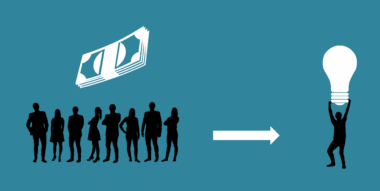

Bootstrap Fundraising: How to Attract Investors Later

Bootstrapping your startup lays a strong foundation for growth. It encompasses self-funding and reinvestment of profits to maintain control and equity. When you bootstrap, you avoid the pressure from external investors. This decreases dependence on external capital while fostering innovative ways to enhance revenue generation. This approach emphasizes building a profitable business organically without relying on loans or investments from venture capitalists. Moreover, it helps validate your startup concept, proving that it can stand on its own merits. This validation is crucial when attracting future investors later on. As your business grows, this self-sustained model becomes attractive to potential investors interested in profitability. By starting small and scaling carefully, you can demonstrate strong financial health over time. This not only shows potential investors your commitment but also serves as proof of your business model’s viability. Remember, a well-run bootstrap operation can reflect positively on future fundraising endeavors, indicating to investors that your startup is worth the risk. By establishing this track record, you increase your attractiveness to investors who prefer to back companies with proven stability and cash flow.

Understanding the Benefits of Bootstrapping

Bootstrapping allows founders to maintain full control over their business operations. When you control your company’s direction, you’re free to make decisions aligned with your vision rather than the interests of external investors. This independence can foster creativity and innovation, essential traits in the startup world. Furthermore, bootstrapped startups often develop a more disciplined approach to resource allocation. Since funds are limited, every expense must be justified, which can enhance operational efficiency. This financial prudence instills a culture of accountability, as every team member understands the importance of maintaining cash flow. Additionally, without investor pressure, founders can focus on long-term strategies rather than short-term results. This mindset is crucial when navigating the unpredictable landscape of entrepreneurship. Moreover, having a sustainable revenue model allows the startup to experience less volatility during challenging economic times. Founders who bootstrap often become highly adaptable, knowing that stability is built through careful management. They can leverage this knowledge when presenting to future investors, showcasing resilience, and an ability to thrive under pressure, thus making a compelling case for their investment.

Establishing a robust business model is paramount when starting out. Take the time to identify who your customers are and what problems your product solves for them. This clarity will help you tailor your offerings effectively, making it easier to attract paying customers. A strong value proposition will set your startup apart from competitors. Regularly gather feedback and be prepared to make adjustments based on market demands. Iterate your product based on real user experiences to ensure it meets their needs efficiently. Track customer satisfaction metrics and focus on retention strategies. Satisfied customers are far more likely to recommend your product to their networks. An effective marketing strategy can significantly boost your business traction and revenue. Utilize low-cost or free marketing channels, such as social media for outreach. Engage customers through consistent content marketing practices, such as blogging and email newsletters. This builds a community around your brand, thus increasing visibility. Ultimately, your goal should be to create a sustainable model that generates cash flow independently. This will demonstrate to potential investors that you can manage resources wisely and make informed decisions that lead to profitability.

The Power of Networking

Building a solid network can be invaluable during your bootstrapping journey. Engage with local startup communities, professional organizations, or entrepreneurial meet-ups. Networking allows for sharing ideas, resources, and feedback that can enhance your business concept. Additionally, connections can lead to mentorship opportunities. Mentors can provide guidance based on their experiences, helping you avoid common pitfalls. These relationships often become influential when seeking funding later since mentors may have networks that include investors looking for promising startups. Do not hesitate to utilize digital platforms for networking, such as LinkedIn or industry-specific forums. Building an online presence can expand your reach beyond geographical boundaries. Participate in discussions and showcase your expertise to build your brand and attract potential investors. Engaging actively in discussions can lead to collaborations, partnerships, or even initial seed funding. Always follow up with new connections, expressing genuine interest in their work. This fosters a sense of camaraderie and positions you well in their minds when opportunities arise. Remember, successful entrepreneurs often rely heavily on their connections, and your network can provide critical leverage in your fundraising efforts.

Leveraging technology is a crucial aspect of scaling your bootstrap startup effectively. Utilize digital tools for seamless operational management, marketing, and customer relationship management. By adopting cost-effective software solutions, you can automate repetitive tasks, thus saving valuable time and resources. Explore options like cloud storage for data management and project management tools for team collaboration. Invest time into learning about data analytics to better understand customer behavior and preferences. This knowledge allows you to personalize the customer experience and improve retention rates. Furthermore, incorporating e-commerce platforms can significantly widen your market reach, especially if your product is digital. Utilize SEO strategies on your website to improve visibility on search engines. High organic search rankings can lead to increased traffic without additional advertising expenses. Implementing these technological strategies can enhance both customer experience and operational efficiency. When you eventually pitch to investors, you’ll have a tidily managed, data-driven company to showcase. Your ability to use resources effectively indicates sound operational leadership—an attractive trait for potential investors.

Financial Planning and Management

Effective financial management is vital for bootstrapped startups. Create a detailed budget that accounts for all operational costs, projecting them against potential revenues. This will give you a clear picture of your cash flow, helping you make informed decisions. Track every dollar spent to understand where your funds go. Adjust your strategies based on your financial performance metrics to avoid unnecessary shortfalls. Understand the importance of maintaining a cash reserve for unforeseen challenges, ensuring that your startup stays afloat. Furthermore, consider pursuing additional revenue streams. Diversifying your income sources can provide a safety net, especially during slower months. Identify complementary products or services that align with your main offerings. Ensure that any new initiatives align with your overall business strategy while adding value. Good financial planning also prepares you for when you’re ready to attract investors. Showcasing detailed financial records and forecasts highlights your operational strength. This planning reassures investors that you understand your financial landscape, reducing their perceived risk of investing in your business.

As you prepare to attract investors, storytelling plays a crucial role in conveying your startup’s vision. Your narrative should articulate your journey, the problems you aim to solve, and the tangible impact you’ve made. A compelling narrative makes it easier for investors to connect with your mission on a personal level. Prepare a clear pitch deck that highlights key metrics, financial predictions, and future milestones. Utilize visual aids to enhance engagement and interest during presentations. Regularly practice your pitch to build confidence and address any potential questions investors may have. Be prepared with data-driven insights that validate your claims. The more compelling your story and accompanying data, the more likely you will engage investors authentically. This preparation is critical to successfully navigating the pitching process. Emphasize your unique selling proposition to make it stand out. Investors see numerous pitches; your goal is to present a narrative that resonates emotionally and professionally. A well-crafted pitch can open doors to funding opportunities, enriching your bootstrap journey and propelling your startup towards growth and sustainability both now and in the future.

Once you secure funding from investors, you need to prioritize maintaining transparency to build trust with them. Regular updates on milestones achieved and financial progress can significantly enhance your relationship with investors. As your startup grows, ensure that their expectations regarding returns align with your operational goals. It’s crucial to be upfront about any challenges faced along the journey and the measures you plan to implement to address them. This open communication fosters respect between you and your investors, creating a partnership-based approach to your business. Remember that investors appreciate when founders take responsibility for their choices, as it demonstrates leadership and accountability. This sense of ownership will also make investors feel valued, often leading to a willingness to provide additional support or resources. Additionally, seek feedback from them to enhance your strategic decisions, integrating their insights into your business operations. Never underestimate the potential of investors as advisors. They can offer invaluable industry connections and advice essential for navigating future challenges. Balancing the expectations of investors while prioritizing your vision will ultimately lead to a harmonious relationship that enriches both parties significantly.