Utilizing Feedback from Shareholder Letters to Improve Reporting

Shareholder letters serve as a critical communication tool between a company’s management and its investors. These letters often reflect the company’s overall performance, prospects, and challenges. By analyzing responses and feedback to these letters, management can gain valuable insights into shareholders’ expectations and concerns. Moreover, consistently reviewing this feedback allows companies to enhance their financial reporting and communication strategies. Enhanced reporting can include more transparency about company operations and future goals. This improvement leads to higher investor confidence and potentially better market performance. To fully utilize feedback, organizations should adopt systematic approaches, such as surveys, interviews, and focus groups. These platforms provide shareholders with opportunities to express their perspectives and suggestions. This two-way communication channel ensures that management stays informed about investors’ interests and preferences. In turn, companies can tailor their messages accordingly and address any misunderstandings that may arise. Engaging shareholders can also help identify trends in shareholder concerns and expectations, leading to proactive adjustments in disclosures and reporting practices. By prioritizing shareholder feedback, companies can foster a cooperative relationship with investors, ensuring alignment and mutual benefit.

The Importance of Transparency in Financial Reporting

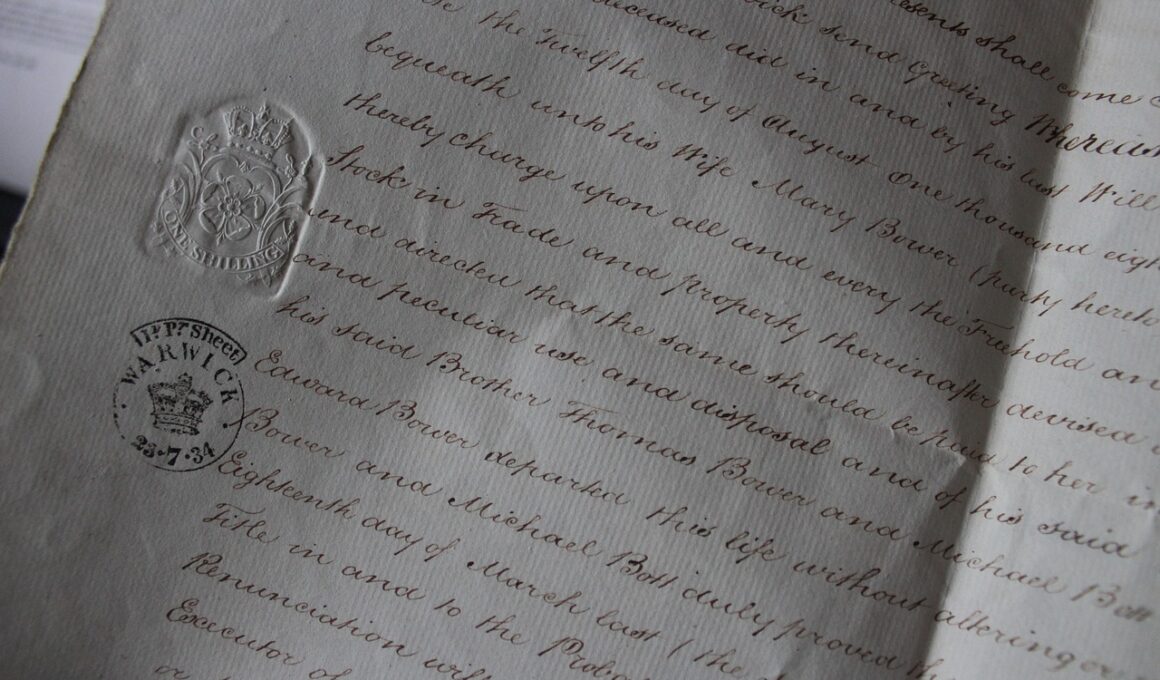

Transparency is a fundamental principle in financial reporting, fostering trust between companies and investors. When shareholder letters clearly articulate financial performance and strategic direction, investors feel more secure in their investment decisions. Transparency helps in demystifying complex financial data, allowing shareholders to understand not just the outcomes but also the rationale behind them. This clarity reduces uncertainty and builds long-term loyalty among investors. Companies should avoid jargon and utilize straightforward language to communicate results effectively. Moreover, by being open about challenges and areas for improvement, organizations can depict a realistic narrative. Engaging shareholders through transparent communications mitigates apprehensions and promotes a sense of partnership. To achieve effective transparency, companies might consider adopting a standardized reporting framework. Standardization can provide consistency and facilitate better comparison across time periods and competitors. Additionally, utilizing visual aids like charts and graphs can enhance comprehension of the reported data. Regular updates and timely responses to shareholder queries can further elevate transparency levels. By embracing this principle, companies not only fulfill regulatory obligations but also create lasting relationships grounded in trust and cooperation with their shareholders.

Feedback from shareholder letters can significantly shape a company’s strategic direction. Understanding investor concerns is crucial for aligning operational practices with shareholder expectations. Companies can analyze common themes that emerge from shareholders’ feedback, focusing on areas such as performance metrics and growth projections. By categorizing feedback into actionable insights, organizations can prioritize enhancements in their reporting practices. For instance, if many shareholders express confusion regarding certain financial metrics, companies might consider refining how those metrics are reported. This focus simplifies investors’ decision-making processes and enhances their understanding of strategic goals and market positioning. Collections of investor insights can also guide product development and marketing strategies, resulting in a stronger alignment with market demands. Furthermore, sharing responses to feedback in future letters demonstrates to shareholders that their input is valued. This continuous feedback loop encourages further participation and enriches the quality of communication between shareholders and management. Addressing past concerns can showcase a company’s responsiveness to stakeholder interests and solidify a commitment to continuous improvement. Ultimately, integrating shareholder feedback into strategic planning can drive better performance and foster enduring investor loyalty.

