ESG Risk Management in Supply Chain Finance Operations

Supply Chain Finance (SCF) is increasingly influenced by Environmental, Social, and Governance (ESG) considerations. Companies in this sector face significant risks if they fail to address ESG factors effectively. These risks can manifest as regulatory compliance issues, reputational damage, and operational disruptions. Such challenges necessitate a robust framework for ESG risk management within SCF operations. A critical step in this process involves identifying the various ESG risks pertinent to the supply chain. Environmental risks, including climate change implications and pollution incidents, require careful assessment. Social risks involve labor practices and community impacts, while governance risks pertain to corporate ethics and transparency. Integrating ESG factors into financing strategies enables companies to navigate these complexities more effectively. By doing so, they can enhance their competitiveness while mitigating potential risks that may affect their operations or reputation in the long run. Furthermore, a commitment to ESG practices can also open up access to financing options tailored to organizations that demonstrate responsible and sustainable practices.

The role of technology in managing ESG risks is increasingly vital within supply chain finance operations. Companies are leveraging advanced analytics and big data to assess ESG compliance across their supply chains. This technology enables better monitoring of suppliers’ performances regarding environmental sustainability, labor practices, and governance standards. Additionally, innovative tools such as blockchain provide increased transparency in transactions, further enhancing trust between financial institutions and their clients. By utilizing these technologies, businesses can implement real-time tracking systems to ensure suppliers adhere to ESG criteria. This proactive approach can minimize potential risks associated with ESG failures. Furthermore, organizations can utilize technology to automate the collection and analysis of ESG data, enabling them to make informed decisions swiftly. Companies that integrate technology into their ESG risk management strategies can identify potential issues before they escalate. Consequently, this can result in cost savings, improved stakeholder relationships, and a stronger commitment to sustainable practices. To succeed in today’s challenging environment, companies must prioritize technological solutions that address their ESG concerns while delivering value to the supply chain.

Engaging Stakeholders for Effective ESG Practices

Effective ESG risk management requires active engagement with all supply chain stakeholders. This includes suppliers, financial partners, and customers who all play a crucial role in promoting responsible practices. By engaging stakeholders in the ESG conversation, companies can foster a more transparent and collaborative environment that promotes accountability. Regular communication and information sharing are essential for cultivating trust and demonstrating a commitment to sustainability. Initiatives such as supplier workshops and stakeholder forums can help gather input and facilitate dialogue regarding ESG goals and challenges faced in the industry. Furthermore, organizations can utilize surveys or feedback mechanisms to assess the ESG performance of suppliers, allowing them to embrace best practices within their operations. Involving stakeholders in the decision-making process ensures that diverse perspectives are considered and that strategies align with overarching sustainability objectives. Engaging key players not only enhances compliance with ESG criteria but also contributes to a positive impact on the broader community. This collaborative approach can significantly strengthen supply chain resilience and support the organization’s long-term growth.

Regulatory frameworks surrounding ESG practices in supply chain finance are evolving rapidly and present both challenges and opportunities for organizations. It’s essential for companies involved in SCF to stay informed about legislative changes that may impact their operations. Compliance with regulations can necessitate significant adjustments in processes and reporting requirements. However, these regulations can also serve as a catalyst for adopting best practices and enhancing transparency in supply chains. Failing to comply may lead to severe penalties, increased scrutiny, and damage to reputation. On the other hand, proactive engagement with regulatory changes can position organizations as leaders in ESG compliance. They can leverage this understanding to create competitive advantages and bolster their credibility in the marketplace. Additionally, implementing comprehensive compliance strategies can enhance a company’s eligibility for financing options associated with sustainable practices. In this context, companies in the realm of supply chain finance must integrate ESG considerations into their risk management frameworks to remain competitive and resilient amid increasing scrutiny and evolving regulations in the industry.

