Cross-Border Identity Verification in Global Financial Transactions

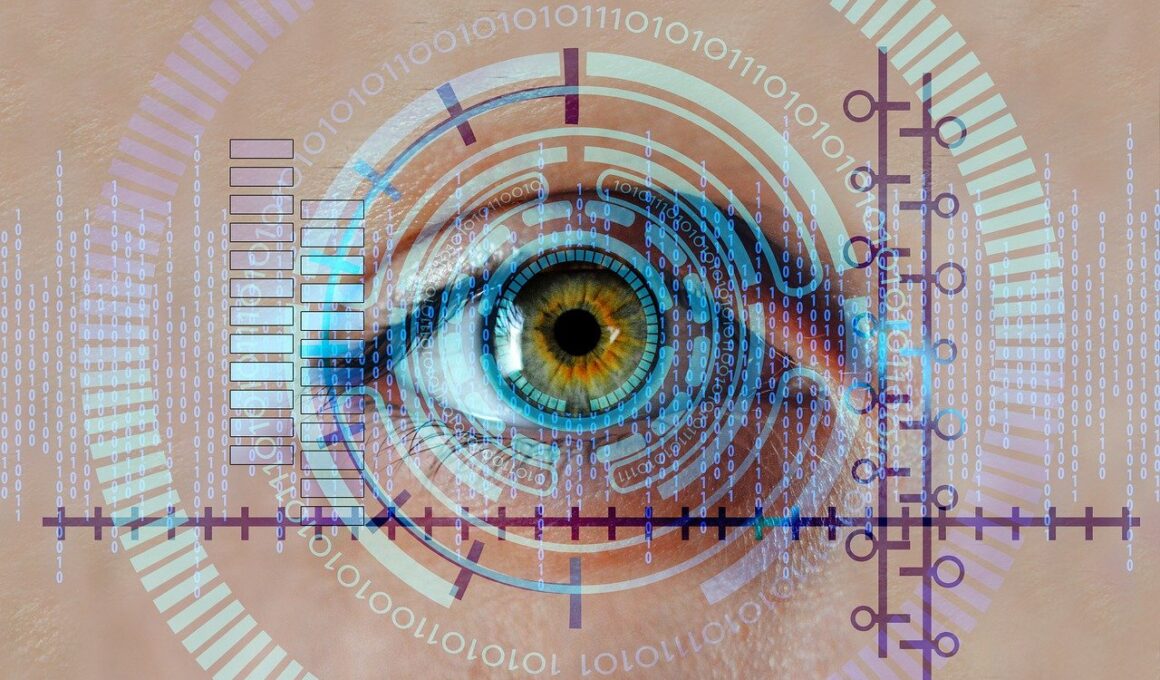

In today’s interconnected world, cross-border identity verification has become paramount for financial institutions. Globalization has significantly accelerated international transactions, leading to an increased demand for secure identity checks. Organizations need robust systems that not only confirm the identity of individuals but also comply with diverse regulations across different jurisdictions. By implementing advanced identity verification techniques, financial entities can mitigate risks associated with fraud, money laundering, and other illegal activities. Technologies such as biometrics, artificial intelligence, and machine learning provide innovative solutions for verifying identities in real-time. Moreover, identity verification technologies must constantly evolve to address the ever-changing landscape of global compliance. This involves adapting to new regulations posed by different countries, which can greatly impact the efficiency of financial transactions. Further, customer experience must not be compromised in the quest for security. Hence, streamlined processes that ensure ease of access while maintaining stringent checks are essential. Ultimately, as globalization expands, the importance of reliable identity verification in finance continues to grow, making it a critical component for fostering trust among other stakeholders.

The Importance of Robust Verification Processes

Establishing a secure and effective identity verification process is crucial for financial institutions engaged in cross-border transactions. Traditional methods often lack the necessary capabilities to sufficiently authenticate identities in a global context. Implementing advanced technology such as digital fingerprints, facial recognition, and encrypted digital IDs can significantly improve security measures. These modern solutions can analyze and match data points across various databases, leading to faster and more accurate verification outcomes. Additionally, leveraging machine learning algorithms can enhance the ability to detect fraudulent activities. By analyzing historical data, these algorithms can identify patterns and anomalies, allowing for proactive risk management. Furthermore, regulatory compliance is a significant challenge; different countries impose varied identification standards. Financial institutions must remain agile, adapting their verification processes to meet these diverse requirements while ensuring minimal disruption to business operations. By meticulously designing these systems, organizations can protect themselves and their customers from cyber threats. Therefore, investing in robust verification processes is not merely an option but an essential strategy towards securing investments in the constantly evolving landscape of global finance.

With the rise of digital transactions, identity verification must also adapt to the shifting technological landscape in finance. Cybercriminals continue to utilize increasingly sophisticated techniques to compromise personal data. Financial institutions must adopt a multi-layered approach to identity verification, which includes not only online security measures but also customer education in protecting sensitive information. Customers should be aware of potential risks associated with online transactions and understand how to safeguard their identities. Financial institutions can enhance customer trust by implementing comprehensive training on identifying phishing scams, maintaining strong password hygiene, and recognizing secure websites. Furthermore, employing two-factor authentication adds an additional layer of security. This method requires users to provide two types of identification before accessing their accounts, whether via a mobile device or another form of verification. Such mechanisms not only deter unauthorized access but also reassure customers about the safety of their transactions. Lastly, building a user-friendly interface that simplifies the verification process can also significantly improve customer compliance, ensuring a successful and secure transaction. It is imperative that financial institutions proactively safeguard their platforms against potential breaches.