Leveraging Technology for Enhanced Reporting

In today’s digital age, technology has transformed many aspects of financial reporting. Companies can now leverage data analytics tools to sift through vast amounts of feedback and identify patterns that might otherwise remain obscure. By utilizing these tools, management can gain insights into investor sentiment and expectations effectively. Advanced analytics allow organizations to measure shareholder engagement and satisfaction levels accurately. Moreover, integrating technological solutions can streamline the process of collecting and interpreting shareholder feedback. Automated systems can help aggregate responses from various channels, such as online surveys and social media, thereby creating a comprehensive view of shareholder perspectives. Additionally, utilizing customer relationship management (CRM) systems can cultivate stronger relationships with shareholders, allowing companies to track individual preferences and responses over time. This relationship fosters a more personalized communication strategy. Furthermore, the presentation of financial data can also benefit from innovative technologies, such as interactive dashboards that engage shareholders visually. Enhanced visuals can make complex data easier to digest while providing a more immersive experience for investors. By embracing technology, organizations not only improve their reporting processes but also create a more engaging platform for shareholders.

To continuously improve financial reporting, it is essential to establish a feedback loop with shareholders. This loop encompasses collecting, analyzing, and implementing feedback derived from shareholder letters. By routinely soliciting and acting upon feedback, companies can demonstrate their commitment to addressing shareholder needs. Feedback mechanisms, such as regular surveys or follow-up inquiries, enable companies to gauge investor satisfaction and pinpoint areas for improvement. The establishment of a formalized approach ensures that feedback is not only collected but also used to inform future reporting. Companies can also benefit from creating focus groups comprised of shareholders, allowing for deeper discussions about their expectations and preferences. These focused discussions can yield rich qualitative data that quantitative surveys may miss. Consequently, companies can gain a more nuanced understanding of stakeholder concerns that warrants attention. Moreover, transparently communicating the adjustments made due to feedback reinforces trust and long-term investor relations. This dialogue creates an environment where shareholders feel more connected to the company’s mission and objectives. By fostering this ongoing communication dynamic, companies can enhance credibility and nurture a loyal investor base that is both engaged and informed.

Engaging Shareholders through Dynamic Reporting

Adopting dynamic reporting methods enhances shareholder engagement by presenting financial data in an accessible format. Companies must strive to move beyond static financial statements and offer more interactive presentations that facilitate understanding among investors. Incorporating elements such as infographics, videos, and real-time data visualizations can transform how information is shared. This modern approach to financial reporting appeals to diverse audiences and accommodates different preferences for consuming information. Offering engaging summaries at the beginning of reports can capture shareholder attention, ensuring they digest key messages. Additionally, it is essential to tailor communication styles for different investor segments. Understanding that institutional investors may require more in-depth analyses compared to retail investors is crucial. By segmenting reports and delivery methods, organizations can ensure that their communications resonate with various audiences. Moreover, incorporating feedback from shareholders on preferred reporting formats can enhance overall satisfaction and engagement. Regularly innovating reporting practices based on direct shareholder feedback can help the company maintain relevance. Ultimately, a proactive approach to dynamic reporting can elevate interaction levels between organizations and their shareholders. This strategy not only benefits communication but ultimately strengthens investor relationships.

In conclusion, utilizing feedback from shareholder letters is an essential practice that can significantly enhance financial reporting. Companies must prioritize understanding shareholders’ perspectives to establish meaningful engagement and improve their strategic approaches. By adopting a culture of transparency and responsiveness, organizations can ensure that they have a solid grasp of shareholder expectations and concerns. Moreover, incorporating technology to analyze feedback and deliver dynamic reports places companies in a strong position to refine their communication efficacy. As business landscapes evolve, actively engaging with shareholders becomes paramount for long-term sustainability. Companies can foster deeper trust and loyalty by sustaining a dialogue that reflects their commitment to transparency and improvement. Feedback mechanisms such as surveys, focus groups, and one-on-one interactions play vital roles in harnessing investors’ insights effectively. Implementing changes based on this feedback is essential for organizations aiming to enhance their financial reporting practices. Ultimately, building a cooperative relationship between companies and their shareholders leads to fruitful communication and lasting investor satisfaction. Embracing this collaborative spirit strengthens both parties and positions the company to thrive in competitive markets.

In summary, utilizing feedback from shareholder letters provides companies with numerous opportunities to enhance financial reporting. With a focus on transparency, responsiveness, and dynamic communication, organizations can establish trusting relationships with their investors. By creating avenues for dialogue and engagement, management can ensure that they remain aligned with shareholders’ expectations and needs. The integration of technology enhances the analysis of feedback, allowing for informed decision-making and improved reporting strategies. As the financial landscape becomes more competitive, maintaining close connections with shareholders is more important than ever. Companies that are proactive in seeking feedback are better equipped to navigate challenges while nurturing investor trust. Dynamic reporting methods resonate increasingly with shareholders, ensuring that they receive information in formats that cater to their preferences. This emphasis on communication enables organizations to demonstrate their commitment to investor relationships actively. In the ever-evolving business environment, adapting to shareholder feedback becomes a cornerstone of strategic improvement. Recognizing and valuing stakeholder input can cultivate a culture of collaboration and innovation. Through these efforts, companies can realize long-term success and bolster their reputations within their industries.