Executive Compensation and Corporate Governance: Balancing Incentives and Risks

Executive compensation represents a crucial element in corporate governance frameworks. It aims to align the interests of top management with those of shareholders, minimizing potential agency conflicts. In this regard, compensation packages typically include a mix of salary, bonuses, stock options, and various incentives designed to motivate executives towards enhancing company performance. However, the absence of proper structure and oversight can lead to unintended consequences, such as excessive risk-taking or short-termism. A primary objective of compensation strategies is to promote sustainable growth while ensuring that executives remain accountable. The effectiveness of these packages largely depends on their design, including metrics used for performance evaluation and the duration of the incentives. Moreover, regulatory frameworks and market conditions further influence compensation practices and can facilitate productive governance. Shareholders play an essential role in this process, demanding transparency and fairness in how executives are rewarded. Therefore, it is vital for boards to strike a balance between enticing talent and mitigating significant risks that may jeopardize long-term corporate health. This ongoing evolution in governance practices requires constant engagement from all stakeholders, including regulators and institutions.

The Role of Incentives in Executive Behavior

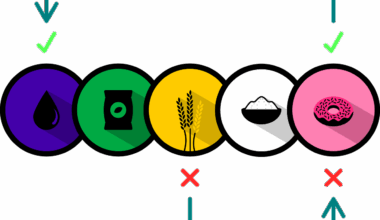

Incentives are pivotal in influencing executive behavior, and understanding their impact is essential for effective governance. Performance-based compensation structures generally motivate executives to pursue strategic initiatives that build shareholder value. These incentives should encourage long-term thinking rather than a focus on short-term gains. However, poorly designed compensation schemes can lead to adverse outcomes, such as excessive risk-taking behaviors. For instance, in the case of stock options, executives might prioritize immediate stock price increases over the organization’s sustainable development. This incentive misalignment can have detrimental effects on overall corporate performance. It is therefore crucial that boards develop compensation strategies that not only reward performance but also promote safe and sustainable risk management. Furthermore, stakeholder engagement, including active investor participation, can help reinforce these goals. Companies must also be mindful of public perception and ethical considerations surrounding executive pay. High levels of transparency and clear communication regarding compensation packages can mitigate potential backlash from shareholders and the market. Thus, governance frameworks must continually adapt to address these complexities, ensuring that incentives drive desired outcomes while keeping risks in check.

Shareholder engagement represents a vital mechanism within corporate governance frameworks. By actively participating in discussions about executive compensation, shareholders gain insight into how company strategies align with their interests. Engagement can take many forms, including voting on compensation packages, attending annual meetings, and communicating directly with board members. A well-informed and engaged shareholder base influences positive changes in governance structures. Companies that prioritize transparency in their compensation practices often build greater trust with investors. This trust is integral, as it fosters a collaborative relationship that enhances governance outcomes. Proxy advisory firms also play an essential role by providing independent analyses of compensation structures, allowing shareholders to make informed voting decisions. Additionally, institutional investors often engage in dialogue with management regarding compensation-related concerns. This interaction helps ensure that compensation practices reflect not only executive performance but also broader corporate objectives and societal expectations. Ultimately, the continuing evolution of shareholder engagement underscores the need for corporations to remain responsive to investor concerns. Therefore, fostering open communication channels between shareholders and management is essential to refining compensation governance and achieving sustainable corporate outcomes.

Regulatory pressures increasingly shape executive compensation practices, demanding greater accountability and transparency. Governments and regulatory bodies have implemented guidelines aimed at curbing excessive executive pay and aligning rewards with company performance. For instance, the Dodd-Frank Act mandates that public companies engage in say-on-pay votes, allowing shareholders to express approval or disapproval of compensation packages. These regulatory measures reflect growing concerns regarding income inequality and the public perception of corporate governance. Boards must navigate these regulations while ensuring that compensation structures remain competitive and effective. Additionally, organizations also face potential litigation risks relating to executive pay structures, making compliance crucial. Thus, the increasing focus on governance and accountability calls for robust internal policies that incorporate best practices surrounding compensation. This means aligning pay structures with long-term performance metrics and ensuring that compensation committees conduct regular reviews. Moreover, companies must prepare for potential regulatory changes that could further impact executive pay. By proactively addressing the evolving landscape of regulations, businesses can enhance their governance frameworks, improving transparency and aligning compensation strategies with sustainable success.

Global Trends in Executive Compensation

Global trends are shaping the landscape of executive compensation in diverse ways. These trends influence how companies develop their compensation structures and policies. For instance, the globalization of executive talent has led to more competitive pay packages being offered by multinational corporations. This competition often forces companies to align their compensation strategies with international benchmarks, which can significantly impact domestic governance practices. Additionally, cultural differences across regions influence how executive compensation is perceived and structured. In some cultures, for example, collective performance is prized over individual success, leading to different compensation designs. Moreover, the increased prominence of environmental, social, and governance (ESG) considerations is transforming how companies evaluate executive performance. Many organizations now include ESG-centric goals in their compensation metrics, reflecting a broader commitment to sustainability and corporate responsibility. As technology continues to evolve, companies are also utilizing data analytics to refine their compensation strategies further. This data-driven approach helps organizations identify the most effective reward mechanisms that attract and retain exceptional talent. Thus, understanding and adapting to these global trends is critical for companies seeking to balance incentive structures with risk management.

Effective corporate governance also necessitates the establishment of strong oversight mechanisms for executive compensation. Compensation committees serve as a vital component in this process, as they are responsible for designing and reviewing pay structures to ensure alignment with organizational goals. Comprising independent board members, these committees help mitigate potential conflicts of interest that may arise in determining compensation packages. By applying rigorous evaluation criteria and conducting regular assessments, committees can help maintain fairness in compensation practices. Furthermore, establishing clear guidelines and benchmarks ensures that compensation reflects both internal equity and external competitiveness. Effective communication of these decisions fosters transparency and builds trust among stakeholders. Additionally, organizations can enhance their governance by incorporating independent external advisories, bringing an objective perspective to compensation matters. Moreover, best practices around governance require ongoing training and education for board members and executives. This ensures that they are equipped to navigate the complexities of executive compensation effectively. By fostering a culture of accountability and continuous improvement, companies can enhance their governance frameworks, ultimately leading to better performance and stakeholder satisfaction.

Conclusion: The Future of Executive Compensation

The future of executive compensation is poised to reflect ongoing changes in corporate governance, investor expectations, and societal values. As stakeholders increasingly demand transparency and accountability, companies must refine their compensation strategies accordingly. An emerging trend is the shift towards long-term performance incentives that align executive rewards with sustainable business practices. This focus on long-term value creation is crucial for preventing the recurrence of past governance failures related to risk management. Additionally, organizations will likely place greater emphasis on equity-based compensation models, allowing executives to share in both the risks and rewards of company performance. Evaluating governance frameworks will become increasingly important to ensure compensation structures promote responsible behavior and mitigate excessive risk-taking. Furthermore, companies will need to enhance their communication strategies, providing investors with clear insights into how compensation is determined. This transparency will be critical in building trust with shareholders. Ultimately, adapting to these evolving dynamics is essential for organizations seeking to cultivate effective governance practices while maximizing shareholder value and meeting broader societal expectations.