How Property Tax Supports Infrastructure Development

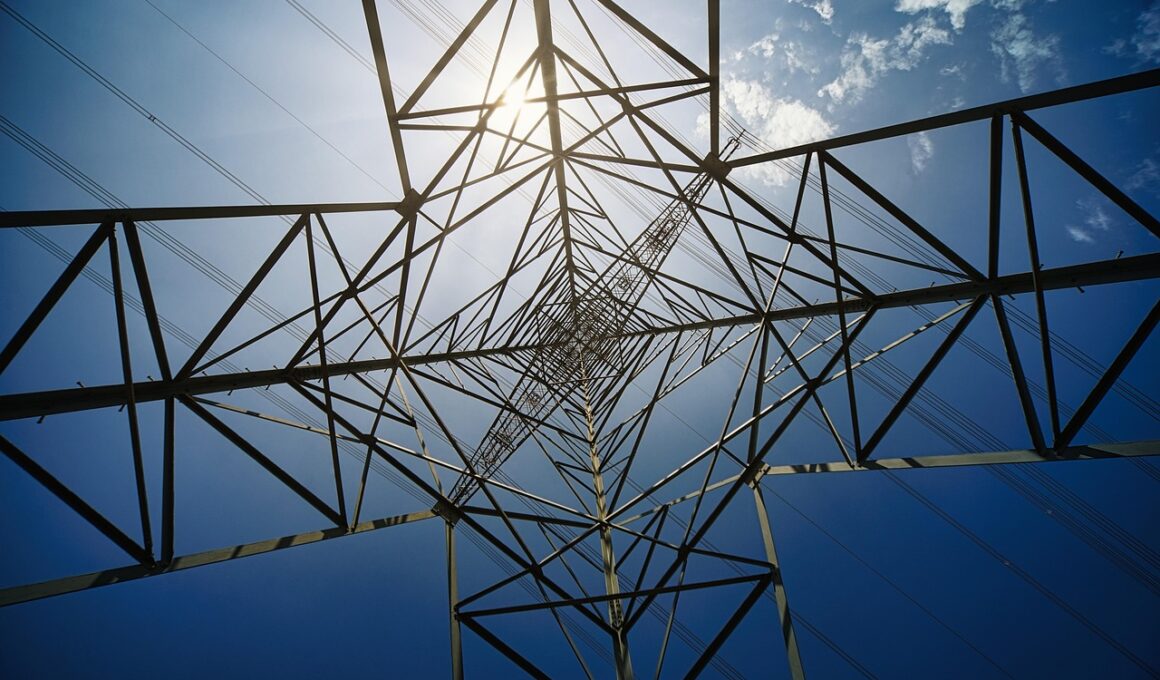

Property tax plays a crucial role in financing infrastructure development in cities and towns across the country. Local governments primarily rely on property tax revenues to fund essential services such as roads, bridges, schools, and public transportation systems. These vital services are foundational for community well-being and economic growth. The funds generated from property taxes help maintain existing infrastructure while also supporting new projects to accommodate growing populations. Furthermore, property taxes are usually assessed based on the value of the properties, ensuring that wealthier homeowners contribute a fair share towards local developments. The predictable revenue stream from property taxes allows local governments to plan and execute infrastructure projects with greater confidence. When property taxes are collected diligently and effectively managed, they can provide a steady source of funding for various public initiatives. Additionally, property tax revenues can also help attract private investments in infrastructure by demonstrating a commitment to maintaining and upgrading public facilities, thereby enhancing community appeal. This can lead to an improved quality of life for all residents and foster economic opportunities within the region.

Moreover, property tax funds can also support public amenities such as parks and recreational facilities, further contributing to the overall livability of an area. Well-maintained parks not only enhance the aesthetic of a neighborhood but also promote healthy lifestyles by providing spaces for physical activity and community gatherings. Furthermore, these community hubs can foster social cohesion, making neighborhoods more attractive to prospective residents and businesses. Local governments often leverage property tax revenue by providing grants and incentives for developers to create residential, commercial, and mixed-use projects, thus stimulating economic growth. This symbiotic relationship between property taxes and infrastructure development boosts property values, which ultimately increases tax revenues in the long run. Additionally, a well-developed infrastructure network can lead to increased property demand, reinforcing the cycle of growth and improved services. It is important for local authorities to be transparent in how property tax revenues are allocated, ensuring that residents are informed and engaged in decision-making processes. Community engagement can further strengthen support for property tax initiatives, highlighting the benefits that come from well-planned and executed public infrastructure projects.

The Importance of Tax Revenue in Urban Planning

Effective urban planning relies heavily on accurate data collection and the judicious use of property tax revenue. Local governments should prioritize infrastructure investments to enhance their economic development plans. Properly funded infrastructure can contribute to increased business opportunities, efficient public transportation systems, updated road networks, and comprehensive utility services. Additionally, infrastructure projects often create jobs, boosting local economies and increasing residents’ disposable income. This, in turn, enhances property value, resulting in a higher tax base for future investments. Local governments can also use property tax revenues to support sustainable infrastructure initiatives, which is vital in today’s environmentally conscious society. Investing in green spaces, energy-efficient facilities, and sustainable transportation options are just a few ways that property taxes can facilitate a transition to more eco-friendly urban environments. Moreover, well-planned infrastructure projects can improve resilience against natural disasters by reinforcing response capabilities and enhancing community safety. These comprehensive planning efforts require collaboration between local governments, businesses, and community members to achieve long-lasting positive impacts. In this context, property taxes serve as more than just a revenue source; they become a means to achieve public policy goals.

