Monitoring Financial Performance Against Strategic Goals

Nonprofit organizations have a crucial need to monitor their financial performance continually against the backdrop of strategic goals. This characterizes the board’s essential responsibility, as it ensures that resources are allocated efficiently. Effective financial oversight enables boards to understand the financial health of the organization and its ability to meet strategic aims. Furthermore, the connection between financial performance and strategic direction helps the organization remain mission-focused. Boards should adopt financial performance metrics that align directly with their strategic goals. These metrics can include indicators like fundraising efficiency, program expense ratios, and reserve levels. Establishing clear benchmarks provides critical insights into performance trends over time. By assessing these metrics regularly, boards can identify areas needing attention, allowing for timely decision-making. Additionally, it promotes transparency among stakeholders, encouraging support and trust. In a dynamic environment, board members must be equipped with the right information. Access to real-time data enhances their ability to make informed choices that benefit the organization. Therefore, the commitment to meticulous monitoring underpins the overall health and longevity of the nonprofit, reinforcing its mission and strategic vision.

Setting appropriate financial goals is crucial for nonprofits aiming for meaningful impact. This requires a collaborative approach involving stakeholders from various levels within the organization. Boards should engage in strategic planning sessions to develop explicit financial objectives that resonate with the overarching mission. Identifying these specific targets enables organizations to align their financial resources effectively. Engaging staff in this process brings diverse perspectives, enhancing goal-setting. Boards will then benefit from a comprehensive understanding of operational needs and external factors influencing finances. Establishing a clear timeline for achieving these goals is equally important, as it allows the board to track progress. Regularly reviewing financial performance against these goals helps identify variances immediately, enabling corrective actions. The organization’s adaptability is key in a rapidly changing landscape. By fostering an environment that values scrutiny and accountability, boards position nonprofits to thrive amidst challenges. Moreover, strategic financial oversight often attracts funding opportunities. Funders appreciate organizations with clear plans and measurable outcomes, making them more likely to support such initiatives. Strong financial planning and performance monitoring ultimately lead to enhanced organizational resilience, ensuring nonprofits can respond adeptly to unexpected situations.

Key Performance Indicators in Nonprofit Finance

Identifying the right Key Performance Indicators (KPIs) is vital for effective financial monitoring. These KPIs, tailored to specific strategic goals, provide a framework for assessing success. Common KPIs include metrics such as revenue growth, expense management, and net assets over time. Boards should focus on a mix of quantitative and qualitative indicators that reflect both financial and mission-oriented outcomes. Regularly reviewing these KPIs fosters an agile response to financial fluctuations, allowing nonprofits to pivot when necessary. With the right technology in place, data can be analyzed efficiently. Dashboards can offer real-time insights, thereby simplifying complex data sets for board members. Integrating technology into financial oversight makes tracking easier and enhances comprehension. Further, these KPIs should be revisited periodically to ensure continued relevance as missions evolve. Engaging in discussions centered around these metrics during board meetings helps cultivate a culture of accountability. When members are informed and involved, they develop a holistic understanding of the implications of financial performance. Enhanced clarity leads to superior decision-making capabilities, ensuring that the organization maximizes its impacts and resources strategically.

Strong financial oversight entails not just monitoring but also anticipating future trends. Boards must stay ahead by reviewing historical data and current economic conditions. Understanding external factors helps frame the financial landscape in which nonprofits operate. For instance, shifts in donor behaviors can impact fundraising strategies significantly. By continually assessing these trends, boards position their organizations to capitalize on opportunities and mitigate risks. Establishing a financial forecasting model can help visualize the implications of various scenarios. This proactive approach allows for improved strategic planning, ultimately leading to more sustainable financial health. Furthermore, boards can communicate more effectively with stakeholders by demonstrating awareness of economic realities. Clear communication fosters greater trust, enhancing collaboration with funders and community partners. As nonprofits face evolving challenges, agility becomes a cornerstone of success. Emphasizing the importance of monitoring market trends encourages boards to adapt quickly, safeguarding mission integrity. By preparing for potential downturns, nonprofits can safeguard against unforeseen circumstances. This holistic approach underscores the importance of strategic foresight, reinforcing the board’s role in guiding the organization through an ever-changing landscape.