Building a Sustainable Supply Chain Network

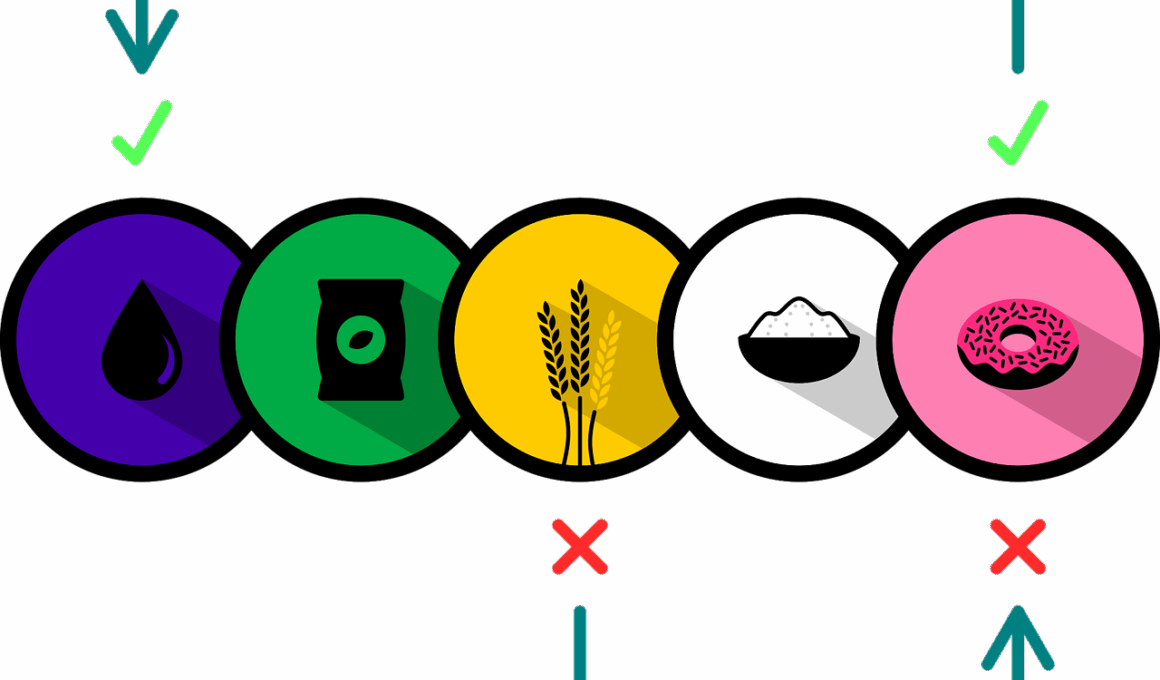

Building a sustainable supply chain network is an imperative for modern businesses, especially in the context of ESG risk management. Establishing a sustainable network involves selecting suppliers who adhere to environmental and social standards. This means assessing the entire supply chain for potential ESG risks and impacts. Companies must evaluate supplier practices regarding waste management, labor conditions, and emissions. Conducting audits regularly is crucial in ensuring that suppliers comply with these sustainability criteria. Moreover, organizations should invest in partnerships with suppliers who demonstrate a commitment to ESG principles and practices. Collaborating with these stakeholders can drive innovation, enhance sustainability efforts, and motivate suppliers who may lag in adopting sustainable practices. Additionally, organizations can set clear expectations for their supply chain partners, fostering continuous improvement in sustainability performances. By creating a network that prioritizes ESG factors, organizations can reduce risks associated with reputational damage and regulatory non-compliance. This proactive measure can enhance financial stability and growth potential while positively contributing to the communities in which they operate. Shared goals encourage a unified approach to achieving greater sustainability outcomes.

Measurement and reporting of ESG performance is vital for supply chain finance organizations. Establishing clear metrics allows organizations to assess their alignment with sustainability goals consistently. Key performance indicators (KPIs) can track environmental impact, labor conditions, and governance practices across the supply chain. Transparency in reporting creates accountability and fosters trust among stakeholders, including investors who are increasingly prioritizing sustainable investments. Companies are encouraged to adopt reporting frameworks that comply with global standards, such as the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB). By doing so, they can enhance credibility and showcase their commitment to ESG principles. Moreover, regular evaluations enable organizations to identify areas of improvement, set new goals, and celebrate successes. Developing a culture of excellence helps in reinforcing the significance of ESG practices within the company and across its supply chain. As businesses increasingly prioritize transparency in their operations, effective measurement and reporting will become key components in driving sustainable growth. They also allow organizations to communicate their progress and foster strong relationships with stakeholders committed to responsible finance.

Future Trends in ESG Risk Management

The future of ESG risk management in supply chain finance is poised for significant change as organizations adapt to emerging trends. Among these trends is a growing emphasis on technology and data-driven insights for identifying and mitigating ESG risks. As firms increasingly prioritize analytics, they will enhance their ability to monitor compliance and make informed decisions. Additionally, regulatory landscapes will evolve globally, creating a need for organizations to remain agile and responsive to new standards. Companies will also witness a surge in demand for sustainable finance products, such as green bonds, as stakeholders push for environmentally responsible investment offerings. This shift encourages organizations to embed sustainability practices into their financial strategies more deeply. Furthermore, collaboration across industries will become essential in sharing best practices and advancing ESG standards. Organizations will enhance their resilience by participating in sustainability consortiums and engaging with like-minded businesses. In this landscape, adopting a proactive stance on ESG risk management will distinguish successful organizations from their peers, promoting accountability, transparency, and long-term value creation.

In conclusion, effective ESG risk management in supply chain finance operations is a multifaceted challenge that organizations must navigate in today’s environment. It requires a commitment to incorporating sustainability practices at all levels of the supply chain. By actively engaging stakeholders, leveraging technology, and adhering to evolving regulatory requirements, organizations can mitigate risks and enhance their reputations. Furthermore, measuring and reporting ESG performance will play a crucial role in demonstrating accountability and progress. Looking ahead, organizations must remain flexible in response to changing trends and the increasing demand for sustainable practices. By prioritizing ESG considerations, companies not only contribute positively to society and the environment but also position themselves for long-term success and resilience in a competitive landscape. With an emphasis on collaboration and shared values, the future of supply chain finance can be transformed into a driving force for sustainable development. Organizations that embrace these practices strengthen their viability against ESG-related risks while fostering trust and respect among stakeholders. Ultimately, integrating ESG risk management is not merely an ethical obligation—it is a strategic imperative in the evolving supply chain finance landscape.