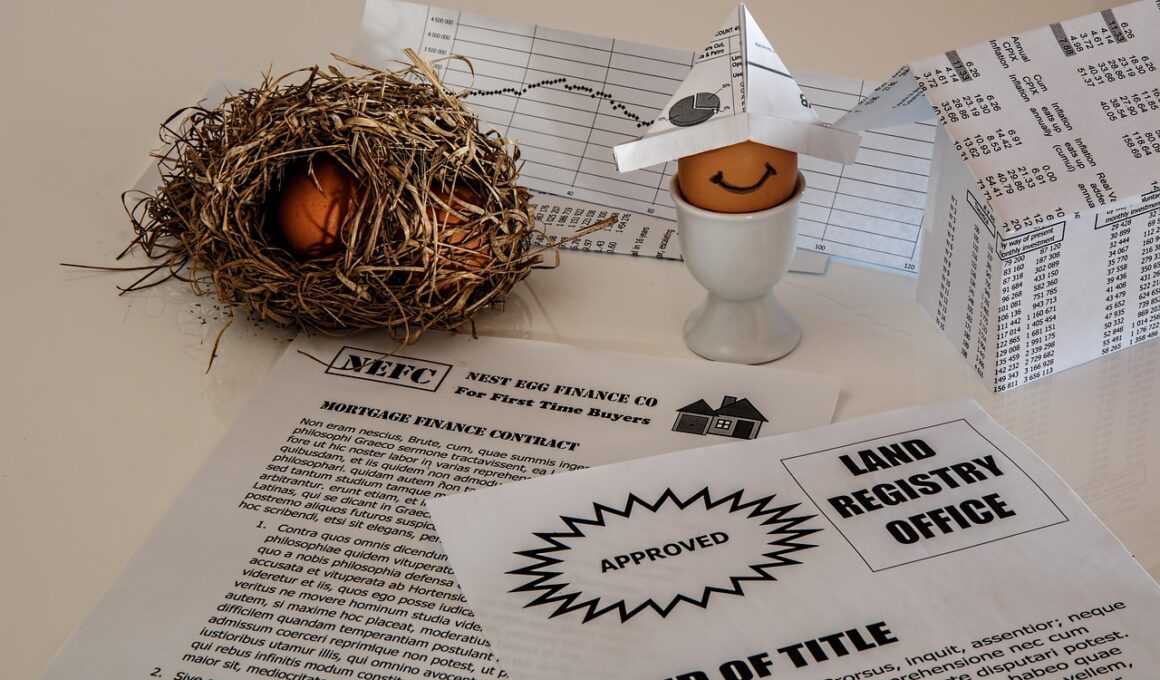

How to Protect Your Assets Through Estate Planning

Estate planning is essential for preserving your assets and ensuring that they are distributed according to your wishes after your passing. A well-structured estate plan ensures that assets such as properties, investments, and personal belongings are handled appropriately. To begin, assess what assets you own, including real estate, bank accounts, insurance policies, and retirement accounts. Next, consider your beneficiaries. Decide who will inherit your assets, whether it’s family, friends, or charitable organizations. It’s crucial to discuss your plans with your beneficiaries so they understand your intentions. A crucial part of estate planning involves creating a will or a trust. These legal documents outline how you want your assets distributed. A will is more straightforward, while a trust can provide more control and flexibility over asset distribution. Additionally, appoint a power of attorney to make decisions on your behalf if you become incapacitated. This can ensure that your healthcare and financial matters are managed according to your wishes. Ultimately, an estate plan protects your assets, ensures your wishes are followed, and alleviates potential conflicts among your loved ones.

The Importance of a Will

Creating a will is a fundamental step in the estate planning process. A will enables you to dictate how your assets will be divided and who will care for any minor children. Without a will, state laws will govern the distribution of your assets, which may not align with your wishes. A properly drafted will can prevent disputes among family members and minimize the potential for conflict after your passing. Be sure to include specific bequests to individuals, along with any particular wishes you have regarding your assets. Consider appointing an executor as well. The executor is responsible for managing your estate according to the will and ensuring that debts and taxes are paid. Additionally, regularly update your will to reflect any major life changes, such as marriage, divorce, or the birth of children. Utilizing the services of an estate attorney can ensure your will is legally sound and compliant with state laws. Estate planning should not be an afterthought; it promotes peace of mind and provides control over your legacy. Creating a clear will is a vital step toward effective estate planning.

