The Role of Business Angels in Financing Innovation

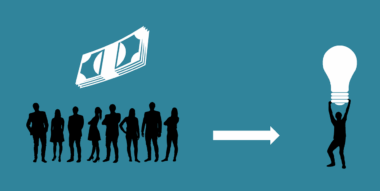

Business angels play an essential role in the landscape of start-up financing, primarily by bridging the gap between entrepreneurs and the necessary capital to launch innovative ideas. These investors provide not just funds but also mentorship, strategic advice, and vital industry connections. Unlike traditional investors, business angels often bring a wealth of experience from running successful businesses themselves. This expertise can significantly enhance the viability of nascent companies, making business angels invaluable partners. By recognizing and supporting innovation, they empower entrepreneurs to fine-tune their business models and achieve sustainable growth. Business angels generally invest in sectors they are familiar with, increasing the probability of meaningful engagement. They assess potential investments carefully, looking for passionate teams and scalable ideas. Their involvement often boosts the credibility of a start-up, attracting further investments from venture capitalists. Furthermore, they tend to invest at earlier stages than venture capitalists, making them critical for start-ups seeking initial funding. Overall, business angels fill a unique niche in the entrepreneurial ecosystem, fostering an environment where innovation can thrive.

Another aspect of working with business angels is their ability to provide faithful guidance throughout the business journey. This often goes beyond mere financial support and enters the realm of long-term partnerships. Angels typically take a hands-on approach, helping founders sharpen their business strategies and operational processes. This mentorship can prove instrumental in navigation, allowing start-ups to make informed decisions in their early stages. By sharing their expertise in industry trends, funding strategies, and resource management, business angels significantly mitigate the risks that come with starting a new venture. This collaborative spirit builds a rapport between investors and entrepreneurs, fostering an atmosphere of trust and cooperation. Additionally, business angels frequently contribute to shaping a start-up’s brand, helping craft effective marketing strategies and build customer relationships. The transference of knowledge and experience helps create well-rounded businesses equipped to tackle market challenges head-on. Establishing artful connections not only sustains initial growth but often lays a strong foundation for future success. As such, the collaborative dynamic between innovators and angels is more than just financial—it’s about nurturing visionary ideas into tangible successes.

Investment Strategies of Business Angels

Understanding the investment strategies employed by business angels is crucial for both entrepreneurs seeking funding and investors hoping to maximize their returns. Most angels prefer to invest in sectors they are familiar with, which allows them to conduct informed assessments and make educated decisions. Many business angels also focus on early-stage companies that demonstrate high growth potential and have a clear, ambitious vision. They seek out teams that exhibit passion, resilience, and a capacity for innovation. Often, business angels diversify their portfolios by investing in multiple start-ups rather than concentrating their resources on a single endeavor. This minimizes the risks associated with start-up investments. Moreover, they are generally more patient than venture capitalists, understanding that growth may take time following an initial investment. These angels typically pursue shorter exit strategies, looking for returns within five to seven years. This flexibility is often appealing to entrepreneurs who may not be ready for the high-pressure expectations set by venture capital. Ultimately, employing strong investment strategies allows business angels to identify and foster promising ventures while reaping rewards from successful collaborations.

Alongside financial gains, many business angels derive satisfaction from contributing to innovative causes. This altruistic motivation can often be as compelling as profit generation. By investing in start-ups that align with their personal values or social impact goals, angels contribute to the wider community within which they live. This philanthropic aspect leads many to support businesses focused on sustainability, technology, healthcare, and education. Angels frequently participate in initiatives that promote diversity in entrepreneurship, funding women-led businesses or those in underrepresented communities. Such actions not only enhance the start-up landscape but also generate positive social change. Furthermore, these contributions can boost an angel’s own reputation, showcasing a commitment to innovation and progressive thought. In this context, business angels become not just investors but influential leaders who inspire upcoming entrepreneurs. Their support can help drive meaningful research and innovation, transforming industries for the better. This sense of purpose often enriches the angel investor experience, enabling them to leave a lasting legacy as part of their financial endeavors. Thereby, they blend wealth-building with impactful social contributions.

