Improving Cash Conversion Cycle with Supply Chain Finance Software

To achieve enhanced efficiency in the cash conversion cycle, businesses must leverage advanced Supply Chain Finance software solutions. These tools streamline processes that traditionally slow down the flow of cash, impacting operations and profitability. By integrating such solutions, companies can effectively manage inventory levels, optimize payment terms, and reduce days sales outstanding (DSO). Additionally, these software platforms provide key insights through robust analytics, offering a clear view of cash flow and supply chain status. Utilizing these tools allows organizations to predict cash needs more accurately, thereby improving liquidity management. Furthermore, reducing the cash conversion cycle not only elevates working capital but also enhances supplier relationships. Timely payments promote trust and build stronger partnerships. These software solutions enable buyers to negotiate extended payment terms while ensuring suppliers remain satisfied. As a result, both parties benefit from an optimized cash flow scenario that enhances overall business performance. Proper design and implementation of these solutions lead to real operational efficiency, significant savings on financing costs, and a competitive edge in the marketplace, paving the way for sustained growth and success in an increasingly dynamic business environment.

The impact of Supply Chain Finance software on working capital management cannot be overstated. This technology empowers organizations to achieve a more sustainable balance between their assets and liabilities, driving consequential financial advantages. For instance, businesses utilizing these solutions can increase the visibility of their cash flows and inventory, thereby making more informed financial decisions. By automating aspects of the supply chain, companies can minimize manual errors and reduce processing times. Such advancements lead to quicker invoicing and accelerated payments. Moreover, these software platforms facilitate real-time updates, enabling companies to adapt quickly to market changes. With users equipped to monitor KPIs and adjust strategies effectively, the likelihood of cash shortages diminishes significantly. Additionally, enhanced forecasting capabilities allowed by Supply Chain Finance software lead to accurate predictions regarding cash needs. Successful companies capitalize on their data to improve efficiency and deploy smarter financing strategies. Those strategies contribute to a better working capital position that supports growth initiatives. Therefore, investing in these software solutions is not merely an operational change; it directly influences a company’s financial health and sustainability, fostering long-term profitability and stability in an ever-evolving marketplace.

Integration of Supply Chain Finance software solutions into existing platforms is achieving increasing importance for businesses. It allows companies to blend systems that manage procurement, inventory, and finance into a seamless experience. Organizations that successfully implement these integrations benefit from improved data consistency and reduced risk of errors. This, in turn, leads to improved decision-making capabilities. Furthermore, adopting integrated systems enhances collaboration between departments, as key players across functions can access unified information in real time. These collaborative efforts lead to more aligned strategies that support overall business objectives. Employees become empowered to act swiftly on insights derived from up-to-date data. As organizations respond to financial challenges effectively, the transparency fostered by Supply Chain Finance software strengthens stakeholder confidence. In addition, seamlessly integrated platforms greatly simplify compliance and audit processes. When data flows freely between systems, it diminishes the burden of reporting requirements. Overall, the integration of Supply Chain Finance software is vital for optimizing operations and enhancing the financial performance of organizations. As businesses continue evolving, embracing integration is the cornerstone of building a resilient and agile supply chain capable of navigating complexities.