Trusts are another powerful tool in estate planning. A trust allows you to place conditions on how and when your assets will be distributed. For example, you may want to delay distribution until beneficiaries reach a certain age, facilitating responsible management of inherited funds. There are various types of trusts, including revocable and irrevocable trusts. Revocable trusts can be altered during your lifetime, offering flexibility if circumstances change. However, irrevocable trusts provide asset protection from creditors and can minimize estate taxes. Trusts can help bypass probate, a lengthy and public process, allowing for a more private and efficient transfer of assets. Additionally, trusts can also outline specific provisions for health care decisions and financial management in case you become incapacitated. Maintaining accurate records and regularly reviewing your trust will enhance its effectiveness. Consulting with a financial planner or estate attorney can assist in determining which type of trust will best suit your goals. Trusts are valuable elements of comprehensive estate planning, enhancing control and efficiency over asset distribution.

Naming Beneficiaries and Power of Attorney

Naming beneficiaries for your financial accounts and trust is crucial. Beneficiaries are individuals designated to receive assets directly from your accounts without needing to go through probate. This can expedite the transfer of your assets and keep the process private. Always review and update beneficiary designations regularly, especially after major life events like marriage, divorce, or the birth of a child. It’s also essential to have a power of attorney in place. This assigns someone to make financial and medical decisions on your behalf in the event of your incapacity. A durable power of attorney remains in effect even if you become unable to make decisions, ensuring that your financial matters are managed according to your wishes. Choose someone trustworthy and capable. Discuss your preferences and create a legal document outlining your decisions. Additionally, consider a healthcare directive to communicate your medical treatment preferences. Properly establishing beneficiary designations and a power of attorney can simplify decision-making processes for your loved ones and minimize family disputes.

Funeral arrangements and end-of-life decisions also deserve consideration in your estate planning. You may wish to outline your preferences for funeral services, burial, or cremation, thus alleviating the burden on family members during a difficult time. Pre-planning your funeral allows you to communicate your wishes clearly and can even help mitigate costs. Discuss your wishes with family, friends, and your estate executor, so they understand your desires. Another aspect to consider is the potential tax implications of your estate. Estate taxes can significantly impact the assets left to your beneficiaries, and consulting an estate planning attorney can help you navigate these issues. Strategies such as gifting during your lifetime or utilizing trusts can reduce estate taxes paid by your estate. Additionally, staying informed about current tax laws can help you make better decisions regarding your estate. Overall, addressing funeral arrangements and understanding the financial implications will ensure that your estate is handled according to your preferences while minimizing potential stress for your loved ones.

The Role of Life Insurance in Estate Planning

Life insurance can play an important role in estate planning by providing liquidity to your estate. This liquidity can be critical when covering debts, taxes, or other expenses after your passing. It ensures that your beneficiaries receive the intended legacy without financial burdens or delays. Setting up an irrevocable life insurance trust (ILIT) can provide estate tax advantages while maintaining control over how your policy proceeds are used. Naming your heirs as beneficiaries directly on a life insurance policy typically avoids probate, allowing them quick access to funds without additional complications. It’s essential to evaluate the coverage amount needed based on your debts, expenses, and the needs of your family. As life circumstances change, review your life insurance policy and update it to reflect current obligations. Engaging a financial planner can help ensure that your life insurance aligns with your overall estate planning goals. Ultimately, strategically incorporating life insurance into your estate plan can provide peace of mind and financial security for your loved ones during difficult times.

Regularly reviewing and updating your estate plan is vital to its effectiveness. Changes in family dynamics, financial circumstances, or laws can significantly impact your plan’s relevance and effectiveness. Set a reminder to review your estate plan every few years and after significant life events, such as marriage, divorce, or the birth of a child. Additionally, tax laws can change, impacting the effectiveness of certain strategies like trusts or gifting. Engaging an estate planning attorney for a periodic review will help you stay informed and updated on any pertinent changes that may affect your estate. It’s also important to maintain a well-organized and accessible record of all estate planning documents, including wills, trusts, and beneficiary designations. Ensuring that your loved ones know where to find your crucial documents can ease the burden they may face during a difficult time. Effective communication with family members about your plans can help mitigate conflicts and confusion. Regularly reviewing and communicating your estate plan will provide your loved ones with a clear understanding of your wishes and intentions.

Conclusion

In conclusion, estate planning is an essential process that safeguards your assets and ensures your wishes are honored. By creating a comprehensive estate plan that includes a will, trusts, beneficiaries, and powers of attorney, you can protect your loved ones and provide clarity regarding your assets. Regularly reviewing and updating your plan can help ensure it remains effective and relevant to your current circumstances. Estate planning not only alleviates the burden on your family during a difficult time but also promotes harmony and preserves your legacy. Every individual, regardless of wealth level, can benefit from well-thought-out estate planning. Take initiative now and pursue estate planning diligently. Consider consulting with an estate planning attorney and financial advisors to create a tailored plan that meets your unique needs and concerns. The earlier you start this process, the better equipped you will be to protect your assets and maintain control over your future. Remember, estate planning is not just for the wealthy; everyone deserves peace of mind regarding their legacy and the security of their loved ones. Empower yourself through proper estate planning today.