Understanding Net Asset Classifications in Nonprofit Accounting

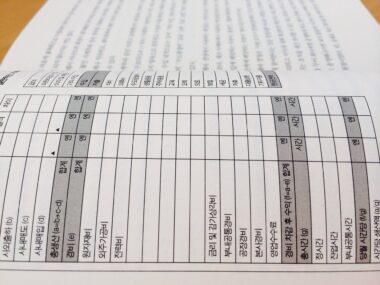

Effective nonprofit accounting heavily relies on understanding net asset classifications, a crucial component under GAAP and FASB standards. This classification impacts how resources are allocated and reported, ultimately affecting both financial performance and compliance. Nonprofits group net assets into three primary categories: unrestricted, temporarily restricted, and permanently restricted assets. Unrestricted assets are available for any purpose deemed necessary, allowing organizations the flexibility to respond to changing needs and priorities. Conversely, temporarily restricted assets are gifted for specific purposes or timeframes, meaning the organization must track these funds to ensure compliance with donors’ intentions. Permanently restricted assets involve endowments or long-term assets, where the principal must remain intact, while only the income may be used for operational costs or projects. This classification helps stakeholders understand financial health, promotes transparency, and builds trust among donors. By appropriately categorizing assets, nonprofits can navigate a complex landscape of regulations and reporting requirements, ensuring they meet legal obligations. Understanding these classifications not only supports compliance but also enhances strategic planning and resource allocation.

When classifying net assets, nonprofits must maintain clear records to uphold transparency and accountability. Each classification serves a specific purpose and dictates how resources can be used or reported. For instance, the handling of unrestricted net assets allows organizations to invest in urgent priorities without restraint. Conversely, temporarily restricted net assets require careful management to meet donor expectations, as failing to comply could damage donor relationships and future funding opportunities. Additionally, the reporting of permanently restricted assets can vary dramatically, impacting how stakeholders perceive the nonprofit’s financial stability and mission sustainability. This nuanced understanding fosters a culture of transparency, encouraging responsible stewardship of funds and further support from contributors. Effective communication of how net assets are classified can significantly enhance donor confidence and foster long-term relationships. Incorporating methodologies for specific tracking systems can help differentiate between assets and their uses. Thus, fostering a keen awareness within finance departments about these classifications is essential for operational success. Compliance with GAAP and FASB not only ensures adherence to legal standards but also aligns the organization with best practices in financial management.

Importance of Accurate Reporting in Nonprofit Accounting

Accurate reporting of net asset classifications is vital for nonprofits, as it directly influences donor trust and regulatory compliance. Misrepresentation of assets can lead to severe financial consequences, including penalties and loss of donor confidence. Organizations need to ensure that their financial statements reflect the true nature of their net assets. This accuracy not only aids in meeting compliance standards but also presents a more transparent picture of fiscal health to stakeholders. Stakeholders, including donors, grantmakers, and board members, rely on accurate financial reporting to make informed decisions about the organization. Clear delineation of net asset classifications can enhance a nonprofit’s ability to secure funding. Funders are more likely to support organizations that demonstrate fiscal responsibility through transparent accounting practices. Nonprofits can employ various strategies to improve their reporting accuracy, including investing in financial management software or consulting with accounting professionals experienced in nonprofit regulation. Training staff on best practices in asset classification can further bolster accuracy and compliance efforts.

Furthermore, nonprofits must recognize that net asset classifications can affect their tax-exempt status. Proper classification ensures that the organization meets IRS guidelines, which is crucial for maintaining public trust. The IRS mandates strict reporting requirements to verify that funds are used as intended and that any restrictions imposed by donors are honored. By strictly adhering to these classifications, nonprofits can also better utilize their funding. They can demonstrate to their donors that the organization’s priorities align with the donor’s intentions and societal needs. Furthermore, accurate classification allows for better strategic planning, enabling organizations to project revenues and allocate resources effectively. When nonprofits manage their net assets responsibly, they reinforce their credibility within the community and cultivate a reputation for ethical management. Additionally, maintaining reserves of unrestricted assets can provide a safety net during unforeseen circumstances, such as economic downturns or emergencies. This proactive approach can safeguard the organization’s longevity and sustainability while keeping stakeholders informed and satisfied.