The Challenges Business Angels Face

Despite their significant contributions, business angels often encounter various challenges in the landscape of start-up funding. One of the primary hurdles they face is the inherent risk associated with investing in unproven businesses. Many start-ups fail, leading to potential losses for investors. Consequently, due diligence plays a pivotal role in the business angel’s investment strategy. Ensuring that they thoroughly vet business plans, teams, and market potential helps mitigate risks. Another challenge is the financial uncertainty typical within early-stage investments. Business angels typically must maintain a long-term perspective and prepare for volatility, as returns on investment can take time. Additionally, they must navigate the regulatory landscape, which can sometimes complicate funding processes. This necessitates a solid understanding of legal aspects to safeguard their investments. Furthermore, finding suitable start-ups demanding investment can be challenging, requiring an extensive network and diligent scouting efforts. Lastly, business angels often deal with emotional elements, as the passion and dedication of entrepreneurs can create personal investment ties that complicate decision-making. Balancing emotional ties with rational investment strategies is key to long-term success in angel investing.

Considering the evolving landscape of start-up funding, business angels must adapt to new trends and technological innovations. With the rise of crowdfunding platforms and equity crowdfunding, the dynamics of investment are shifting. Many business angels find themselves exploring these new avenues for attracting potential start-ups while diversifying their investment portfolios. Such platforms create a new layer of competition among angels, requiring them to distinguish themselves by offering unique value beyond financial backing. Moreover, staying in sync with emerging technologies—such as artificial intelligence, blockchain, and renewable energy—is crucial for appealing to cutting-edge start-ups actively seeking funding. Being knowledgeable about the latest industry trends and innovations allows business angels to position themselves effectively. Additionally, social media and digital marketing have transformed how entrepreneurs attract investors today, meaning that angels need to embrace these methods in their networking efforts. By evolving in alignment with market changes, business angels can continue to play a pivotal role in financing innovation. Their adaptability can lead to sustained success, enabling them to nurture a new generation of entrepreneurial talent poised to reshape industries and communities.

The Future of Business Angels

The future of business angels appears promising, particularly as the entrepreneurial landscape continues to flourish. Increased globalization means entrepreneurs today have access to broader networks and opportunities than ever before. This influx of start-up activity can lead to heightened engagement among business angels, amplifying investment opportunities. Furthermore, innovation in digital tools and communication platforms allows for better collaboration between investors, entrepreneurs, and resources. Future business angels may harness technology to streamline processes, access real-time data, and engage with potential investments more efficiently. Additionally, the rise of social impact investing suggests that many angels will prioritize funding for start-ups that align with ethical values and sustainability goals. Such a trend will likely see an influx of investors across demographic and geographic boundaries. Millennials and Generation Z, who value social responsibility, are expected to reshape the investor demographic, embracing opportunities that reflect their ideals. As the investment landscape evolves, business angels will continue to play an integral role in providing funding, mentorship, and guidance, fostering innovative start-ups that align with evolving market demands and societal expectations.

In summary, the role of business angels in financing innovation cannot be overstated. These investors provide essential capital and invaluable mentorship to emerging entrepreneurs. By fostering creativity and supporting diverse business ventures, they contribute positively to the economy. The dynamic blend of financial backing and hands-on guidance creates a nurturing ecosystem for start-ups to flourish. Challenges remain within the angel investing realm, yet the evolving landscape brings fresh opportunities. Business angels adopting innovative strategies will find themselves at the forefront of a thriving industry that prioritizes creativity, ethics, and community impact. As we observe this collaborative evolution, future entrepreneurs and investors alike are well-positioned to collaborate effectively, nurturing innovative solutions to tomorrow’s challenges. The partnership between business angels and start-ups paves the way for success stories that inspire others to pursue ambitious dreams. Overall, their involvement truly matters in shaping the future of entrepreneurship. This powerful impact reinforces the idea that innovation can arise from anywhere, driven by passionate individuals willing to take the leap. Aspiring leaders can learn much from the collaboration and mentorship that these relationships offer in pursuing their entrepreneurial goals.