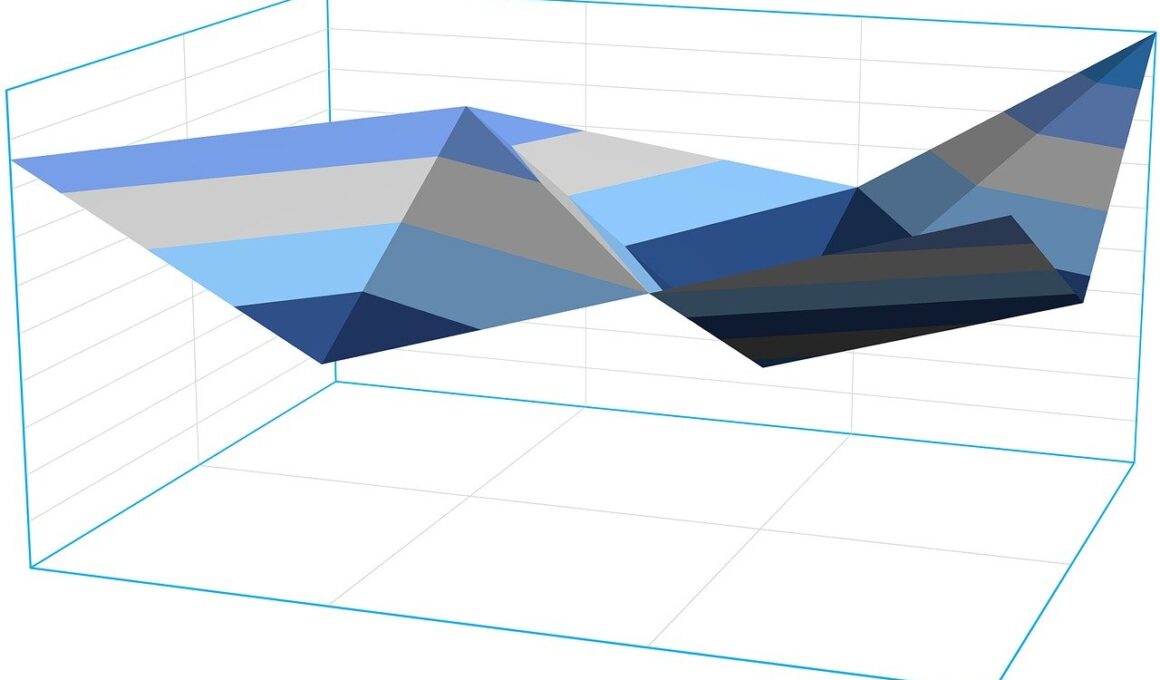

The Role of Financial Dashboards

Financial dashboards are invaluable tools that can enhance the board’s understanding of organizational performance. They convert complex financial data into visually appealing summaries, enabling quick assessments. A well-designed dashboard may illustrate trends, provide comparisons against targets, and highlight urgent areas needing intervention. Boards should prioritize the creation of custom dashboards tailored to their specific financial goals. By leveraging visual analytics, members can grasp insights more rapidly, facilitating more effective discussions in meetings. Regular updates to dashboards ensure that the information remains timely and relevant. Additionally, fostering familiarity with these tools among board members enhances their confidence in decision-making. Training sessions can empower members to utilize these dashboards fully, cultivating financial literacy within the board. This ultimately leads to a more prepared board that is engaged in conversations surrounding financial oversight. Accurate and accessible data increases accountability and transparency. Stakeholders appreciate when boards demonstrate a thorough understanding and management of finances. By consistently leveraging dashboards, nonprofits can navigate their financial landscapes proactively, ensuring that boards can uphold their fiduciary duties effectively. This innovative approach transforms raw data into strategic action, enhancing the organization’s operational efficiencies.

Engaging with stakeholders is an integral part of monitoring financial performance effectively. This includes not only board members but also staff, donors, and community partners. By establishing open communication channels, organizations can ensure that financial insights are shared widely and understood. This transparency fosters a collaborative environment where all parties are aligned with strategic financial goals. Regular stakeholder meetings can serve as platforms for discussing financial updates and metrics. Involving stakeholders in these discussions promotes collective accountability, ensuring a deeper commitment to organizational objectives. Furthermore, surveys can solicit feedback on financial processes, providing additional insights into areas for improvement. By valuing input from diverse perspectives, boards can make well-rounded decisions that reflect the communal vision. Additionally, maintaining relationships with funders and community leaders enhances support for financial initiatives. These connections can lead to new funding opportunities, further strengthening financial health. It is essential for nonprofits to illustrate how they achieve financial goals related to their missions. By communicating successes widely, organizations can cultivate trust and encourage continued investment in their objectives. Such collaboration ultimately positions nonprofits to achieve greater impact and resilience in executing their strategic plans.

Continuous Improvement Through Financial Reviews

Regular financial reviews are critical for fostering a culture of continuous improvement within nonprofits. By systematically assessing performance against financial goals, boards can identify best practices and areas for development. Implementing recurring financial reviews enables organizations to refine their strategies over time. These sessions should not just focus on metrics but also explore underlying factors influencing performance. Engaging staff in interpretative discussions about performance fosters a culture of learning and aligned thinking. Furthermore, conducting impact assessments can elucidate the relationship between financial activities and strategic outcomes effectively. This feedback loop enhances organizational understanding, paving the way for future innovations. In addition, these reviews create opportunities to celebrate financial successes, reinforcing positive behaviors among staff and stakeholders. Acknowledging achievements can spur further commitment to financial objectives. Boards should approach evaluations constructively, encouraging dialogue rather than solely critiquing performance. This fosters a collaborative environment in which everyone feels invested in the organization’s mission. Over time, a proactive review culture enhances both financial discipline and mission alignment. By remaining open to feedback and adapting strategies based on findings, nonprofits can navigate complexities efficiently while promoting sustained growth and impact.

The ongoing evolution of nonprofit finance demands agile approaches to monitoring financial performance. Boards must equip themselves with updated knowledge and tools to address future challenges. This involves cultivating strong relationships with financial experts, consultants, and peers within the sector. Leveraging external expertise provides fresh insights and benchmarking opportunities against industry standards. Regular training sessions can further enhance a board’s financial acumen, ensuring they stay well-informed on relevant regulations and practices. As nonprofits face fluctuating economic conditions, financial resilience becomes paramount. Boards should continually evaluate their risk management processes to ensure organizational sustainability. Additionally, sharing resources and practices across nonprofit networks can lead to sharing innovative monitoring strategies. Collaboration strengthens sector-wide capabilities, driving collective improvement in financial oversight. By attending workshops and conferences, board members gain exposure to best practices and innovative solutions. These efforts reinforce the commitment to continual professional development. An informed board is more likely to make sound financial decisions that align with strategic goals. Ultimately, fostering a culture of lifelong learning enhances the effectiveness of nonprofit governance. As such, nonprofits can systematically improve their financial oversight, ensuring they remain responsive and relevant in fulfilling their missions.