Step-by-Step Guide to Setting Up a Double-Entry Bookkeeping System

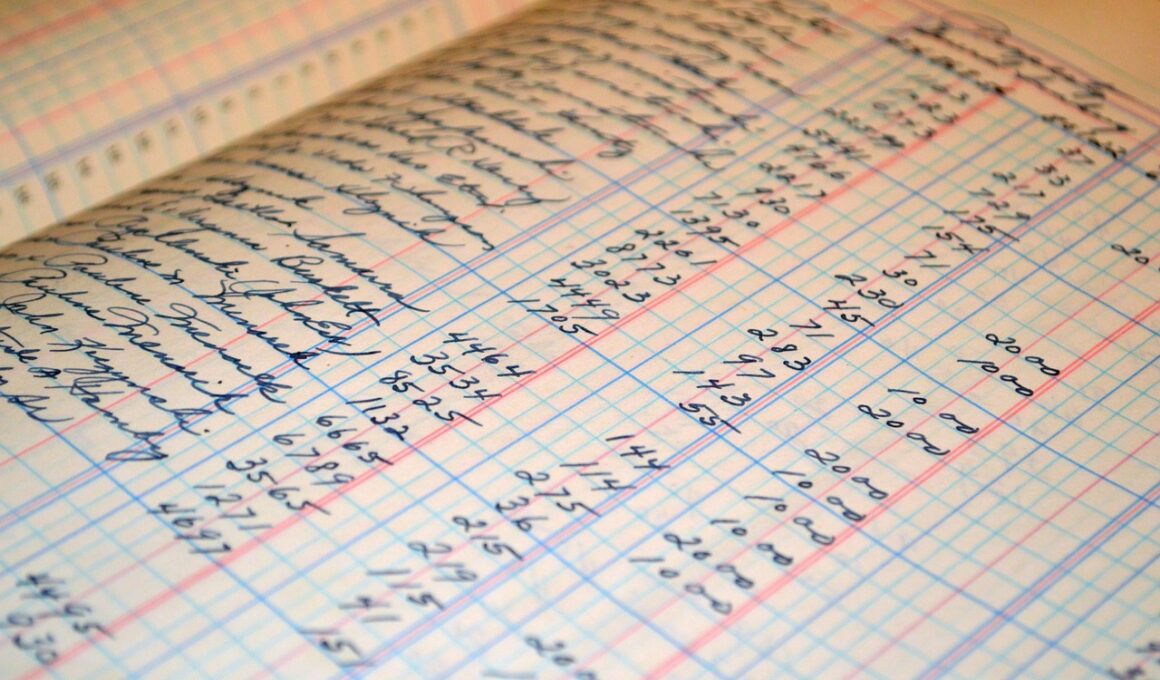

Double-entry bookkeeping is an essential part of accounting that ensures every financial transaction has equal and opposite effects in at least two different accounts. The fundamental principle is based on the accounting equation, which states that Assets = Liabilities + Equity. Understanding this concept is critical for effectively managing financial records. To set up a double-entry system, begin by determining the accounts needed for tracking your business activities. Start with categorizing your assets, liabilities, equity, revenues, and expenses. Once these categories are defined, it’s essential to set up a chart of accounts. This organizational tool will help you efficiently track financial transactions. Ensure each account has a unique identification number for clarity. Select accounting software that supports double-entry bookkeeping, as it can automate many processes and reduce errors. Popular options include QuickBooks, Xero, and Sage Business Cloud Accounting, among others. After you have established your accounts, begin recording your transactions accurately and consistently. Each transaction should involve both a debit and a credit entry to reflect the dual impact on your accounts accurately.

Next, let’s discuss the importance of journal entries in a double-entry system. A journal entry is a record of a transaction that contains necessary details such as the date, the accounts involved, and the debit and credit amounts. It’s crucial to record transactions promptly to maintain accurate financial statements. Follow a standard format when making entries: first, indicate the date of the transaction, followed by the account debited and the amount, and then the account credited and the corresponding amount. This clarity will help avoid confusion later. Keeping a systematic approach in your journal will ensure that all financial activities are traceable. After making journal entries, they should be posted to the respective accounts in the general ledger. The ledger is where you summarize all transactions in the relevant accounts. Reconcile your ledger regularly to confirm that the debits equal credits. This reconciliation process is essential for catching errors early on. If discrepancies arise, thoroughly review transaction records and journal entries for mistakes or omissions to maintain accurate financial records.

