GAAP Principles in Revenue and Expense Recognition

Generally Accepted Accounting Principles, or GAAP, are essential frameworks guiding the accounting practices of organizations in the United States. These principles provide rules and guidelines to ensure that financial statements are accurate, transparent, and comparable across entities. A core aspect of GAAP is the recognition of revenue and expenses, significantly influencing companies’ financial health and performance assessments. Revenue recognition involves recording revenue when it is earned, not necessarily when cash is received, aligning with the accrual basis of accounting. This concept helps businesses report their actual financial performance more accurately. On the other hand, expense recognition mandates that expenses should also be recorded when incurred, irrespective of when payment occurs. Together, these principles help mitigate misstatements and provide a clear picture of financial results, ensuring stakeholders can make informed decisions. GAAP also sets standards that help harmonize practices with International Financial Reporting Standards (IFRS), which can be crucial for global businesses. Understanding these principles is vital for accountants to ensure compliance while preparing financial statements. Therefore, it’s essential for anyone involved in finance to grasp these foundational concepts.

Key GAAP Principles in Revenue Recognition

The revenue recognition principle under GAAP outlines specific criteria that must be met before revenue can be recognized. This includes identifying the contract with a customer, determining performance obligations, and determining the transaction price. It is crucial for businesses to understand that not all revenue can be recognized immediately; it must be recognized as the performance obligations are satisfied over time or at a point in time. GAAP allows for different methods of revenue recognition, such as over time for long-term contracts or at delivery for products. This framework ensures that revenue is reported in a manner that faithfully reflects the timing of revenue realization. Additionally, the principle prohibits the recognition of revenue based solely on cash receipts. By following these guidelines, companies can avoid potential overstatements of revenue, which can mislead investors and skew financial ratios. This adherence significantly increases the reliability of the financial statements, enhancing stakeholder confidence. Misapplying the revenue recognition principles can lead to severe consequences, including financial penalties and damage to reputation, highlighting the importance of rigorous financial practices.

Another critical aspect of GAAP in revenue recognition is the treatment of bundled contracts or multiple-element arrangements. When a company sells multiple products or services as a single package, it must allocate the transaction price to each distinct performance obligation based on their relative standalone selling prices. This allocation requires careful assessment to ensure compliance with GAAP principles. For example, if a software company sells a subscription service bundled with training sessions, it must recognize revenue separately for the subscription and the training as each service is delivered. Accurately allocating revenue helps present a more truthful representation of the company’s financial position, ensuring that stakeholders see income attributed accurately. The use of this methodology directly aligns with the principles of consistency, transparency, and comparability embodied in GAAP. By following these protocols, firms can enhance their credibility with investors and regulatory bodies. As businesses evolve, complexities in revenue generation arise, making ongoing education on these principles critical for finance professionals wanting to maintain compliance while navigating intricate financial landscapes.

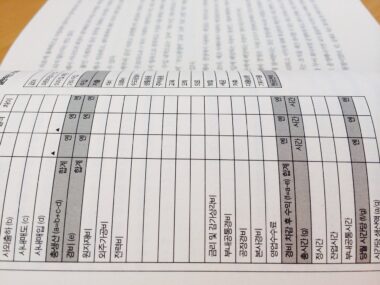

Expense Recognition Principles

Expense recognition under GAAP follows the matching principle, which requires that expenses be recognized in the same period as the revenues they help generate. This approach ensures a fair representation of a company’s profitability for each accounting period. Understanding how to appropriately match costs and revenues is vital for accurate financial reporting. For instance, if a business incurs costs to produce goods, these expenses should be recorded in the same period the goods are sold, not when the costs were paid. This allows stakeholders to understand the business’s operational efficiency better and evaluate its financial performance. Moreover, GAAP provides guidelines on specific expense categories, including inventory costs and long-term assets depreciation. Companies must account for expenses systematically to comply with GAAP, which often involves complex calculations, particularly related to depreciation and amortization of assets. As different industries have varying accounting methodologies and standards, it is critical for professionals to understand industry-specific guidelines to ensure compliance. This understanding bolsters financial accuracy and instills confidence in the financial statements provided by the organization.

