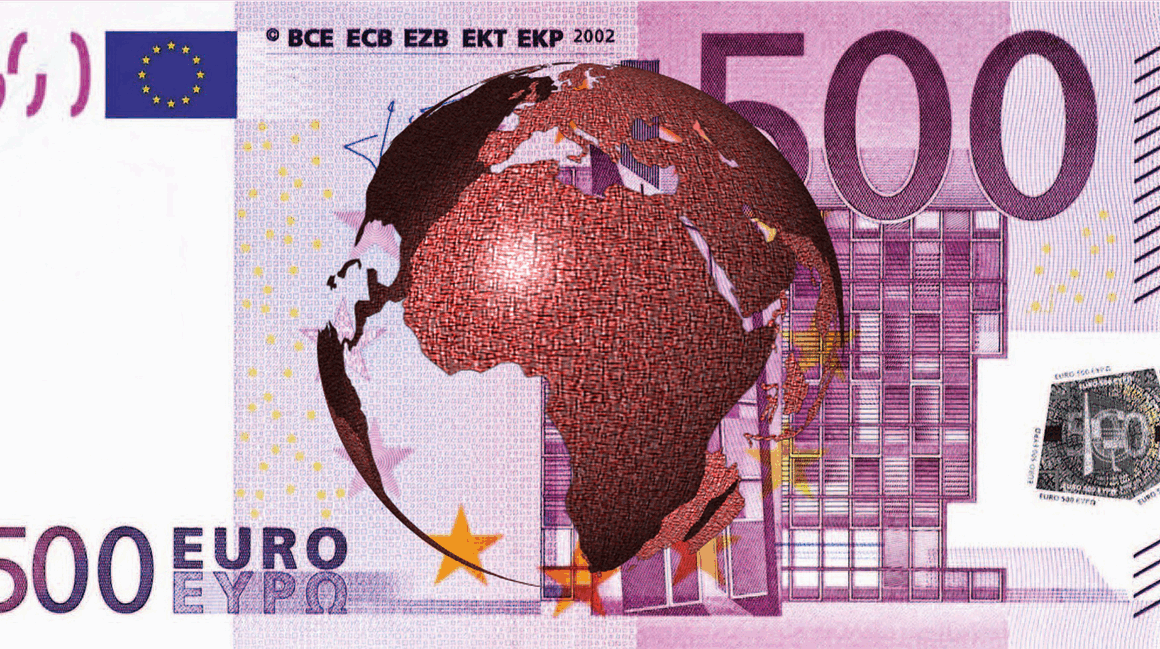

The Impact of Globalization on Financial Markets

Globalization has dramatically reshaped the landscape of financial markets across the world. It has facilitated increased connectivity between geographical regions, leading to profound changes in how capital flows and investments are made. The integration of financial systems has enabled investors to diversify their portfolios internationally, which in turn promotes economic growth and stability in developing countries. Additionally, globalization encourages competition among financial institutions, fostering innovation and efficiency. This interconnectedness has its downsides, however, as economic shocks in one nation can now easily ripple through global markets. The financial crises of 2008 and the COVID-19 pandemic illustrate how incidents in one area can influence distant economies. Moreover, globalization has resulted in varying regulations and compliance standards, making it essential for multinational corporations to navigate these complexities effectively. In conclusion, the effects of globalization on financial markets are multifaceted, encompassing both opportunities and challenges. As economic interdependence continues to evolve, stakeholders must remain vigilant to adapt and respond accordingly to mitigate risks while capitalizing on the potential benefits that globalization brings.

Influence on Investment Strategies

The rise of globalization has significantly impacted investment strategies employed by investors and financial managers. Investors are now more aware of international opportunities and the potential for higher returns in emerging markets. With enhanced technology and communication tools, real-time data allows investors to respond quickly to market fluctuations across the globe. Diversification across multiple nations can reduce risk, which many investors increasingly consider necessary for their portfolios. Additionally, globalization has helped foster the development of various financial instruments, such as Exchange-Traded Funds (ETFs) that cater specifically to international investments. However, with these opportunities come challenges, such as currency risk and political instability. Investors must constantly evaluate the risk-return trade-off associated with investments in foreign markets. The introduction of financial regulations and compliance in different countries further complicates investment strategies. Conducting thorough due diligence becomes crucial for mitigating potential legal and financial repercussions. Furthermore, the emergence of socially responsible investment strategies emphasizes not only financial returns but also ethical considerations. Hence, globalization has transformed investment strategies, compelling investors to adapt to a more interconnected environment that demands deeper analysis and understanding.

One significant aspect of globalization’s impact on financial markets is the rise of emerging economies. Countries such as China, India, and Brazil have become significant players on the global stage, attracting foreign investment and influencing market dynamics. These emerging markets often present higher growth trajectories, making them appealing for investors looking to maximize returns. As capital flows into these regions, local businesses can expand and contribute to global supply chains. However, investitures in emerging markets are accompanied by heightened volatility, often due to responsive governmental policies and fluctuations in commodities. Investors must account for these factors when analyzing their investment opportunities. Furthermore, trade agreements between major economies often facilitate better access to these emerging markets. Increased dependency on international trade can also lead to economic benefits; countries would foster more sustainable partnerships and collaboration. Global financial institutions are increasingly tailoring their services to meet the needs of these rapidly emerging economies, adapting strategies accordingly. The relevance of understanding cultural, political, and economic nuances in these regions cannot be underestimated. Therefore, while emerging markets offer opportunities, investors must navigate complexities associated with these fast-paced environments.

