Integrating Supply Chain Finance Software with Payment Platforms

Integrating supply chain finance software with payment platforms is increasingly crucial for organizations aiming to enhance financial efficiency. This technology allows businesses to automate payments, optimize cash flow, and improve supplier relationship management. A seamless integration between these systems can lead to significant operational efficiencies. Companies can expect to reduce payment processing times while also increasing accuracy. Implementing such integrations enables real-time tracking of invoices and payments, which is beneficial for all parties involved. Additionally, organizations can benefit from enhanced visibility over their financial transactions. By utilizing both supply chain finance software and payment platforms together, businesses can build a comprehensive financial ecosystem. This integration not only bolsters transaction security but also ensures compliance with financial regulations. Furthermore, the use of data analytics within these systems can provide insights into spending patterns and cash flow trends. Identifying supplier performance metrics and payment trends will enable strategic decision-making. The final result leads to a healthier financial state while fostering better collaborations with suppliers, ensuring a win-win situation in the supply chain.

Effective supply chain finance software solutions transform procurement and payment processes, delivering remarkable advantages. Many organizations now realize the necessity for software that interfaces well with popular payment platforms. Businesses need to select solutions that provide customizable features tailored to their specific needs. Ensuring that the software efficiently connects with existing payment systems creates a more efficient workflow. With internet-based technologies becoming prevalent, deploying cloud-based solutions is a popular choice. These solutions offer flexibility and scalability while amassing financial data from various sources. Enhanced reporting capabilities enable managers to oversee expenditures in real-time, empowering data-driven decisions. Security remains a primary concern as cyber threats evolve. Reliable supply chain software implements stringent security protocols to safeguard sensitive information. Customer support and technical assistance are equally essential factors in choosing the right software. A solid support network allows users to resolve any issues expediently. Companies should look for providers that showcase comprehensive service packages, including setup, training, and ongoing assistance. When supply chain finance software is effectively integrated, it elevates operational excellence, driving profitability and sustainability across the organization.

Collaboration between supply chain finance software and payment platforms offers numerous benefits for organizations. One key advantage is the enhancement of liquidity management. Optimized working capital allows businesses to allocate resources more effectively, ensuring that they can react swiftly to market fluctuations. The ability to pay suppliers promptly can foster stronger relationships, driving innovation and partnerships. Moreover, accurate forecasts become achievable when payment data is readily accessible. Incorporating advanced analytics into the finance software allows for more precise cash flow predictions. Companies can develop strategies to optimize financial resources fluidly. Enhanced visibility into their financial commitments can create a more robust approach to risk management. With the automation of routine tasks, organizations can redirect focus toward strategic initiatives. This shift triggers a more proactive approach to financial planning and operational strategies. A combined approach also streamlines reconciliation efforts, fostering efficiency in the accounting processes. In addition, organizations can diversify their funding channels, catering to various suppliers and buyers. Companies are better equipped to address market demands swiftly while maintaining financial stability. An integrated system fosters a collaborative environment that ultimately leads to sustainable growth.