In addition to the matching principle, the cost principle plays a significant role in expense recognition under GAAP. This principle dictates that expenses are recorded at their actual costs rather than indicating future value potential. For example, if an organization purchases a building for $2 million, that amount is recorded as an expense, even if its market value increases over time. This principle helps ensure that financial statements reflect what the company has spent, which prevents inflated profit margins and unrealistic projections. It serves as a safeguard for stakeholders against misleading information. Furthermore, adhering to the cost principle fosters uniformity in financial reporting, as different entities will report expenses consistent with the actual costs incurred. Clarity and honesty in expense reporting are crucial for maintaining the trust of investors, regulators, and other stakeholders. In instances of inflated asset values or erroneous capitalizations, companies may face significant risks, including loss of credibility and financial penalties. Therefore, understanding and implementing GAAP principles is essential for the integrity of financial statements.

Implications of GAAP on Financial Statements

The implementation of GAAP principles has profound implications on a company’s financial statements. These accounting standards shape how financial information is presented, ensuring consistency and comparability across periods and organizations. By adhering to GAAP, businesses provide an accurate portrayal of their financial positions, allowing stakeholders to rely on the data presented in the reports. This reliability enhances the validity of assessments and comparisons made between current and previous performance, as well as with other similar organizations. The clarity provided by GAAP also streamlines the process of financial modeling and forecasting. Investors frequently analyze financial statements to make informed investment decisions, so understanding GAAP principles can significantly affect a company’s attractiveness to potential investors. Consequently, companies that maintain strong compliance with GAAP not only fulfill regulatory requirements but also enhance their market image. Transparency in financial reporting fortifies investor confidence, potentially leading to better capital access and market performance. This illustrates the ripple effect GAAP compliance has on overall business success, emphasizing its importance in the accounting ecosystem.

Despite the numerous benefits, applying GAAP principles can pose challenges to organizations, particularly smaller businesses with limited resources. Maintaining compliance demands a significant commitment of time and expertise, as companies must regularly update their accounting practices to reflect any changes in GAAP standards. Moreover, the complexity of certain GAAP provisions can overwhelm accountants, especially for those without extensive training in current regulations. However, embracing these challenges can lead to more robust financial management practices and improved business operations. Utilizing technology, such as accounting software solutions aligned with GAAP, can help businesses streamline their processes and reduce compliance burdens. By integrating these tools, companies can automate many aspects of financial reporting and ensure adherence to value-driven accounting practices. Regular training and consultations with industry professionals can also enhance understanding and implementation of GAAP standards. Ultimately, organizations must see GAAP compliance as an investment in their financial stewardship rather than a burden. Adopting a proactive approach towards compliance can lead to better decision-making and superior financial outcomes.

Conclusion: The Importance of Understanding GAAP

In conclusion, understanding the principles of GAAP regarding revenue and expense recognition is crucial for anyone involved in finance and accounting. These principles not only ensure compliance with regulations but also help maintain transparency, enabling accurate financial reporting. They form the backbone of sound financial practice, assisting companies in building trust with stakeholders. By recognizing revenue accurately and matching expenses appropriately, organizations can provide a true reflection of their financial performance. The repercussions of failing to comply with GAAP can be severe, ranging from financial penalties to loss of investor confidence. For prospective accountants or business professionals, a solid grasp of GAAP is not just beneficial, it is essential for career growth. Consequently, continuous education and training in these standards will empower finance professionals to navigate complexities in financial reporting. Businesses that prioritize adherence to GAAP will likely achieve greater operational efficiency and profitability over time. Thus, investing in understanding these principles is vital not only for compliance but also for optimizing financial strategies for the future.