Analyzing Dividend Payout Ratios for Smarter Investments

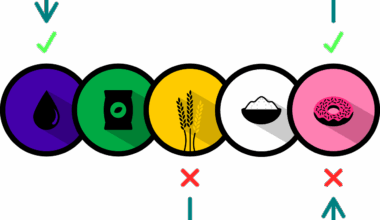

Investing in dividends has become a favored strategy among investors seeking passive income. Among the essential financial metrics investors analyze, the dividend payout ratio stands out. This ratio helps illustrate how much earnings a company distributes to its shareholders in the form of dividends. It can provide insights into the sustainability of the company’s dividend payments. Generally expressed as a percentage, a lower dividend payout ratio might indicate a company retains more earnings for growth, which is attractive for growth-oriented investors. Conversely, companies with high payout ratios may appeal to those looking for immediate income. Evaluating these ratios alongside other metrics is crucial, as they can vary significantly by industry. For example, utility companies often maintain higher payout ratios due to stable cash flows, unlike tech companies reinvesting earnings into R&D. Thus, knowing how to interpret these ratios can significantly affect investment decisions. Conducting thorough research and consistently tracking these figures allows investors to make smarter decisions in dividend investing.

Furthermore, understanding the context of payout ratios is essential. A high ratio may not always mean the company is financially robust. Stagnant earnings potential can indicate that shareholders will not realize future capital growth. When assessing dividends, keep an eye on the company’s broader financial health indicators, including cash flow, debt levels, and overall market conditions. This comprehensive analysis ensures that the dividends will remain sustainable in the long term. The interpretation of payout ratios requires investors to understand how they correlate with corporate earnings and shareholder equity. Evaluating companies with different business cycles using these ratios can make uncovering lucrative investment opportunities easier. To enhance investment knowledge, consider reputable resources or financial news outlets like Investopedia. They often provide valuable insights alongside statistical data that cater to investors at any experience level. However, individuals must use this information as a foundational aspect of their investment research. Relying on multiple sources for complete financial information allows for a more nuanced understanding of dividend strategies.

The Importance of Dividend Stability

Investors should consider dividend stability when analyzing payout ratios. Companies capable of consistently paying dividends without interruption may be better positioned financially. A stable dividend payout ratio can indicate strong management and resilient business practices. This stability reassures investors, particularly during economic downturns. Regularly receiving dividends even during challenging market conditions is appealing and can contribute significantly to an investor’s total returns. Additionally, companies that increase their dividends regularly often demonstrate confidence in their financial health and future prospects. These businesses may be less exposed to market volatility, making them less risky. A historic pattern of increasing dividend payouts can act as a signal of a company’s commitment to returning value to shareholders. Investors who prioritize dividend stability may create more predictable income streams, making budgeting easier. Therefore, researching dividend histories helps inform decisions, revealing companies likely to continue rewarding their shareholders proactively. In essence, a thorough examination of payout ratios, combined with dividend stability insights, empowers investors to enhance their portfolios significantly.

Moreover, monitoring payout ratios over time gives invaluable insights into potential growth trajectories of dividend-paying stocks. A gradual decline in the payout ratio may suggest that management is making strategic decisions to reinvest into the business. Strategic reinvestment can foster innovation, further business expansion, and long-term sustainability. In contrast, an increased payout ratio might raise red flags. This could mean the company is relying heavily on its cash reserves to continue dividend payments, possibly leading to financial strain. Analyzing historical trends of payout ratios can often reveal a company’s actual performance potential. This allows investors to distinguish between a temporary dip in payout ratio and a more concerning financial trend. Comparative analysis with peer companies can also yield crucial insights into how a business aligns with industry norms. As such, investors should remain vigilant in observing these ratios as part of larger investment strategies. Ignoring fluctuations in payout ratios may result in missed opportunities or increased risk for capital loss.

Evaluating Industry Standards for Payout Ratios

Investment strategies often vary significantly across different sectors, making it crucial to understand industry standards. For instance, technology companies may exhibit lower payout ratios since they typically reinvest earnings to innovate and expand operations. Conversely, consumer staples and utilities may show higher ratios, driven by the need to maintain dividends to attract income-focused investors. This disparity results from the distinct business models and growth potential inherent in these industries. As such, comparing a company’s payout ratio with its industry average can provide important context regarding its performance and financial health. Investors can use this comparison to identify potential alerts or opportunities in underperforming sectors. For example, if a technology company suddenly increases its payout ratio significantly, it may warrant a closer examination of its financial strategies and overall sustainability. Understanding industry benchmarks helps investors align their portfolios according to their risk profiles and investment objectives. Applying this knowledge strategically can lead to better-informed investment decisions, contributing to long-term financial success.

Investors should also pay attention to the potential impact economic cycles have on dividend payout ratios. Economic downturns often prompt companies to adjust their dividend payment strategies, affecting shareholder returns. During recessions, companies may cut or suspend dividend payouts due to decreased earnings and cash flow constraints. This adjustment could lead many income-focused investors to reevaluate their positions. Understanding these cyclical factors while analyzing payout ratios builds a more comprehensive investment perspective. Attuning your strategy to respond to economic shifts allows investors to prepare for market volatility effectively. Additionally, considering macroeconomic indicators, such as interest rates and inflation trends, can further influence decisions regarding dividend-paying stocks. In contrast, during periods of economic growth, companies may increase their payouts or expand dividend yields, boosting prospects for income generation. Therefore, proactive monitoring of these elements serves as a protective measure in safeguarding investments against unforeseen pressures in the market.

Conclusion: Maximizing Your Dividend Investment Strategy

Conclusively, analyzing dividend payout ratios is a fundamental component of successful dividend investing. Understanding these metrics provides valuable insights into a company’s financial health, growth potential, and dividend stability. Ultimately, this knowledge empowers investors to make informed decisions, potentially maximizing their income. By prioritizing research into dividend histories, industry standards, and the overall economic landscape, investors can refine their strategies for consistent, sustainable growth. Ensuring a thorough evaluation process incorporating these factors will lead to better alignment with individual investment objectives. Regularly monitoring and reassessing dividend payout ratios alongside supplementary financial metrics will enhance portfolio performance significantly. Engaging with reputable financial resources aids in staying updated with market trends and crucial insights. As dividends play a critical role in generating returns over time, consistently applying dividend strategies can help investors achieve their financial milestones. Adapting to market conditions while navigating dividend investments will lead to a smarter, more strategic investment approach in pursuit of financial freedom.