Understanding Different Investment Vehicles

Investment vehicles are essential tools for building wealth and achieving financial goals. They come in various forms, each with unique characteristics. The choice of investment vehicle largely depends on individual financial objectives, risk tolerance, and investment horizon. Some common types include stocks, bonds, mutual funds, ETFs, and real estate. Among these, stocks represent ownership in companies and may yield high returns but carry higher risks. Bonds, on the other hand, are debt instruments that provide fixed interest over time, typically considered safer than stocks. Mutual funds pool money from multiple investors to buy diversified assets. ETFs, or exchange-traded funds, function similarly but trade like stocks. Real estate can offer rental income and capital appreciation but requires significant upfront investment. It is crucial to research and understand these options before diving in, as they impact financial growth significantly. Experts often recommend a diversified portfolio to balance risks and returns across various asset classes, ensuring long-term stability. Consulting a financial advisor can help in making informed decisions tailored to individual needs and market conditions. So, empower yourself with knowledge to navigate the complex landscape of investments effectively.

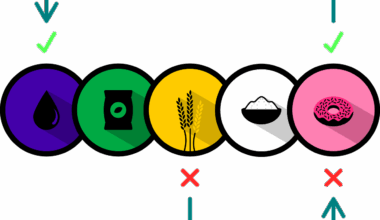

To further appreciate investment vehicles, it helps to understand asset classes. Asset classes are categories that exhibit similar characteristics, influencing how they perform in different economic conditions. The three primary asset classes are equities, fixed income, and cash equivalents. Equities include stocks and share ownership, promising higher returns, while also exposing investors to market volatility. Fixed-income assets like bonds, prioritize capital preservation and income generation through interest payments. Lastly, cash equivalents, such as certificates of deposit, offer liquidity and safety but typically yield lower returns than equities and bonds. Diversification across these asset classes cushions against adverse market shifts, controlling overall portfolio risk. It is vital to regularly assess your portfolio allocation to adapt to changing market dynamics. Regular evaluations can identify areas needing adjustment based on market performance or personal financial goals. Rebalancing leads to maintaining intended risk levels and reaping potential rewards. Realizing which investment vehicle aligns with your financial journey is crucial for success. For practical tips on investing prudently, consider online finance workshops or reputable investment courses. With the right knowledge, you can make timely and informed investment decisions.

Stocks: Ownership and Risk

Stocks provide direct ownership in companies, making them appealing for those seeking growth. When you invest in stocks, you essentially buy a share in the company’s success, gaining access to potential capital gains and dividends, which are a share of profits distributed to shareholders. However, investing in stocks also comes with inherent risks. Their values can fluctuate significantly based on market conditions, economic factors, and company performance. Therefore, it is essential to thoroughly research individual stocks before making investments. Investors should consider factors such as market trends, company management, and financial health. Additionally, diversifying stock investments across various sectors helps mitigate risks associated with individual stock volatility. Popular strategies include value investing and growth investing, each with its own risk-return profile. Behavioral finance plays a role in how investors react to stock market movements, often leading to emotional decision-making that can adversely impact portfolios. Financial literacy thus becomes crucial, enabling investors to remain calm and collected during market downturns. Educating yourself about market dynamics and investing strategies strengthens financial acuity and empowers better decision-making over time.

Bonds play a crucial role within an investment portfolio, providing stability and income. Unlike stocks, bonds are considered less volatile and relatively safer. They can either be government-issued or corporate-issued debt instruments. When you invest in bonds, you essentially lend money to the issuer in exchange for periodic interest payments and the principal amount upon maturity. The fixed income nature of bonds makes them an attractive option for conservative investors. However, they are not without risks, such as interest rate risk, default risk, and inflation risk. Interest rate risk occurs when rising rates decrease bond prices, potentially leading to losses if sold prematurely. Duration, a measure of sensitivity to interest rate changes, is an essential consideration when investing in bonds. Investors should assess their risk tolerance and market outlook when determining the appropriate bond mix. It’s also worth exploring options like municipal bonds, treasury bonds, and corporate bonds, each offering unique benefits. Investing in them can yield tax advantages and consistent cash flow. Ultimately, understanding these dynamics can help harness the full potential of bond investments within the context of a diversified portfolio.