The Role of Technology in Global Finance

Technology is undeniably a driving force behind the acceleration of globalization in financial markets. Innovations such as Blockchain, artificial intelligence, and mobile banking have revolutionized how financial transactions are executed, reducing costs and improving efficiencies. Digital currencies and electronic trading platforms have emerged, allowing instantaneous transactions across borders. This technological evolution enables investors to access markets that were previously inaccessible, broadening their opportunities considerably. Moreover, technological advancements facilitate compliance with diverse regulatory frameworks, simplifying the management of cross-border investments. The rise of Fintech companies has disrupted traditional banking, pushing financial institutions to adapt or face obsolescence. Consequently, investors now benefit from increased competition and better service quality. As technology continues to evolve, expectations for transparency and security in financial transactions also rise among investors and regulatory bodies. Cybersecurity has become an essential area of focus to protect sensitive financial information. Understanding the implications of these technological developments will help stakeholders navigate the globalization of financial markets effectively. In summary, technology plays a critical role in reshaping financial practices, creating a more interconnected and agile global finance environment.

Globalization has altered risk management approaches within financial markets. As companies expand their operations and investments internationally, they encounter new risks associated with currency fluctuations, political instability, and cultural differences. Consequently, organizations have diversified and developed more sophisticated risk management strategies to address these challenges effectively. Hedging mechanisms, such as derivatives, allow businesses to mitigate potential risks arising from foreign currency exposure. Firms increasingly rely on international risk assessment frameworks and models to manage these complexities. Additionally, the implementation of enterprise risk management (ERM) practices has gained traction, promoting a holistic view of risk across an entire organization. Businesses now recognize the need for integrated risk management approaches to support their overall strategic objectives. Moreover, as globalization fosters competition, enterprises must proactively identify and manage risks to maintain their competitive edge. The emphasis on sustainable risk management practices will likely increase as stakeholders demand more transparency and accountability. Thus, effective risk management is crucial for organizations looking to navigate the complexities of globalization while safeguarding their interests in diverse, volatile markets.

Regulatory Implications

The impact of globalization on financial markets necessitates significant attention to regulatory frameworks. As financial transactions transcend borders, differences in regulations among nations can complicate compliance efforts for businesses and investors alike. This disparity often leads to regulatory arbitrage, where firms exploit loopholes in less stringent environments. Furthermore, significant events—such as financial crises—prompt global calls for regulatory reform to safeguard stability and prevent systemic risks. Institutions like the International Monetary Fund (IMF) and the Financial Stability Board (FSB) play pivotal roles in promoting regulatory harmonization across countries. However, achieving a universal regulatory framework presents challenges due to varying political priorities and economic realities. Financial institutions must stay abreast of regulatory changes to ensure compliance in multiple jurisdictions. Firms would benefit from investing in compliance technology and strategies to navigate the complexities of global regulation effectively. Furthermore, as globalization has increased information exchange, authorities are now better equipped to detect illicit financial flows and tax evasion. Ultimately, the regulatory implications of globalization in financial markets reflect ongoing efforts to balance growth and stability, requiring vigilance from all market participants.

In conclusion, the impact of globalization on financial markets is complex and significant. It presents myriad opportunities for investors and corporations, facilitating access to new markets and enhancing capital flow. However, it also introduces challenges, including increased volatility and regulatory complexities. Stakeholders must remain adaptable, constantly reassessing strategies in response to the evolving global landscape. As technology continues to reshape financial interactions, the need for robust risk management and compliance becomes more paramount. Understanding the various cultural and economic contexts will enable investors to make informed decisions while maximizing their returns. The financial markets will continue to evolve as globalization progresses, emphasizing the importance of strategic foresight. Those who can navigate this interconnected world skillfully will likely thrive, while the less prepared may face unforeseen obstacles. As global markets become more interdependent, effective collaboration among nations and institutions will be crucial in fostering stability and promoting sustainable growth. Through continued adaptation and innovation, stakeholders can harness the potential benefits globalization offers while mitigating the associated risks.

In conclusion, the impact of globalization on financial markets is complex and significant. It presents myriad opportunities for investors and corporations, facilitating access to new markets and enhancing capital flow. However, it also introduces challenges, including increased volatility and regulatory complexities. Stakeholders must remain adaptable, constantly reassessing strategies in response to the evolving global landscape. As technology continues to reshape financial interactions, the need for robust risk management and compliance becomes more paramount. Understanding the various cultural and economic contexts will enable investors to make informed decisions while maximizing their returns. The financial markets will continue to evolve as globalization progresses, emphasizing the importance of strategic foresight. Those who can navigate this interconnected world skillfully will likely thrive, while the less prepared may face unforeseen obstacles. As global markets become more interdependent, effective collaboration among nations and institutions will be crucial in fostering stability and promoting sustainable growth. Through continued adaptation and innovation, stakeholders can harness the potential benefits globalization offers while mitigating the associated risks.