Technological Innovations in Identity Verification

Technological advancements in identity verification have transformed how financial transactions are conducted globally. Automation, blockchain technology, and advanced data analytics have significantly improved efficiency and security. Automation facilitates rapid processing and real-time verification, reducing customer wait times and enhancing satisfaction. Blockchain technology adds an immutable layer of security as it can record elucidated transaction history while ensuring data integrity and validation. Control over personal data evolves as customers can manage their identities through decentralized platforms, granting permissions for access. Moreover, data analytics provides insights into consumer behavior, enabling financial institutions to tailor their verification processes more effectively. However, the potential for bias in algorithms must be monitored, leading to a need for ongoing assessments. Proper regulations and ethical guidelines should govern the use of such technologies to prevent discrimination or misuse of information. As these innovations continue to evolve, it is essential for financial institutions to remain vigilant against emerging threats. Staying ahead means adopting best practices for technology integration while ensuring compliance with local and international standards. A proactive approach toward innovation will secure trust and protect commercial interests in financial sectors.

When it comes to cross-border transactions, regulatory compliance is a major hurdle for financial institutions. Different regions have unique laws governing personal data and identity verification processes that must be adhered to. For instance, the General Data Protection Regulation (GDPR) in Europe emphasizes privacy and protection of personal data. On the other hand, the USA may have a more decentralised regulatory framework. Consequently, financial institutions must maintain clarity in their understanding of various regulations each applicable jurisdiction mandates. Failing to comply with these regulations can result in severe penalties and damage to reputation. It is critical for organizations to establish a compliance team dedicated to interpreting laws and monitoring changes in regulations. Adopting compliance management systems can assist financial institutions in navigating the complex legal landscape while ensuring that verification processes remain efficient. Simultaneously, ongoing training and development for staff regarding compliance issues can enhance overall organizational effectiveness. Moreover, regular audits of verification systems reinforce a culture of accountability and operational excellence, ensuring all measures are in line with statutory requirements. Ultimately, a strong compliance framework is a necessity for protecting organizations and reinforcing global trust.

The Role of Customer Experience in Verification

While security and compliance are priorities, the customer experience remains vital in cross-border identity verification. Customers demand seamless, efficient transactions that do not hinder their experience. If verification processes are lengthy or invasive, customers may abandon transactions, impacting sales and brand loyalty. Thus, financial institutions must balance rigorous security measures with user-friendly systems. Streamlining the onboarding process, for example, can significantly enhance customer satisfaction. Implementing automated identity checks ensures that essential security remains intact, but in a much more efficient manner. Furthermore, utilizing a clear user interface can guide customers effortlessly through the verification process, decreasing frustration levels. The convenience of mobile applications should not be undermined, as many customers prefer conducting transactions using their smartphones. Accessible support channels are crucial in case of difficulties during verification; maintaining communication reassures customers about their financial safety. Organizations could also gather feedback based on customer experiences to identify areas of improvement, ultimately shaping their services around user expectations. A positive customer experience leads to higher retention rates, proving beneficial in today’s competitive landscape.

In conclusion, cross-border identity verification plays a vital role in global financial transactions by elevating both security and customer trust. As the financial landscape advances, institutions must leverage innovative technologies and establish robust verification processes. Addressing regulatory compliance and emphasizing customer experience will ensure that financial entities thrive in an interconnected world. The emphasis must be on creating adaptable solutions that cater to local and international laws while maintaining efficiency and accuracy. Enhanced identity verification is no longer merely a protective measure; it is integral to fostering a safe transacting environment. Stakeholders must recognize the necessity of collaboration in establishing best practices for identity verification globally. Educational initiatives can empower customers, ensuring that they actively participate in protecting their identities. Regular advancements in technology should be monitored closely, keeping up with emerging threats as well as regulatory changes. Financial organizations must be open to pivoting their strategies, promoting a forward-thinking approach to identity verification. By forging reliable partnerships, investing in staff training, and prioritizing customer experience, the finance sector can secure itself against potential risks while accommodating the needs of clients worldwide.

Future Trends in Identity Verification

Looking ahead, the future of identity verification in finance will likely see further evolutionary trends that enhance user experience and security. Advancements such as the implementation of artificial intelligence (AI) could revolutionize verification processes. AI algorithms can learn from vast amounts of transaction data and adapt to recognize suspicious patterns, which is crucial for mitigating fraud. Furthermore, innovations like cryptographic techniques may enable safer data sharing among authorized parties without compromising customer privacy. Enhanced biometric verification methods, including voice and gesture recognition, are emerging as reliable alternatives alongside existing solutions like fingerprints and facial recognition. Moreover, collaboration across borders will foster a more integrated approach to identity verification, creating a global framework for secure transactions. Expectations for privacy will continue to climb, demanding that institutions remain transparent about data handling practices. Lastly, user-centric designs that prioritize accessibility and simplicity will play a critical role in shaping future verification methods in finance. As trends evolve, ongoing adjustments will be indispensable in ensuring sustainable success and protection within the complex web of global financial transactions.