In addition, local governments can utilize property tax incentives to attract developers and businesses, thereby fostering economic growth. By offering tax abatements or reductions, they can make it financially attractive for businesses to invest in underdeveloped areas. This not only leads to increased employment opportunities but also ensures that property tax revenues are generated from new developments in the future. Furthermore, strategic planning with property tax funding can lead to the revitalization of distressed neighborhoods. The rehabilitation of infrastructure in these areas has the potential to reverse decades of economic decline and improve residents’ quality of life. Investment in neglected infrastructure attracts additional funding and private investment, creating a compounding effect on local economies. By prioritizing these areas, local governments can effectively ensure that all community members benefit from property tax-funded infrastructure improvements. Smart use of property tax revenues empowers local authorities to create thriving, inclusive neighborhoods that cater to a diverse population. Ultimately, property tax emerges as a significant tool in shaping vibrant cities that meet the needs of both current and future generations.

Challenges in Property Tax Management

Despite its importance, managing property tax systems presents numerous challenges for local governments. One major issue is the accurate assessment of property values, which is crucial for ensuring that tax revenues are fair and commensurate with property worth. Inaccurate valuations can lead to disparities where some property owners pay significantly more than others for similar properties. This can create dissatisfaction among taxpayers and raise the question of equity in property taxation systems. Additionally, changing market conditions can affect property values unpredictably, complicating tax assessments and budgeting for infrastructure projects. Furthermore, local governments may face resistance from residents when it comes to increasing property taxes, even when the revenues are crucial for funding important infrastructure initiatives. Education and communication are key tools local authorities can use to inform citizens about the necessity of these revenues for community support. Transparency in the tax collection process is essential to maintain trust and encourage compliance from residents. Local governments must continuously adapt their strategies to ensure they are effectively utilizing property taxes to fund needed infrastructure projects while also remaining accountable to their constituents.

Moreover, outdated tax structures may not accurately reflect the current economic conditions and demographics of a community. As communities evolve, property tax systems must be capable of adapting to new realities. This includes recognizing the impact of gentrification, which can lead to displacement if property taxes rise too rapidly. Local governments are encouraged to examine alternative funding mechanisms that can complement property taxes, such as grants and bonds. By diversifying funding sources, they can better manage the fiscal challenges associated with infrastructure development. Additionally, leveraging technology in tax assessment and collection processes can streamline operations and improve accuracy in revenue collection. Implementing automated systems reduces human error and provides residents with more accessible information regarding their tax obligations. Local authorities should consider training staff to utilize modern tools effectively while also innovating to address challenges that may arise over time. A proactive approach to managing property taxes and their allocation can bolster public confidence in local governments’ ability to fund and maintain essential infrastructure services.

Future Directions for Property Tax and Infrastructure

Looking ahead, the future of property taxation will likely hinge on innovative approaches that prioritize sustainability and community engagement. Local governments may increasingly explore value capture mechanisms, where the increased value of properties resulting from public investments is partially returned to fund further infrastructure. This concept can help create a self-sustaining cycle of investment that benefits both the community and the local government. New technologies and data analytics can provide insights into property market trends, allowing for more informed assessments and equitable taxation. Moreover, governments may also engage residents more effectively in decision-making about where to allocate property tax revenues. By incorporating community feedback and fostering discussions around infrastructure development, local authorities can align public projects with the actual needs and priorities of residents. Collaboration with various stakeholders, including nonprofits and private developers, is crucial for maximizing the effectiveness of property tax funding. Ultimately, a forward-thinking approach that embraces adaptability, transparency, and collaboration can transform property taxes from a budgetary tool into a catalyst for dynamic, sustainable community growth.

In summary, property tax plays a pivotal role in supporting infrastructure development and enhancing community livability. As local governments navigate various challenges associated with property tax management, collaboration, transparency, and innovation will be critical to the success of their initiatives. By focusing on sustainable investments, engaging residents in decision-making, and leveraging technology, local governments can maximize the benefits of property tax revenues. Infrastructure funded through property taxes is instrumental in creating vibrant, resilient communities that can adapt to ever-changing social, economic, and environmental conditions. Community engagement ensures that residents feel a sense of ownership over the projects funded by their contributions, leading to increased trust and participation. As we consider the future of property taxation, it is clear that the relationship between property taxes and infrastructure investment will continue to evolve, reflecting the dynamic needs of communities. The collaborative efforts between government bodies, community members, and private stakeholders will drive successful outcomes in the development and maintenance of essential infrastructure. Ultimately, well-managed property tax systems can serve as the backbone for thriving societies.