The Influence of Currency Fluctuations on International Hedge Funds

The relationship between currency fluctuations and international hedge funds is intricate and multifaceted. Currency fluctuations can significantly affect the returns that hedge funds achieve, particularly those operating globally. For investment strategies dependent on currency movements, such as global macro, the precise management of currency risk becomes critical. Hedge funds often employ complex financial instruments like futures and options to hedge against unforeseen currency risk. Additionally, the interplay of currency exchange rates can impact the valuation of assets held in different currencies, necessitating active management and monitoring. Furthermore, fluctuations in currency values can lead to potential arbitrage opportunities for hedge funds, enabling savvy managers to exploit price discrepancies across markets. When currencies experience volatility, hedge funds with diverse portfolios might face profit or loss due to conversion rates. Ultimately, understanding the nuances of currency dynamics becomes essential for hedge fund managers striving to maximize returns. Overall, currency risk management strategies ultimately play a crucial role in ensuring stability during unpredictable economic conditions, particularly in a globalized investment world where economic indicators can shift rapidly, affecting currency values significantly.

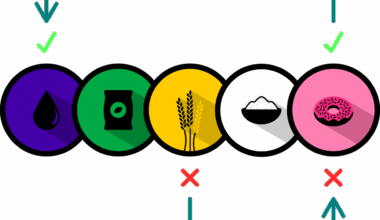

For hedge funds, currency fluctuations can represent both challenges and opportunities. Each currency’s movement can lead to unexpected gains or losses, making it necessary for fund managers to remain vigilant and proactive. A key strategy used by hedge funds involves diversifying currency exposure to mitigate risks associated with currency depreciation and appreciation. When managing foreign investments, hedging mechanisms can be utilized to protect against currency risk. Some hedge funds may forward contract their currency exposures to lock in current rates, thereby safeguarding against adverse movements. Others may choose to leverage to amplify returns that arise from favorable currency movements. Additionally, the macroeconomic landscape plays a monumental role in influencing currency behavior, which hedge funds must constantly analyze and consider in their investment strategies. Understanding factors such as interest rate differentials, inflation trends, and geopolitical events can provide vital insights into future currency movements. The ability to accurately anticipate shifts in currency values can significantly impact a hedge fund’s performance. Effective risk management in relation to currency fluctuations is thus indispensable for hedge funds looking to secure long-term success in the ever-changing financial landscape.

Key Strategies for Currency Risk Management

One of the primary methods hedge funds utilize to mitigate currency risk is through active management of currency positions. This can involve taking directional bets on currencies based on economic indicators and forecasts. For instance, fund managers may analyze shifts in central bank policies to anticipate potential changes in currency values. Additionally, employing systematic trading strategies that rely on algorithm-based analysis can enhance decision-making processes related to currency trades. Implementing stop-loss orders is also a critical part of managing currency risk; these preset limits help minimize losses by automatically selling positions upon reaching a designated loss threshold. Hedge funds may also utilize correlated currencies in their portfolios, as this can lead to a natural hedging effect, balancing gains and losses from different currency exposures. Furthermore, fostering strategic partnerships with financial institutions can aid in accessing additional tools for managing currency risk more effectively. Constantly reassessing financial exposures and adjusting strategies in response to market conditions is essential. By doing so, hedge funds can potentially navigate complex currency landscapes and optimize their overall investment performances while minimizing downside risks associated with exchange rate volatility.

Another critical aspect of managing currency exposure is the psychological component involved in trading decisions. Exchange rate movements can lead to emotional responses from traders, which can result in irrational decision-making. Hedge funds often address this issue through a rigorous adherence to investment protocols and utilizing stringent risk management frameworks. These frameworks are designed to limit exposure to adverse market movements, providing a structured approach to handle currency fluctuations effectively. Additionally, educating the team on the influences of behavioral finance can cultivate a more rational trading environment. Hedge funds also benefit from implementing robust performance measurement metrics to evaluate how well currency strategies are performing. By establishing performance benchmarks and analytical tools, hedge funds can gain a clearer perspective on their currency exposure. Having a disciplined plan in place allows for a more methodical approach to making portfolio adjustments based on performance outcomes. Regular reviews of currency positions allow managers to discern which strategies are yielding positive results and which areas may require reconsideration or reallocation, thereby ensuring that they remain agile in a fast-changing global financial landscape.

