How Blockchain is Changing Supply Chain Finance

Supply Chain Finance (SCF) has undergone significant transformations in recent years, mainly driven by advancements in technology. As global trade continues to expand, businesses face challenges in managing liquidity and risk along their supply chains. Blockchain technology, with its ability to provide a transparent, secure, and efficient framework for transactions, is emerging as a game-changer. By facilitating real-time data sharing among all stakeholders involved—suppliers, buyers, and financial institutions—blockchain helps mitigate risks. Enhanced visibility allows companies to track goods and payments seamlessly, reducing friction in cash flows. This innovation not only strengthens trust among parties but also streamlines operations by reducing paperwork. Moreover, SCF solutions powered by blockchain can lower transaction costs significantly. Overall, leveraging blockchain technology in supply chain finance enhances efficiency, reduces costs, and facilitates better supplier relationships. That’s why many businesses are actively exploring its potential to unlock financial benefits and improve operational performance in their supply chains. In conclusion, blockchain represents a critical advancement in tackling traditional challenges, enabling smoother and more efficient financial transactions throughout the supply chain.

As organizations adopt blockchain technology for their supply chain finance processes, they can realize transformative benefits. Enhanced visibility into transactions and inventory allows stakeholders to respond more swiftly to any disruptions. When all participants have access to a single source of truth, this reduces reliance on intermediaries and expedites the financing process. Consequently, suppliers can receive early payments, which improves their working capital. Additionally, buyers can access financing more easily through transparent terms and conditions available on the blockchain. This increased efficiency motivates suppliers to offer better prices and terms, ultimately benefiting consumers. Moreover, the adoption of smart contracts further automates transactions, ensuring that funds are released automatically once predefined conditions are met. Hence, businesses can allocate resources more effectively, leading to improved cash flow management. Another significant advantage of this approach is its potential for fraud reduction. By creating immutable records of transactions, blockchain minimizes the risk of fraud and ensures compliance. Therefore, organizations investing in blockchain-driven supply chain finance solutions are better positioned to thrive in the competitive landscape. In short, the convergence of technology and finance is reshaping supply chain management by fostering collaboration and innovation.

Benefits of Blockchain in Supply Chain Finance

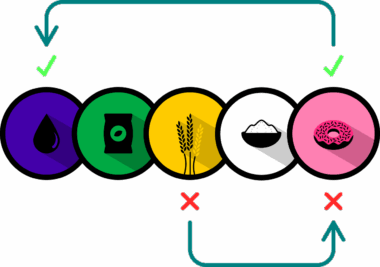

There are several primary benefits associated with implementing blockchain in supply chain finance. First, the increased transparency aligns interests among all parties involved in the supply chain. With clear visibility of transactions, trust is significantly enhanced, reducing disputes and misunderstandings. Second, improved efficiency leads to substantial cost savings. Traditional financing processes often involve lengthy paperwork and multiple intermediaries. Blockchain eliminates many of these issues, streamlining operations and shortening transaction times. Third, the integration of blockchain facilitates data security. Using cryptographic principles, blockchain technology ensures that critical data remains safe from hacking and unauthorized access, collaborating on shared databases is more secure. Furthermore, it minimizes counterparty risk by providing reliable information on supply chain participants’ creditworthiness. Fourth, blockchain enhances sustainability in supply chain finance by promoting ethical practices. It enables organizations to track the origins of materials and ensures adherence to environmental and labor standards. Finally, access to financing improves for small and medium-sized enterprises (SMEs), as they can provide verifiable proof of transactions and operational performance. Thus, the benefits of blockchain technology extend beyond efficiency, promoting ethical practices and financial inclusivity.

Nonetheless, the transition to blockchain-enabled supply chain finance comes with challenges. One of the primary obstacles is the need for industry-wide collaboration and standardization. Different businesses may utilize varying blockchain systems, making interoperability a significant concern. To address this, stakeholders must come together to create common standards for sharing data and transactions. Another challenge is the initial investment required to implement blockchain technology. Companies must assess whether the benefits outweigh the costs, especially during the transition phase. Training personnel to understand and utilize this technology effectively also poses a hurdle. As with any digital transformation, resistance to change exists within organizational cultures. Proper change management strategies should be put in place to encourage adoption. Moreover, regulatory uncertainty surrounding blockchain usage presents a considerable challenge. In many jurisdictions, clear guidelines are lacking, complicating compliance efforts for organizations. Addressing privacy concerns related to shared data is also critical to maintain customer trust. Therefore, while the potential of blockchain in supply chain finance is undeniable, a comprehensive approach is vital to overcoming these challenges for successful implementation.

Real-World Applications of Blockchain in Supply Chain

Many industries have started adopting blockchain technology within their supply chain finance processes, showcasing its diverse applications. In the food industry, companies are using blockchain to track the journey of products from farm to table. This enhances food safety and allows consumers to verify the origins of their purchases easily. In the pharmaceutical sector, blockchain ensures the authenticity of drugs, combating counterfeits by verifying each transaction along the supply chain. Additional applications include logistics, where companies streamline operations by sharing real-time tracking information and automating payments upon delivery. Retailers look to blockchain for improving inventory management by using smart contracts to manage stock levels dynamically. Furthermore, the automobile industry uses blockchain to maintain tamper-proof records of vehicle ownership and services. This provides potential buyers with confidence in the reliability and value of used vehicles. By embracing blockchain technology, organizations across these sectors create more resilient supply chains, supporting improved financial performance and customer satisfaction. Consequently, as adoption grows, it’s likely the number of real-world blockchain applications will continue to expand, solidifying its place in modern supply chain finance.

Future developments in blockchain technology promise even greater advancements for supply chain finance. As the landscape continues to evolve, we can anticipate improved scalability and faster transaction speeds. Enhancements in underlying technologies, such as decentralized finance, will enable automated, compliant financing solutions. Artificial intelligence (AI) integration will further enhance decision-making processes by providing predictive analytics on inventory and demand. Additionally, we can expect an increase in public and private partnerships dedicated to advancing blockchain standards, promoting interoperability among various systems. Furthermore, regulatory frameworks are likely to emerge, fostering a more conducive environment for blockchain adoption across industries. This will help relieve some of the uncertainties currently hindering widespread implementation. Additionally, quantum computing may revolutionize security measures, offering unprecedented levels of data protection. Predictive modeling capabilities, leveraging blockchain’s comprehensive data, will enhance risk assessment and management in supply chains. Ultimately, these advancements will create more efficient, transparent, and resilient supply chains. It’s essential that companies remain adaptable and informed about these potential changes, ensuring they can capitalize on advancements in blockchain technology within supply chain finance.

Conclusion

In conclusion, blockchain is fundamentally reshaping supply chain finance, offering unprecedented opportunities for efficiency, transparency, and security. Organizations that embrace these technologies can optimize their financial operations while building stronger, more collaborative supply chain relationships. The clear advantages of enhanced trust, reduced costs, and improved cash flow management cannot be overstated. However, companies must navigate the challenges of adoption, ensuring they commit to data security and industry standards. The transition toward blockchain will not happen overnight; it will require strategic planning and a willingness to adapt to new technologies. As more businesses recognize the transformative potential of blockchain, we will see an increase in innovative applications and successful implementations. This trend represents not only a significant shift in supply chain finance but also highlights the growing importance of technology in the modern economy. Ultimately, the convergence of blockchain with supply chain finance creates opportunities that elevate business operations, promoting financial inclusion and sustainability. Only time will reveal the full impact of blockchain within this sector; however, its promise is evident. Organizations must act now to stay ahead of the curve and seize these opportunities.