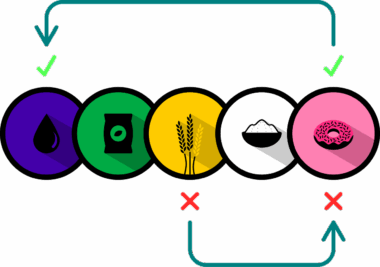

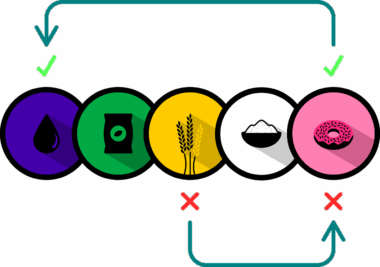

Another significant advantage of utilizing Supply Chain Finance software is the enhancement of supplier financing options. Companies can leverage these platforms to arrange early payment programs that benefit suppliers directly. In these arrangements, suppliers receive payments ahead of standard payment terms, which enhances their cash flow and financial stability. In exchange, suppliers may offer discounts or favorable terms, further improving the buyer’s overall costs. Such win-win scenarios promote stronger supplier relationships and foster loyalty, ensuring reliability over time. Additionally, these early payment solutions often translate into lower interest expenses for companies, as they can strategically manage outflows more efficiently. The access to diverse financing options provided through the software simplifies the process of selecting the best solution. Suppliers gain flexibility, while buyers benefit from cost reductions and reduced supply chain risks. As companies increasingly adopt technology-driven financing methods, competitive advantages continue to emerge. Evaluating and selecting the right Supply Chain Finance solution is crucial for achieving these benefits. Companies that engage in early payment programs experience more resilient supply chains, reinforced by financial partnerships geared towards mutual growth, leading them toward operational excellence in today’s markets.

The Role of Technology in Supply Chain Financing

Technology fundamentally shifts how Supply Chain Finance operates, primarily through cloud-based solutions enhancing accessibility. This transformation allows businesses to connect with suppliers and finance partners in a unified platform, improving efficiency. Cloud-based systems enable real-time data exchange and analytics, allowing stakeholders to understand cash flow dynamics better. With enhanced visibility into transactions, companies can manage payment schedules proactively, avoiding cash shortages. Moreover, technology allows organizations to automate reconciliation processes and generate comprehensive reports that enhance strategic decision-making. By deploying Supply Chain Finance software, businesses gain a competitive edge as they can respond to market fluctuations with agility. Additionally, advancing technology creates opportunities for predictive analytics, enabling organizations to anticipate their financing needs and plan accordingly. Such insights lead to improved risk assessment and management, which is vital for sustaining relationships among buyers and suppliers. The interconnectivity afforded by these solutions fosters collaboration and transparency, ultimately creating more resilient supply chains. Embracing technological advancements empowers companies to not just survive but thrive. As Supply Chain Finance evolves, organizations must embrace these innovations, positioning themselves for growth in a fast-paced and shifting landscape within their industries.

The integration of sustainability initiatives with Supply Chain Finance software further enhances overall operational performance. Today’s consumers and stakeholders increasingly demand responsible practices that reduce environmental impacts. These software solutions enable businesses to gain insights into their supply chains, highlighting areas where sustainability improvements can be made. For instance, companies can evaluate supplier performance based on sustainability metrics, ensuring that finance decisions align with responsible sourcing practices. Furthermore, incorporating such metrics into financial analyses encourages suppliers to adhere to environmentally-friendly practices. This alignment not only supports corporate social responsibility but also opens pathways for new partnerships and collaborations with environmentally-conscious businesses. Moreover, sustainable supply chains positively affect brand reputation and customer loyalty, essential factors for long-term success. Companies focusing on sustainable Supply Chain Finance strategies position themselves as industry leaders who act responsibly towards the environment. This proactive approach meets the expectations of stakeholders while also driving efficiency and reducing costs through optimized resource utilization. Ultimately, integrating sustainability into Supply Chain Finance software solutions proves beneficial not only for companies but also for the planet, showcasing a commitment to a better future.

In conclusion, enhancing the cash conversion cycle through Supply Chain Finance software is crucial for today’s businesses striving for efficiency. By adopting these sophisticated solutions, organizations can significantly optimize cash flow management, improve supplier relations, and streamline financing options. The ability to harness data effectively allows businesses to make strategic decisions that improve operational performance and drive profitability. Additionally, integrating sustainability initiatives presents an opportunity for companies to strengthen their market position while catering to growing consumer demands for responsible practices. Furthermore, the technological evolution in Supply Chain Finance provides advanced capabilities for real-time analytics and collaboration. Companies adopting these innovations foster resilience in their supply chains, enabling them to navigate challenges with ease. Ultimately, leveraging Supply Chain Finance software is not just about technological adoption; it represents a strategic transformation that lays the foundation for future growth and success. As organizations evolve in an increasingly competitive landscape, the emphasis on cutting-edge solutions will be paramount in determining their short-term and long-term outcomes. The journey towards enhanced cash management, improved supplier relationships, and sustainability will ultimately serve as the catalyst for ongoing success in today’s dynamic business world.