Impact of Macroeconomic Indicators

The performance of international hedge funds is directly influenced by macroeconomic indicators, which serve as key determinants of currency fluctuations. Economic metrics such as GDP growth rates, employment figures, and inflation data help predict currency trends, enriching the decision-making processes of hedge fund managers. Changes in interest rates, dictated by central bank policies, particularly affect currency strength, making these indicators crucial in hedging strategies. For example, a rise in interest rates typically strengthens a currency as it offers higher returns on investments denominated in that currency. Conversely, disinflationary pressures can weaken a currency, prompting hedge funds to adjust their strategies accordingly. Understanding these macroeconomic relationships enables hedge funds to take informed positions on currency trades. Additionally, geopolitical events can disrupt currency stability, presenting both risks and opportunities. Thus, hedge funds must remain up-to-date on global political climates and economic forecasts to better position themselves amid currency fluctuations. This dynamic interplay of economic indicators emphasizes the importance of thorough market analysis and strategic forecasting in driving successful hedge fund operations, ensuring an adaptive approach to navigating complex currency landscapes.

Furthermore, liquidity in currency markets plays a significant role in how hedge funds conduct currency trades. High liquidity levels allow for smoother transactions, enabling hedge funds to enter and exit positions with minimal price impact. Conversely, in less liquid markets, currency fluctuations can lead to greater volatility, increasing the risks associated with trading. Hedge funds generally avoid trading in currencies with low trading volumes, as this can introduce considerable uncertainty to their strategies. The impact of liquidity may also extend to the spreads between bid and ask prices, which can widen during periods of market stress. Hedge funds are keenly aware that capricious fluctuations can affect their overall profitability in unpredictable ways. Thus, they often consider liquidity risk in their analysis, particularly when engaging in large trades. This heightened awareness of liquidity risk necessitates the use of tools such as market orders or limit orders when executing currency trades. Furthermore, maintaining relationships with currency brokers can ensure access to favorable trading terms and information. Ultimately, a strong understanding of liquidity dynamics contributes significantly to the efficacy of currency management strategies employed by hedge funds in the international finance arena.

Future Trends in Currency Fluctuations

As globalization continues to evolve, the way hedge funds manage currency fluctuations is also likely to change. Factors such as rapid technological advancements play a pivotal role in how trading strategies are developed and executed. For instance, the emergence of algorithmic trading and machine learning techniques enables hedge funds to analyze vast amounts of data quickly. These innovations can lead to more precise predictions regarding currency movements, helping hedge funds to position themselves advantageously in competitive markets. Additionally, the increasing sophistication of financial products allows hedge funds to create complex hedging strategies tailored to specific risks arising from currency fluctuations. As new market players enter the field, competition will intensify, necessitating continued development of innovative approaches to currency risk management. Looking ahead, it is expected that regulatory changes will further elevate the importance of risk management frameworks. Hedge funds must remain vigilant and adapt to an evolving landscape in which currency fluctuations are becoming increasingly challenging to predict. By staying ahead of these trends and utilizing technology effectively, hedge funds can navigate the intricate world of international finance, ultimately enhancing their prospects for success in the coming years.

To summarize, currency fluctuations are integral in shaping the landscape of international hedge funds. The ability to understand, anticipate, and respond to these fluctuations is paramount for hedge fund managers seeking to optimize their portfolios. Implementing robust currency risk management strategies, such as diversification and active monitoring, can enhance a fund’s resilience against adverse movements. Moreover, aligning with macroeconomic indicators and market trends ensures that hedge funds remain competitive in volatile environments. As the global financial system continues to evolve, hedge funds must leverage innovative trading technologies while refining their risk frameworks. These efforts are essential in an increasingly complex market, where currency volatility poses both risks and opportunities. Continuous assessment and adjustment to strategies will empower hedge funds to navigate this dynamic landscape effectively. Ultimately, the interplay of macroeconomic forces, liquidity circumstances, and technological advancements will define the future of hedge fund management in the realm of currency management. By adapting to these changes, hedge funds can position themselves for sustained success within the global finance ecosystem.