EMV and Mobile Payments: Integration Strategies

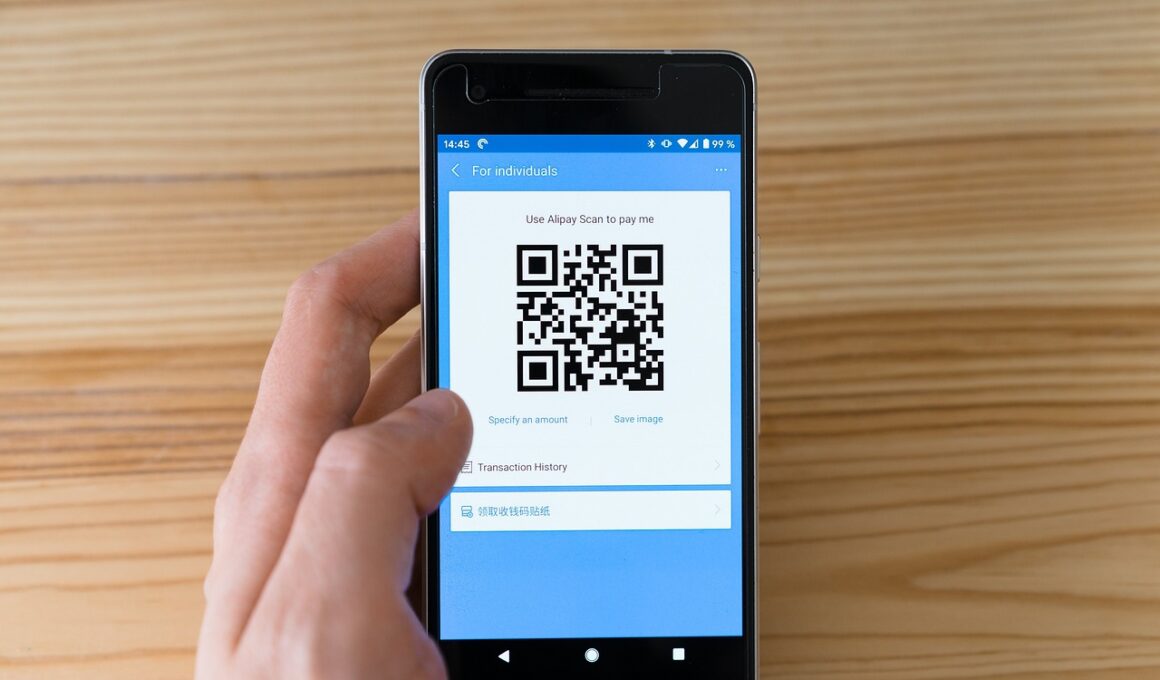

EMV technology, short for Europay, MasterCard, and Visa, has significantly transformed the landscape of digital payments. It enhances transaction security through embedded microchips in credit and debit cards, making it harder for fraudsters to clone cards compared to magnetic stripe cards. As merchants adopt EMV systems, mobile payments have emerged as an essential extension of this technology. Integrating EMV into mobile payment systems increases transaction security, making it crucial for consumers and businesses. Technology providers need to design systems that support both traditional card transactions and mobile payments for seamless user experience. Mobile payment applications like Apple Pay and Google Wallet leverage EMV standards, ensuring that merchants can approve mobile transactions swiftly while maintaining security. Additionally, merchants must ensure that their existing payment infrastructure is EMV-enabled to accept mobile payments effectively. Training staff on new EMV protocols is also vital for reducing friction during transactions. As the popularity of mobile payments rises, integrating EMV will become vital for ensuring that businesses remain competitive and secure while meeting the demands of tech-savvy customers who prefer mobile transaction options.

The integration of EMV technology into mobile payment systems provides various benefits beyond just security enhancements. One major advantage is improved customer trust and satisfaction. By adopting EMV, businesses signal to customers that they prioritize secure transactions, which can lead to increased consumer loyalty. Furthermore, the speed of transactions is enhanced with EMV-enabled mobile payments, as consumers simply tap their devices to make payments instead of swiping cards or manually entering information. This streamlined approach reduces wait times and improves the overall shopping experience, especially during peak hours. Another key benefit is compliance with industry standards. As the payment landscape continuously evolves, companies that adopt EMV technology will remain compliant with the latest regulations. This compliance extends to protecting customer data and minimizing liability costs associated with potential fraud. Mobile payment systems that are integrated with EMV technology may also access enhanced analytics and reporting features, providing businesses valuable insights into consumer behavior and purchasing patterns. Ultimately, integrating EMV into mobile payments not only fulfills security requirements but also enhances operational efficiency for retailers.