Trial Balance and Financial Statements

Once you’ve recorded transactions and maintained an updated general ledger, it’s time to create a trial balance. A trial balance is a summary report that lists all the balances of the accounts at a particular time, ensuring that the total debits equal the total credits. This serves as a preliminary check to identify any inconsistencies in your records. Prepare the trial balance by ensuring that every account is correct, calculating each balance, and summing both debit and credit sides. If both totals match, you proceed to generate key financial statements, which provide insights into your business’s financial health. The primary financial statements include the income statement, balance sheet, and cash flow statement. The income statement reflects your revenues and expenses, showing profitability over a specific period, while the balance sheet summarizes your assets, liabilities, and equity at a specific point in time. Lastly, the cash flow statement outlines how cash flows in and out of your business, highlighting liquidity pressures that may require management strategies.

Another important aspect of double-entry bookkeeping involves adjusting entries. At the end of an accounting period, adjustments might be necessary to ensure your financial statements reflect the true financial status of your business. This could include accruals, deferrals, and estimations. Accruals account for incurred expenses or earned revenues that have not been recorded yet, ensuring the matching principle is upheld. Deferrals, on the other hand, deal with prepaid expenses or unearned revenues. These adjustments ensure that incomes and expenses are recognized in the correct time period. Regularly making these adjustments allows for precise financial reporting and compliance with accounting standards. After making these adjustments, once again prepare a trial balance to check for any discrepancies. This ongoing process helps to maintain the integrity of financial records. Moreover, it prepares you for the upcoming financial reporting period, eliminating undue stress as deadlines approach.

Year-End Closings and Records Maintenance

At the end of the fiscal year, closing entries must be completed to prepare accounts for the new accounting period. Closing entries summarize all income and expenses for the year and transfer the balances to the retained earnings account. This important step ensures that the revenue and expense accounts start fresh for the new year. Make sure to compile all necessary documentation to support your year-end closings, including bank statements, payroll records, and invoices. Besides closing entries, maintaining accurate records throughout the year is crucial for a successful bookkeeping process. Implement a consistent filing system for documents, both physical and digital, to facilitate easy access to information when preparing reports. Data organization is key when meeting regulatory requirements during audits. Ensure you comply with local regulations about record retention timelines to avoid penalties. Regularly backup digital records to prevent loss of vital financial data. An organized approach to bookkeeping will not only simplify year-end processes but also promote confidence in your financial standings among stakeholders.

Finally, continually assess the efficiency of your double-entry bookkeeping system. Conduct regular audits to ensure accuracy and identify areas for improvement. Seek feedback from staff involved in the bookkeeping process on potential changes or enhancements. Timely identification and correction of issues can significantly improve the accuracy of your financial statements. Additionally, stay updated on accounting regulations and software to ensure compliance and leverage new features that can improve productivity. Invest in training for staff involved in accounting processes, as knowledgeable employees are less likely to make errors. Consider consulting with a certified public accountant (CPA) for expert opinion and assistance when needed. Their insights can be invaluable, particularly for complex accounting matters. Always have a contingency plan in place for software issues and implement a systematic review process for your financial records. Being proactive will lead to a reliable and accurate double-entry bookkeeping system.

Conclusion: Best Practices for Effective Double-Entry Bookkeeping

In conclusion, establishing a double-entry bookkeeping system is a foundational aspect of effective financial management. By following the outlined steps from setting up accounts to making journal entries, and preparing financial statements, you create a robust framework for tracking business transactions. Consistent and accurate record-keeping ensures compliance and helps identify potential financial issues before they escalate. Remember the importance of regular reconciliations and adjustments, and don’t overlook year-end closing processes. An efficient bookkeeping system also aids in timely decision-making based on accurate financial data. Incorporate feedback mechanisms, invest in staff training, and stay informed about developments in accounting practices. Implementing these best practices will lead to improved accuracy, reduced errors, and better overall financial oversight. Continuously strive to enhance your system as the business environment changes, allowing you to maintain financial health and inform strategic decisions. Whether you’re managing a small business or a larger enterprise, mastering double-entry bookkeeping will equip you with the tools necessary for success.

Step-by-Step Guide to Setting Up a Double-Entry Bookkeeping System