How Blockchain Technology Could Revolutionize Receivables Financing

Receivables financing is a vital aspect of business operations, allowing companies to improve their cash flow and manage working capital effectively. Traditionally, businesses have relied on banks and financial institutions to provide necessary liquidity based on their outstanding invoices and receivables. However, the introduction of blockchain technology brings a transformative potential to this arena. Blockchain, with its decentralized and transparent nature, offers several significant advantages for receivables financing. It enables secure transactions without intermediaries, providing a robust environment for validating and processing invoices efficiently. Furthermore, the adoption of smart contracts can automate payment processes once certain conditions are met, helping reduce the risk of disputes. The capability for real-time tracking changes the way businesses approach financing options. Blockchain allows companies to monitor their receivables at every stage, enhancing transparency for both lenders and borrowers. Moreover, access to accurate and timely data can improve risk assessment models, leading to more favorable financing terms. In addition to these benefits, businesses can secure their financial transactions against fraud, an issue that has historically plagued the receivables sector.

Traditionally, companies often face challenges securing necessary financing due to lengthy processes involving verification and collateral requirements. This is where blockchain technology shines, enabling faster and more efficient transactions. By leveraging distributed ledger technology, all parties involved in a transaction maintain a complete and transparent record of the financing process. This reduces the need for repeated documentation and verification, which are often sources of delay. Companies make use of blockchain to verify transactions instantly, ensuring that they do not fall prey to errors commonly present in manual processes. As blockchain continues to gain traction, it becomes evident that the change is not just technological but also cultural, pushing companies toward adopting more secure and transparent financial practices. The process of selling receivables can streamline significantly, allowing businesses to focus more on growth rather than on overcoming administrative hurdles. The efficiency afforded by blockchain could lead to better relationships between sellers and buyers, fundamentally altering the dynamics of business transactions. Firms that adopt this technology stand to gain a competitive advantage, simplifying their operations, enhancing trust, and ultimately improving overall profitability.

The Impact of Smart Contracts

Smart contracts enhance the potential of blockchain in receivables financing by automating many processes currently reliant on human intervention. A smart contract is a self-executing contract with the terms of the agreement directly written into lines of code on the blockchain. Once the conditions of the contract are met, the contract automatically executes, leading to seamless transactions. Companies can deploy these contracts to trigger payments instantly upon verification that goods have been delivered or services provided, significantly reducing delays that usually occur in traditional financing methods. The elimination of intermediaries through smart contracts leads to lower transaction costs for businesses while enhancing transaction speed. Moreover, businesses can confidently engage in larger transactions, knowing the processes are automated and reliable. Smart contracts can be customized to suit specific needs, making them a versatile tool for various businesses. By incorporating smart contracts into receivables financing, firms can not only increase their operational efficiencies but also enhance their cash flow stability, which is crucial for any growing enterprise. Consequently, smart contracts pave the way for a more responsive and transparent receivables financing ecosystem.

Blockchain technology’s role in enhancing transparency also leads to broader trust among participants in the supply chain. For receivables financing, trust is a critical factor, as lenders need assurance that the invoices hold value and that the businesses issuing them are credible. The immutable nature of blockchain creates a reliable record that cannot be altered, giving stakeholders peace of mind. When companies can demonstrate their financial health through transparent records, they strengthen their position in seeking financing. Lenders can leverage the blockchain’s trust layer to analyze data points in real time, improving due diligence processes and enabling more informed lending decisions. Furthermore, blockchain’s transparent nature prevents fraud and manipulation of documents, which has been a persistent issue in traditional financing. Eliminating such risks can lower the cost of capital for businesses, creating a more favorable climate for investment. Over time, as more companies and financial institutions embrace blockchain, the standards for receivables financing will likely evolve, pushing traditional players to adapt or fall behind. This evolution will inevitably lead to better financing possibilities for a diverse range of businesses in various sectors.

