policies and encourage staff adherence to them. Implementing best practices in data management can reinforce compliance. For instance, organizations should limit access to sensitive information on a need-to-know basis, minimizing the risk of unauthorized access. Additionally, data minimization principles advocate only collecting information that is necessary for a specified purpose. Thus, institutions are better positioned to protect their digital identity frameworks by refining data governance structures. Regular compliance training is equally essential; it boosts employee understanding of evolving regulations. Engaging legal teams to conduct compliance audits ensures institutional transparency and accountability. This ongoing commitment to regulatory compliance ultimately underpins trust in financial systems, enhancing customer confidence in organizations’ commitment to protecting their digital identities.

Collaboration across multiple sectors fosters innovative solutions to address cybersecurity challenges. By engaging in partnerships with governmental and technological entities, financial organizations can stay informed on the latest threats and defenses. For instance, sharing threat intelligence can create a proactive cybersecurity culture that amplifies overall readiness against evolving vulnerabilities. Public-private partnerships can facilitate information exchange and best practices among organizations. Furthermore, participating in cybersecurity alliances can bolster collective defense efforts. Education and training initiatives must also extend beyond the organization, reaching customers using financial services. Empowering customers to adopt safer online behaviors can reduce the likelihood of identity theft and fraud significantly. Initiatives such as public awareness campaigns help educate users on recognizing phishing attempts and securing their personal data. Financial institutions may consider organizing workshops and webinars to promote healthy online habits and safe digital identity management. Transparent communication about security measures instills confidence in services offered, reassuring customers that their digital identities are safeguarded. As tech advances, collaborative models that unify various sectors are imperative for comprehensive cybersecurity strategies. The multifaceted nature of these collaborations strengthens relationships built around trust while effectively addressing persistent cybersecurity threats within the finance area.

Future Trends in Digital Identity Management

As technology continues to evolve, future trends in digital identity management are rapidly emerging. The advancement of blockchain technology is a notable development, with its potential to enhance security and ensure data integrity. Decentralized identity systems built on blockchain provide individuals with greater control over their personal information. Organizations will be able to authenticate users without extensive reliance on traditional databases. Furthermore, developments in artificial intelligence are promising, with machine learning algorithms improving cybersecurity measures. Predictive analytics will enhance threat detection, identifying potential vulnerabilities before they are exploited. Identity verification processes will also become more seamless through the use of AI-driven software, enhancing user experience while maintaining security. Another trend is the growth of privacy-centric technologies, shifting the focus towards user agency and control. Solutions such as Zero Trust Architecture are gaining traction, where no one is trusted by default, regardless of their location within the network. As these trends emerge, financial institutions must remain agile, adapting to new technology while implementing effective security strategies. Continuous innovation will define the future landscape of digital identity management, enabling organizations to manage identities sustainably while combatting increasing cybersecurity threats.

Adopting a proactive approach that emphasizes both technology and human factors will be essential. Institutions must recognize that technology alone cannot address the complexities of cybersecurity threats. A holistic strategy encompassing technology, awareness, and culture change is vital for effective cybersecurity management. Encouraging an organizational culture where security is a shared responsibility among all employees helps reinforce trust and accountability. Employees who understand their role in safeguarding digital identities will contribute significantly to overall security posture. Furthermore, ongoing training encourages adaptability in the face of new threats. Engaging stakeholders across the organization ensures collective participation in maintaining robust security protocols. In addition, responding effectively to incidents and learning from them is crucial for evolving defenses. Analyzing events can illuminate gaps in processes and systems, guiding future improvements. As organizations adapt to changing landscapes, consistent evaluation and adjustment of security strategies are required. With the rapid growth of digital transactions in finance, organizations must prioritize security without compromising user experience. SaaS solutions should streamline secure access to services while ensuring identity validation remains robust. As technology advances, organizations in finance must remain vigilant, staying ahead of cybersecurity threats while protecting digital identities with innovative strategies.