Challenges in Integration

Despite the advantages, integrating EMV technology into mobile payments poses several challenges that businesses must navigate. One of the primary obstacles is the cost associated with upgrading existing point-of-sale (POS) systems. Many retailers may find the investment in EMV-compatible readers and software daunting, especially small to medium-sized enterprises. Furthermore, from a technical standpoint, integrating EMV with older systems can lead to compatibility issues, requiring significant adjustments to infrastructure or even complete overhauls. Moreover, staff training is crucial yet often overlooked; employees must understand how to use new systems effectively and troubleshoot potential problems. The complexity of EMV can also create hesitation among businesses when considering deployment. API integration with mobile platforms can be resource-intensive and time-consuming, raising further concerns about return on investment. Additionally, there is a potential for operational disruptions during the transition phase. Businesses should create a strategic plan to minimize disruptions while ensuring continued customer service and operational efficiency throughout the integration process.

Consumer education is another essential aspect that businesses must address in the integration of EMV technology with mobile payments. Many customers are unaware of the distinctions between traditional card transactions and mobile payments that utilize EMV standards. To maximize the benefits of EMV integration, retailers should offer clear instructions on how to use mobile payment options effectively. This can include in-store demonstrations, signage, and engaging digital marketing campaigns to inform consumers of new technologies. Enhancing consumer awareness builds trust and encourages customers to adopt mobile payments while emphasizing their security features. Businesses may also consider loyalty programs to incentivize mobile payment use, such as offering discounts or rewards for using EMV-enabled mobile payment methods. Developing a robust customer education strategy can create a seamless transition for consumers as they adopt new payment technologies. This proactive approach will likely result in greater acceptance and utilization of mobile payments, benefiting both the customer experience and the business’s bottom line.

Future Trends in EMV Integration

The future of EMV technology in mobile payments holds promising trends as companies innovate to improve user experience and security. One significant trend is the integration of biometric authentication measures, such as fingerprint or facial recognition, into mobile payment systems. These advanced authentication methods provide an additional layer of security and convenience for users, making transactions more efficient. Furthermore, as the internet of things (IoT) continues to grow, EMV-enabled devices can communicate seamlessly with other connected devices to facilitate even more secure payments in various environments. The natural evolution of mobile wallets will also see the integration of EMV in applications for online shopping, enabling consumers to benefit from increased security and convenience across all their retail interactions. Additionally, artificial intelligence may emerge as a crucial component in combating fraud, utilizing machine learning algorithms to detect and prevent suspicious activities better. Companies that embrace these innovations will not only enhance their payment systems but also set themselves apart in an increasingly competitive market.

To successfully integrate EMV technology with mobile payments, businesses need to prioritize collaboration with payment processors and technology partners. Forming strategic alliances can help companies streamline the deployment process while mitigating technical challenges. Businesses should evaluate various operating systems and platforms to determine the best fit for their specific needs, ensuring compatibility with existing infrastructure is a top priority. A phased approach to integration may also yield better results; businesses can start by pilot-testing EMV systems in selected locations before rolling it out to their entire operation. This allows them to gather valuable feedback and make necessary adjustments to improve the user experience. Moreover, post-integration support is paramount. Businesses should ensure they have access to technical support as they roll out their EMV-compatible mobile payment systems. This provides peace of mind knowing that assistance is available should any issues arise. Establishing a contingency plan for potential technical problems can help mitigate risks and ensure seamless operations, demonstrating leadership in adopting modern payment technologies.

Conclusion

In summary, the integration of EMV technology into mobile payment systems is a multifaceted process that offers numerous benefits, including enhanced security, faster transactions, and improved consumer trust. However, it is not without its challenges, such as costs, technical obstacles, and the need for consumer education. The potential for future innovation, including biometric authentication and IoT integration, provides exciting opportunities for retailers and consumers alike. By prioritizing strategic partnerships, thorough training, and customer support, businesses can navigate the transition to EMV-enabled mobile payments effectively and efficiently. Companies that invest in these integrations will likely gain a competitive edge while positioning themselves for future challenges and opportunities in the ever-evolving digital payments landscape. As the market continues to evolve, maintaining awareness of consumer needs and emerging technologies will be vital. Ultimately, embracing EMV within mobile payments is not just a technological upgrade; it represents a critical component of modern commerce, shaping how purchases are made and perceived in the digital age.

As EMV technology steadily merges with mobile payments, understanding the intricate landscape of this digital transformation becomes crucial for success in the industry. Organizations should remain agile, adaptable, and forward-thinking when implementing these strategies to thrive in a competitive environment.