Mutual Funds and ETFs Explained

Mutual funds and ETFs (Exchange-Traded Funds) are popular investment vehicles, offering paths to diversification while simplifying the investment process. A mutual fund pools resources from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities, managed by professional fund managers. Investors typically buy or sell mutual fund shares at the end of the trading day at the net asset value (NAV). On the other hand, ETFs function similarly, but trade on exchanges like stocks throughout the day. They offer more liquidity and flexibility than traditional mutual funds, allowing investors to respond to market fluctuations swiftly. Both options provide diversification and professional management, beneficial for those lacking time or expertise in managing individual investments. When considering mutual funds or ETFs, it is crucial to analyze their expense ratios, historical performance, and the investment strategy they employ. Additionally, investors must understand their investment goals and risk tolerance to determine if these vehicles align with their objectives. Additionally, reviewing the fund’s portfolio holdings will ensure alignment with personal growth expectations and risk tolerance levels.

Real estate, while demanding a larger initial investment, serves as another vital vehicle for wealth-building. Individuals can participate in real estate through direct ownership, real estate investment trusts (REITs), or partnerships. Physical properties can generate passive income and appreciation over time. However, managing properties requires diligence and active involvement, or one can hire property management services to handle day-to-day operations. Moreover, market fluctuations can affect property values, so it’s essential to conduct thorough market research before purchasing real estate. Tax advantages, like depreciation and mortgage interest deductions, can further enhance returns. Alternatively, REITs allow investors to access real estate without the headaches of property management, as they trade on exchanges like stocks. Both options present unique risk-reward profiles, hence evaluating investment goals becomes vital in making informed choices. Passive investors often seek REITs due to liquidity, while active investors may find direct ownership potentially more rewarding in the long run. Building a comprehensive understanding of the real estate market can create valuable opportunities for lasting investment returns.

The Importance of Financial Literacy

Financial literacy is a critical aspect of successfully navigating various investment vehicles. Being financially literate equips individuals with the knowledge and skills necessary to make informed decisions about savings and investments. Understanding the complexities of different investment options is essential, ensuring better outcomes regardless of market conditions. It empowers individuals to evaluate risks, compare potential returns, and choose investment strategies effectively. Moreover, those who are financially literate can create budgets, manage debts, and plan for retirement more efficiently. Continuous education through workshops, courses, and financial literature can enhance financial savvy. Additionally, engaging with financial advisors can offer personalized insights, further solidifying knowledge of investments. Equipping oneself with this knowledge is crucial for long-term financial wellbeing and stability. People often overlook the importance of financial literacy, leading to missed opportunities and poor investment decisions. Thus, enhancing financial literacy is indispensable, as it lays the foundation for achieving financial success over time. Self-educating or seeking professional guidance is strongly recommended to boost confidence in making investment choices. Ultimately, the more informed you are, the greater your potential for financial success.

In conclusion, understanding different investment vehicles is a fundamental aspect of wealth management. The array of options available today can cater to diverse financial goals and risk appetites. Stocks, bonds, mutual funds, ETFs, and real estate offer unique advantages and should be evaluated according to individual circumstances. By diversifying and having a clear investment strategy, investors can balance the inherent risks associated with different asset classes. Financial literacy is paramount in making sound investment choices and enhancing future financial success. Continually educating oneself and seeking professional advice fosters better understanding and control over personal investments. Each investment vehicle serves a purpose within a financial strategy and can lead to achieving economic objectives. Therefore, take charge of your financial journey by gaining insights and knowledge about how these instruments work. Properly informed decisions between these vehicles can greatly impact financial health. As you embark on your investment journey, remember to review and adapt your strategy based on market conditions and personal goals. The right mindset, coupled with sound financial practices, forms the pathway to wealth accumulation and sustainable financial independence.