Cost Efficiency and Accessibility

Another critical advantage of blockchain technology in receivables financing is cost-efficiency. Traditional financing models often incur high fees due to intermediary services and the complex validation process. Blockchain removes many of these intermediaries, which helps minimize costs associated with transaction fees. Companies can save money on operational expenses, contributing to their overall profitability. Additionally, by improving the speed and efficiency of transactions, companies can allocate resources more effectively, focusing on core operations instead of administrative tasks. Furthermore, enhanced accessibility is a significant benefit offered by blockchain in this area. Smaller businesses, typically seen as higher-risk borrowers, often struggle to secure financing due to their limited credit histories. With blockchain, lenders can access a comprehensive view of a company’s transaction history and performance metrics, allowing even smaller players to prove creditworthiness. This opens the door for new opportunities and allows a wider range of companies to participate in the financing market. Consequently, blockchain plays an important role in leveling the playing field, ensuring that more businesses have access to vital receivables financing, irrespective of their size.

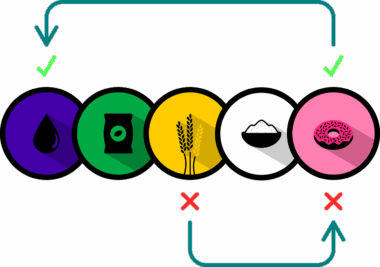

As blockchain technology evolves, we might see new financial models emerge that redefine how receivables financing operates. The concept of tokenization, where receivables could be represented as digital tokens on the blockchain, could facilitate an innovative approach to financing. By allowing companies to create digital representations of their receivables, they can sell or trade those tokens in a decentralized marketplace. This would enable instant liquidity, allowing businesses to gain access to cash by leveraging their receivables efficiently. Tokenization could also enhance transparency as it would create a verifiable audit trail. Such mechanisms avoid the complexities associated with traditional financing, streamlining the fundraising process for companies. The formation of decentralized financial ecosystems would allow businesses to connect directly with investors who are looking for opportunities in receivables financing. This approach significantly enhances opportunities for value creation across the supply chain. Businesses that engage in tokenization stand to benefit from increased market agility, better pricing mechanisms, and ultimately, improved productivity. Thus, embracing these emerging trends could position companies at the forefront of a new era in receivables financing.

Conclusion and Future Outlook

The intersection of blockchain technology and receivables financing presents an exciting opportunity for businesses seeking financial solutions. As industries increasingly adopt this technology, the landscape for financing will likely undergo significant changes. Enhanced efficiency, transparency, and cost reductions are just some of the promising benefits that blockchain can offer. Companies keen on embracing this transformation can shape their financial future, allowing for resilient business practices that withstand economic fluctuations. Furthermore, as the regulatory frameworks begin to adapt to these technological advancements, clearer guidelines will emerge, paving the way for broader acceptance of blockchain in mainstream finance. Companies that adapt quickly to this changing environment will not only thrive but will set new industry standards for receivables financing. However, businesses must stay informed about best practices and potential risks associated with blockchain implementation. The future of receivables financing will ultimately hinge on a collective understanding of blockchain’s capabilities and challenges. As a result, companies need to prioritize education and innovation in capital financing strategies, ensuring they’re well-prepared to navigate this transformative wave and leverage blockchain technology effectively.

Overall, blockchain technology stands poised to revolutionize receivables financing by enhancing security and efficiency while reducing costs. Also, it offers the potential to reshape financing opportunities for a diverse range of businesses, ultimately contributing to stronger financial ecosystems. The shift toward blockchain signifies not only a technological change but also a cultural transformation in how businesses approach financing solutions. Companies that prioritize integrating blockchain into their operational framework will be well-positioned to capitalize on the forthcoming advancements in this sector. The combination of rapid technological changes and a growing understanding of blockchain’s potential will enable more businesses to succeed in securing financing. Understanding this evolving landscape will be key for companies looking to thrive as blockchain continues to reshape the financial infrastructure. As more organizations embrace these changes, it becomes increasingly clear that blockchain technology could become indispensable in receivables financing. The future is bright for businesses willing to adopt new strategies and technologies, marking the beginning of a new chapter in the realm of receivables financing, fueled by innovation and a commitment to progress.