Challenges in Integration

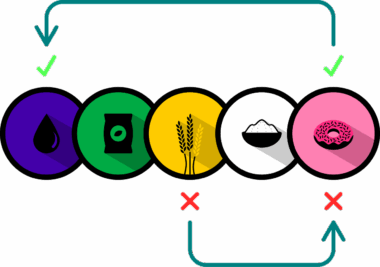

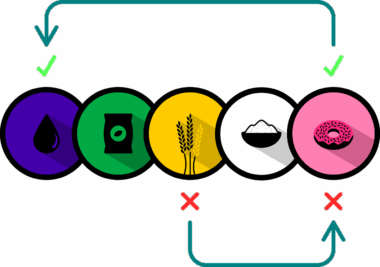

While integrating supply chain finance software with payment platforms presents several opportunities, it also brings inherent challenges. Not all organizations possess the necessary technological infrastructure to implement such integrations seamlessly. Ensuring compatibility between different systems is paramount, which requires thorough assessment and analysis. Resistance to change within teams can become an obstacle; thus, stakeholder engagement is crucial during transition phases. Comprehensive training programs ensure that employees understand how to utilize new technologies effectively. Another challenge is data security, especially when transferring sensitive financial information. Businesses must employ robust cybersecurity measures to mitigate risks and protect against breaches. Regulatory compliance should not be overlooked either; companies must ensure that their systems adhere to relevant laws governing finance and data protection. The implementation timeline can also pose challenges as businesses juggle existing processes while transitioning to new systems. Companies may experience temporary disruptions to cash flow during the initial integration period. Therefore, meticulous planning and communication are vital. By addressing these challenges proactively, organizations can significantly enhance their chances of a successful integration.

Continuous improvement mechanisms are essential for optimizing the integration of supply chain finance software with payment platforms. Organizations should regularly evaluate the performance of these integrated systems to identify areas for enhancement. This iterative approach allows companies to adapt to changing market conditions and technological advancements. Feedback loops from employees, suppliers, and clients can provide valuable insights into various aspects of the integrated systems. Regular audits and assessments are necessary to ensure all components operate cohesively. Benchmarking performance can help organizations set realistic goals for future improvements. As new features and technologies emerge, businesses must stay abreast of developments in the fintech landscape. Ensuring that the supply chain finance software evolves alongside payment systems is critical for maintaining competitiveness. Implementing agile methodologies can facilitate adaptive planning; organizations can more readily respond to shifts in financial technology or market demands. This commitment to continuous improvement fosters a culture of innovation, ensuring ongoing success. Moreover, leveraging partnerships with technology providers enhances the overall capabilities of integration. Building relationships with fintech firms creates opportunities for co-development and tailored solutions that meet specific business needs.

Adopting integrated supply chain finance and payment platforms can significantly influence a company’s overall performance. By fostering operational efficiency, companies can reduce processing time and avoid costly errors. Rapid payments to suppliers also enhance operational relationships, creating a win-win scenario. The potential for improved working capital management cannot be understated; organizations benefit from optimized cash flows that stabilize financial performance. Accurate and timely payment data enables forecasting with higher precision, helping managers to strategize effectively. Simplifying audits through consolidated systems saves valuable time and resources while increasing compliance accuracy. Furthermore, organizations that invest in integrated systems showcase a commitment to leveraging technology for competitive purposes. Achieving such objectives contributes not only to logistical improvements but also boosts employee morale as task automation offers time for strategic projects. The long-term viability of partnerships with suppliers and clients creates further advantages. Improved financial stability leads to more significant collaboration opportunities, driving sustainable growth. Ultimately, the holistic approach offered by integrating these systems creates lasting benefits, enhancing overall supply chain resilience and agility. As organizations adapt to a technology-driven operational world, such integrations become essential.

Conclusion and Future Directions

In conclusion, the integration of supply chain finance software with payment platforms represents a significant advancement in the financial management of enterprises. Embracing such technology is no longer a luxury but rather an imperative for organizations aiming to remain competitive. With ongoing advancements in technology, the potential for greater integration will continue to grow. Future developments might include enhanced AI capabilities that predict market fluctuations, ensuring smart financial decisions. Furthermore, as organizations develop their digital strategies, the concept of fully integrated ecosystems will become clearer. The flexibility offered by cloud solutions will allow businesses to adapt more easily to demand changes while managing finances effortlessly. Businesses must prioritize understanding customer needs when integrating these systems further. By effectively addressing these needs, organizations can create aligned solutions that enhance user experience significantly. The role of data analytics cannot be overlooked; leveraging insights leads to improvement across various operational domains. The importance of ensuring compliance with regulations will remain crucial as financial landscapes and legal requirements evolve. In summary, integrating supply chain finance software with payment platforms will pave the way for improved organizational efficiency in the years to come.