Challenges in Managing Net Asset Classifications

Despite the clear benefits, managing net asset classifications presents challenges for many nonprofits. Organizations often struggle with the complexity of tracking assets, particularly when donor restrictions change or are miscommunicated. Additionally, staff turnover can lead to inaccurate classifications due to lost knowledge or inconsistent practices. Nonprofits need robust internal controls and documentation strategies to navigate these challenges successfully. Developing a comprehensive chart of accounts specific to asset classifications can enhance clarity and improve tracking. Additionally, thorough training for staff members involved in accounting processes is crucial, as it can minimize the risk of errors and omissions in classification. Regular audits can further ensure compliance with GAAP and FASB regulations, providing peace of mind for the organization and its stakeholders. Donors appreciate transparency; thus, nonprofits that face challenges with asset classifications should address them promptly to reinforce trust and accountability. Building a culture that values accurate reporting and active donor engagement can significantly improve these classifications’ effectiveness while enhancing relationship-building initiatives within the community.

The impact of COVID-19 on nonprofit funding has further accentuated the importance of understanding net asset classifications. As many organizations faced unprecedented financial challenges, the ability to access unrestricted funds became a vital lifeline. Nonprofits that had robust reserves of unrestricted net assets were better positioned to navigate this period, illustrating the need for strategic asset management. Moreover, organizations that can adeptly categorize their net assets stand to attract more support during challenging times. Donors tend to favor nonprofits that can demonstrate flexibility and judicious use of immediate resources. Apart from navigating crises, maintaining operational momentum through strategic funding pivots became essential. In times of significant societal need, transparency in asset management can enhance fundraising efforts, inspire donor confidence, and solidify community support. Nonprofits that continued to engage actively with their donors during the pandemic often found opportunities for new funding avenues and partnerships, leading to long-term benefits. Therefore, understanding net asset classifications not only serves compliance but emerges as a vital component in ensuring resilience amid fluctuating economic landscapes.

Conclusion: The Path Forward for Nonprofit Accounting

In conclusion, effective management and reporting of net asset classifications are critical elements in nonprofit accounting. Organizations must prioritize accurate classifications to ensure compliance, foster accountability, and cultivate donor trust. With the right systems in place, nonprofits can successfully navigate asset classifications, securing funding and expanding their mission impact within the community. Through ongoing training, investment in technology, and adherence to best practices, nonprofits can fortify their financial reporting practices while meeting regulatory requirements. As transparency becomes increasingly important in the nonprofit sector, the implications of effective net asset classification extend far beyond compliance. Nonprofits can leverage these practices to build stronger connections with stakeholders, enhancing their reputation and ability to raise funds. Moving forward, nonprofits must remain agile in their approaches to asset management, adapting to changing regulations and donor expectations. By doing so, they can sustain their missions and continue delivering valuable services to their communities.

In addition to focusing on operational efficiency, embracing technology can facilitate better tracking and reporting of net asset classifications. The integration of financial management software tailored for nonprofits provides comprehensive visibility into asset management. By automating processes, nonprofits can reduce the administrative burden while enhancing accuracy in reporting. This investment not only simplifies financial practices but also ensures organizations can focus on their mission, ultimately maximizing impact. For nonprofits looking to improve their understanding and management of net asset classifications, engaging with professional advisors can provide tailored solutions. It’s critical that nonprofits develop a culture of continuous improvement, routinely assessing and refining their methodologies for asset classification. By prioritizing accurate reporting, building donor trust, and demonstrating financial viability, nonprofits can cultivate long-lasting relationships that endure beyond specific projects or funding cycles. This holistic approach to understanding net asset classifications strengthens an organization’s foundation and positions it for ongoing success in achieving its mission, ensuring compliance with accounting standards, and generating goodwill as it navigates an ever-evolving financial landscape.